What is Collateral, A Beginner's Guide to Secured Loans

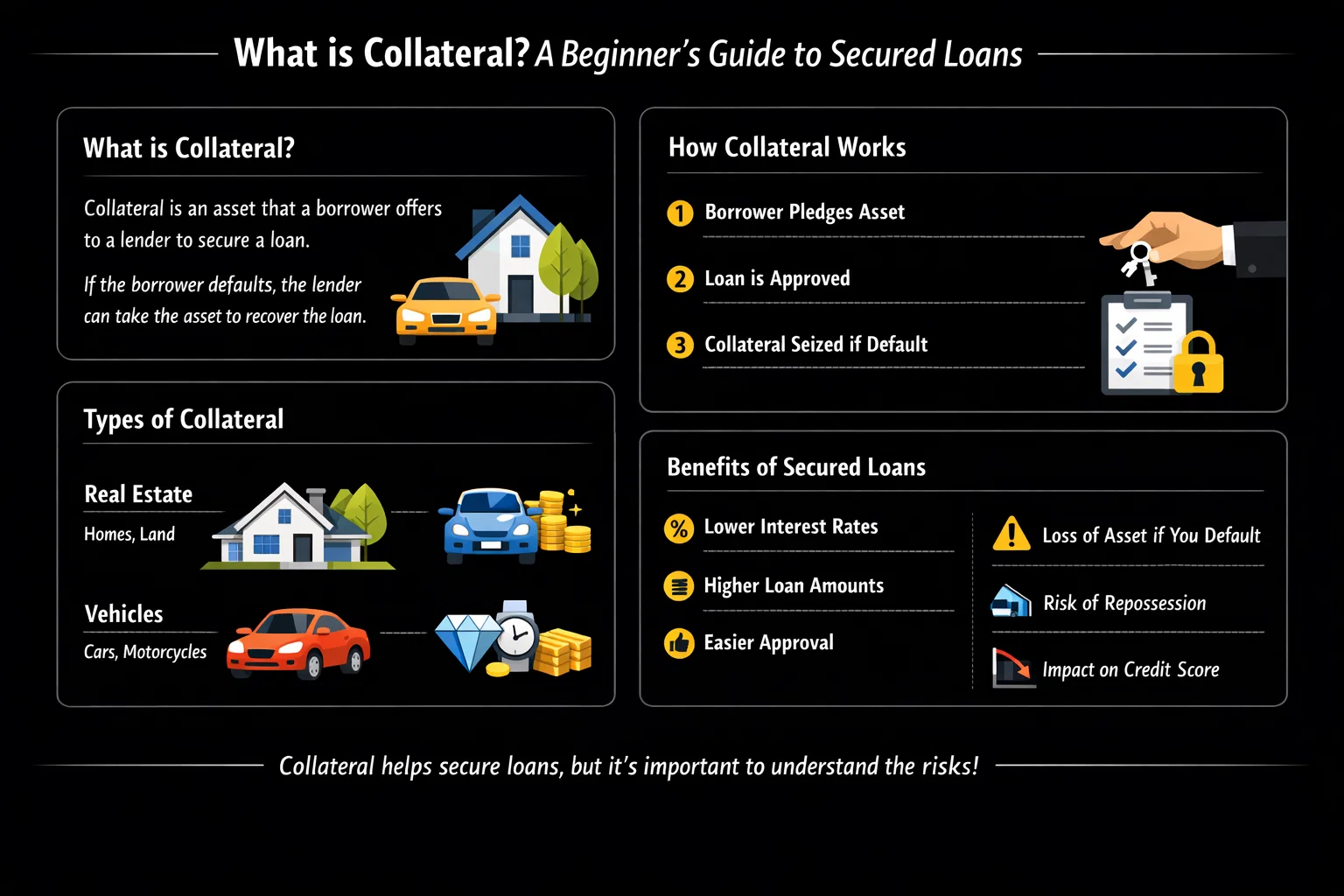

Collateral is an asset guaranteed as security for a loan. If the borrower defaults, the lender can seize the asset to recover their losses. This fundamental concept is the bedrock of secured lending, enabling everything from mortgages and auto loans to complex financial derivatives.

