How to Set Your Financial Goals A Step-by-Step Guide

Without a financial roadmap, you’re just driving aimlessly. Learning how to set financial goals transforms your vague money worries into a clear, actionable plan for a secure and prosperous future. This guide will walk you through the entire process, from dreaming about your why to building a strategy that turns those dreams into reality.

For individuals in the US, Canada, UK, and Australia, having a structured financial plan is the first step towards major life milestones like buying a home, saving for retirement, or funding your children’s education in a predictable way.

Summary Table

| Aspect | Detail |

|---|---|

| Goal | To create a clear, actionable, and personalized financial roadmap. |

| Skill Level | Beginner |

| Time Required | 1-2 hours for initial setup |

| Tools Needed | Pen & Paper, Spreadsheet (Excel/Google Sheets), Budgeting App |

| Key Takeaway | A goal without a plan is just a wish. Defining your goals with clarity and a timeline is 90% of the battle won. |

Why Learning to Set Financial Goals is Crucial

Financial goals are the foundation upon which financial security is built. They provide direction for your income, discipline for your spending, and motivation for your saving and investing habits.

The Problem It Solves: Most people feel anxious about money because they don’t have a clear target. They earn, they spend, and they hope for the best. This leads to living paycheck-to-paycheck, being unprepared for emergencies, and watching retirement drift further away.

The Outcome: By following this process, you will gain control over your finances. You’ll know exactly what you’re working towards, how much you need, and when you need it. This reduces stress, builds confidence, and empowers you to make informed financial decisions that align with your life’s ambitions.

Aligning Your Goals With Your Values

Your financial goals won’t stick if they’re not connected to what you truly value. Many people set goals based on what they think they should want (a bigger house, a fancy car) without asking why. This section is about bridging the gap between your money and your mindset.

1. Identify Your Core Values

Before assigning dollar amounts, define what matters most. Is it Security, Freedom, Family, Experiences, Growth, or Philanthropy? Your financial plan should be a tool to fund these values.

Exercise: List your top 5 values. Now, look at your current spending. Does your money flow toward these values, or away from them? This audit is often the most powerful motivator for change.

2. Understand Your Money Scripts

We all have unconscious beliefs about money, often formed in childhood. These are called money scripts. Common ones include:

- There will never be enough. (Scarcity Mindset)

- Money will solve all my problems. (Magical Thinking)

- It’s selfish to want more money. (Villainizing Wealth)

- Action: Recognize your dominant money script. Does it help or hinder your goal-setting? A scarcity mindset, for example, might prevent you from investing because you’re too focused on potential loss, thereby hindering your long-term growth goals.

3. Reframe Your Goal Language

Instead of I have to save $1,000 this month, which feels like a punishment, try I get to invest in my future freedom by saving $1,000 this month. This simple shift connects the action to a positive value, making it feel like a choice rather than a chore.

A budget is just a math equation. A financial plan powered by your values is a life-design document. When your goals are an expression of your deepest values, you’ll find the discipline to follow through.

How to Communicate About Money with Your Partner or Family

Financial goals are rarely a solo mission. Misalignment with a partner or family is one of the biggest causes of plan failure. Turning money from a source of conflict into a tool for shared dreams is critical.

1. Schedule a Formal Family Finance Meeting

This isn’t a argument in the kitchen. Set a positive, distraction-free time. Come prepared with your individual values (from the Psychology section) and dreams.

2. Use I Statements and Active Listening

- Instead of: You waste too much money on [X].

- Try: I feel anxious about our savings when I see spending on [X], because my core value is security. Can we talk about how we can both feel our values are being respected?

3. Create Yours, Mine, and Ours Buckets:

Not every dollar needs to be jointly controlled. A powerful system is:

- Ours Account: For shared goals and bills (mortgage, groceries, vacations).

- Yours/Mine Accounts: A predetermined, equal amount of no-questions-asked fun money for each person to spend freely. This preserves autonomy and eliminates friction over small, personal purchases.

