Premium Bonds What Are They and How Do They Work

Premium Bonds are a uniquely British financial institution, offering a chance to win tax-free cash prizes every month instead of receiving traditional interest. Issued by the government-backed National Savings and Investments (NS&I), they represent one of the safest savings vehicles available, where your initial capital is fully guaranteed. For millions of savers across the UK, they provide a thrilling, risk-free alternative to conventional savings accounts.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | A savings security issued by the UK government where holders are entered into a monthly prize draw instead of earning interest. |

| Also Known As | NS&I Premium Bonds |

| Main Used In | |

| Key Takeaway | Your capital is 100% safe, but your return is not guaranteed and is based on luck in a monthly lottery. |

| Formula | N/A (Return is based on prize fund rate and chance) |

| Related Concepts |

What are Premium Bonds

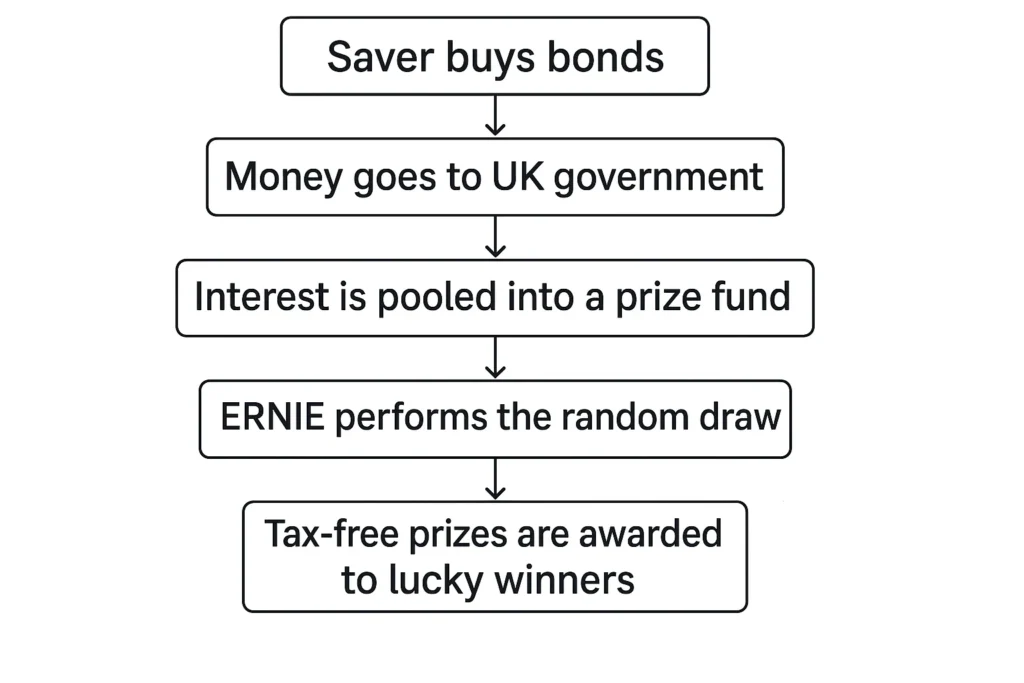

Premium Bonds are a non-interest-bearing savings product offered by National Savings and Investments (NS&I), a government-backed savings bank in the UK. When you buy Premium Bonds, you are essentially lending money to the government. However, instead of paying you a fixed or variable interest rate, NS&I pools the interest that would have been paid to all bondholders and distributes it as tax-free cash prizes through a monthly random draw.

Think of it like a savings account combined with a monthly lottery ticket. You never lose the money you put in (the ticket price), and each month your “tickets” (each £1 bond) get entered into a draw to win prizes, from £25 to £1 million. The key difference from a normal lottery is that you can always withdraw your initial stake.