For individuals and businesses in the US, UK, Canada, and Australia, understanding collateral is crucial for accessing credit, from a home loan secured by real estate to a business line of credit backed by inventory. It directly influences the interest rates offered by major banks and financial institutions.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | An asset pledged by a borrower to a lender to secure a loan. |

| Also Known As | Security, Security Interest, Loan Security |

| Main Used In | Banking, Corporate Lending, Mortgages, Margin Trading, Derivatives |

| Key Takeaway | It reduces risk for the lender, which typically results in lower interest rates and better loan terms for the borrower. |

| Related Concepts |

What is Collateral

At its core, collateral is a form of insurance for the lender. Think of it like this: you want to borrow your friend’s expensive camera. To make them feel comfortable lending it to you, you offer them your laptop as a “guarantee.” If you break the camera, your friend can sell your laptop to cover the cost. In finance, this principle is scaled up. A bank lends you money for a house, and the house itself becomes the guarantee. This security allows lenders to offer larger sums of money and more favorable terms than they would for an unsecured loan, which relies solely on the borrower’s creditworthiness and promise to repay.

Key Takeaways

The Core Concept Explained

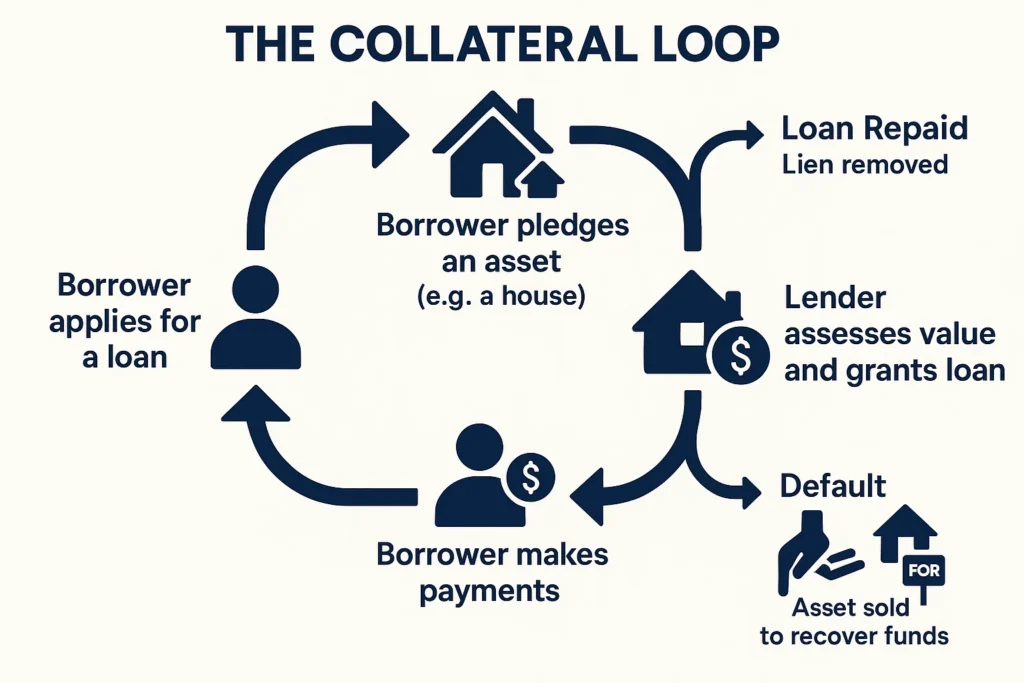

Collateral creates a safety net within the financial system. It measures and mitigates the risk of default. When you pledge an asset, the lender places a “lien” on it. This is a legal claim that prevents you from selling the asset without using the proceeds to pay off the loan. The process is governed by contracts and, in cases like mortgages, heavily regulated by bodies like the SEC in the US or the FCA in the UK.

The key metric here is the Loan-to-Value (LTV) Ratio. A lower LTV ratio (meaning a larger down payment or more collateral value relative to the loan) indicates less risk for the lender. For example, a mortgage with a 20% down payment has an 80% LTV, which is considered much safer than a 95% LTV loan. If the value of the collateral falls significantly (e.g., a housing market crash), the loan can become “underwater,” where the loan balance exceeds the asset’s value, increasing risk for both parties.

How is Collateral Value Determined

While collateral itself isn’t a formula, its value and the resulting loan amount are determined through a rigorous process. The cornerstone metric is the Loan-to-Value (LTV) Ratio.

The Loan-to-Value (LTV) Ratio

This ratio measures the relationship between the loan amount and the appraised value of the collateral.

