Liquid Capital What It Is, Why It Matters, and How to Manage It

Liquid capital is the lifeblood of any financial endeavor, representing the cash or assets that can be instantly converted to cash to meet immediate obligations. It is the ultimate measure of financial health and flexibility, acting as a buffer against unexpected expenses or opportunities. For businesses and investors across the US, UK, Canada, and Australia, managing liquid capital effectively is the difference between seizing a market opportunity and facing a liquidity crisis.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | Assets that can be converted into cash immediately with minimal loss of value. |

| Also Known As | Liquid assets, quick assets, current assets (in a business context). |

| Main Used In | Corporate Finance, Personal Finance, Investing, Small Business Management. |

| Key Takeaway | High liquid capital provides safety and opportunity; low liquid capital creates risk and inflexibility. |

| Formula | Liquid Capital = Cash + Cash Equivalents |

| Related Concepts |

What is Liquid Capital

Liquid capital goes beyond the cash in a bank register or a company’s checking account. It encompasses all assets that can be rapidly sold or converted into cash at or near their market value. Think of it as your financial “go-bag”, the resources you can access right now without having to sell off core possessions or long-term investments at a fire-sale price.

An easy analogy: Your liquid capital is like the water in your hydration pack during a marathon. You need constant, easy access to it to keep going. Your illiquid assets (like your house or a piece of heavy machinery) are like the water reservoir at home, essential, but no help to you mid-race when you need a drink.

Key Takeaways

The Core Concept Explained

Liquid capital measures immediate financial power. A high level indicates strong short-term health, allowing an entity to pay bills, cover debts, and handle emergencies without disrupting operations. A low level is a red flag, signaling potential vulnerability to cash flow problems, which can force desperate actions like taking on high-interest debt or selling assets at a loss.

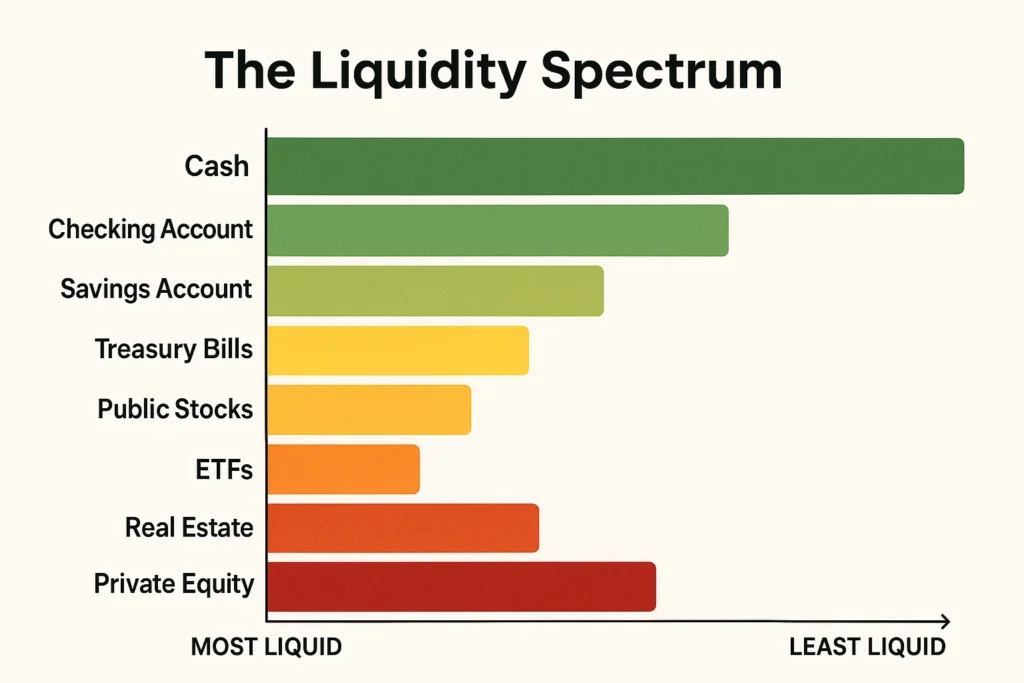

The core of the concept lies in the “liquidity spectrum.” Assets fall on a scale from most liquid to least:

