Stop-Loss Order What It Is and How to Use It Effectively

A stop-loss order is an automatic instruction to sell a security when it reaches a specific price, designed to cap your potential losses on a trade. It is one of the most fundamental and essential risk management tools for any active trader or investor. For market participants in the US, UK, Canada, and Australia, using stop-losses on platforms like the NYSE, NASDAQ, or LSE is a standard practice to protect capital from severe market downturns.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | A pre-set order to automatically sell a security when its price falls to a specified level. |

| Also Known As | Stop Order, Protective Stop |

| Main Used In | Stock Trading, Forex, Crypto, Futures, Options |

| Key Takeaway | It is a crucial tool for limiting losses and enforcing trading discipline without requiring constant monitoring. |

| Related Concepts |

What is a Stop-Loss Order

A stop-loss order is an automated command you give to your broker to sell a security once it hits a predetermined price point. Think of it as a safety net or an insurance policy for your trades. Its primary purpose is to prevent emotional decision-making and significant financial loss by mechanically closing a position when the market moves against you.

Imagine you’re on a boat. A stop-loss is like a leak detector that automatically starts the bilge pump if water rises above a certain level. You don’t have to constantly check for leaks; the system protects the boat automatically, allowing you to focus on steering.

Key Takeaways

The Core Concept Explained

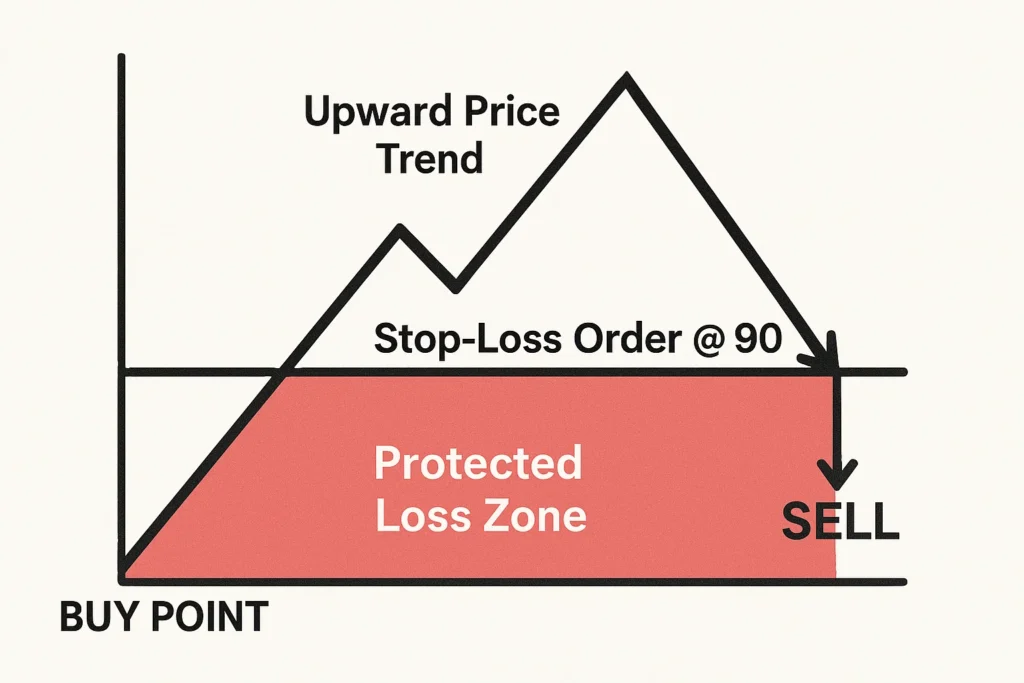

When you place a stop-loss order, you are setting a conditional trigger. Nothing happens until the market price touches your specified “stop price.” Once that level is breached, your stop-loss order is activated and turns into a market order to sell, which is then executed at the next available price.

This means you are defining your maximum acceptable loss upfront. For example, if you buy a stock at $100 and place a stop-loss at $90, you have predefined that you are unwilling to lose more than $10 per share on this trade.

How to Place a Stop-Loss Order

Placing a stop-loss is a strategic decision, not a calculation. It involves determining a price level at which your original trade thesis is invalidated.

Step-by-Step Placement Guide

- Identify Your Entry Price: This is the price you paid for the asset (e.g., $50 per share for a company listed on the NASDAQ).

- Determine Your Risk Tolerance: Decide the maximum percentage or dollar amount you are willing to lose. A common risk tolerance is 1-2% of your total trading capital per trade, or a 5-10% drop from the purchase price of the asset.

- Set the Stop Price: Calculate the price based on your risk. For a $50 stock with a 10% max loss, your stop price is $45 ($50 * 0.90).

