What is Dark Pool in Trading An Off-Exchange Trading

A dark pool is a privately organized financial forum or exchange for trading securities, not visible to the public until after the trade is executed. These off-exchange venues allow institutions to trade large blocks of shares anonymously, aiming to minimize the market impact of their orders. For active investors in the US, UK, Canada, and Australia, understanding dark pool liquidity is crucial to grasping where a significant portion of today’s equity volume, especially on exchanges like the NYSE and NASDAQ, actually takes place.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | A private, off-exchange trading venue where large institutional orders are executed anonymously. |

| Also Known As | Alternative Trading System (ATS), Dark Liquidity, Off-Exchange Venue |

| Main Used In | Institutional Equity Trading, Block Trading, Crypto Markets |

| Key Takeaway | They provide anonymity and reduced market impact for large trades but reduce price discovery and public market transparency. |

| Formula | N/A |

| Related Concepts |

What is a Dark Pool

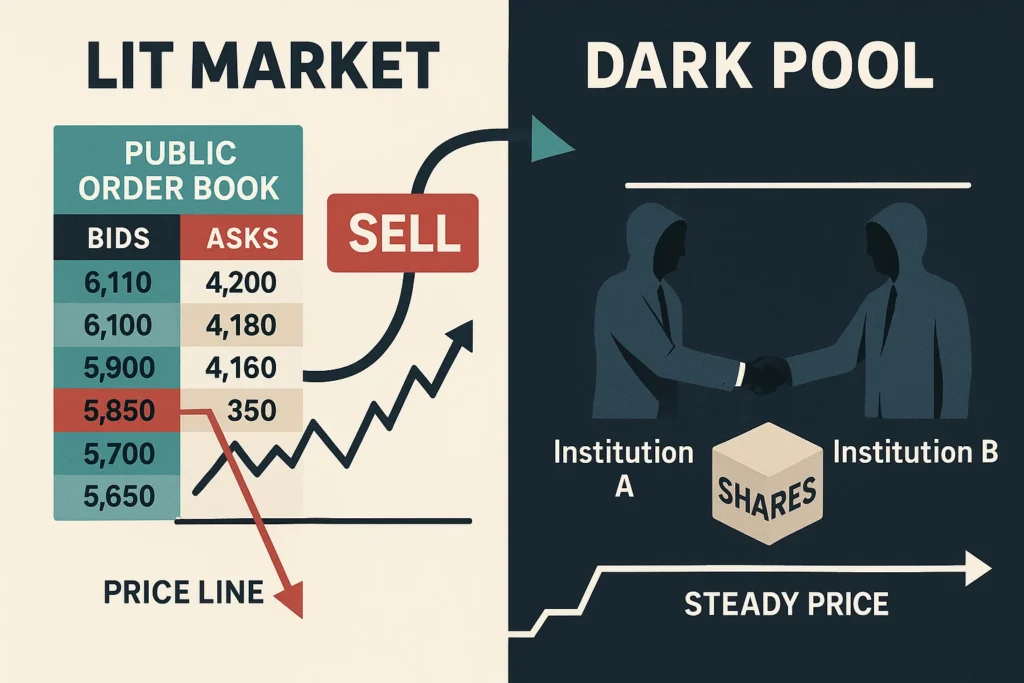

A dark pool is a type of Alternative Trading System (ATS) that provides liquidity and anonymity for trading large blocks of securities away from public eyes. Think of it as a members-only club for institutional market participants like pension funds, mutual funds, and investment banks. Unlike the “lit” markets—public exchanges like the NYSE or NASDAQ where order books are visible—dark pools keep orders hidden until after they are executed. This secrecy is the core feature, designed to prevent other traders from front-running or moving the market against a large pending order. The trading volume in these venues is substantial; according to the SEC, dark pools regularly account for a significant percentage of all U.S. equity trades.

Key Takeaways

The Core Concept Explained

The core concept hinges on information asymmetry. In a public “lit” market, a fund wanting to sell 500,000 shares of Apple would likely see the price drop as its order is executed, costing it millions. A dark pool allows that fund to post its intent anonymously. The pool’s matching engine then finds a counterparty (e.g., another institution wanting to buy a large block) and executes the trade at or within the prevailing National Best Bid and Offer (NBBO). The trade is reported to the consolidated tape, but only after execution, hiding the initiator’s strategy. This process significantly reduces slippage and transaction costs for large orders. However, it means a chunk of trading activity and liquidity is invisible, which can lead to a distorted view of a stock’s true supply and demand.