Formula: LTV Ratio = (Loan Amount / Appraised Value of Collateral) × 100

Step-by-Step Valuation Guide

- Appraisal: A qualified professional assesses the fair market value of the asset. For real estate, this is a real estate appraiser; for a car, it might be based on Kelley Blue Book (US) or similar guides; for securities, it’s the current market value.

- Lien Check: The lender confirms there are no other existing claims on the asset.

- LTV Calculation: The lender calculates the LTV ratio to determine the maximum loan amount they are willing to offer.

Example Calculation: A US Mortgage

- Input Values: You want to buy a home appraised at $500,000. You have a $100,000 down payment.

- Calculation:

- Loan Amount = Purchase Price – Down Payment = $500,000 – $100,000 = $400,000

- LTV Ratio = ($400,000 / $500,000) × 100 = 80%

- Interpretation: An 80% LTV is standard and favorable in the US market. It often allows you to avoid private mortgage insurance (PMI). A higher LTV, say 90%, would mean a riskier loan and likely a higher interest rate.

In the UK, the Financial Conduct Authority (FCA) oversees mortgage lending, and LTV ratios are a key part of affordability checks. Similarly, in Australia, the Australian Prudential Regulation Authority (APRA) guides banks on responsible lending practices, including LTV caps for certain types of loans.

Why Collateral Matters to Traders and Investors

Collateral is not just for home and auto buyers; it’s a powerful tool across the financial landscape.

- For Individuals & Businesses: It’s the key to accessing capital. It can mean the difference between getting a small, high-interest personal loan and a large, low-interest business expansion loan. It makes significant life purchases, like a home, possible.

- For Traders: In margin trading, traders use their existing securities as collateral to borrow money from a broker to buy more stocks. This amplifies both gains and losses. Understanding collateral is essential to managing margin calls.

- For Investors & Analysts: When evaluating a company, analysts look at its debt and the assets backing that debt. A company with high levels of unsecured debt is riskier than one with debt secured by valuable, liquid assets. Collateral quality directly impacts a company’s credit rating and investment appeal.

How to Use Collateral in Your Financial Strategy

Leveraging collateral wisely can optimize your financial health.

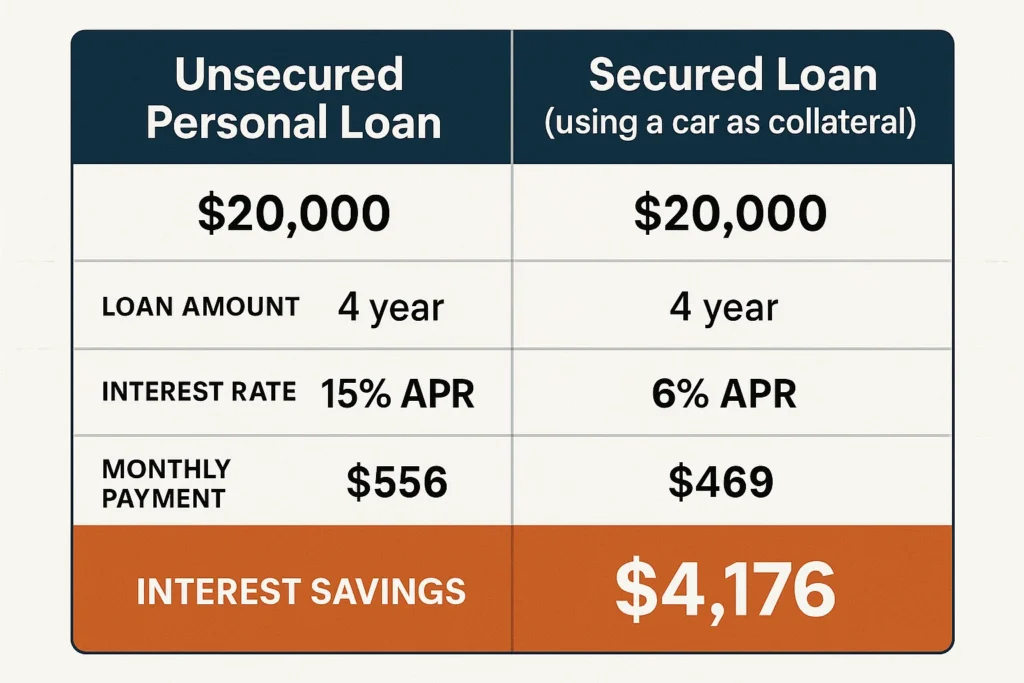

- Use Case 1: Securing a Lower Interest Rate. If you have a high-interest unsecured loan, you might be able to refinance it with a secured loan using a paid-off vehicle or other asset as collateral, significantly reducing your interest expense.

