What Is Commodity and How to Trade It

A commodity is a basic good used in commerce that is interchangeable with other goods of the same type, such as oil, gold, or wheat. They are the fundamental building blocks of the global economy, fueling industries and feeding nations. Understanding commodities is essential for any investor or trader looking to diversify their portfolio and hedge against inflation and geopolitical risk.

For investors in the US, UK, Canada, and Australia, commodities are a vital asset class traded on major exchanges like the CME Group, the London Metal Exchange (LME), and the ICE, offering a direct play on global economic trends.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | A basic, interchangeable raw material or primary agricultural product that can be bought and sold. |

| Also Known As | Hard & Soft Commodities, Raw Materials, Futures. |

| Main Used In | Futures Trading, Portfolio Diversification, Hedging, Economic Analysis |

| Key Takeaway | Commodities provide a crucial hedge against inflation and geopolitical risk, but are often highly volatile. |

| Related Concepts |

What is a Commodity

A commodity is a fundamental economic good that is fungible, meaning each unit is virtually identical to every other unit. Think of a barrel of West Texas Intermediate crude oil, an ounce of pure gold, or a bushel of number 2 yellow corn. It doesn’t matter which specific barrel, ounce, or bushel you get; they are standardized and interchangeable. This fungibility is what allows them to be traded in large quantities on global exchanges without the need to inspect each individual unit. The prices of these raw materials are determined by the relentless forces of global supply and demand, making them a pure play on macroeconomic and geopolitical events.

Key Takeaways

The Core Concept Explained

The core of a commodity lies in its lack of differentiation. Unlike a branded product (e.g., a Coca-Cola), a commodity’s value comes from the underlying material itself, not from its brand, marketing, or unique features. This standardization creates a massive, liquid global market. A high price for a commodity like copper indicates strong industrial demand and potential economic growth, while a low price can signal a slowdown. For agricultural commodities like soybeans, a high price might be driven by poor harvests due to drought, while a glut in supply can cause prices to crash.

How are Commodities Traded

While you can physically own some commodities like gold bullion, most trading happens financially through derivatives, primarily futures contracts. A futures contract is a legal agreement to buy or sell a specific quantity of a commodity at a predetermined price on a set future date. These are standardized and traded on exchanges like the CME Group in Chicago or the ICE in the US and the LME in London. This system allows farmers to lock in a price for their future harvest (hedging) and allows speculators to bet on price movements without ever taking delivery of 1,000 barrels of oil.

For traders in the US and UK, accessing commodity markets is typically done through futures brokers regulated by bodies like the SEC, CFTC, or the FCA. Popular commodities like Brent Crude and Gold are quoted in USD on these exchanges, making them accessible to a global audience.

Why Commodities Matter to Traders and Investors

Commodities play several critical roles in the financial ecosystem:

- For the Economy: They are the essential inputs for virtually every industry. The price of copper affects construction, lithium affects EV production, and corn affects food and ethanol. They are a barometer of global economic health.

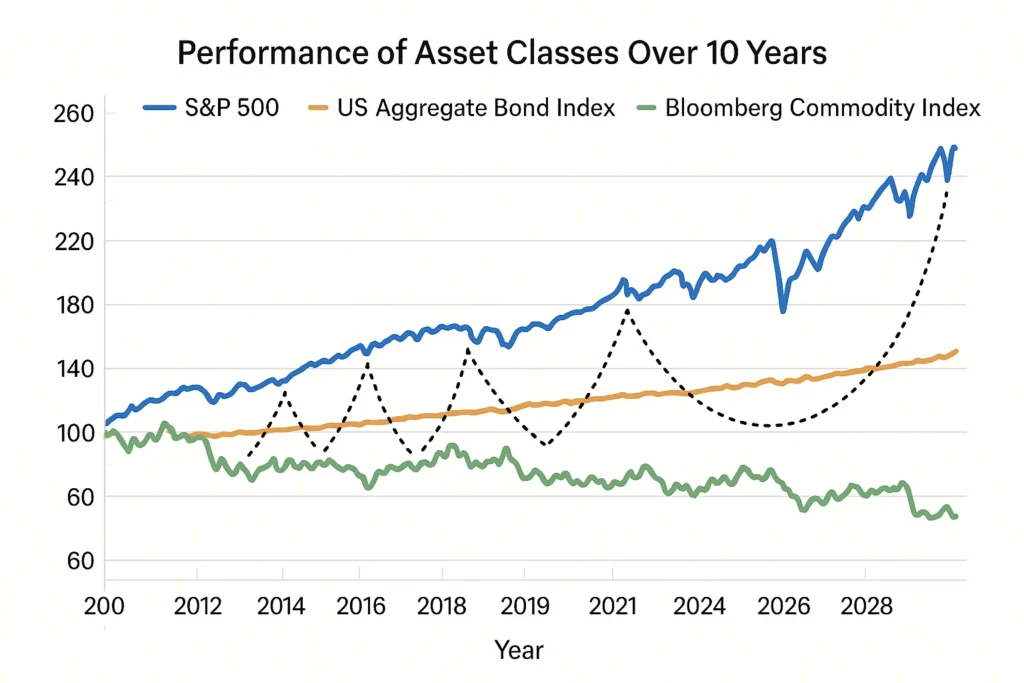

- For Investors (Portfolio Diversification): Commodities often have a low or negative correlation with stocks and bonds. When traditional markets are down, commodities can hold their value or even rise, smoothing out portfolio returns.

