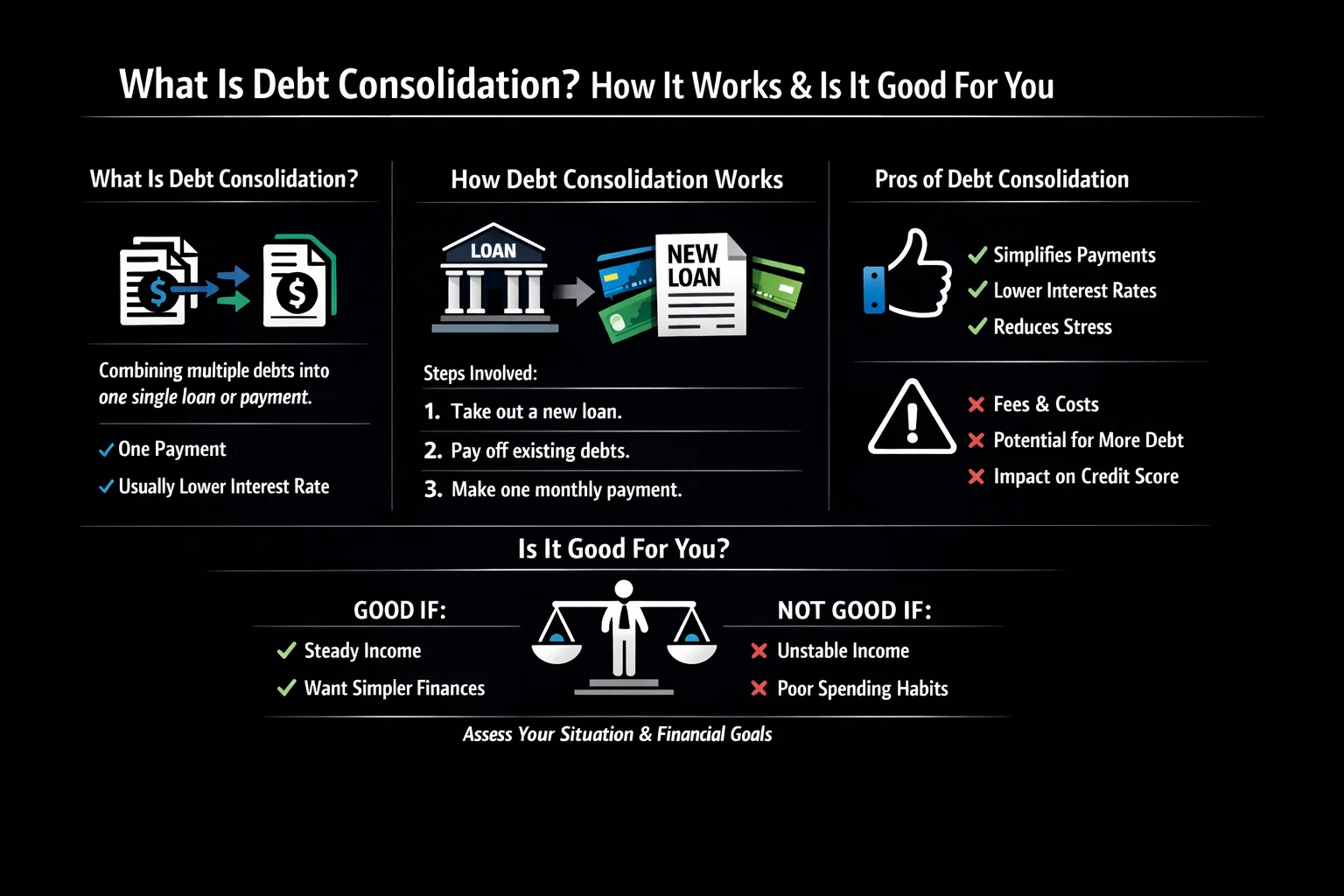

What Is Debt Consolidation, How It Works, Is It Good For You

Debt consolidation is a strategic financial management tool that combines multiple high-interest debts into a single, more manageable loan. This approach simplifies monthly payments and can significantly reduce overall interest costs. For consumers in the US, UK, Canada, and Australia struggling with credit card balances, personal loans, and other unsecured debts, mastering this concept is key to regaining financial control and improving credit health.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | A financial strategy that replaces multiple debts with one new loan, ideally at a lower interest rate. |

