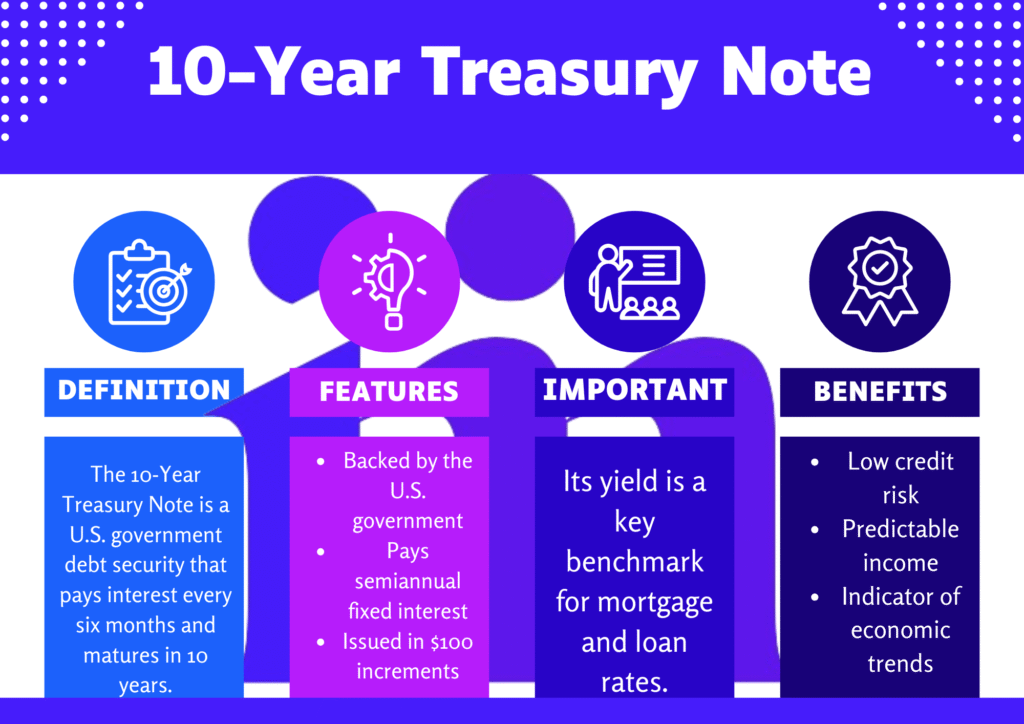

A 10-Year Treasury Note is a U.S. government debt security with a 10-year maturity. It provides a fixed interest payment twice a year and repays the original investment when it matures. Often called the “10-Year T-Note,” it’s a benchmark for global borrowing rates and a key indicator of economic health.

Key Features of the 10-Year Treasury Note

- Maturity: Repays principal after 10 years.

- Fixed Interest Rate: Set at auction, with semi-annual payments.

- Liquidity: Actively traded, making it easy to buy/sell.

- Low Risk: Backed by the U.S. government (virtually no default risk).

- Market Sensitivity: Prices fluctuate with interest rates and inflation expectations.

Pros and Cons of 10-Year Treasury Note

Pros:

- Safety: Ideal for conservative investors.

- Portfolio Stability: Balances riskier assets like stocks.

- Predictable Income: Fixed payments for a decade.

Cons:

- Interest Rate Risk: When interest rates go up, bond values typically go down.

- Inflation Risk: Returns may lag behind inflation.

- Lower Returns: Typically underperform stocks long-term.

How 10-Year Treasury Yields Work

Yields move inversely to prices. For example:

| Scenario | Bond Price | Yield |

|---|---|---|

| High Demand | $1,050 | Falls |

| Low Demand | $950 | Rises |

Yields reflect investor sentiment. Rising yields signal economic growth expectations; falling yields suggest uncertainty.

Types of U.S. Treasury Securities

| Type | Maturity | Interest Paid |

|---|---|---|

| T-Bill | <1 Year | No (Discount) |

| T-Note | 2–10 Years | Semi-Annual |

| T-Bond | 20–30 Years | Semi-Annual |

The 10-Year T-Note bridges short-term bills and long-term bonds, offering a balance of risk and return.

Real-World Example

In 2020, investor Sarah bought a 10-Year T-Note at $1,000 with a 0.61% coupon rate. When interest rates later rose to 0.6850%, selling the bond early would mean a loss (despite still receiving fixed payments), highlighting interest rate risk.

Why It Matters in Finance

The 10-Year yield influences mortgages, corporate bonds, and savings accounts. It’s an economic barometer:

- Low Yields: Signal caution (e.g., 2020 pandemic).

- High Yields: Indicate growth or inflation fears (e.g., 2023 rate hikes).

Central banks, like the Federal Reserve, monitor it to guide monetary policy.

Takeaway: The 10-Year Treasury Note offers safety and steady income but balances risks like inflation and rate shifts, making it a cornerstone of global finance.