- Most Liquid: Cash, Bank Accounts (Checking/Savings)

- Highly Liquid: Money Market Funds, Treasury Bills, Publicly Traded Stocks (Blue Chips)

- Moderately Liquid: Mutual Funds, Corporate Bonds, ETFs

- Less Liquid: Real Estate, Private Equity, Machinery, Fine Art

The Psychology of Liquid Capital

Liquid capital isn’t just a financial metric; it’s a psychological tool. Studies in behavioral finance show that having a robust emergency fund (a form of liquid capital) significantly reduces financial anxiety. This “peace of mind premium” allows investors to stick to their long-term strategies during market volatility instead of panic-selling. For entrepreneurs, it provides the mental space to make strategic decisions for growth rather than desperate decisions for survival. Understanding this psychological benefit reframes liquid capital from a “low-return drag” into an “anxiety-reduction asset.”

Liquid Capital in the Gig Economy and for Freelancers

The traditional “3-6 months of expenses” rule often isn’t enough for freelancers, contractors, and gig economy workers whose income is inherently variable. For this growing segment of the workforce, a more prudent target is 6-12 months of essential expenses. This larger buffer accounts for not only personal emergencies but also client non-payment, dry spells in projects, and the time needed to find new gigs. For a freelancer in Canada or the UK, this enhanced liquid capital reserve is their most important business asset, acting as their corporate treasury and personal safety net combined.

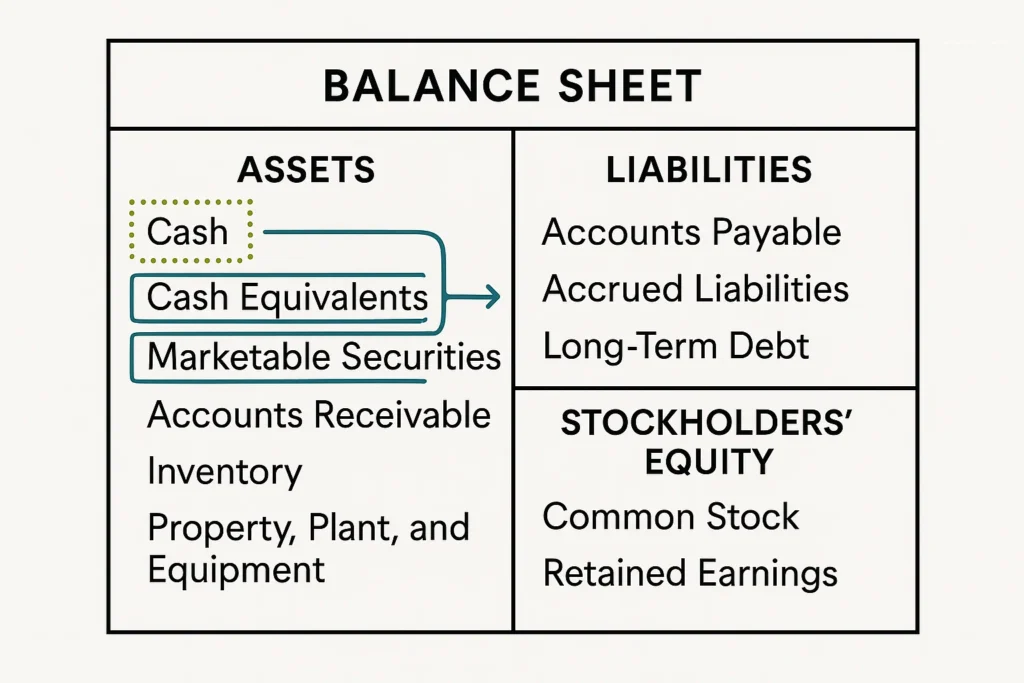

How to Calculate Liquid Capital

For a precise snapshot, the calculation is straightforward. It focuses on the most liquid assets on a balance sheet.

Formula:

Liquid Capital = Cash + Cash Equivalents

Step-by-Step Calculation Guide

- Identify Cash: This includes physical currency and balances in checking and savings accounts.

- Identify Cash Equivalents: These are short-term, highly liquid investments that are readily convertible to known amounts of cash and have minimal risk of value changes. Examples are Treasury bills, money market funds, and commercial paper.