| Also Known As | Loan Consolidation, Debt Refinancing |

| Main Used In | Personal Finance, Credit Management, Consumer Lending |

| Key Takeaway | It simplifies repayment and can save money, but it’s not a debt reduction strategy and requires financial discipline to be effective. |

| Formula | N/A |

| Related Concepts |

What is Debt Consolidation

Debt consolidation is the process of taking out a new loan or credit facility to pay off multiple existing liabilities. Think of it like merging several small, turbulent streams into one calm, navigable river. You’re not erasing the debt; you’re restructuring it into a more organized and often less expensive form. The primary goals are to secure a lower overall interest rate, simplify monthly budgeting by having just one due date and payment, and potentially pay off debt faster with a structured plan.

Key Takeaways

The Core Concept Explained

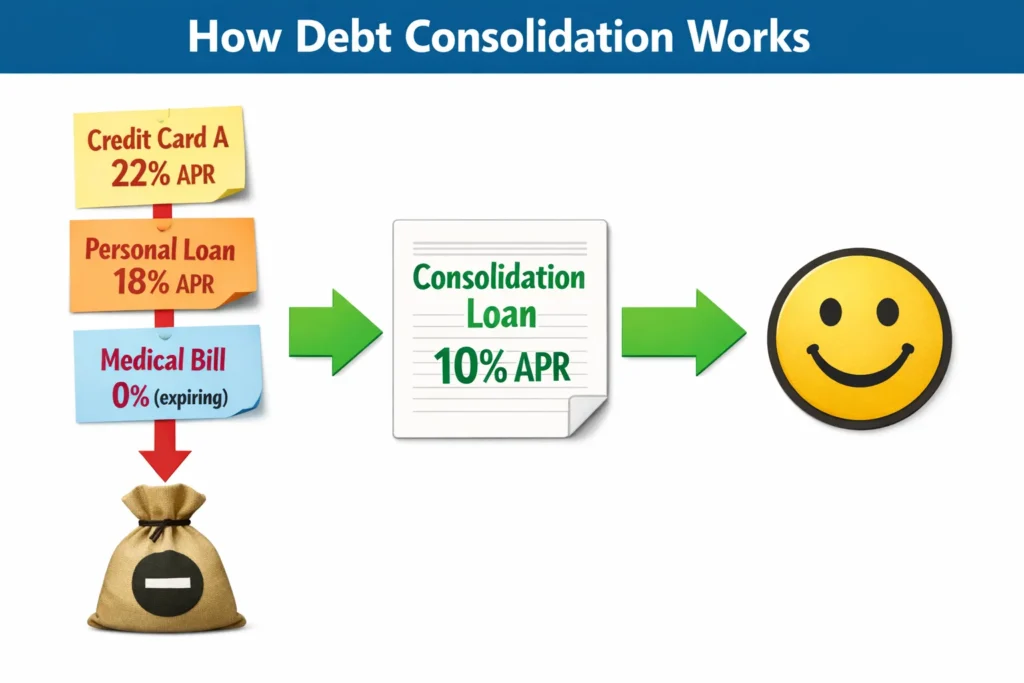

At its heart, debt consolidation is about cash flow management and interest rate arbitrage. You are leveraging a better credit profile (or a different type of loan) to access cheaper capital to pay off expensive capital. For example, if you have three credit cards with APRs of 22%, 19%, and 24%, your money is draining away in high-interest charges. A consolidation loan at 12% APR immediately reduces the cost of carrying that debt. Furthermore, it changes the debt from revolving (credit cards) to installment (a fixed loan), which can be psychologically easier to manage and pay down systematically.