4. Establish a What If Plan:

Agree on rules for unexpected windfalls (e.g., a bonus or inheritance) or financial setbacks. For example: Any windfall over $1,000 will be allocated as 50% to a shared goal, 25% to your fun money, and 25% to my fun money. This prevents conflicts before they happen.

What You’ll Need Before You Start

Knowledge Prerequisites: A basic understanding of your current income and expenses. You don’t need to be an expert, just honest about your cash flow.

Data Requirements

- Your net income (take-home pay).

- A list of your essential and discretionary monthly expenses.

- A rough idea of your current debt and assets.

Tools & Platforms

- Pen & Paper: For a brain-dumping session.

- Spreadsheet (Google Sheets/Excel): For organizing and calculating.

- Budgeting App: Tools like Mint, YNAB (You Need A Budget), or PocketSmith can help track your progress.

To get a crystal-clear view of your finances, using a robust budgeting tool is essential. Many of the best personal finance apps, like Monarch Money or Simplifi by Quicken, can automatically sync with your bank accounts to categorize spending and help you track your goals in real-time.

How to Set Your Financial Goals: A Step-by-Step Guide

Step 1: Brainstorm and Dream (The Why)

Before you get into numbers, dream big. Forget limitations for a moment. What do you want your life to look like in 1, 5, 10, and 25 years? Write down everything, from take a vacation to Italy to buy a house to retire at 60 with no financial worries.

Pro Tip: Categorize these dreams into Short-Term (0-2 years), Medium-Term (3-10 years), and Long-Term (10+ years). This makes them more manageable.

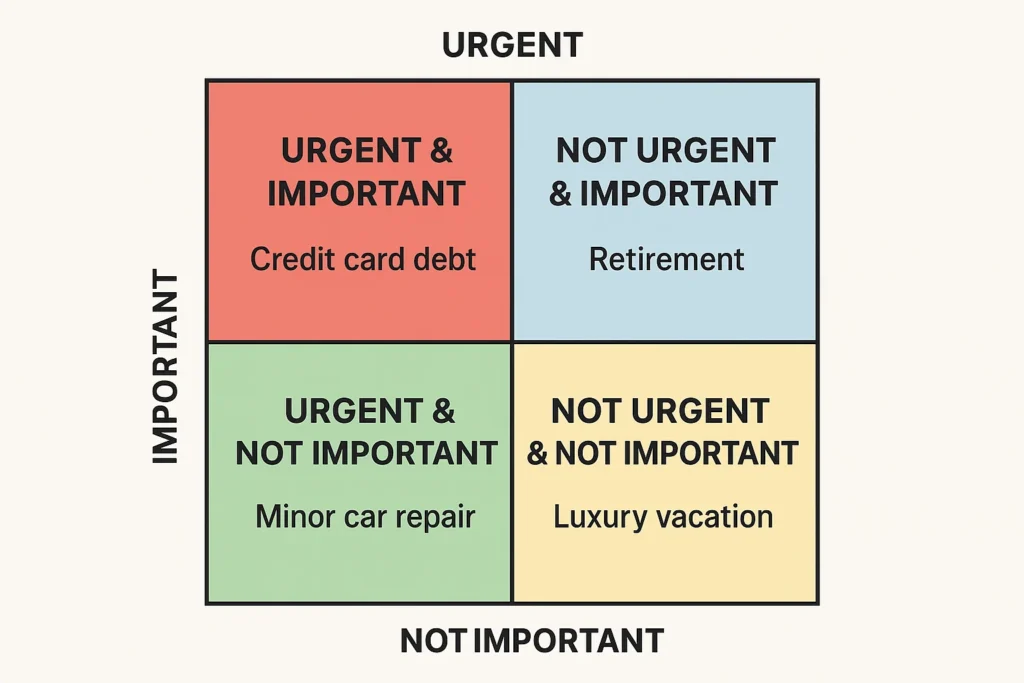

Step 2: Categorize and Prioritize

Now, bring order to your brainstorm. Group similar goals and decide which are most important. Is paying off debt a higher priority than saving for a new car? This step forces you to make conscious choices about what truly matters to you.

