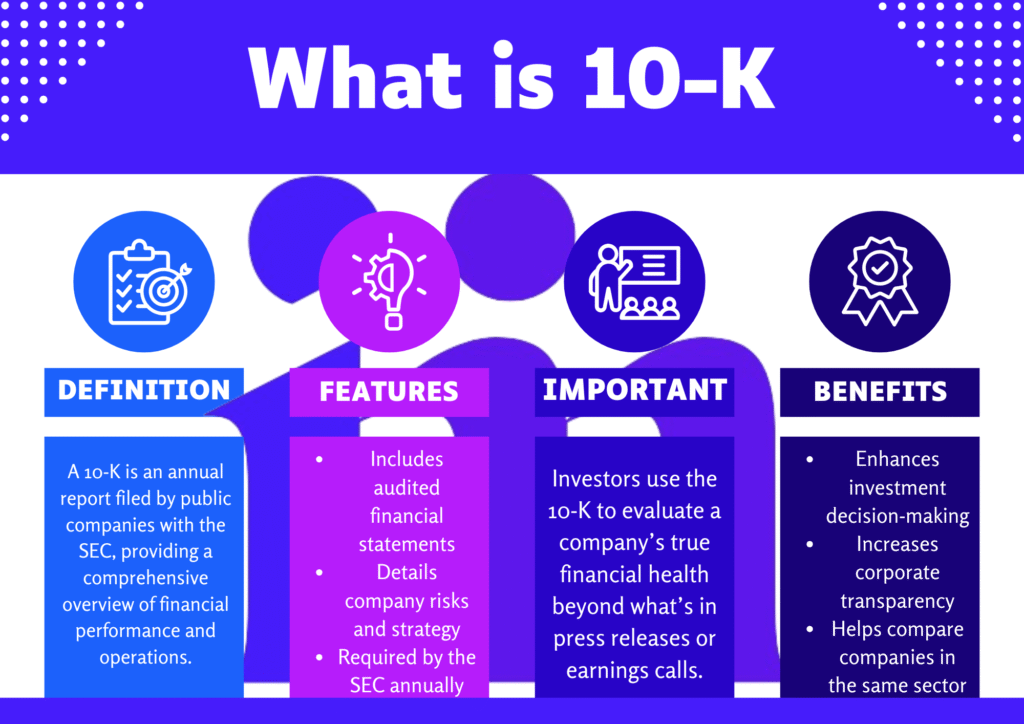

Definition

A 10-K is a detailed annual filing that publicly listed companies are required to submit to the U.S. Securities and Exchange Commission (SEC). This document outlines the company’s financial condition, potential risks, and business operations, serving as a valuable resource for investors evaluating their choices.

Key Features of a 10-K

- Mandatory Disclosure: Every publicly traded company in the U.S. must file the 10-K within 60 to 90 days following the end of its fiscal year.

- Detailed Financials: Includes audited financial statements (income statement, balance sheet, cash flow) and management analysis.

- Risk Factors: Lists potential threats to the business, from market shifts to regulatory changes.

- Executive Insights: The section titled Management’s Discussion and Analysis (MD&A) offers insights into past performance and outlines future business strategies.

- Legal Proceedings: Discloses ongoing lawsuits or regulatory actions impacting the company.

Pros and Cons of a 10-K

Pros:

- Transparency: Offers an unfiltered look at a company’s finances and risks.

- Comparability: Standardized format allows investors to compare firms.

- Regulatory Compliance: Ensures companies adhere to SEC disclosure rules.

Cons:

- Complexity: Lengthy and jargon-heavy, challenging for casual investors.

- Time Lag: Filed months after the fiscal year ends, reducing data freshness.

Real-World Example

In 2023, TechCorp Inc. (a fictional SaaS company) reported a 15% revenue drop in its 10-K due to cybersecurity breaches. The filing highlighted increased R&D spending to address vulnerabilities and a new risk factor: rising competition in cloud services. Investors used this data to reassess TechCorp’s stock valuation.

Why the 10-K Matters in Finance

The 10-K is a cornerstone of financial transparency. Investors rely on it to gauge a company’s stability, while regulators use it to monitor compliance. Financial analysts rely on the 10-K for earnings projections, while journalists often use it as a source for investigative stories. Unlike marketing-driven annual reports, the 10-K is a legal document with enforceable accuracy. For a more thorough understanding, check out a comprehensive guide on how to analyze financial statements.

Takeaway: A 10-K is a critical tool for understanding a company’s true financial picture, essential for investors, analysts, and anyone serious about mastering SEC filings.