What Is Cash Flow, How It Makes You a Better Investor

Cash flow is the net amount of cash and cash-equivalents going in and out of a company. It is the lifeblood of any company, determining its ability to pay bills, invest in growth, and return value to shareholders. For investors in the US, UK, Canada, and Australia, analyzing a company’s cash flow statement is a non-negotiable step in identifying financially healthy and sustainable investments on exchanges like the NYSE, NASDAQ, and LSE.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | The total amount of money being transferred into and out of a business, representing its operational liquidity. |

| Also Known As | Cash Inflows/Outflows, Net Cash Position |

| Main Used In | Fundamental Analysis, Corporate Finance, Business Valuation, Credit Analysis |

| Key Takeaway | Positive, growing cash flow from operations is a primary indicator of a company’s financial health and long-term viability, often more telling than net income. |

| Related Concepts |

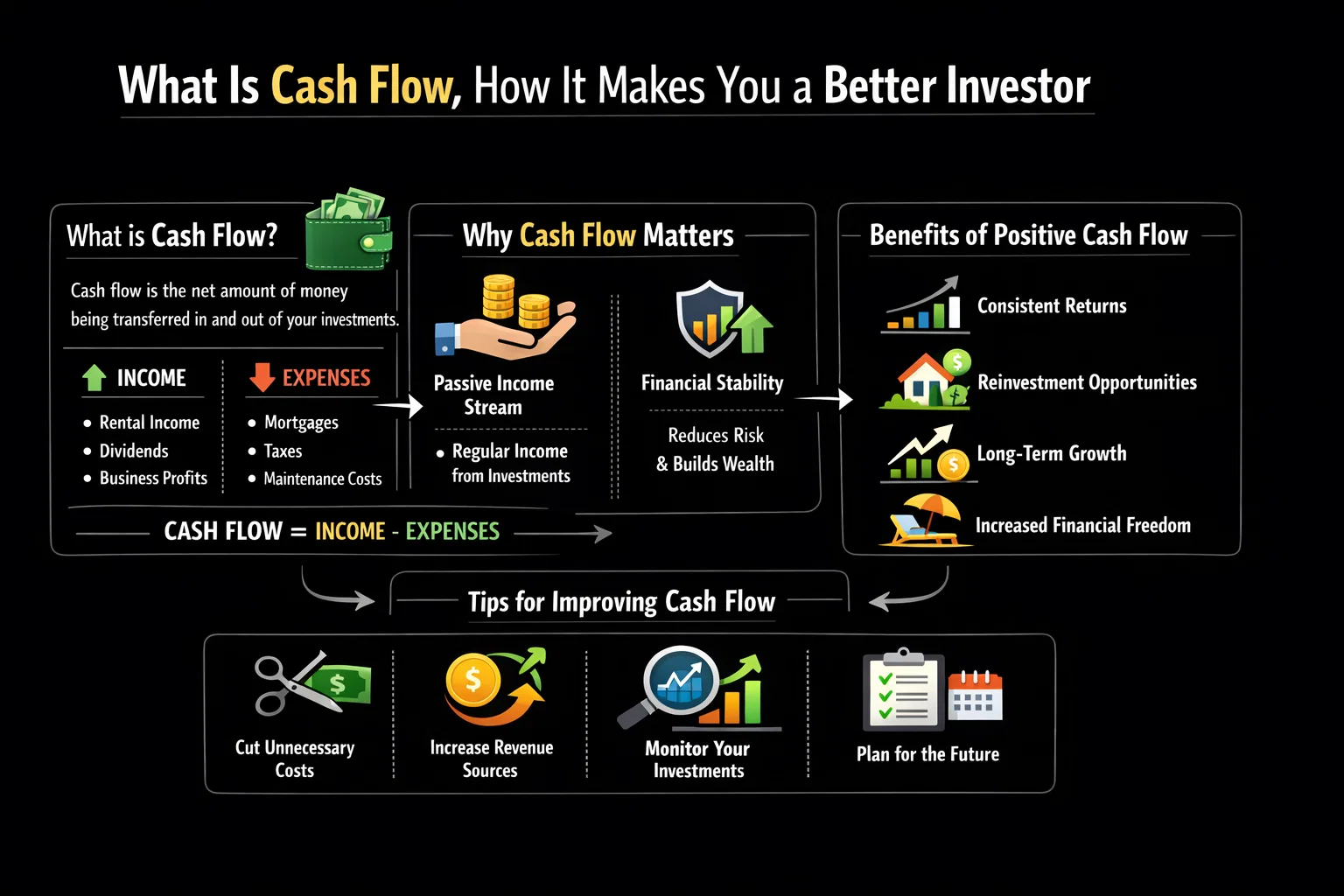

What is Cash Flow

Cash flow is the movement of money in and out of your business or an investment. Think of it like a checking account for a company: money comes in from customers (inflows) and goes out to pay for expenses like salaries, rent, and supplies (outflows). The difference between these inflows and outflows over a specific period is the net cash flow. It’s a direct measure of a company’s ability to generate cash to fund its operations and growth. Unlike accounting profit (net income), which includes non-cash items like depreciation, cash flow is a real-time look at the financial health of an entity.