Key Takeaways

The Core Concept Explained

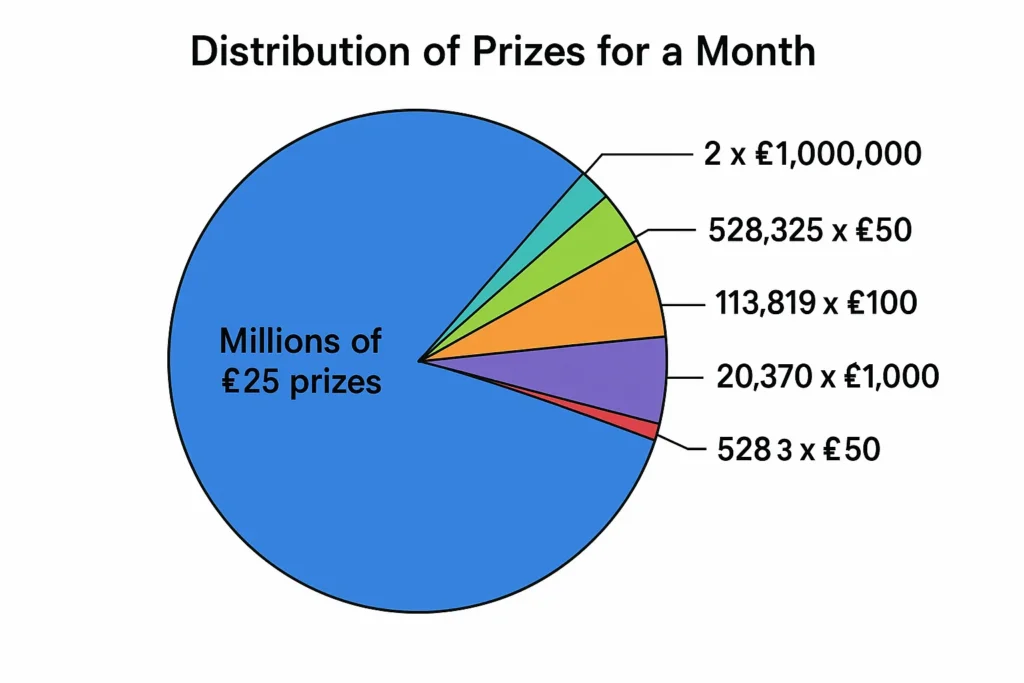

The core concept is the substitution of guaranteed interest for the chance to win a prize. The interest that would typically be paid to savers is allocated to a “prize fund.” This fund is then used to pay out prizes of various sizes. The odds of winning are determined by the total number of bonds in circulation and the prize fund rate. A computer called ERNIE (Electronic Random Number Indicator Equipment) generates the winning bond numbers randomly.

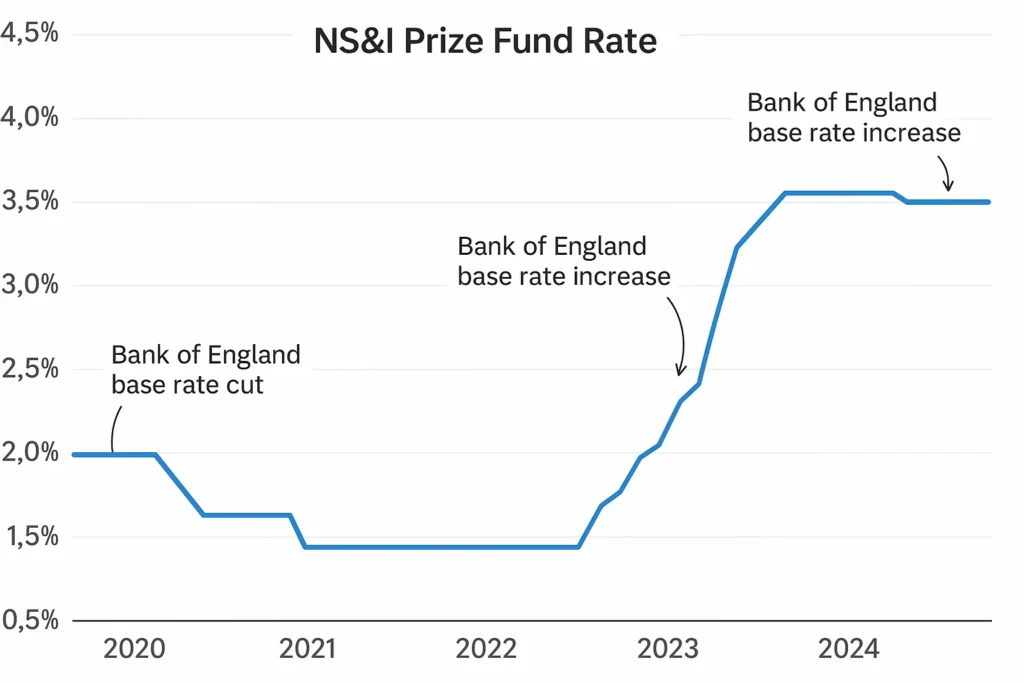

What a high or low “prize fund rate” indicates: A higher prize fund rate means that NS&I is allocating more money to the prize pool, which improves the overall odds of winning for all bondholders. A lower rate means the opposite. This rate is influenced by the Bank of England’s base rate.

How Premium Bond Returns are Calculated

While there’s no formula to calculate your personal return, the overall system’s profitability is expressed through the “prize fund rate.” This is an annualised percentage that represents the total value of prizes distributed as a proportion of the total bonds held.

Understanding the Odds

The most critical number for a Premium Bond holder is the odds of winning per £1 bond. This is published by NS&I and is typically expressed as “odds of 1 in X,000 for each £1 bond to win a prize each month.” For example, if the odds are 21,000 to 1, it means for every £21,000 you have invested, you could statistically expect to win one prize of at least £25 over the course of a year. However, this is an average, and your actual experience can vary wildly.

