Slippage What It Is, How It Works, and How to Manage It

Slippage is the hidden cost of trading, representing the difference between the price you expect to get and the price you actually receive. It’s an unavoidable reality in fast-moving markets that can silently erode your profits. For active traders in the US, UK, Canada, and Australia executing orders on volatile assets, understanding and managing slippage is as crucial as picking the right entry point.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | The difference between a trade’s expected price and the actual executed price. |

| Also Known As | Price Improvement, Negative Slippage, Positive Slippage |

| Main Used In | Day Trading, Forex, Crypto, Futures, Options |

| Key Takeaway | Slippage is most prevalent during high volatility and with large market orders; it can be both a cost and a benefit. |

| Formula | Slippage = Execution Price – Expected Price |

| Related Concepts |

What is Slippage

In its simplest form, slippage is the “price of impatience.” When you place a market order, an order to buy or sell at the best available current price, you are essentially telling your broker, “Fill this order now, at whatever price you can get.” The “current price” you see on your screen is based on the last traded price, but the market is a dynamic auction with constantly shifting buy (bid) and sell (ask) offers. Between the time you click “buy” and the time your broker finds a seller, the price can change. That difference is slippage.

Imagine you see a concert ticket online for $100. You click “buy,” but by the time the website processes your payment, the only tickets left are being resold for $110. The $10 difference is your “slippage.” In financial markets, this happens in milliseconds.

Key Takeaways

The Core Concept Explained

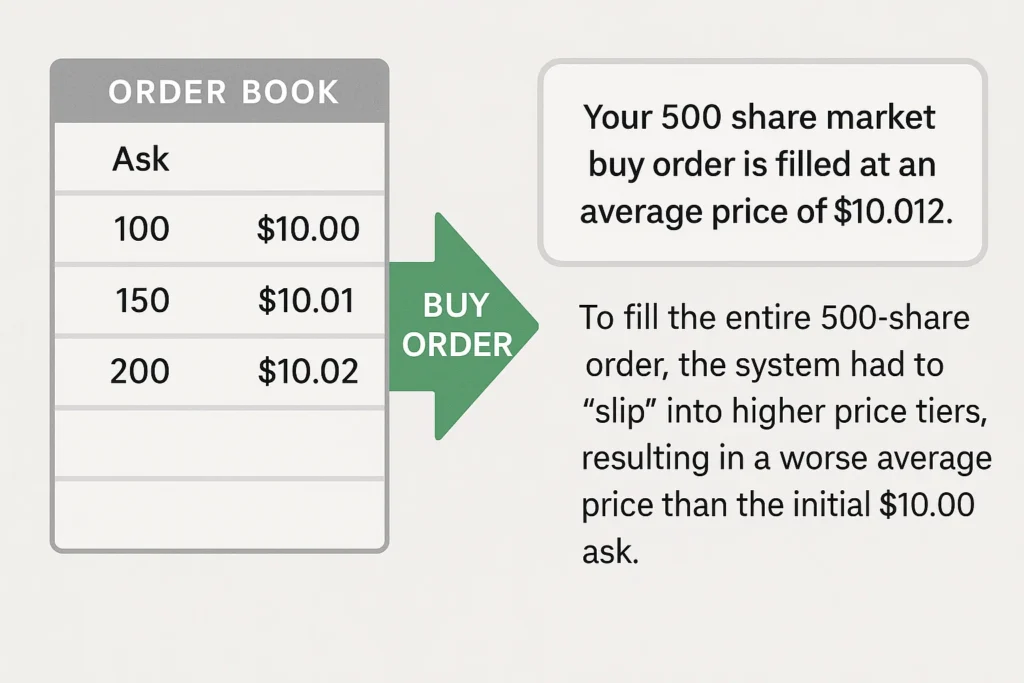

Slippage measures the market’s friction. It occurs because financial markets don’t have a single price; they have a bid-ask spread. The “expected price” is usually the last traded price or the current ask (for a buy) or bid (for a sell). However, if there aren’t enough orders at that price to fulfill your entire order, your trade gets “slipped” to the next best available price.

A high slippage value indicates a fast-moving or illiquid market where price stability is low. A low or zero slippage value suggests a stable, liquid market where large orders can be filled with minimal price impact.

How to Calculate Slippage

The calculation for slippage is straightforward. It can be expressed in absolute price terms or as a percentage.