Key Takeaways

The Core Concept Explained

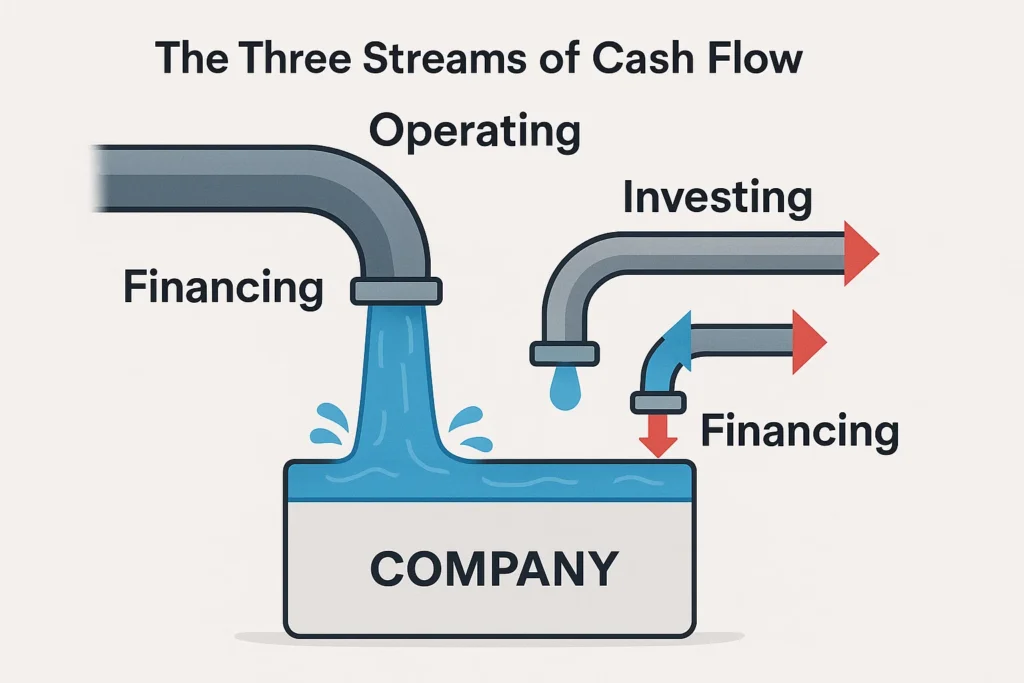

Cash flow measures the actual cash-generating power of a business. It answers fundamental questions: Can the company pay its employees and suppliers? Can it invest in new equipment without taking on dangerous debt? Can it pay dividends to its shareholders? The cash flow statement, one of the three core financial statements, is broken down into three sections that provide a complete picture:

- Operating Cash Flow (CFO): Cash generated from the core business operations. A positive and growing CFO is a strong positive signal.

- Investing Cash Flow (CFI): Cash used for investing in assets (like property or equipment) or from selling other businesses. This is typically negative for a growing company, as it invests in its future.

- Financing Cash Flow (CFF): Cash from investors or banks (issuing stock or debt) and cash paid to shareholders (dividends, stock buybacks).

What a high or low value indicates:

- Consistently Positive Net Cash Flow: Indicates a company that is self-sustaining and financially secure.

- Negative Operating Cash Flow: A major red flag, suggesting the core business is not generating enough cash to sustain itself.

- Negative Investing Cash Flow: Often a sign of growth and expansion, which can be positive if supported by strong operating cash flow.