Why Premium Bonds Matter to Savers and Investors

- For Cautious Savers: They offer absolute capital security. The fear of losing your initial deposit is eliminated, making them a cornerstone of a low-risk savings strategy.

- For Higher-Rate Taxpayers: The prizes are entirely tax-free. For individuals who have used up their Personal Savings Allowance, this can be more efficient than a taxable savings account, even if the average return is slightly lower.

- For Anyone Seeking a “Thrill”: They introduce an element of fun and anticipation into saving, which can encourage a regular savings habit.

How to Use Premium Bonds in Your Savings Strategy

- Case 1: An Emergency Fund Vehicle: You can hold a portion of your easily accessible emergency fund in Premium Bonds. The money is safe and can typically be withdrawn within a few working days. The chance of a win is a bonus on top of capital preservation.

- Case 2: Saving for Children: Premium Bonds can be held in a parent’s or guardian’s name on behalf of a child, making them a popular gift and a fun way to start a savings pot for a grandchild or niece/nephew.

- Case 3: Diversifying Low-Risk Assets: If you have significant sums in cash ISAs or savings accounts, allocating a portion to Premium Bonds diversifies your type of return (luck-based vs. interest-based) while maintaining the same level of capital security.

To start building your portfolio of Premium Bonds, you’ll need to open an account directly with NS&I online or via post. It’s also wise to compare this with other safe-haven assets.

- Capital Security: Your money is 100% protected by the UK government.

- Tax-Free Prizes: All winnings are free from UK Income Tax and Capital Gains Tax.

- Accessibility: You can start with just £25 and withdraw your funds relatively quickly.

- The “Dream Factor”: Offers a chance, however small, to win a life-changing sum.

- No Guaranteed Return: You could hold the maximum £50,000 for years and win nothing.

- Inflation Risk: If you don’t win, your money is effectively losing purchasing power over time due to inflation.

- Opportunity Cost: The average return (prize fund rate) may be lower than the best easy-access savings accounts or Cash ISAs, especially for basic-rate taxpayers.

- Psychological Disappointment: The lack of a guaranteed return can be frustrating for some savers.

Premium Bonds in the Real World: A Case Study

In September 2023, NS&I increased the prize fund rate from 3.70% to 4.65%, improving the odds of winning from 24,000-1 to 21,000-1. This was a direct response to rising interest rates from the Bank of England.

Impact: This change meant that millions of bondholders instantly had a better statistical chance of winning a prize each month. For a holder with the maximum £50,000, the expected annual return increased from around £1,850 to £2,325, on average. However, this is a perfect illustration of the limitation: one holder might win £5,000, while another with the same amount might win only a single £25 prize. The outcome is entirely random.

Premium Bonds vs Savings Account

The most common comparison is with a standard savings account.

| Feature | Premium Bonds | Savings Account |

|---|---|---|

| Return Type | Variable, luck-based (prizes) | Guaranteed, predictable (interest) |

| Capital Security | 100% Guaranteed (up to any amount) | Up to £85,000 per institution per person (FSCS) |

| Tax Treatment | Prizes are tax-free | Interest may be taxable beyond Personal Savings Allowance |

| Primary Use | Safe saving with a chance of high return | Predictable cash accumulation |

Conclusion

Premium Bonds are a unique and valuable tool for capital preservation with a chance for a tax-free gain. They are not a substitute for a growth-oriented investment portfolio but serve as an excellent component of the low-risk, cash-holding part of your finances. As we’ve seen, their main strength, government-backed security, is balanced by their main weakness, the unpredictability of returns. They shine brightest for higher-rate taxpayers seeking tax-efficient savings and for anyone who appreciates the monthly excitement of the draw. Before investing, compare the current prize fund rate against the best easy-access savings accounts to assess the opportunity cost.

Ready to balance security and potential reward in your savings plan? Understanding all your options is key. We’ve reviewed the best safe-haven assets for UK investors to help you make an informed decision.

Related Terms

- Gilts: UK government bonds that pay a fixed interest coupon. Lower risk than corporate bonds but unlike Premium Bonds, their market value can fluctuate.

- Cash ISA: A tax-free wrapper for cash savings. Interest earned within an ISA is tax-free, but the return is guaranteed, not prize-based.

- National Savings and Investments (NS&I): The government-backed provider that issues Premium Bonds, along with other products like Guaranteed Growth Bonds.

Frequently Asked Questions

Recommended Resources

- The official NS&I Premium Bonds page for the latest rates and odds.

- The MoneySavingExpert Premium Bonds Calculator to estimate your potential chances of winning.