Formula:

Slippage = Execution Price – Expected Price

Percentage Slippage:

Slippage % = ((Execution Price – Expected Price) / Expected Price) * 100

Step-by-Step Calculation Guide

Let’s break down a real-world example for a trader in the UK buying shares on the London Stock Exchange (LSE).

You want to buy 1,000 shares of “UK Corp PLC.” The last traded price was £5.00, and the current best ask price is £5.01. You place a market order.

| Step | Action | Value |

|---|---|---|

| 1. Expected Price | The price you see when placing the order. | £5.01 |

| 2. Execution Price | The actual average price your 1,000 shares were filled at. Due to low liquidity, only 500 were filled at £5.01, and 500 were filled at £5.03. | (500 * £5.01 + 500 * £5.03) / 1000 = £5.02 |

| 3. Slippage | Execution Price – Expected Price | £5.02 – £5.01 = £0.01 |

| 4. Slippage % | ((£5.02 – £5.01) / £5.01) * 100 | 0.2% |

| 5. Total Cost | Slippage per share * Number of Shares | £0.01 * 1,000 = £10 |

You paid £10 more than you initially expected for this trade due to negative slippage.

The Psychology of Slippage

How you react to slippage is as important as understanding it.

- The “Fill” Fallacy: The relief of a guaranteed fill with a market order can be psychologically comforting, even if it comes at a worse price. Traders must train themselves to value price certainty (limit orders) over execution certainty when the stakes are high.

- Chasing the Market: A trader who sees a stock moving rapidly upwards might FOMO in with a market order, knowingly accepting slippage to get in. This emotional decision often leads to the worst possible fills. A disciplined limit order, while risking a missed trade, often results in better long-term performance.

- Anchoring on the Expected Price: After experiencing negative slippage, a trader might become anchored to the price they should have gotten, leading to frustration and poor decision-making. Accepting slippage as a cost of doing business is a mark of a professional mindset.

Why Slippage Matters to Traders and Investors

- For Traders: Slippage directly impacts the profitability of short-term strategies. A scalper aiming for a 5-cent profit can see their entire gain wiped out by a 2-cent slippage on entry and exit. It’s a critical variable in backtesting; ignoring it creates unrealistically optimistic results.

- For Investors: While long-term investors may be less affected by single instances of slippage, it adds up over time, especially with frequent contributions or rebalancing. For large institutional orders (e.g., a pension fund buying millions of shares), managing slippage, often called “implementation shortfall,” is a primary focus.

- For Crypto Traders: In the 24/7, highly volatile crypto markets, slippage is a constant concern. Decentralized exchanges (DEXs) allow users to set a “slippage tolerance” (e.g., 1%), which dictates the maximum price movement they are willing to accept before the transaction fails.

Slippage in Algorithmic and High-Frequency Trading (HFT)

For quant funds and HFT firms, managing slippage is the entire game. They employ sophisticated models to minimize it.

- Volume-Weighted Average Price (VWAP): A common benchmark algorithm that breaks a large order into smaller pieces to be executed throughout the day at the average price, thus minimizing market impact and slippage.

- Liquidity Seeking Algorithms: These “sniff out” liquidity across multiple trading venues (exchanges, dark pools) to find the best possible price for a large order, directly combating slippage.

- The Arms Race: HFT firms colocate their servers physically next to exchange servers to gain microsecond advantages, all to ensure their orders are filled before others, a practice that directly impacts their ability to avoid negative slippage and capture positive slippage.

How to Use Slippage in Your Strategy

Managing slippage isn’t about eliminating it, it’s about minimizing its negative impact and even harnessing it.

- Use Case 1: Avoiding Negative Slippage with Limit Orders

- Scenario: You want to buy a stock but are concerned about volatility. Rather than placing a market order, utilize a limit order. Set your maximum buy price at or near the current ask. This guarantees you will never pay more than your limit, effectively capping your potential negative slippage at zero.

- Use Case 2: Capturing Positive Slippage

- Scenario: You want to sell a stock that is gapping up on good news. By placing a market order to sell, you risk the price dropping before your order fills. However, if the price jumps higher, your sell order might get filled at a better price than expected. This is positive slippage. Some brokers even offer price-improvement algorithms designed specifically for this.