- Positive Financing Cash Flow: Could mean the company is raising capital for growth, but if it’s consistently used to cover operating losses, it’s a warning sign.

How to Calculate Cash Flow

While “cash flow” itself is a broad term, its components are meticulously reported on the Cash Flow Statement. The overall Net Cash Flow is the sum of the three activities.

Net Cash Flow = Cash from Operating Activities + Cash from Investing Activities + Cash from Financing Activities

Step-by-Step Calculation Guide

The Cash Flow Statement reconciles net income with the actual cash position. It starts with net income and makes adjustments for non-cash items and changes in working capital.

Let’s walk through a simplified example for “Company XYZ” (figures in USD, as would be reported to the SEC).

| Input Values | Amount (USD) |

| Net Income | $200,000 |

| Depreciation & Amortization | $30,000 |

| Increase in Accounts Receivable | -$25,000 |

| Decrease in Inventory | $10,000 |

| Purchase of Equipment | -$50,000 |

| Proceeds from a Bank Loan | $40,000 |

| Dividends Paid | -$15,000 |

Calculation:

- Operating Cash Flow:

- Start with Net Income: $200,000

- Add back non-cash expenses (Depreciation): +$30,000

- Adjust for working capital: (Increase in Receivables: -$25,000) + (Decrease in Inventory: +$10,000)

- Total Operating Cash Flow = $200,000 + $30,000 – $25,000 + $10,000 = $215,000

- Investing Cash Flow:

- Purchase of Equipment: -$50,000

- Total Investing Cash Flow = -$50,000

- Financing Cash Flow:

- Proceeds from Loan: +$40,000

- Dividends Paid: -$15,000

- Total Financing Cash Flow = $25,000

Total Net Cash Flow = $215,000 (Operating) + (-$50,000) (Investing) + $25,000 (Financing) = $190,000

Interpretation: Company XYZ is highly healthy. Its core operations generated $215,000 in cash, which was more than enough to fund its equipment purchases and dividend payments, resulting in a strong net increase in cash for the period.

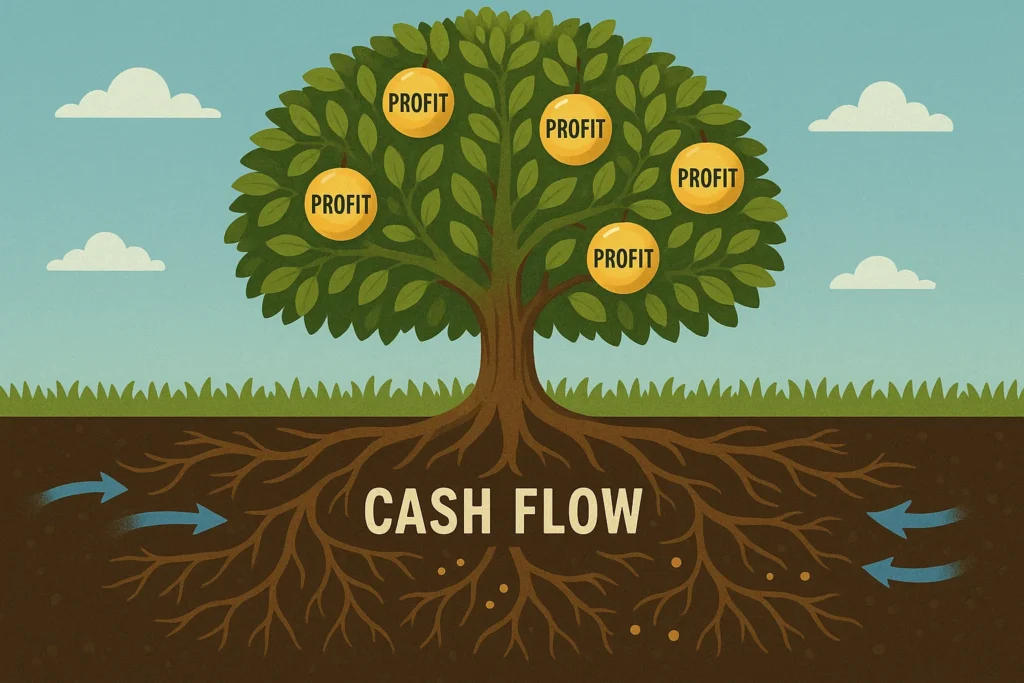

Why Cash Flow Matters to Traders and Investors

Cash flow is the bedrock of fundamental analysis. It moves beyond theoretical profitability to reveal the tangible financial reality of a company.