- Submit the Order: In your brokerage platform (e.g., Charles Schwab, Interactive Brokers), select “Stop Loss” as the order type, enter the stop price ($45), and the number of shares.

Example:

You buy 100 shares of “TechCorp UK” on the LSE for £20.00 per share. You decide your invalidation point is £18.00.

- Input Values: Buy Price = £20.00, Stop-Loss Percentage = 10%, Stop Price = £18.00

- Interpretation: “Placing a stop-loss at £18.00 means my maximum loss on this trade is capped at £2.00 per share, or £200 total, excluding commissions.”

Why Stop-Loss Orders Matter to Traders and Investors

- For Traders: It provides an automated exit strategy, freeing them from screen-watching and preventing a small loss from snowballing into a catastrophic one during a rapid market move. It’s fundamental for protecting your trading capital.

- For Investors: Even long-term investors use stop-losses to protect profits in a bull market or to automatically sell a stock if its fundamentals deteriorate, as reflected in a falling share price. It’s a guard against bear markets and black swan events.

- For Everyone: It instills discipline. The hardest decision in trading is often when to sell a losing position. A stop-loss makes that decision in advance, based on logic, not fear or hope.

How to Use Stop-Loss Orders in Your Strategy

Use Case 1: Capital Preservation on a Long Trade

- Scenario: You buy ASX-listed “MiningCo Ltd” shares at A$100.

- Action: You place a stop-loss order at A$90. If bad news hits and the stock plummets, your position is automatically sold around A$90, limiting your loss to 10%.

Use Case 2: Protecting Profits (Trailing Stop-Loss)

- Scenario: Your A$100 MiningCo shares rise to A$150.

- Action: You replace your static stop-loss with a trailing stop order set at 15%. This stop price “trails” the market price by 15%. If the price rises to A$160, the stop moves to A$136. If the price then falls 15% from its peak, the order triggers, locking in significant profits.

To implement advanced order types like trailing stops, you need a brokerage with robust trading tools. We’ve reviewed the best platforms for active traders to help you choose.

Advanced Stop-Loss Strategies

Moving beyond the basic percentage-based stop, here are sophisticated placement techniques used by professional traders:

- Volatility-Based Stops (ATR): Use the Average True Range (ATR) indicator. Instead of a fixed percentage, set your stop at 1.5 or 2 times the ATR below your entry. This adapts your stop to the asset’s inherent volatility, preventing premature exits on naturally volatile stocks.

- Technical Analysis Stops: Place your stop-loss just below a key technical level, such as:

- A major support level on a chart.

- A significant moving average (e.g., the 50-day or 200-day EMA).

- The neckline of a chart pattern (e.g., head and shoulders).

- Time-Based Stops: If a trade doesn’t move in your anticipated direction within a certain timeframe (e.g., 5-10 days), exit it regardless of price. This protects capital from “dead” trades that go sideways.

- Disciplined Risk Management: Enforces a pre-defined exit strategy.

- Emotion Removal: Prevents “hoping” a losing trade will recover.

- Capital Protection: The single most important tool for preserving your trading bankroll.

- Peace of Mind: Allows you to step away from the screen without worry.

