Eagles Spread What It Is and How It Works for Traders

The Eagles Spread is a foundational options trading strategy designed to profit from a stock’s moderate upward move while strictly limiting risk. For traders in the US, Canada, and other major markets, it’s a cost-effective alternative to simply buying a call option, offering a crucial balance between opportunity and capital preservation on platforms like the CBOE, NYSE, and NASDAQ.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | A bullish options strategy involving buying one call option and selling another call option at a higher strike price with the same expiration date. |

| Also Known As | Bull Call Spread, Debit Call Spread, Vertical Bull Spread |

| Main Used In | Options Trading, Derivatives Market |

| Key Takeaway | It’s a defined-risk strategy that sacrifices unlimited profit potential for lower upfront cost and built-in risk management. |

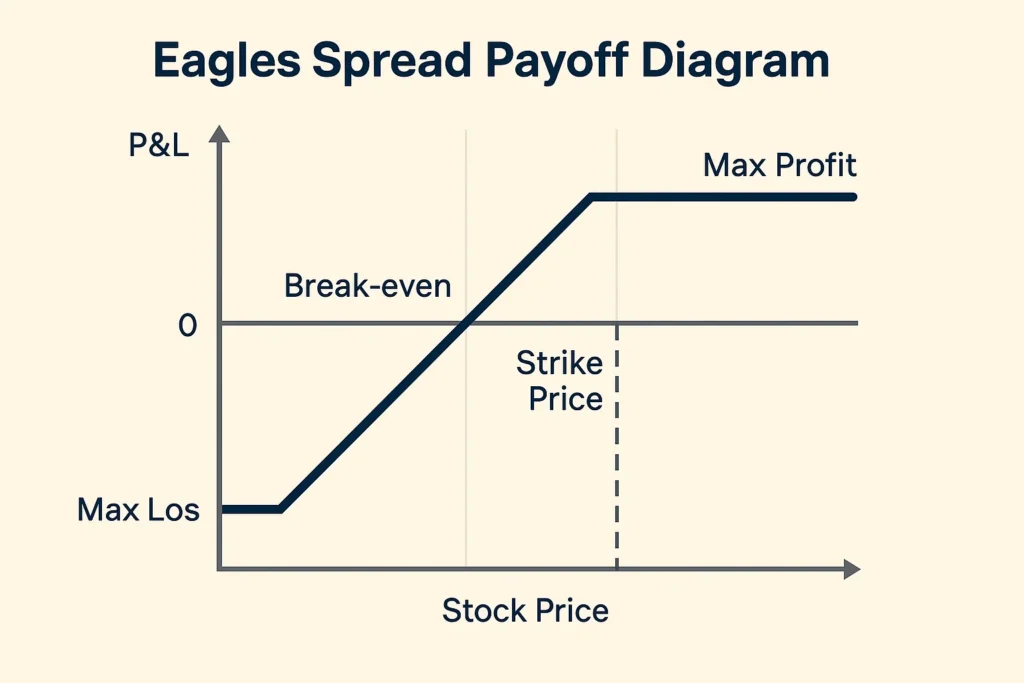

| Formula | Maximum Profit = (Difference in Strike Prices – Net Premium Paid) x 100Maximum Loss = Net Premium Paid x 100Break-Even = Lower Strike Price + Net Premium Paid |

What is an Eagles Spread

An Eagles Spread, more commonly known as a Bull Call Spread, is a debit spread strategy used when a trader is cautiously optimistic about a stock or index. Instead of just buying a call option (which can be expensive), you simultaneously buy one call option and sell another call option at a higher strike price. Both options have the same underlying asset and the same expiration date.

The goal is to finance the purchase of the more expensive call by selling the less expensive one, reducing the initial cost, but also capping your maximum profit.

Think of it as buying a ticket for a concert you think will be popular. You buy a standard ticket (your long call) but immediately sell the right to buy a VIP ticket (your short call) to someone else for a small fee. You’ve reduced your net cost for your standard ticket, but if the concert becomes a massive hit, you don’t benefit from the VIP section’s value. Your profit is limited, but your initial risk is lower.

Key Takeaways

The Core Concept Explained

The core of the Eagles Spread is the trade-off between cost, risk, and reward. By selling the higher-strike call, you collect a premium, which directly lowers the cost of buying the lower-strike call. This reduction in cost also lowers your break-even point, making it easier to profit from a smaller price move.

However, the premium from the short call is not free money. You are obligating yourself to sell the shares at the higher strike price if assigned. This obligation caps your upside potential. No matter how high the stock price climbs above the short call’s strike, your profit is locked in.

What a high or low value indicates: There is no single “value” for the spread itself. Traders analyze the net debit (cost), the maximum potential profit, and the probability of profit based on the chosen strikes. A wider spread between strikes usually means a higher cost but also a higher maximum profit potential.

How to Calculate an Eagles Spread

The calculations for an Eagles Spread are straightforward, which is a key benefit of this defined-risk strategy.

Step-by-Step Calculation Guide

Let’s break down a real-world example for a US-listed stock.