- As an Inflation Hedge: When inflation erodes the value of currency, the price of tangible assets like oil, metals, and food typically rises. Holding commodities can protect your purchasing power.

- For Traders (Volatility & Speculation): The inherent volatility of commodities, driven by news, weather, and data reports, creates numerous short-term trading opportunities for active traders.

How to Use Commodities in Your Strategy

- Case 1: Inflation Hedging with Gold: When economic data from the US Bureau of Labor Statistics signals rising inflation, investors often allocate a portion of their portfolio (e.g., 5-10%) to gold ETFs like the SPDR Gold Shares (GLD). Gold has historically well-preserved wealth during phases of currency weakening.

- Case 2: Portfolio Diversification with a Broad Basket: Instead of betting on a single commodity, an investor can buy a commodity index ETF like the Invesco DB Commodity Index Tracking Fund (DBC). This provides exposure to a range of energy, metal, and agricultural futures, reducing single-commodity risk.

- Case 3: Speculative Trading on Supply Shocks: A trader anticipating a cold winter in Europe might analyze natural gas storage reports and buy natural gas futures (e.g., /NG on the CME). If the winter is indeed harsh, demand spikes can lead to significant price increases, allowing the trader to profit.

To start trading commodity futures, you’ll need a brokerage account with robust charting tools and direct market access. We’ve reviewed the best platforms for futures trading to help you get started.

The 4 Main Paths to Commodity Investing

Understanding the various vehicles is key to choosing the right one for your goals and risk tolerance.

- Direct Physical Ownership: Buying the physical commodity itself (e.g., gold bars, silver coins). Pros: Direct ownership, no counterparty risk. Cons: High storage and insurance costs, illiquidity for large quantities.

- Futures Contracts: The direct method for traders. Pros: High leverage, direct price exposure, high liquidity. Cons: Extreme complexity, high risk of magnified losses, margin calls.

- Commodity Stocks: Buying shares of companies involved in commodities (e.g., ExxonMobil for oil, Barrick Gold for gold). Pros: Easy to trade, potential for dividends. Cons: Exposure to company-specific risks (management, debt) in addition to commodity price risk.

- Commodity ETFs/ETNs: The most popular method for retail investors. Pros: Diversification, ease of trading, no need for a futures account. Cons: Can suffer from tracking error and contango-related decay (for futures-based ETFs).

The Commodity Trader’s Calendar

Price moves are often triggered by scheduled data releases. Here are the key reports for major commodities:

- Energy (Crude Oil & Natural Gas):

- EIA Weekly Petroleum Status Report (Wednesdays): The most important report for US oil inventories.

- OPEC+ Meetings: Scheduled and unscheduled meetings that decide production quotas.

- Metals (Gold & Silver):

- U.S. CPI and PPI Inflation Data: Major driver of gold as an inflation hedge.

- FOMC Meeting Minutes & Interest Rate Decisions: Impacts the USD and, consequently, dollar-denominated metals.

- Agriculture (Grains):

- USDA World Agricultural Supply and Demand Estimates (WASDE) (Monthly): The “bible” for grain traders, providing global forecasts for supply and demand.

- Inflation Protection Tangible assets typically appreciate during inflationary periods.

- Portfolio Diversification Low correlation with traditional assets can reduce overall portfolio risk.

- High Return Potential Significant volatility can lead to substantial profits for savvy traders.

- Global Demand Driven by worldwide economic growth and population trends.

- Tangible Asset Unlike stocks, they represent a physical good with intrinsic utility.

- High Volatility Prices can swing wildly due to unpredictable events (weather, politics).

- No Income Generation Unlike dividend stocks, commodities produce no yield.

- Complexity of Futures Trading futures involves leverage and complex concepts, which can be daunting for beginners.

- Susceptible to Geopolitics Events in major producing countries can cause sudden price shocks.

- Storage Costs Physical ownership (e.g., gold bars) incurs insurance and storage fees.