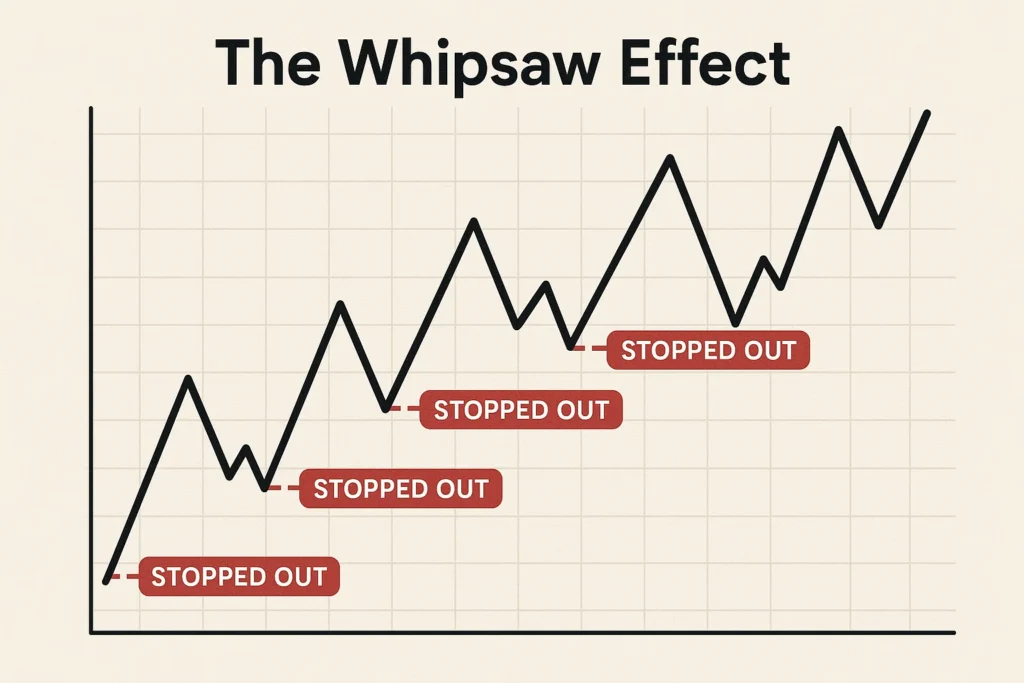

- Whipshots/Volatility: In a choppy market, a temporary price dip can trigger your stop, only for the price to immediately rebound. This is known as being “stopped out.”

- No Price Guarantee: A stop-loss becomes a market order. During a gap down or flash crash, the actual sell price can be significantly lower than your stop price.

- Over-reliance: A stop-loss is a tool, not a strategy. It must be part of a larger plan that includes position sizing and analysis.

Psychology of the Stop-Loss: Why Traders Hate Using Them

Understanding the mental barriers is key to overcoming them.

- The “It Will Come Back” Fallacy: Hope is the enemy of the disciplined trader. A stop-loss makes the loss real, which is psychologically painful, but it prevents the much greater pain of a 50%+ loss.

- Regret After a Whipsaw: Being stopped out only to see the price rise is frustrating. The key is to not view this as a failure of the tool, but as the cost of doing business and insurance. The one time you don’t use a stop-loss could be the time a stock collapses permanently.

- Reframing the Mindset: Don’t think, “I lost $500 on that trade.” Think, “I paid $500 to ensure my portfolio survived and I live to trade another day.” The goal is long-term profitability, not being right on every single trade.

Stop-Loss Order in the Real World: The Flash Crash of 2010

On May 6, 2010, US financial markets experienced a “Flash Crash,” with the Dow Jones Industrial Average plunging nearly 1,000 points in minutes before rapidly recovering.

This event perfectly illustrates both the purpose and the limitation of stop-loss orders. Traders with stop-losses in place were automatically sold out of their positions, which protected them from further losses if the crash had been real and sustained. However, due to the extreme volatility and lack of liquidity, many sell orders were filled at absurdly low prices, pennies on the dollar, far below their intended stop price. When the market rebounded minutes later, these traders had been locked out of their positions at a massive loss, demonstrating the risk of gap risk.

Stop-Loss Order vs Limit Order

The most common point of confusion is between a Stop-Loss and a Limit Order.

| Feature | Stop-Loss Order | Limit Order |

|---|---|---|

| Primary Purpose | To limit a loss or protect profits. | To define a specific entry or exit price. |

| Order Activation | Activates when price hits the stop level. | Is live immediately, waiting to be filled. |

| Execution Price | Becomes a market order; price not guaranteed. | Guarantees price but not execution. |

| Best Used For | Exiting a trade automatically when it goes wrong. | Entering a trade at a specific price or taking profits at a target. |

Conclusion

The stop-loss order is a non-negotiable component of prudent financial risk management. While it is not a perfect tool, vulnerable to whipsaws and gap risk as we’ve discussed, its benefits in enforcing discipline and preventing catastrophic losses far outweigh its limitations. By thoughtfully incorporating stop-losses into your overall trading plan, you shift the focus from predicting the market to proactively managing your risk. Start by defining your risk tolerance for every new position and let the stop-loss handle the rest.

Ready to implement stop-loss orders with confidence? The right brokerage platform is key. Explore our curated list of the best online brokers for beginners and pros alike to find a partner that offers the advanced order types you need.

Related Terms

- Take-Profit Order: The opposite of a stop-loss; an order to automatically sell a security when it reaches a profitable price target.

- Trailing Stop-Loss: A dynamic stop-loss that follows the market price upward to lock in profits while still protecting against downturns.

- Market Order: An order to buy or sell immediately at the best available current price. A stop-loss becomes this.

- Stop-Limit Order: A hybrid order that combines a stop-loss with a limit order to control the execution price, though it risks non-execution.

Frequently Asked Questions

Recommended Resources

- Advanced Order Types: Trailing Stops and Stop-Limits

- How to Set a Stop-Loss in 3 Minutes

- The U.S. Securities and Exchange Commission (SEC) guide on order types

- The official investor education resources from the ASIC

How did this post make you feel?

Thanks for your reaction!