- Use Case 2: Accessing Business Capital. A small business owner can use commercial property or equipment as collateral to secure a loan for expansion, rather than giving up equity to investors.

- Use Case 3: Margin Trading. An investor with a $50,000 portfolio in a margin account might be able to borrow an additional $25,000 from their broker to purchase more securities, using their original portfolio as collateral. Warning: If the portfolio’s value drops, the investor will face a margin call, requiring them to deposit more cash or sell assets to maintain the required collateral level.

To start using collateral in your investment strategy, you’ll need a brokerage platform that offers margin accounts. Choosing the right broker is critical. A reputable, independent broker comparison site like BrokerChooser or Investopedia’s broker reviews are extremely helpful.

- Lower Interest Rates Secured loans are less risky for lenders, resulting in significantly lower APRs.

- Access to Larger Loans You can borrow amounts that would be unavailable with an unsecured loan.

- Easier Approval If you have a weak credit history, offering collateral can help you get approved.

- Longer Repayment Terms Secured loans often come with longer repayment periods, lowering monthly payments.

- Risk of Asset Loss The primary risk: defaulting means losing your asset.

- Over-Leveraging It’s easy to borrow too much, putting multiple assets at risk.

- Asset Depreciation The value of your collateral can fall, potentially triggering a margin call.

- Lengthy Process The appraisal and lien process for assets like real estate can be slow.

Types of Collateral

Not all assets are created equal in the eyes of a lender. The acceptability of collateral depends on its liquidity, stability, and market value.

- Real Estate: The most common form for large loans. Includes residential and commercial property. Highly valued but illiquid (slow to sell).

- Cash and Cash Equivalents: The most liquid collateral. For example, a Certificate of Deposit (CD) can be used to secure a loan from the same bank.

- Securities: Stocks, bonds, and mutual funds. Used for margin accounts. Value is liquid but can be volatile.

- Vehicles and Equipment: Cars, trucks, and machinery. Value is easily assessed but depreciates quickly.

- Accounts Receivable and Inventory: Used by businesses. Lenders may offer a percentage of the value of unpaid invoices (receivables) or unsold stock (inventory).

- Cryptocurrency: An emerging and high-risk class. Volatility requires very conservative LTV ratios.