Commodity in the Real World: The 2020 Oil Price Crash and Rebound

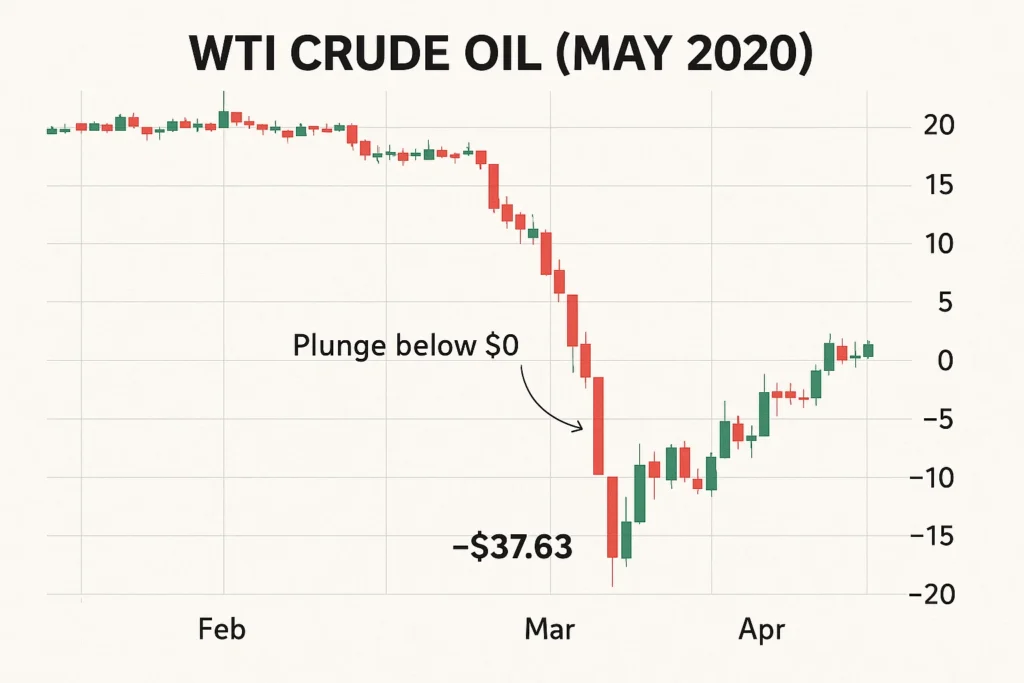

The COVID-19 pandemic created a perfect storm for the oil market, providing a stark lesson in commodity dynamics. As global lockdowns halted travel and industry in March 2020, demand for crude oil plummeted. Simultaneously, a price war between Saudi Arabia and Russia flooded the market with supply. This massive supply-demand imbalance caused the front-month West Texas Intermediate (WTI) futures contract to do something unprecedented: it fell into negative territory, closing at -$37.63 per barrel on April 20, 2020. This meant sellers were paying buyers to take oil off their hands, as storage capacity reached its limits.

However, this extreme low set the stage for a powerful rebound. As economies reopened, demand recovered. Production cuts by OPEC+ and US shale producers finally balanced the market. Within a year, WTI prices had not only recovered but surged past $70 per barrel. This event highlighted the extreme volatility of commodities, the critical importance of storage and logistics in the futures market, and the powerful recovery potential driven by global economic forces.

This case study, centered on the US benchmark WTI crude, underscores the high-stakes nature of commodity trading on Western exchanges and the global impact of decisions made by entities like OPEC.

Commodity vs Stock

A common point of confusion is the difference between a commodity and a stock.

| Feature | Commodity | Stock |

|---|---|---|

| What it represents | Ownership of a physical, raw material. | Ownership share in a publicly-traded company. |

| Value Driver | Global supply and demand. | Company earnings, growth, and management. |

| Income | Typically none (no dividends). | May pay dividends. |

| Primary Market | Futures/Spot markets (e.g., CME, LME). | Stock exchanges (e.g., NYSE, NASDAQ, LSE). |

| Risk Profile | High volatility, geopolitical risk. | Company-specific and market risk. |

Conclusion

Ultimately, understanding commodities provides a critical lens for evaluating global economic health and building a resilient investment portfolio. While they offer powerful benefits like inflation hedging and diversification, as we’ve seen, they are not without their caveats, including high volatility and complexity. By incorporating commodities thoughtfully—whether through broad-based ETFs for long-term investors or focused futures for active traders—you can make more informed, strategic decisions that protect and grow your capital. Start by analyzing the commodity exposure already in your portfolio and consider how adding a targeted allocation might improve your overall risk-return profile.

Ready to put these concepts into action? The right tools are essential. To start trading commodities, you’ll need a reliable brokerage platform with access to futures markets or commodity ETFs.

Related Terms

- Futures Contract: The primary financial instrument for trading commodities.

- Spot Price: The current market price for immediate delivery of a commodity.

- Inflation Hedge: An investment that protects against the decreasing purchasing power of a currency, a key function of commodities.

- Exchange-Traded Fund (ETF): A popular way for retail investors to gain exposure to commodities without trading futures directly.