- For Investors: It helps identify high-quality companies with durable competitive advantages (or “economic moats”). A company that consistently generates strong free cash flow has the flexibility to innovate, pay dividends, buy back shares, and weather economic downturns without relying on external financing. For long-term investors in markets like the FTSE or ASX, this is a key metric for buy-and-hold decisions.

- For Traders: While traders often focus on technicals, unexpected cash flow announcements can cause significant price movements. A company missing cash flow estimates can see its stock plummet, while one beating estimates can gap up. Traders can use this for event-driven strategies.

- For Analysts: Cash flow is indispensable for valuation. The Discounted Cash Flow (DCF) model is considered one of the most robust valuation methods, as it values a company based on the present value of its expected future cash flows. It’s also crucial for credit analysis, as lenders need to know if a company can generate enough cash to service its debt.

How to Use Cash Flow in Your Strategy

Integrating cash flow analysis into your research process can significantly improve your stock-picking.

Use Case 1: Spotting Financial Distress

- Scenario: You’re looking at a company whose stock price has been falling. The P/E ratio looks cheap.

- Action: Check the Cash Flow Statement. If Operating Cash Flow is consistently negative and the company is relying on Financing Cash Flow (issuing more debt or stock) to stay afloat, it’s a major red flag. Avoid this value trap.

- Example: Many struggling retailers show this pattern before declaring bankruptcy.

Use Case 2: Identifying a Cash Cow

- Scenario: You are looking for stable, dividend-paying companies.

- Action: Look for companies with strong, stable, or growing Operating Cash Flow that is significantly higher than Net Income. Then, check Free Cash Flow (Operating Cash Flow minus Capital Expenditures) and ensure the dividend payments are comfortably covered by it. A company like this can sustain and grow its dividend.

- Example: Mature consumer staples or utility companies often fit this profile.

Use Case 3: Finding Aggressive Growth

- Scenario: You’re interested in a tech company re-investing everything back into the business.

- Action: It’s okay if Operating Cash Flow is modest and Investing Cash Flow is highly negative due to heavy capital investment. The key is to ensure the company has enough cash reserves or access to financing (a strong cash position on the balance sheet) to fund this growth until it becomes profitable. Analyzing their cash burn rate is crucial here.

To start analyzing cash flow statements like a pro, you need access to high-quality financial data. Explore our guide to the Best Online Brokerages for Fundamental Analysis to find a platform with powerful screening and reporting tools.

- Reality Check: It provides a clear picture of a company’s liquidity and financial resilience, which earnings alone can obscure.

- Hard to Massage: While not immune to manipulation, cash flow is generally more reliable than net income.

- Predictive Power: Strong and growing cash flow is a powerful predictor of a company’s ability to fund future growth.

- Universal Applicability: It can be used to analyze and compare companies across different industries and countries.

- A Snapshot in Time: It represents past performance and does not guarantee future cash flows.

- Capital Intensive Bias: It can make capital-intensive companies look worse than asset-light companies in the short term.

- Can Be Misleading in Isolation: A one-time event can create a large positive cash flow that is not repeatable.

- Doesn’t Measure Efficiency: A company can have high cash flow but low profitability if it is inefficient.

The Four Cash Flow Patterns: Classifying Any Company

Beyond the numbers, companies often fall into recognizable cash flow patterns. Identifying which pattern a company fits can help you quickly assess its lifecycle stage and investment profile.

1. The High-Growth “Star”

- Pattern: Strong & Growing Operating Cash Flow, but heavily Negative Investing Cash Flow.

- What it Means: The company is successfully monetizing its product and is re-investing every dollar (and more) back into the business to fuel rapid expansion. This is common in tech and biotech.

- Investment Takeaway: High risk, high potential reward. The key is to ensure the burn rate is justified by massive market opportunity and a clear path to future profitability.

- Example: Amazon in its first decade as a public company.

2. The Mature “Cash Cow”

- Pattern: Strong, Stable, and Growing Operating Cash Flow. Investing Cash Flow is modestly negative (for maintenance).

- What it Means: The company has a dominant market position, limited growth opportunities, and generates far more cash than it needs to run the business.