How Do Dark Pools Operate

While there’s no single formula, dark pools operate under specific regulatory frameworks and technological protocols. For traders in the US, UK, Canada, and Australia, understanding these mechanics is key. Regulation ATS from the SEC governs them in the United States, requiring registration and fair access rules.

The Matching Engine and Order Types

At the heart of a dark pool is a concealed matching engine.

- Non-Displayed Liquidity: Orders are not visible on any public order book.

- Mid-Point Matching: Many pools execute trades at the mid-point between the public National Best Bid and Offer (NBBO), offering price improvement to both sides.

- Order Types: Primarily use Indications of Interest (IOIs) or hidden/iceberg orders. An IOI is a vague signal of interest to buy or sell a stock, often within a size range, broadcast to select participants within the pool.

The Regulatory Landscape: SEC, FCA, and Global Rules

Dark pools don’t operate in a void. Their existence is shaped by region-specific regulations that every international investor should know.

- In the United States: Governed by SEC Regulation ATS. Key rules include registration, public reporting of trades (via the consolidated tape), and, for larger pools (“Tier 1” ATSs), fair access requirements. The SEC’s Market Information Data Analytics System (MIDAS) tracks off-exchange volume.

- In the United Kingdom: Regulated by the Financial Conduct Authority (FCA) under MiFID II regulations. MiFID II introduced the Double Volume Cap (DVC) mechanism, which limits the amount of trading in a stock that can occur in dark pools to protect price discovery—a rule directly targeting dark pool overuse.

- In Canada: Overseen by the Investment Industry Regulatory Organization of Canada (IIROC). Dark pools, known as Dark Orders, are permitted but must provide “meaningful price improvement” over the public market when executing client orders.

- In Australia: Regulated by the Australian Securities and Investments Commission (ASIC). ASIC focuses on ensuring dark pools operate fairly and has implemented rules around transparency and conflicts of interest.

Why Dark Pools Matter to Traders and Investors

Dark pools are a double-edged sword that significantly shapes modern market microstructure.

- For Institutional Investors & Fund Managers: They are essential tools for executing large block trades with minimal market impact. This directly improves fund performance by lowering execution costs, which is a critical metric for clients in tier-1 markets.

- For Retail Traders: The impact is indirect but real. When a large amount of order flow is diverted to dark pools, the liquidity on public exchanges decreases. This can lead to wider bid-ask spreads and more volatile price moves when large hidden orders eventually leak into the public market. Retail traders might find their orders filled at worse prices than expected if public liquidity is thin.

- For Analysts and Regulators: They represent a challenge to market transparency and price discovery. Analysts must be aware that reported public volume may not reflect total trading interest. Regulators, like the SEC and the UK’s Financial Conduct Authority (FCA), continuously scrutinize them to ensure they don’t create a two-tiered, unfair market.

How to Use Dark Pool Awareness in Your Strategy

While retail traders can’t directly trade in dark pools, savvy investors can use tools and data to gauge their influence.

- Use Case 1: Interpreting Unusual Volume Spikes: A stock closes with a large price move but only moderate reported volume on the NASDAQ. This discrepancy can signal significant dark pool activity that preceded or caused the move. Tools that track dark pool volume (e.g., charting platforms with “Off-Exchange” volume metrics) can help identify this.

- Use Case 2: Identifying Hidden Support/Resistance: Large block trades executed in dark pools often represent institutional conviction. If a stock repeatedly finds buyers (bounces) at a specific price level despite weak public bids, it may indicate hidden institutional accumulation via dark pools, acting as a strong support level.

To start tracking dark pool influence on your stocks, you need a brokerage platform with advanced market data and charting. Research platforms that provide Level II data and off-exchange volume analytics to get a clearer picture.

- Reduced Market Impact: Allows institutions to move large blocks of shares without significantly affecting the public market price.

- Price Improvement: Mid-point matching can offer execution at better prices than the public bid or ask.

- Strategic Anonymity: Shields large trading intentions from competitors and high-frequency traders.

- Lower Transaction Fees: Often have lower direct costs compared to traditional public exchanges.

- Hampers Price Discovery: By hiding orders, they prevent the market from fully seeing true supply and demand.

