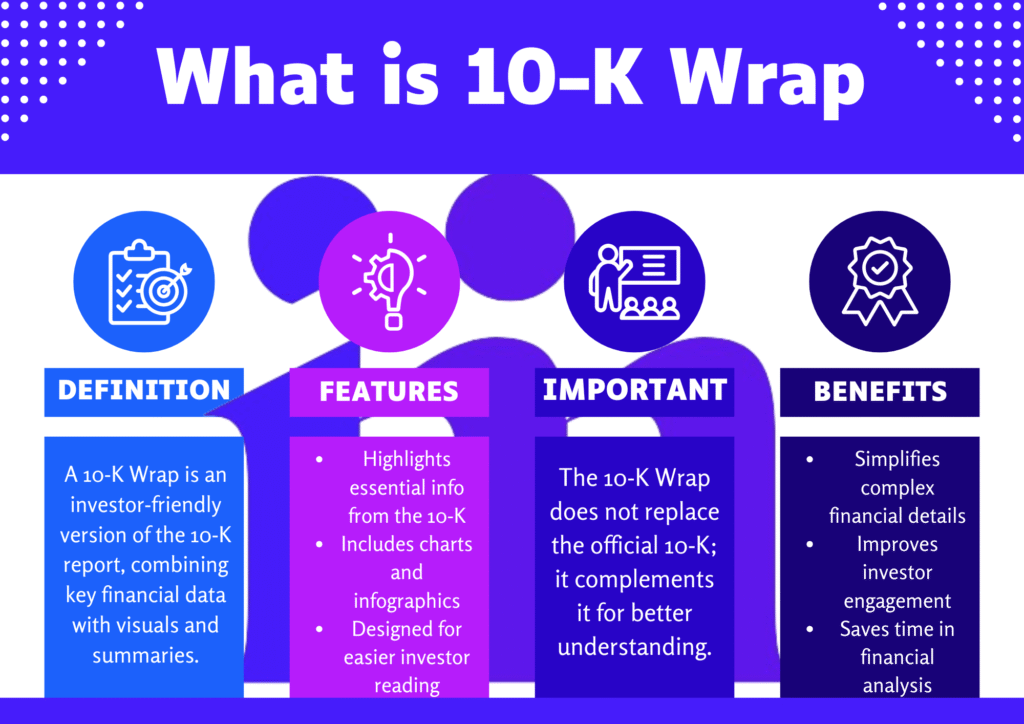

Definition

A 10-K Wrap is a simplified summary of a company’s official 10-K report filed with the SEC. It distills complex financial data, legal disclosures, and operational details into an investor-friendly format. Consider it a summarized guide to a company’s yearly results.

Key Features of a 10-K Wrap

- Summarizes the 10-K: Condenses 100+ pages of regulatory filings into 5–10 pages.

- Highlights Key Metrics: Focuses on revenue growth, profitability, risks, and strategic priorities.

- Visual Enhancements: Incorporates visual tools like charts, graphs, and infographics to make the information easier to understand.

- Targets General Investors: Designed for non-experts, unlike the technical 10-K.

How a 10-K Wrap Works

Companies or third-party analysts create 10-K Wraps in three steps:

- Extract Core Data: Pull critical financials, risks, and management insights from the 10-K.

- Simplify Language: Replace jargon with plain English.

- Add Visuals: Use design elements to improve readability.

Key Elements of a 10-K Wrap

- Executive Summary: 1–2 page overview of annual performance.

- Financial Highlights: Revenue, net income, EPS, and cash flow trends.

- Risk Factors: Top 3–5 risks (e.g., market shifts, regulatory changes).

- Management Commentary: CEO or CFO insights on strategy.

10-K vs. 10-K Wrap: Key Differences

| Aspect | 10-K Report | 10-K Wrap |

|---|---|---|

| Length | 100–300 pages | 5–10 pages |

| Audience | Regulators, analysts | General investors |

| Content | Detailed legal/financial | Simplified summaries |

| Format | Text-heavy | Visuals + bullet points |

Pros and Cons of 10-K Wraps

Pros:

- Saves Time: Quick overview for busy investors.

- Improves Engagement: Visuals make data memorable.

- Democratizes Information: Accessible to non-experts.

Cons:

- Oversimplification: May omit nuanced details.

- Bias Risk: Emphasis depends on creator’s perspective.

Real-World Example: TechGrowth Inc.

In 2023, TechGrowth Inc. released a 10-K Wrap alongside its official filing. The 8-page document highlighted a 22% revenue jump, AI expansion plans, and supply chain risks. Infographics showed quarterly sales trends, helping retail investors grasp growth drivers without reading 200 pages.

Why 10-K Wraps Matter in Finance

They serve as a connection between meeting regulatory requirements and communicating with investors. By making annual reports digestible, they foster transparency, support informed decisions, and enhance market efficiency. For companies, they’re a tool to build trust and attract a broader investor base.

How to Create an Effective 10-K Wrap

- Prioritize Clarity: Use subheadings and bullet points.

- Include Comparisons: Show YoY growth vs. competitors.

- Link to Full 10-K: Provide a reference for deep divers.

- Review with Experts: Verify that the information is consistent with SEC submissions.

Takeaway: A 10-K Wrap turns dense financial data into actionable insights, empowering investors to make smarter decisions quickly.