- Investment Takeaway: Lower risk, income-oriented. Look for consistent dividend payments and share buybacks. Ideal for conservative portfolios.

- Example: Procter & Gamble or Coca-Cola.

3. The “Turnaround” or “Cyclical”

- Pattern: Operating Cash Flow is highly volatile or recently turned from negative to positive. Financing Cash Flow may have been positive to survive the downturn.

- What it Means: The company is either in a cyclical industry (like autos or semiconductors) or is executing a successful turnaround after a period of distress.

- Investment Takeaway: Requires timing and a strong stomach. The opportunity is to buy when OCF is troughing and sentiment is poor.

- Example: A major airline recovering post-pandemic.

4. The “Distressed” or “Decline”

- Pattern: Negative or rapidly declining Operating Cash Flow. Relies on Financing Cash Flow (issuing debt or stock) to stay alive.

- What it Means: The business model is broken. The company is burning through cash and its survival is in question.

- Investment Takeaway: Extremely high risk. Typically best avoided by most investors unless you are a specialist in distressed debt or bankruptcy.

- Example: A brick-and-mortar retailer failing to adapt to e-commerce.

Cash Flow in the Real World: A Case Study

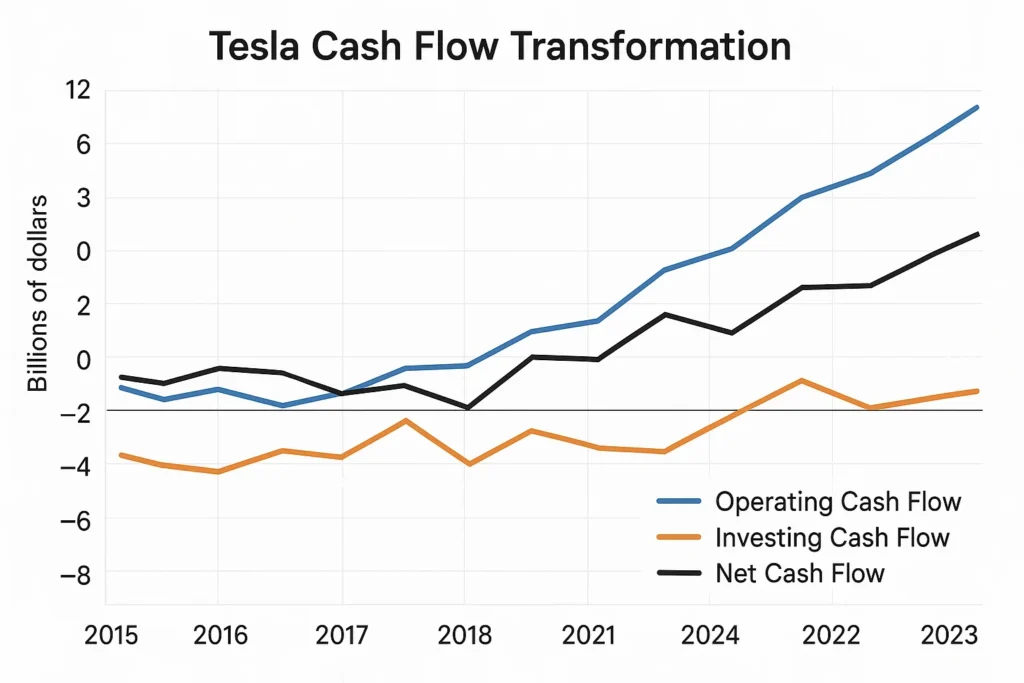

The Tale of Tesla (TSLA) in its Growth Phase

For years, Tesla was a polarizing stock. Critics pointed to its consistent lack of GAAP profitability and negative free cash flow as reasons it was overvalued. However, a deeper look at the cash flow statement told a more nuanced story.

- The Situation (Pre-2020): Tesla’s Investing Cash Flow was massively negative as it poured billions into building its Gigafactories and scaling production. Its Operating Cash Flow was volatile. To fund this, it relied heavily on Financing Cash Flow—raising capital by issuing new shares and taking on debt.

- The Interpretation: While risky, this wasn’t necessarily a sign of a failing business. It was a sign of a capital-intensive business in a high-growth phase. Investors betting on Elon Musk’s vision were essentially funding this growth, hoping the massive investments would eventually pay off.