Common Mistake to Avoid: Trying to achieve every single goal at once. This leads to spreading your resources too thin and achieving nothing. Focus on your top 3-5 priorities first.

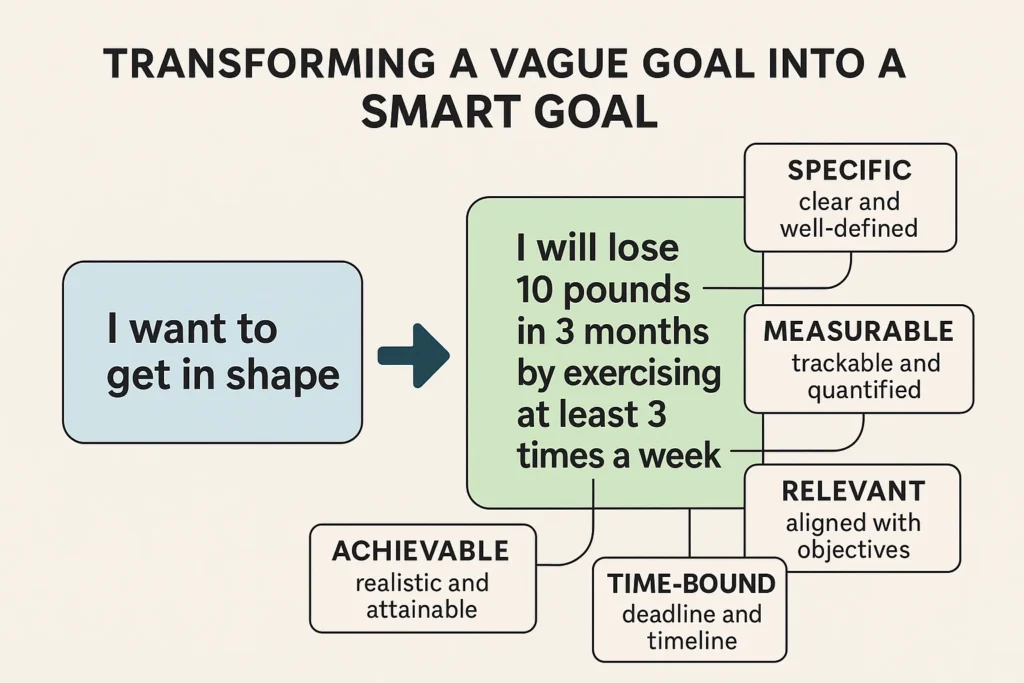

Step 3: Make Them SMART

This is the most critical step. Transform your vague dreams into SMART goals.

- Specific: What exactly do you want? (Not save money, but save for a down payment.)

- Measurable: How much money do you need? (e.g., $30,000)

- Achievable: Is it realistic given your income?

- Relevant: Does it align with your core values from Step 2?

- Time-bound: By when? (e.g., in 5 years)

Example Transformation:

- Vague Goal: I want to be rich.

- SMART Goal: I will save a $40,000 down payment for a house in 4 years by saving $833 per month.