- Sum the Values: Add the total value of cash and cash equivalents together.

Example Calculation: A US-Based Small Business

| Input Values | Amount (USD) |

|---|---|

| Cash on Hand | $5,000 |

| Checking Account Balance | $25,000 |

| Savings Account Balance | $40,000 |

| Money Market Fund Holdings | $30,000 |

| Total Liquid Capital | $100,000 |

Interpretation: This business has $100,000 available to cover immediate expenses like payroll, rent, supplier payments, or an unexpected equipment repair. An analyst would compare this to the company’s short-term liabilities to assess its liquidity position.

Why Liquid Capital Matters to Traders and Investors

- For Traders: Day traders and swing traders need significant liquid capital to meet margin calls, jump on quick breakout opportunities, and avoid being forced to close positions at a loss due to a lack of available funds. A trader with low liquid capital is one market dip away from a catastrophe.

- For Investors: Long-term investors use liquid capital for dollar-cost averaging, purchasing dips in the market, and covering living expenses in retirement without being forced to sell long-term holdings during a bear market. For investors in the UK or Australia, this is crucial for managing tax liabilities without disrupting a core investment portfolio.

- For Analysts: It’s a primary indicator of a company’s short-term survivability. A company like a listed firm on the NYSE or FTSE with strong liquid capital is seen as a lower risk, as it can weather economic downturns and invest in R&D or acquisitions without needing to raise expensive capital.

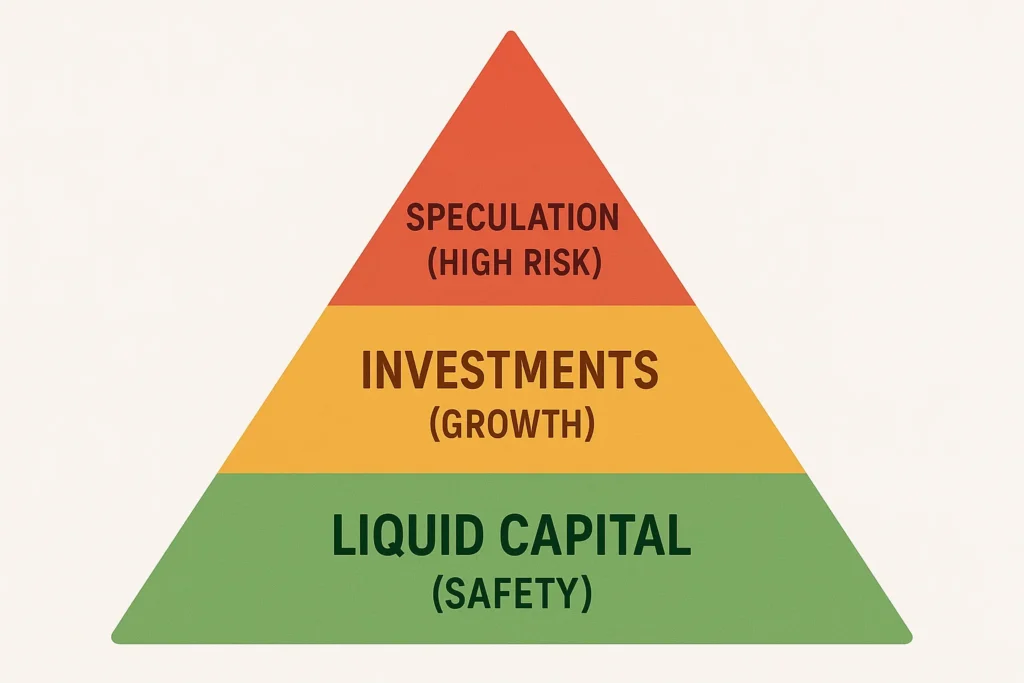

How to Use Liquid Capital in Your Strategy

Use Case 1: The Emergency Fund (Personal Finance)

Financial advisors consistently recommend holding 3-6 months’ worth of living expenses in liquid capital (e.g., a high-yield savings account). This isn’t for investment; it’s a financial airbag. When your car breaks down or you face unexpected medical bills, you tap this fund instead of high-interest credit cards.