The Hidden Psychology of Debt Consolidation

While the mathematical benefits of debt consolidation are clear, the psychological advantages are equally powerful—and often underestimated. Understanding this “mental math” can be the difference between success and failure.

The Cognitive Load Theory in Action

Managing multiple debts creates what psychologists call “cognitive overload.” Each credit card, medical bill, and personal loan represents a separate decision point: different due dates, varying minimum payments, unique login portals. Research from Stanford University shows that this mental juggling activates the same brain regions as physical pain. The result? Decision fatigue sets in, making you more likely to avoid checking balances, miss payments, or make impulsive spending decisions.

A single consolidation payment reduces this cognitive load by up to 80% for someone with five different debts. You transform from being an air traffic controller managing multiple landing planes to a train conductor on a single, predictable track.

The Goal Gradient Hypothesis

This psychological principle states that people accelerate their effort as they approach a finish line. With multiple credit cards, there’s no visible “finish line”—you’re running on multiple treadmills simultaneously. A consolidation loan with a fixed term (say, 48 months) creates a clear, visible countdown.

Practical Psychological Strategy:

When you consolidate, create a simple debt-free countdown calendar. Mark the payoff date prominently. Each month, physically check off the payment. This ritual activates your brain’s reward centers, releasing dopamine and reinforcing the positive behavior. According to a University of Chicago study, individuals who used visual payoff trackers were 42% more likely to complete their debt repayment plan without accruing new debt.

The Identity Shift

There’s a subtle but profound shift from “I am someone in debt” to “I am someone executing a debt payoff plan.” This reframing—studied extensively in behavioral economics—moves you from a passive victim of circumstances to an active architect of your financial future. The single payment becomes not just a transaction, but a monthly reaffirmation of your new financial identity.

How Debt Consolidation Works

While there’s no single formula, the process involves a clear financial assessment.

Step-by-Step Process

- Inventory Your Debt: List every debt—creditor, total balance, interest rate (APR), and minimum monthly payment.

- Calculate Your Current Weighted Average Interest Rate: This is your benchmark.

- (Debt A Balance × APR%) + (Debt B Balance × APR%) / Total Debt Balance.

- Check Your Credit Score: Your score (from Equifax, Experian, or TransUnion in the US) will determine the rates you qualify for. Aim for a “Good” score (670+) for the best unsecured personal loan terms.

- Shop for a Consolidation Product: Compare offers for personal loans, balance transfer cards, or home equity products.

- Compare the New Rate & Terms: Ensure the new APR is lower than your weighted average. Factor in any fees (origination, balance transfer).

- Apply, Receive Funds, and Pay Off Old Debts: Once approved, use the new funds to pay off the old accounts in full. Crucially, keep the old accounts open but do not use them, as closing them can hurt your credit score.

For a consumer in the US, this might mean checking their FICO score for free via their bank, then comparing personal loan offers from lenders like SoFi or LightStream, or a 0% intro APR balance transfer card from issuers like Chase or Citi. In the UK, they might look at a loan from a high-street bank like Barclays or a peer-to-peer platform. Always reference checking your official credit report from agencies like Experian.

Example with Numbers:

- Current Debts: Credit Card 1: $5,000 at 22% | Credit Card 2: $3,000 at 19% | Personal Loan: $2,000 at 15%.

- Weighted Avg Rate: (($5k*0.22)+($3k*0.19)+($2k*0.15)) / $10,000 = 19.3%

- Consolidation Offer: A 3-year personal loan for $10,000 at 11% APR with a 5% origination fee ($500).

- Analysis: Despite the fee, the 8.3% reduction in interest rate will likely result in significant savings over three years and a fixed, predictable monthly payment.

