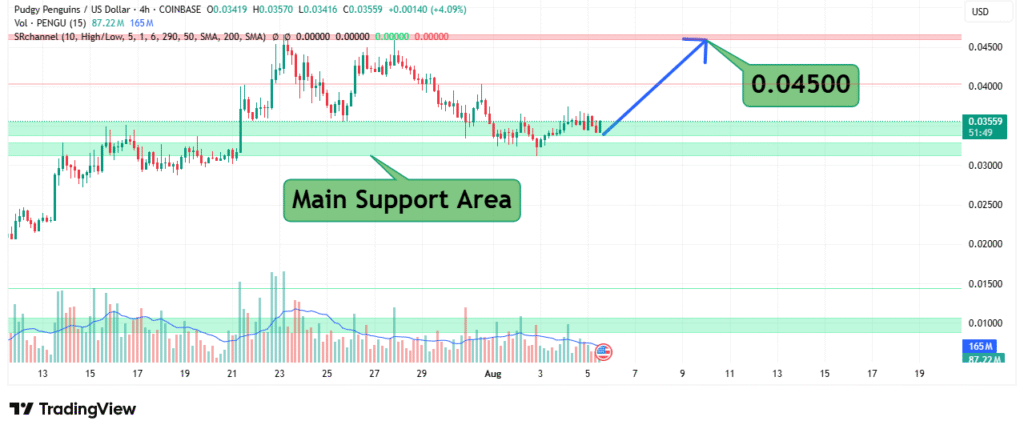

Pudgy Penguins (PENGU) is Targeting 28% Rally to $0.045

Pudgy Penguins (PENGU) is currently consolidating around the $0.035 zone after bouncing from its main support area. Market structure suggests a possible bullish reversal, with price action pointing toward a 28% upside move toward the $0.045 resistance level.

Technical Overview

PENGU recently retested the critical support area near $0.030, where buyers stepped in to defend the level. This support has historically acted as a demand zone, triggering upward moves whenever tested. Currently, the price has rebounded to $0.035 and is attempting to break short-term resistance levels.

Trend Outlook

- The chart shows a potential higher-low formation, indicating bullish momentum building.

- A sustained move above $0.038 could confirm strength and trigger an extended rally toward $0.045.

- On the downside, losing the $0.030 support would invalidate the bullish setup and potentially revisit lower supports near $0.020.

Volume and Momentum

Volume remains relatively low but shows signs of early accumulation. A spike in trading activity around the breakout point ($0.040) could validate the bullish target. Momentum indicators are also improving from oversold levels, signaling potential for further upside.

Price Target

If the bullish momentum holds, PENGU has a 28% rally potential toward the $0.045 target, aligning with previous major resistance. This level will be key for determining if the rally can extend toward higher zones or face profit-taking.

Conclusion

PENGU’s rebound from the main support area suggests renewed buying interest. A break above $0.040 could pave the way for a 28% upside move toward $0.045. Traders should watch the $0.030 support as the critical invalidation point for this bullish scenario.