- Use Case 3: Trading Around High-Impact News

- Scenario: The US Federal Reserve is about to make an interest rate announcement. Volatility will be extreme, and spreads will widen. The best strategy to avoid massive slippage is to not trade with market orders during this window. Wait for the volatility to settle.

Using limit orders is one of the simplest ways to control slippage. To effectively implement this, you need a brokerage platform with fast, reliable order execution. We’ve tested the platforms that offer the best order types and fill quality.

- Positive Slippage: It can work in your favor, giving you a better fill than expected.

- Guaranteed Execution: When using market orders, you accept slippage in exchange for the near-certainty that your order will be filled immediately, which is critical for entering or exiting a position quickly.

- Market Efficiency: Slippage is a natural mechanism that reflects the true, real-time balance of supply and demand.

- Erodes Profits: Negative slippage is an direct, often hidden, cost that reduces trading profits.

- Unpredictable: The exact amount of slippage is unknown at the time of order placement, making precise risk management difficult.

- Makes Backtesting Unreliable: A strategy that looks profitable in a theoretical backtest (which assumes perfect fills) may be unprofitable in live trading due to unaccounted-for slippage.

- Worsens with Order Size: The larger your order relative to the available liquidity, the worse the slippage is likely to be.

Slippage in the Real World: A Case Study

The “Flash Crash” of May 2010 provides a dramatic example of extreme slippage.

On May 6, 2010, US markets, including the Dow Jones Industrial Average, plummeted nearly 1,000 points in minutes before rapidly recovering. During this period of unprecedented volatility and illiquidity, the bid-ask spreads for thousands of stocks and ETFs widened exponentially.

- Scenario: A trader holding an S&P 500 ETF (like SPY) might have had a stop-loss order set at $100 to limit losses. As the crash accelerated, the liquidity at $100 vanished. Their market sell order could have been filled hundreds of ticks lower, at prices like $95, $90, or in infamous cases like Procter & Gamble, for as low as $1. The slippage here was catastrophic.

- The Aftermath: This event led to regulatory changes, including the implementation of “limit up-limit down” rules on US exchanges to prevent such extreme price dislocations. It serves as a permanent reminder of the risks of using market orders in chaotic conditions.

Slippage vs Bid-Ask Spread

Slippage is often confused with the Bid-Ask Spread, but they are distinct yet related concepts.

| Feature | Slippage | Bid-Ask Spread |

|---|---|---|

| What it is | The change in price from expectation to execution. | The difference between the best buy and sell prices available. |

| When it occurs | During the order execution process. | Exists continuously in the order book. |

| Primary Cause | Price movement & lack of liquidity over time. | Imbalance of buy/sell orders at a point in time. |

| Relationship | The bid-ask spread is the minimum potential slippage for a market order. Slippage increases as the spread widens or the price moves. | A wide spread creates a larger “slippage zone” for incoming market orders. |

Conclusion

Understanding slippage is fundamental to becoming a realistic and disciplined trader. It is not an abstract concept but a tangible transaction cost that, like a broker’s commission, must be managed. While its negative form can silently eat into returns, its occurrence can be mitigated through strategic order types like limits and by avoiding the most volatile market periods. By acknowledging slippage and incorporating it into your risk and strategy models, you move from hoping for the best to planning for reality. The most successful traders aren’t those who never face slippage, but those who have a plan to control it.

Ready to put these concepts into action? The right tools are essential. We’ve meticulously reviewed and ranked the best online brokers for active traders to help you find a platform with fast execution and advanced order types, which are key to managing slippage.

Related Terms

- Bid-Ask Spread: The foundational cost of a round-trip trade; slippage often occurs beyond the spread.

- Market Order: The order type that guarantees execution but accepts slippage risk.

- Limit Order: The order type that guarantees price but risks non-execution, used to prevent negative slippage.

- Liquidity: The ease of trading an asset without impacting its price; low liquidity is a primary driver of high slippage.

- Implementation Shortfall: The academic and institutional term for the total cost of executing a large order, which includes slippage, commissions, and fees.

Frequently Asked Questions

Recommended Resources

- Advanced Order Types: A Trader’s Guide to Controlling Slippage

- YouTube Video: How to Set Slippage Tolerance on MetaTrader 4

- U.S. Securities and Exchange Commission (SEC): Investor Bulletin on Stop Loss Orders (explains the risks related to slippage).

- Investopedia: Definition and examples of Implementation Shortfall.

How did this post make you feel?

Thanks for your reaction!