Why It Matters for Financial Health

Debt consolidation is more than a technical move; it’s a psychological and strategic reset for your finances. For individuals feeling overwhelmed, it transforms a chaotic, stressful situation into a clear, actionable plan. It directly combats high-interest compounding, which is the primary enemy of wealth building. By freeing up cash flow previously eaten by interest, it allows individuals to allocate funds towards emergency savings, retirement accounts (like a 401(k) or ISA), or other financial goals. In markets like the US and UK where consumer debt levels are high, it’s a fundamental tool for responsible credit management.

How to Use Debt Consolidation in Your Strategy

Case 1: The High-Interest Credit Card Pile-Up

- Scenario: You have $15,000 spread across 4 cards with APRs from 18-25%. Making minimum payments will take decades.

- Action: Apply for a debt consolidation loan from an online lender or credit union. Use the lump sum to pay off all cards. Commit to a 3-5 year repayment plan. The fixed monthly payment and end date create a clear finish line.

Case 2: The Expiring Promotional Rate

- Scenario: You have a large medical bill on a 0% payment plan that expires in 3 months, after which it jumps to 29% APR.

- Action: Proactively apply for a balance transfer credit card with a 0% intro APR for 12-18 months. Transfer the balance before the promo rate expires. Crucially, calculate the monthly payment needed to pay it off before the intro period ends and set up autopay.

Case 3: Streamlining for Simplicity

- Scenario: You have multiple small debts with different due dates—you keep forgetting one and incurring late fees.

- Action: Consolidate even if the interest rate savings are minimal. The psychological benefit of a single payment and the elimination of late fees can be worth it. A personal line of credit could work here.

To find and compare the best 0% APR balance transfer cards currently available in your country, independent comparison sites like NerdWallet (US) or MoneySavingExpert (UK) are invaluable resources.

Debt Consolidation Spreadsheet Template

Will consolidation actually save you money? Don’t guess—calculate. Here’s a complete walkthrough you can implement right now in Google Sheets or Excel.

Debt Inventory Calculation

Use this table to calculate your weighted average interest rate

| Creditor | Balance | Interest Rate (APR) | Minimum Payment | Type | Action |

|---|---|---|---|---|---|

|

Chase Visa

**** 4521

|

$8,500.00 | 24.99% | $255.00 | Credit Card | |

|

Discover

**** 7890

|

$4,200.00 | 21.49% | $126.00 | Credit Card | |

|

Medical Center

ACC-2024-567

|

$2,300.00 |

0.00%

(expires 6/2024)

|

$115.00 | Medical | |

|

Personal Loan

LendCo #4321

|

$5,000.00 | 15.00% | $150.00 | Installment | |

| TOTAL DEBT | $20,000.00 |

Weighted Avg:

19.8%

|

$646.00 |

4 Accounts

|

Weighted Average Calculation

This is your benchmark rate. Any consolidation offer must beat this rate after accounting for fees.

Compare Loan Offers with This Formula:

Total Cost of New Loan =

Loan Amount + (Loan Amount × Origination Fee %) +

[PMT(New Rate/12, Term in Months, Loan Amount) × Term in Months]

Let’s Compare Two Real Offers:

- Online Lender: $20,000 at 11.5% APR, 5% origination fee, 48-month term

- Fee: $20,000 × 0.05 = $1,000

- Monthly payment: $520 (use =PMT(0.115/12, 48, 20000) in Excel)

- Total paid: ($520 × 48) + $1,000 = $25,960

- Credit Union: $20,000 at 13.0% APR, 1% origination fee, 36-month term

- Fee: $200

- Monthly payment: $674

- Total paid: ($674 × 36) + $200 = $24,464

The Surprising Insight: The lower interest rate loan actually costs $1,496 MORE because of the higher fee and longer term! This is why you must look at total cost, not just the APR.