Use Case 2: The Strategic Opportunity Fund (Investing)

Separate from your emergency fund, maintain a pool of liquid capital to deploy when markets correct. When a stock you’ve been monitoring drops 20% due to temporary bad news, you have the “dry powder” to buy in without selling other assets.

Use Case 3: Business Cycle Management (Corporate Finance)

A retail business in the US should build up liquid capital before a slow season to ensure it can cover fixed costs like rent and payroll. Conversely, a tech startup might conserve liquid capital to extend its “runway” before it needs to seek another round of funding.

To effectively manage your liquid capital, you need a bank that offers competitive yields on your savings. We’ve reviewed the best high-yield savings accounts to help your money work for you even when it’s on standby.

- Risk Mitigation: Protects against income shocks and unexpected expenses.

- Financial Flexibility: Allows you to act quickly on opportunities without taking on debt.

- Reduces Stress: Provides peace of mind, knowing you can handle financial emergencies.

- Strong Credit Profile: Businesses with high liquid capital are often viewed more favorably by lenders.

- Opportunity Cost: Cash and cash equivalents typically offer very low returns, often below the rate of inflation. Holding too much means your wealth is effectively eroding in purchasing power.

- Not a Growth Driver: Liquid capital is a defensive tool. It does not generate significant wealth on its own.

- Management Overhead: Requires active management to ensure the amount is “just right” not too much and not too little.

Liquid Capital in the Real World: A Case Study

The 2008 Financial Crisis provides a stark lesson. Two iconic investment banks, Lehman Brothers and Goldman Sachs, faced the same storm.

- Lehman Brothers was heavily invested in illiquid assets (complex mortgage-backed securities). When the market for these assets froze, they couldn’t sell them to raise cash to meet their obligations. Their liquid capital was insufficient, leading to bankruptcy.

- Goldman Sachs, meanwhile, had managed its balance sheet more conservatively and had a stronger buffer of liquid capital. This, combined with a swift conversion to a bank holding company, allowed it to survive and eventually thrive.

This contrast powerfully illustrates that during a systemic crisis, the value of illiquid assets can become theoretical, while the value of liquid capital is absolute.

Liquid Capital vs Working Capital

It’s often confused with Working Capital, but they are distinct.

| Feature | Liquid Capital | Working Capital |

|---|---|---|

| What it measures | The most liquid assets available immediately. | Short-term financial health and operational efficiency. |

| Formula | Cash + Cash Equivalents | Current Assets – Current Liabilities |

| Scope | Narrow (only the most liquid assets). | Broad (includes inventory, receivables). |

| Primary Use | Assessing immediate solvency and cash-on-hand. | Assessing the ability to fund day-to-day operations. |

Conclusion

Ultimately, understanding and managing liquid capital is a fundamental practice for enduring financial health. It is the bedrock upon which both safety and opportunity are built. While, as we’ve seen, holding excessive amounts can lead to missed growth due to opportunity cost, the far greater risk for most individuals and businesses is having too little. By consciously allocating a portion of your resources to liquid assets, you create the resilience to withstand unexpected setbacks and the agility to pounce on strategic opportunities. Start by auditing your personal or business balance sheet today to ensure your liquid capital is adequate for your needs.

Ready to build your financial safety net? The first step is finding the right place for your liquid assets. We’ve meticulously reviewed and ranked the best cash management accounts and high-yield savings platforms to help you optimize your liquid capital.

Related Terms

- Liquidity Ratio: Metrics like the current ratio and quick ratio that use balance sheet data to quantify liquidity.

- Cash Flow: The net flow of cash into and out of a business; the engine that replenishes liquid capital.

- Balance Sheet: The financial statement where liquid capital is reported.

- Asset Allocation: The strategy of dividing an investment portfolio among different asset categories, which includes deciding what percentage to keep in liquid assets.

Frequently Asked Questions

Recommended Resources

- How to Calculate and Interpret Liquidity Ratios

- Building a 6-Month Emergency Fund: A Step-by-Step Guide

- U.S. Securities and Exchange Commission (SEC) on Cash and Cash Equivalents

- Investopedia: Liquid Asset Definition

- The Federal Reserve – Economic Data (FRED): Data on Money Supply