- Underlying Stock: XYZ Corp, trading at $149

- Action: Buy to Open 1 XYZ $150 Call for a premium of $3.00 ($300 per contract)

- Action: Sell to Open 1 XYZ $155 Call for a premium of $1.00 ($100 per contract)

- Expiration: Same for both contracts (e.g., 30 days out)

Example Calculation Table

| Input/Calculation | Value | Explanation |

|---|---|---|

| Net Premium Paid (Debit) | $3.00 – $1.00 = $2.00 | Total cost to enter the trade per share. |

| Maximum Loss | $2.00 x 100 = $200 | The total net debit paid. This is the most you can lose. |

| Maximum Profit | ($155 – $150 – $2.00) x 100 = $300 | (Spread Width – Net Debit) x Multiplier. |

| Break-Even Point | $150 + $2.00 = $152 | The stock price must be above $152 at expiration to profit. |

Interpretation: In this trade, you risk $200 to make a maximum potential profit of $300. The stock does not need to rocket to $160 for you to profit; it only needs to be above $152 at expiration, which is a 2% increase from the current price.

The Greeks of an Eagles Spread

Understanding how the option “Greeks” affect this strategy is crucial for intermediate traders.

- Delta: The spread has a positive net delta, meaning it profits from upward price movement. The delta is highest when the stock is between the strikes and decreases as it approaches the short strike.

- Gamma: The spread has limited gamma risk. While the individual legs have gamma, the opposing nature of the long and short calls creates a hedge, resulting in a relatively stable delta over a range of prices.

- Theta (Time Decay): As mentioned in the FAQ, Theta’s effect is complex. Initially, the spread may have a near-neutral or slightly positive theta, meaning it benefits slightly from time passing. As expiration nears, theta becomes a more significant factor, generally working in your favor if the stock is near or above the break-even.

- Vega (Volatility Risk): The spread has a negative net vega. This means it is negatively affected by a rise in implied volatility (IV) and benefits from a drop in IV. This is because the short call (which you sold) has more vega exposure than the long call in relative terms.

Adjusting and Managing an Eagles Spread

A static strategy is a losing strategy. Here’s how to manage a live Eagles Spread.

- Rolling the Spread Up: If the stock moves up rapidly and you become more bullish, you can “roll” the entire spread to higher strikes. This involves buying to close your current spread and selling to open a new one with higher strikes (e.g., from $150/$155 to $155/$160). This locks in some profit and gives you further upside, usually for an additional debit.

- Rolling the Spread Out in Time: If the stock hasn’t moved as expected and expiration is nearing, you can roll the spread to a later expiration date. This gives the trade more time to work, but you will likely have to pay an additional debit to do so.

- Taking Early Profits: Don’t feel you must hold until expiration. If the spread achieves 50-80% of its maximum profit potential with several weeks remaining, it is often wise to close it. The remaining potential profit is small, but the risk of a reversal is still present.

Why the Eagles Spread Matters to Traders and Investors

- For Traders: It provides a cost-effective way to express a bullish view. The lower break-even point compared to a long call means you can be right about the direction and still profit even if the move isn’t explosive. It’s a prime tool for trading within a expected range or around earnings reports.

- For Investors: It can be used to “rent” upside potential in a stock you own without committing more capital, or to establish a position at an effective entry point lower than the current market price.

- For All: Its defined-risk nature is its most critical feature. Before you even enter the trade, you know your exact worst-case scenario, allowing for precise position sizing and superior risk management.

How to Use the Eagles Spread in Your Strategy

Use Case 1: Trading a Range Breakout

You believe stock ABC, trading at $78, is consolidating and is about to break above resistance at $80. Instead of buying a $80 call for $2.00, you implement an Eagles Spread: Buy the $80 call for $2.00 and sell the $85 call for $0.50. Your net cost is $1.50. If ABC only rises to $83, a plain long call might still be a loser, but your spread is already in profit because your break-even is $81.50.

Use Case 2: Reducing Cost Basis on a Long Call View

You are very bullish on DEF but find the outright call premiums expensive due to high implied volatility. By selling a higher-strike call, you directly reduce the cost of your bullish bet, accepting a capped upside in exchange for a higher probability of profit.

To execute an Eagles Spread, you need a brokerage platform that supports multi-leg options strategies. We’ve tested the best platforms for active traders to find the ones with the lowest fees and most reliable execution.

- Defined and Limited Risk: You cannot lose more than the initial net debit paid.

- Lower Cost and Break-Even: Significantly cheaper than buying a naked call option.

- Higher Probability of Profit vs. Long Call: The lower break-even point makes it easier to achieve a profitable trade.

- Flexibility: Can be implemented with various strike widths to adjust risk/reward.

- Capped Profit Potential: The primary trade-off. You will not benefit from a massive, unexpected rally above your short strike.

- Early Assignment Risk: There is a risk of being assigned on the short call before expiration, which can complicate the position.

- Requires Margin: While risk is defined, your broker will require you to have a margin account to sell the short call.

- Can Lead to “Small Winners”: In a massive bull move, seeing your profits capped while the stock soars can be frustrating.