Pro Tip: Add a Behavioral Slippage column. Research shows people with consolidation loans have a 30% chance of adding new debt within 12 months. Factor in a 10-20% “slippage buffer” in your calculations—can you still afford the payment if you add a small emergency expense?

Banks vs. Credit Unions vs. Online Lenders

The consolidation market has fragmented into distinct paths. Your choice isn’t just about rate—it’s about which ecosystem matches your financial profile and goals.

Banks vs. Credit Unions vs. Online Lenders

| Lender Type | Best For | Typical APR Range | Key Differentiator | Ideal Credit Score |

|---|---|---|---|---|

| Traditional Banks (Chase, Wells Fargo, Bank of America) |

Existing customers with premium relationships | 12.99% – 23.99% | Relationship pricing—your rate improves with deposit/investment balances | 720+ |

| Credit Unions (Navy Federal, Alliant, Local CUs) |

Members seeking flexibility and lower fees | 9.99% – 18.99% | “Character lending”—may consider job stability over perfect credit | 660+ |

| Online Lenders (SoFi, LightStream, Upstart) |

Tech-savvy borrowers wanting speed | 7.99% – 25.99%* *Varies by credit profile |

AI-driven underwriting; fastest funding (24-72 hours) | 680+ (Upstart: considers education/job) |

| Peer-to-Peer (Prosper, LendingClub) |

Those declined by traditional lenders | 15.99% – 35.99% | Funded by individual investors; most flexible approval criteria | 640+ |

Regional Considerations:

- US: Online lenders dominate for prime borrowers. Credit unions win for “near-prime.”

- UK: Building societies function like credit unions. Price comparison sites (MoneySuperMarket) are mandatory first stops.

- Canada: Big 5 banks are more competitive. Consider Purpose Financial or Borrowell for online options.

- Australia: “Big Four” banks plus growing fintech sector (SocietyOne, MoneyPlace).

The Hidden Fee Analysis:

Origination Fees: Online/P2P: 1-8% | Banks/CUs: 0-5%

Prepayment Penalties: Almost universally $0 in 2024

Late Payment: $25-39, but many online lenders offer 15-day grace

Payment Method Fee: Some charge for credit card payments (avoid!)

The Application Sweet Spot Strategy:

- Weekday Mornings: Underwriting teams are freshest.

- 90-Day Rule: Space applications to minimize credit score impact.

- Document Ready: Have 2 most recent pay stubs, 2 years of tax returns (self-employed), and bank statements ready.

- The “Pre-Approval” Hack: Many lenders (SoFi, Discover) offer soft-pull pre-approval that doesn’t affect your score.

Regulatory Protections by Region:

- US: Truth in Lending Act requires clear APR disclosure. CFPB complaint database reveals lender patterns.

- UK: FCA’s “consumer duty” rules require lenders to act in your best interest.

- AU: ASIC’s responsible lending obligations.

Emerging Trend: Consolidation-Plus products are appearing. LightStream offers a rate beat program. SoFi offers career coaching and financial planning with loans. These add-ons can provide value beyond the interest rate.

- Lower Interest Costs: The primary financial benefit. Reducing your APR saves money over the life of the debt.

- Simplified Budgeting: One payment, one due date. Reduces mental overhead and risk of missed payments.

- Fixed Repayment Schedule: Provides a clear debt-free timeline and motivates discipline.

- Potential Credit Score Boost: Can improve your credit utilization ratio and adds a positive installment loan to your credit mix.

- Reduced Stress: Transforming financial chaos into order provides significant psychological relief.

- Risk of Re-Debting: Without behavior change, freed-up credit cards can be used again, burying you deeper.

- Potential Higher Long-Term Cost: Extending the loan term too much can mean paying more total interest.

- Fees and Costs: Origination, balance transfer, or closing costs can erode savings.

- Requires Good Credit: The best rates are reserved for borrowers with good to excellent credit scores.

