Definition

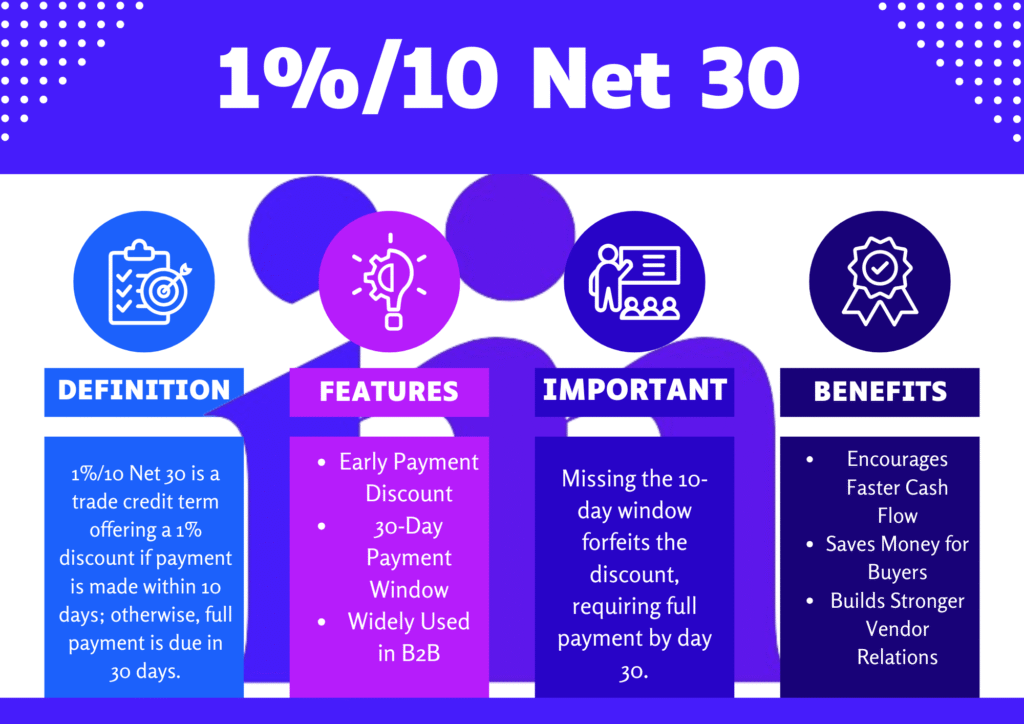

1%/10 Net 30 is a standard payment arrangement in business-to-business deals, offering a 1% discount if the invoice is paid within 10 days. If the early payment option isn’t used, the total amount must be settled within 30 days. It balances cash flow incentives for buyers with timely payments for sellers.

Key Features of 1%/10 Net 30

- Early Payment Discount: Buyers save 1% by settling invoices within 10 days.

- Standard Net Terms: If the buyer doesn’t take the discount, the full is due by the 30th day.

- Cash Flow Management Tool: Helps businesses optimize working capital and liquidity.

- Negotiable Terms: Often tailored based on buyer-seller relationships or industry standards.

Pros and Cons of 1%/10 Net 30

Pros:

- Improved Cash Flow (Seller): Accelerates receivables, reducing the risk of late payments.

- Cost Savings (Buyer): Discounts reduce expenses for buyers who pay early.

- Strengthened Relationships: Encourages trust and reliability between parties.

Cons:

- Buyer Cash Strain: Smaller businesses may struggle to pay early to claim discounts.

- Revenue Trade-Off (Seller): Discounts cut into profit margins if widely used.

Real-World Example

A fictional supplier, OfficePro, sells 20,000 worth of equipment to a retailer with 120,000 worth of equipment to a retailer with 1200 (1%) and pay 19,800. Otherwise, the entire $20,000 must be paid by the 30th day of the invoice period. This incentivizes the retailer to prioritize payment or risk losing savings.

Why 1%/10 Net 30 Matters in Finance

This term is a cornerstone of working capital optimization, enabling businesses to manage liquidity efficiently. For sellers, it minimizes late payments and improves cash flow predictability. For buyers, discounts act as a reward for promptness, akin to short-term financing. In industries with tight margins, like manufacturing or wholesale, these terms can significantly impact profitability and cash flow management.

Takeaway: This term benefits both parties by encouraging prompt payments while still providing a reasonable timeframe for settling the full balance, promoting healthier business relationships.