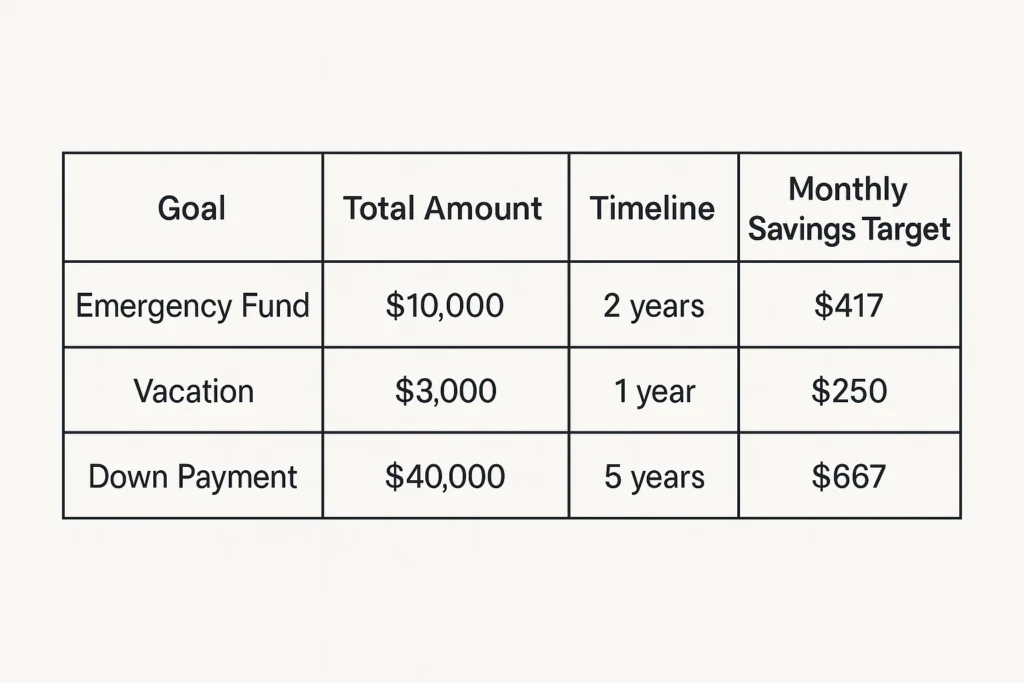

Step 4: Calculate the Numbers and Create an Action Plan

Break down your SMART goal into a monthly savings target. This is where your budget comes in.

Formula: Total Goal Amount / Number of Months Until Deadline = Monthly Savings Target.

Example Calculation:

- Goal: $40,000 down payment in 4 years (48 months).

- Calculation: $40,000 / 48 months = $833 per month.

Now, review your budget. Where can you find $833 per month? This might involve reducing discretionary spending (dining out, subscriptions) or finding ways to increase your income.

Step 5: Choose the Right Account and Investment Vehicle

Not all money should be saved the same way. Your goal’s timeline determines where you should park the cash.

- Short-Term Goals (<5 years): Use low-risk vehicles like a High-Yield Savings Account (HYSA) or Certificates of Deposit (CDs). The priority is capital preservation.

- Long-Term Goals (10+ years, like retirement): Utilize the stock market’s growth potential through tax-advantaged accounts like a 401(k) or IRA (in the US) or a TFSA/RRSP (in Canada). The priority is growth.

To achieve those long-term growth goals, you’ll need a reliable brokerage platform. For hands-off investors, robo-advisors like Betterment or Wealthfront can automatically invest your money based on your timeline. For DIY investors, platforms like Charles Schwab or Fidelity offer extensive tools and low fees.

How to Track Your Goals and Stay Motivated

Creating a plan is one thing; sticking to it is another. The set it and forget it mentality often leads to failure. Proactive tracking and motivation systems are the secret sauce to long-term success.

1. Choose Your Tracking Method

- The Digital Dashboard: Use apps like Tiller Money or Copilot that can auto-populate spreadsheets with your bank data, creating live charts of your goal progress. This is perfect for the data-driven individual.

- The Simple Spreadsheet: Create a tab for each goal. Track the target amount, date, and your monthly contributions. Use a graph to visualize your progress. The act of manually updating it can be a powerful ritual.

- The Analog System: For some, a physical Goal Tracker poster on the wall or a dedicated journal is more tangible and motivating. Coloring in a savings thermometer as you reach milestones provides a visual and psychological reward.

2. Implement the Debt Snowball or Avalanche for Debt Goals

If paying off debt is a primary goal, the method matters for motivation.