- The Pivot (2020 Onwards): As production of the Model 3 and Model Y ramped up, the story changed. Tesla’s Operating Cash Flow turned consistently and strongly positive. It reached a milestone where its operating cash generation could fund its capital expenditures, leading to sustained positive free cash flow. This was the validation long-term bulls had been waiting for and was a key driver behind its meteoric stock price rise.

Advanced Cash Flow Metrics

Once you’ve mastered the standard cash flow statement, these advanced metrics can provide even deeper insights.

1. Free Cash Flow to Equity (FCFE)

- What it is: The cash flow available to the company’s equity shareholders after all expenses, reinvestment, and debt repayments.

- Formula: FCFE = Operating Cash Flow – Capital Expenditures + Net Borrowing

- Why it matters: It’s the theoretical maximum amount that can be paid out as dividends without harming the company’s financial structure. It’s crucial for dividend sustainability analysis.

2. Free Cash Flow to the Firm (FCFF)

- What it is: The cash flow available to all funding providers (both debt and equity holders). Also known as Unlevered Free Cash Flow.

- Formula: FCFF = Operating Cash Flow – Capital Expenditures – (Taxes paid on operating profit)

- Why it matters: This is the key input for the Discounted Cash Flow (DCF) valuation model. It represents the cash flows of the business independent of its capital structure.

3. Cash Flow Return on Investment (CFROI)

- What it is: A metric that compares the cash flows generated by a company to the capital invested in it, expressed as a percentage.

- Why it matters: It’s a more cash-focused version of Return on Invested Capital (ROIC). A CFROI that is higher than the company’s cost of capital indicates it is creating value. It’s excellent for comparing the efficiency of companies across different industries.

4. Cash Conversion Cycle (CCC)

- What it is: A measure of how quickly a company can convert its investments in inventory and other resources into cash flows from sales.

- Formula: CCC = Days Inventory Outstanding + Days Sales Outstanding – Days Payable Outstanding

- Why it matters: A shorter CCC is better. It means the company is efficient at managing its working capital, it sells inventory quickly, collects cash from customers fast, and takes its time to pay suppliers. A lengthening CCC can be an early warning sign of operational issues.

Cash Flow vs Profit (Net Income)

A key distinction is between Cash Flow and Profit (Net Income).

| Feature | Cash Flow | Profit (Net Income) |

|---|---|---|

| What it measures | Actual movement of cash in/out of the business. | Accounting profitability based on accrual accounting. |

| Basis of Accounting | Cash Basis | Accrual Basis (revenues when earned, expenses when incurred) |

| Includes Non-Cash Items | No | Yes (e.g., Depreciation, Amortization) |

| Primary Use | Assessing liquidity and short-term viability. | Measuring operational efficiency and profitability over a period. |

Conclusion

Ultimately, understanding cash flow provides a critical lens for evaluating a company’s true financial health and sustainability. While it is a powerful tool, as we’ve seen, it’s not infallible and should be used in conjunction with other analysis like the income statement and balance sheet. By incorporating cash flow analysis into your overall strategy, you can avoid value traps, identify high-quality compounders, and make more informed, data-driven decisions. Start by looking at the cash flow statement in your next stock research report.

Ready to put these concepts into action? The right tools are essential. We’ve meticulously reviewed and ranked the best online brokers for fundamental analysis to help you get started.

Related Terms

- Free Cash Flow (FCF): The cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. It’s what’s truly available for shareholders.

- Operating Cash Flow (OCF): Cash generated from the normal operations of a business. It’s the purest measure of a company’s core profitability in cash terms.

- Discounted Cash Flow (DCF): A valuation method used to estimate the value of an investment based on its expected future cash flows, adjusted for the time value of money.

- EBITDA: Earnings Before Interest, Taxes, Depreciation, and Amortization. Often used as a proxy for operating cash flow, though it has limitations as it ignores changes in working capital.

Frequently Asked Questions

Recommended Resources

- How to Perform a DCF Valuation

- Top 5 Free Cash Flow Stocks for 2024

- U.S. Securities and Exchange Commission (SEC) EDGAR Database – To access the official cash flow statements of any US-listed company.

- Investopedia: Cash Flow Statement – For a deep dive into the components and structure.

- The International Financial Reporting Standards (IFRS) Foundation – For understanding global standards on cash flow reporting.