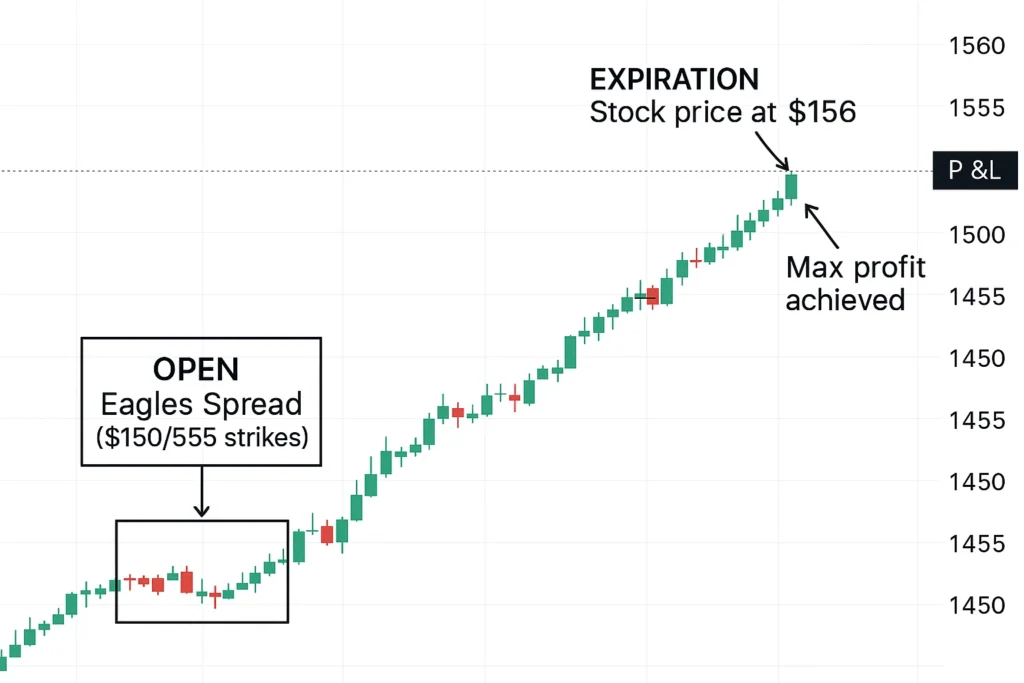

Eagles Spread in the Real World: A Case Study

Scenario: Trading Apple (AAPL) Before a Product Launch

In September, ahead of a new iPhone launch, a trader is moderately bullish on Apple, trading at $172. They expect a positive but not earth-shattering move. Instead of buying a $175 call for $5.00 ($500), they initiate an Eagles Spread.

- Trade: Buy AAPL $175 Call for $5.00 | Sell AAPL $185 Call for $2.00

- Net Debit: $3.00 ($300 total)

- Break-Even: $178

- Max Profit: $700 (if AAPL is at or above $185 at expiration)

- Max Loss: $300 (if AAPL is at or below $175 at expiration)

Outcome: At expiration, the new iPhone is well-received, and AAPL climbs to $182. A trader who bought only the $175 call would have a profit of ($182 – $175 – $5.00) * 100 = $200. The Eagles Spread trader, however, achieves a profit of ($182 – $175 – $3.00) * 100 = $400. They made twice the profit on a smaller price move due to their lower cost basis.

Eagles Spread vs Long Call

The most common comparison is between the Eagles Spread (Bull Call Spread) and simply buying a call option.

| Feature | Eagles Spread (Bull Call Spread) | Long Call |

|---|---|---|

| Cost | Lower (Net Debit) | Higher (Premium Paid) |

| Risk | Defined & Limited (to the net debit) | Defined & Limited (to the premium paid) |

| Profit Potential | Capped | Theoretically Unlimited |

| Break-Even Point | Lower (Long Strike + Net Debit) | Higher (Strike Price + Premium) |

| Best For | Moderate, controlled bullish moves | Strong, explosive bullish moves |

Conclusion

Ultimately, the Eagles Spread is a strategic tool for the disciplined trader who seeks to profit from bullish conviction without taking on unlimited risk or cost. It elegantly solves the problem of high options premiums by financing a long position with a short one, all while providing the clarity of known worst- and best-case scenarios from the outset. While the sacrifice of unlimited upside is a real limitation, the benefits of lower cost, a more achievable break-even point, and defined risk make it a cornerstone of many options portfolios. Start by analyzing stocks you are cautiously bullish on and model how an Eagles Spread would have performed compared to a long call.

Ready to put the Eagles Spread into action? The right tools are essential. We’ve meticulously reviewed and ranked the best online brokers for options trading to help you find a platform with the advanced tools and low fees you need to succeed.

Related Terms

- Bear Put Spread: The bearish equivalent, using put options.

- Credit Spread: A strategy where you receive a net credit to open, like a Bull Put Spread.

- Iron Condor: A more advanced, neutral strategy that often uses two credit spreads.

- Implied Volatility: A critical factor affecting the premiums of the options used in the spread.