- Debt Snowball: List your debts from smallest to largest balance. Pay minimums on all, and throw every extra dollar at the smallest debt. The quick win of paying off an entire account provides a huge motivational boost to keep going.

- Debt Avalanche: List your debts from highest to lowest interest rate. Pay minimums on all, and target the debt with the highest interest rate first. This method saves you the most money on interest over time.

3. Build a Reward System

Your journey shouldn’t be a miserable grind. Schedule small, non-financially-derailing rewards for hitting milestones.

- Example: When I pay off my first credit card, I’ll celebrate with a nice bottle of wine and a home-cooked meal.

- Example: When I hit the 50% mark on my down payment savings, I’ll treat myself to a weekend getaway.

4. Conduct a Monthly Money Date

Schedule a non-negotiable 30-minute meeting with yourself (and your partner, if applicable). Review your progress, celebrate wins, and adjust the plan if needed. This turns abstract goals into a managed project.

How to Use Your Financial Plan in Your Investment Strategy

Your financial goals are the why, and your investment strategy is the how.

Scenario 1: Saving for a Child’s College Education (15-year timeline): This is a long-term goal. Your strategy should be aggressive initially (e.g., 80% stocks, 20% bonds) in a 529 Plan or similar education account, becoming more conservative as the enrollment date approaches.

Scenario 2: Building an Emergency Fund (Immediate need): This is a short-term goal. Your strategy is purely about safety and liquidity. Park this cash in a separate High-Yield Savings Account where it’s safe from market downturns and easily accessible.

Case Study: Sarah, a 30-year-old graphic designer, wanted to buy a home in 5 years. She set a SMART goal of $50,000. By cutting unused subscriptions ($50/month), reducing dining out ($150/month), and allocating a yearly bonus ($2,000), she found her $770 monthly savings target. She automated this transfer into a dedicated high-yield savings account, and is now confidently on track.

Common Mistakes When Setting Financial Goals

Pitfall 1: Setting goals that are too vague. Save more money is easy to ignore.

Solution: Apply the SMART framework ruthlessly. Make every goal Specific, Measurable, etc.

Pitfall 2: Not accounting for inflation. $30,000 today will not have the same purchasing power in 10 years.

Solution: For long-term goals, add a 2-3% inflation buffer to your target amount.

Pitfall 3: Forgetting about life. Unexpected expenses will happen.

Solution: Build a small buffer into your budget and always have a separate emergency fund so a car repair doesn’t derail your entire plan.

What to Do When You Get Off Track

Life happens. A job loss, a medical emergency, or simply a moment of weakness can throw your best-laid plans into disarray. The difference between financial success and failure isn’t perfection,it’s how you handle the setbacks.

Follow this 4-Step Recovery Plan:

Step 1: Practice Self-Compassion, Not Self-Blame.

The worst thing you can do is engage in negative self-talk. I’m so bad with money, or I’ve ruined everything, will only make you want to give up. Acknowledge the setback, accept that it’s a normal part of the process, and commit to getting back on course without judgment.

Step 2: Diagnose the Cause Objectively.

Was this a true financial emergency (like a necessary car repair) or a lapse in discipline (like an unbudgeted shopping spree)? Be honest.

- For an Emergency: This is what your emergency fund is for. Tap into it, and then immediately adjust your goals. Your new short-term goal becomes Replenish the Emergency Fund.

- For a Lapse: Identify the trigger. Were you stressed? Bored? Socially pressured? Understanding the why helps you build a defense for next time.

Step 3: The Reset and Restart Protocol.

- Don’t Try to Catch Up: If you missed a $500 savings goal, don’t try to save $1000 next month. This is a recipe for failure and frustration.

- Simply Restart: The most powerful action you can take is to make your next scheduled savings transfer or debt payment as if nothing happened. Get back on the plan at the regular pace.

Step 4: Adjust the Plan, Don’t Abandon It.