- Could Turn Debt Secured: Using a home equity loan puts your home at risk if you default.

Debt Consolidation in the Real World: A Post-Pandemic Case Study

Following the COVID-19 pandemic, many consumers in the US, UK, and Canada saw their credit card balances swell due to emergency expenses and economic uncertainty. A typical case involved “Jane,” a professional with a good income but a credit score that had dipped to 650 due to high utilization. She had:

- Credit Card A: $8,000 at 24.99% APR

- Credit Card B: $4,000 at 21.49% APR

- Store Card: $2,000 at 29.99% APR

Total: $14,000 at a weighted average of ~24.5%.

Making minimum payments, she was on a 20+ year payoff plan, mostly paying interest. She researched online and secured a debt consolidation loan from a digital lender for $14,000 at 12.5% APR over 4 years. Her single monthly payment became fixed and manageable. By not using her old cards, her credit utilization plummeted. Within 12 months of consistent payments, her credit score rebounded to 720. She saved thousands in interest and had a clear path to being debt-free in 4 years. This story was common across Western economies as individuals used debt management tools to recover financial stability.

Debt Consolidation vs Debt Settlement

| Feature | Debt Consolidation | Debt Settlement |

|---|---|---|

| Primary Goal | Restructure debt for lower cost/simpler payment. | Negotiate to pay less than the full amount owed. |

| Impact on Credit | Can be neutral or positive if managed well. | Severely negative (settled accounts are major derogatories). |

| Cost | May involve fees, but you repay 100% of principal. | You pay a fraction of the debt, but fees to settlement companies can be high. |

| Best For | Those with steady income who can afford to repay in full. | Those in severe financial hardship who cannot afford minimum payments. |

| Time Horizon | 2-7 years for repayment. | 2-4 years for negotiation/settlement. |

Conclusion

Ultimately, debt consolidation is a powerful financial engineering tool designed to optimize the structure of your liabilities, not to eliminate them. As we’ve explored, its true value lies in combining interest savings with psychological clarity and a structured payoff plan. The key to success is pairing this tool with disciplined spending behavior. By carefully assessing your debt portfolio, shopping for the right product, and committing to the new repayment plan, you can transform a stressful debt situation into a manageable, finite challenge. It’s a strategic step toward not just debt freedom, but long-term financial resilience.

Ready to see if debt consolidation is right for your unique situation? The first step is understanding your credit profile and comparing real offers. We recommend starting your research with trusted, free comparison tools from authoritative sources like the Consumer Financial Protection Bureau (CFPB) in the US or the Financial Conduct Authority’s (FCA) register in the UK to find accredited advisors.

Related Terms

- Debt-to-Income Ratio (DTI): A key metric lenders use to evaluate your eligibility for a consolidation loan. It’s your total monthly debt payments divided by your gross monthly income.

- Balance Transfer: A specific type of consolidation where you move credit card debt to a new card with a low or 0% introductory APR.

- Credit Counseling: A service offered by non-profit agencies that can include creating a debt management plan (DMP), which is a form of structured consolidation often with waived fees from creditors.

- Personal Loan: An unsecured installment loan commonly used as the vehicle for debt consolidation.

- Bankruptcy: A legal last-resort process for debt relief, fundamentally different from consolidation as it involves discharging (eliminating) debt under court supervision.

Frequently Asked Questions About Debt Consolidation

Recommended Resources

- For Foundational Knowledge: The Consumer Financial Protection Bureau (CFPB) website has excellent, unbiased guides on dealing with debt and understanding loan options.

- For Credit Score Understanding: AnnualCreditReport.com (the official, free source for US credit reports) and your country’s equivalent (like Credit Karma in Canada/UK, or CheckMyFile in the UK).

- For Comparing Offers: Independent comparison sites like Bankrate (US) or MoneySuperMarket (UK) allow you to see personalized rates from multiple lenders without affecting your credit score for soft inquiries.