- Fragments Liquidity: Pulls volume away from central exchanges, which can increase volatility and spreads for retail traders.

- Opacity & Trust Issues: The lack of pre-trade transparency can lead to perceptions of an unfair, two-tiered market.

- Potential Conflicts: Broker-owned pools may face conflicts between client interests and proprietary trading desks.

How Brokers Route Your Orders: The Retail Connection to Dark Liquidity

While you can’t directly trade in an institutional dark pool, your retail orders are part of the broader order flow ecosystem that interacts with dark liquidity.

- Payment for Order Flow (PFOF): Your zero-commission broker may sell your order flow to a wholesale market maker (like Citadel Securities or Virtu). These firms often operate their own internal matching engines—sometimes called “internal dark pools”—where they try to match retail buy and sell orders against each other or their own inventory before going to the public exchange.

- Price Improvement? In theory, this internalization can provide slight price improvement (fractions of a cent per share). However, the primary incentive for the broker is the payment, not necessarily the best possible execution for you.

- What to Ask Your Broker: To be an informed investor, check your broker’s order routing disclosure (often in a quarterly “606 report”). Look for what percentage of their non-directed orders are sent to external ATSs (dark pools) vs. exchange venues.

Dark Pool in the Real World: The “Flash Crash” and Ongoing Scrutiny

While not the sole cause, dark pool activity was a significant component in the May 6, 2010, Flash Crash, where the Dow Jones plummeted nearly 1000 points in minutes before recovering. Investigations found that market liquidity became severely fragmented. As public exchanges became volatile, many large market participants withdrew to dark pools or cancelled orders, draining liquidity from the public “lit” books and exacerbating the price swing. This event highlighted the systemic risk posed by fragmented, opaque liquidity pools.

More recently, regulatory actions in Tier-1 markets underscore their importance. In 2024, the SEC continued to push for greater transparency reforms, proposing rules to make more ATS data public. In the UK, the FCA has ongoing reviews of wholesale market conduct, scrutinizing dark pool operations.

Dark Pool vs High-Frequency Trading (HFT)

| Feature | Dark Pool | High-Frequency Trading (HFT) |

|---|---|---|

| Primary Goal | Anonymity & minimal market impact for large blocks. | Speed & arbitrage; profiting from tiny inefficiencies. |

| Visibility | Orders are completely hidden pre-trade. | Orders are usually on public exchanges; speed is the hidden advantage. |

| Typical User | Large institutional investors (pension funds, mutual funds). | Proprietary trading firms, quantitative hedge funds. |

| Impact on Liquidity | Can fragment and hide liquidity. | Provides liquidity but can withdraw it instantly (“flash” liquidity). |

| Time Horizon | Minutes to hours/days for order completion. | Milliseconds to seconds. |

Conclusion

Ultimately, understanding dark pools provides a critical lens for evaluating market fairness and execution quality. While they are a powerful tool for institutions to manage transaction costs, as we’ve seen, they are not without controversy and can fragment the market. For the individual investor, awareness of dark pool activity means looking beyond basic volume metrics, understanding that true market interest may be hidden, and choosing brokers with transparent order routing policies. By incorporating this understanding into your overall market analysis, you can make more informed, realistic assessments of price action and liquidity.

Ready to see how market structure impacts your trades? The right brokerage with transparent execution reports is key. We’ve reviewed the best online brokers for advanced traders who prioritize execution analytics and order routing transparency.

Related Terms:

- Order Flow: The stream of buy and sell orders in a market. Dark pools divert a specific type of order flow (large, institutional).

- Market Maker: A firm that quotes both a buy and sell price to provide liquidity. Some dark pools are run by electronic market makers.

- Payment for Order Flow (PFOF): The practice where brokers sell their retail order flow to market makers. This is related as it deals with the routing and profitability of order flow, some of which may end up in wholesale pools that function similarly to dark pools.

Frequently Asked Questions About Dark Pools

Recommended Resources

- U.S. Securities and Exchange Commission (SEC) page on Alternative Trading Systems is the authoritative source for US rules.

- The Investopedia entry on Dark Pools provides a solid, evergreen overview.

- Research papers on sites like SSRN often delve into the market microstructure effects of dark pools.

- Explore financial data terminals like Bloomberg, which provide dark pool trade indicators and analytics (though these are premium services).