If the setback was major and long-term (e.g., sustained income loss), your original plan may no longer be realistic.

- Revisit your SMART goals. Can you extend the timeline? For example, change save $40,000 in 4 years to save $40,000 in 5 years, which lowers your monthly commitment from $833 to $667.

- Re-prioritize. You may need to temporarily pause saving for a want goal (like a vacation) to focus on a need goal (like the emergency fund).

Falling off the horse once doesn’t mean the journey is over. The most successful people in any field are those who get back up the fastest. Your financial plan is a living document, designed to be navigated with, not broken by, the realities of life.

- Provides Clarity and Reduces Anxiety: Knowing your target is incredibly empowering.

- Creates Motivation: Watching your progress toward a concrete goal is a powerful motivator to stay disciplined.

- Improves Decision-Making: Makes it easy to say no to impulsive spending that doesn’t align with your goals.

- Enables Automation: Once you know your monthly targets, you can set up automatic transfers, making saving effortless.

- Can Feel Restrictive: Some people chafe at the structure.

- Requires Regular Review: Life changes, so your goals must be revisited annually.

- Risk of Discouragement: If you fall behind, it’s easy to get discouraged and give up entirely (this is why flexibility is key).

The Role of Insurance and Estate Planning in Your Financial Goals

You can save and invest perfectly for decades, but one unforeseen event can wipe it all out. Protecting your assets is not a separate topic,it’s a foundational part of achieving your financial goals.

1. Insurance is a Goal-Protection Tool:

- Health Insurance: Prevents a medical crisis from becoming a financial catastrophe.

- Disability Insurance: Arguably more important than life insurance for most working people. It replaces your income if you are unable to work due to illness or injury.

- Life Insurance: Essential if others depend on your income. It ensures your family can still achieve goals like paying off the mortgage or funding college if you’re not there.

- Umbrella Insurance: Provides cheap, extra liability coverage above your home/auto policies.

2. Basic Estate Planning is Non-Negotiable:

This isn’t just for the wealthy. It’s about ensuring your assets go where you want them to, with minimal hassle and cost.

- A Will: Dictates who inherits your assets and who becomes the guardian of your minor children.

- Beneficiary Designations: Double-check these on retirement accounts and life insurance policies, they override what’s in a will.

- Power of Attorney & Advance Healthcare Directive: Allows someone you trust to manage your finances and medical decisions if you become incapacitated.

Building wealth is like constructing a building. Insurance and estate planning are the scaffolding and safety nets that ensure a single storm or accident doesn’t bring the whole structure down. Review your coverage annually as your goals and family situation evolve.

Taking It to the Next Level

Once you’ve mastered basic goal-setting, you can optimize further.

The Bucket Strategy for Retirement: Instead of one giant retirement goal, segment it into time-based buckets: a Bucket for immediate expenses (cash), a second for mid-term needs (bonds), and a third for long-term growth (stocks). This provides a sophisticated income strategy.

Leveraging Tax-Efficiency: Deepen your knowledge of how different account types (Roth vs. Traditional IRA, Taxable vs. Tax-Deferred) can be used strategically to minimize your tax burden and accelerate goal achievement.

Goal-Based Planning vs General Budgeting

| Feature | Goal-Based Planning | General Budgeting |

|---|---|---|

| Primary Focus | Achieving specific life outcomes | Tracking income vs. expenses |

| Mindset | Forward-looking and proactive | Backward-looking and reactive |

| Motivation | Intrinsic (driven by dreams) | Extrinsic (driven by constraint) |

| Best For | Building long-term wealth and achieving dreams | Getting out of debt and understanding cash flow |

Conclusion

You now hold the blueprint for taking control of your financial destiny. By moving from vague wishes to specific, time-bound, and actionable SMART goals, you have fundamentally changed your relationship with money. Remember to review your plan annually, celebrate small wins, and be kind to yourself if you need to adjust course.