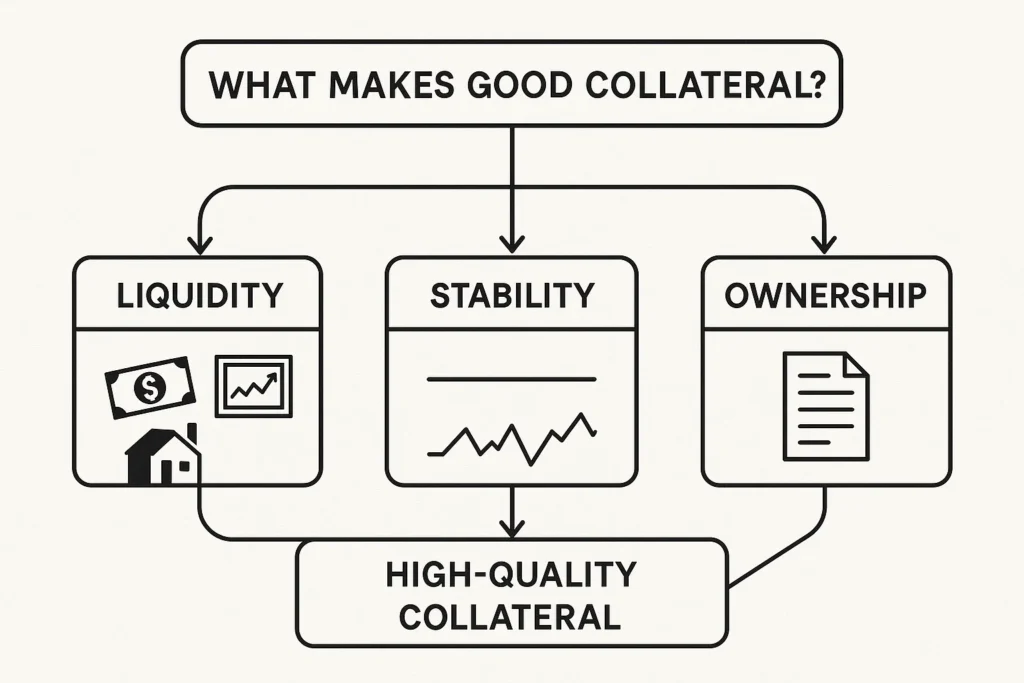

What Makes Good Collateral

Lenders evaluate collateral based on several key characteristics, often remembered by the acronym “L-S-O”:

- Liquidity: How quickly and easily can the asset be sold for cash? (Cash > Public Stocks > Real Estate).

- Stability of Value: Is the asset’s value likely to remain steady or appreciate? (Real estate is generally stable; cryptocurrencies are not).

- Ownership and Title: Can you prove clear, unencumbered ownership of the asset? Is there already a lien on it?

Collateral in the Real World: The 2008 Financial Crisis

The 2008 global financial crisis is a stark, real-world lesson in the systemic importance—and potential failure—of collateral. At the heart of the crisis were Mortgage-Backed Securities (MBS). Banks bundled thousands of mortgages (with houses as collateral) into complex financial products and sold them to investors worldwide.

The problem was that the underlying collateral was often overvalued, and loans were given to high-risk borrowers (subprime mortgages) with little documentation. When homeowners began to default, the value of the MBS plummeted. Financial institutions like Lehman Brothers, which were heavily invested in these “toxic assets,” found themselves insolvent. The collateral that was supposed to secure these investments was, in reality, worth far less than anyone had assumed, causing a catastrophic chain reaction through the global financial system. This event led to massive regulatory changes, including the Dodd-Frank Act in the US, which imposed stricter rules on lending and securitization.

The crisis had a profound impact on global markets, including the FTSE 100 in the UK and the ASX 200 in Australia, highlighting how interconnected the world’s financial systems are and how vital proper collateral valuation is.

Secured Loan vs Unsecured Loan

| Feature | Secured Loan | Unsecured Loan |

|---|---|---|

| Collateral Requirement | Requires an asset as security. | Based on creditworthiness; no asset required. |

| Risk to Lender | Lower (asset can be seized). | Higher (reliance on borrower’s promise). |

| Interest Rates | Typically lower. | Typically higher. |

| Loan Amounts | Generally higher, based on asset value. | Generally lower, based on income/credit. |

| Examples | Mortgage, Auto Loan, Home Equity Loan. | Credit Card, Personal Loan, Student Loan. |

Conclusion

Understanding collateral is fundamental to making informed financial decisions, whether you’re buying a home, growing a business, or actively trading. It is a powerful tool that can unlock favorable credit terms and amplify investment strategies, but it comes with the sobering risk of asset loss. As we’ve seen, its mismanagement can even have global consequences. By thoughtfully selecting the right assets to pledge and maintaining a healthy Loan-to-Value ratio, you can harness the benefits of collateral while mitigating its dangers. Start by reviewing your own assets and considering how they could be strategically used to achieve your financial goals.

Ready to put these concepts into action? The right tools are essential. To manage your investments and potentially use a margin account, you need a reliable brokerage platform. We recommend comparing features and fees at reputable sources like The Securities and Exchange Commission’s (SEC) investor education site or The Financial Industry Regulatory Authority (FINRA) to make an informed choice.

Related Terms

- Loan-to-Value Ratio (LTV): The key metric for determining how much can be borrowed against an asset.

- Lien: The legal claim a lender has on a collateral asset.

- Margin Call: A demand from a broker for an investor to deposit more cash or securities when the value of their collateral falls below a required level.

- Leverage: The use of borrowed capital (often via collateral) to increase an investment’s potential return.

Frequently Asked Questions About Collateral

Recommended Resources

- Investopedia: Collateral Definition – A great resource for quick reference and deeper dives into related terms.

- Consumer Financial Protection Bureau (CFPB): What is a mortgage closing? – Provides official information on the mortgage process, where collateral is key.

- The SEC’s Office of Investor Education and Advocacy – Offers a reliable glossary and educational materials for investors.