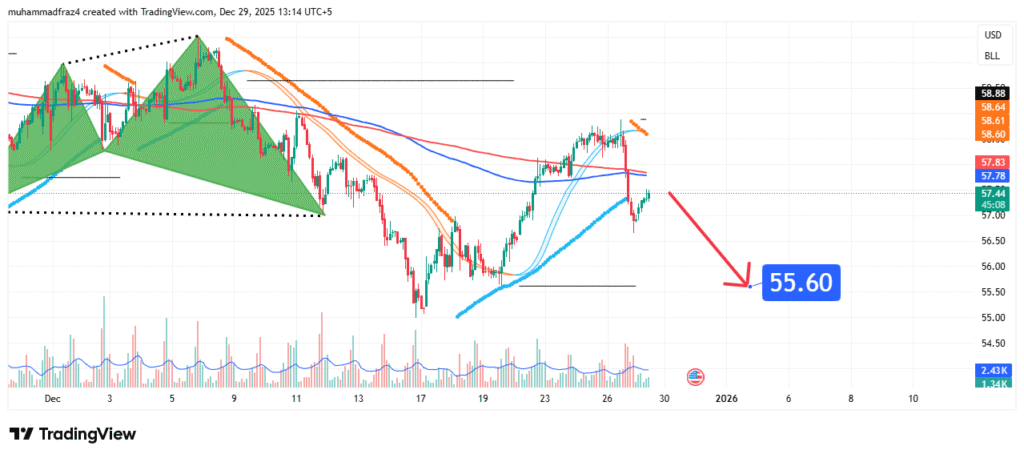

WTI Crude Oil Forecast Breakdown to $55.60 in View

Crude oil’s price

Current Market Structure and Price Action

The market structure is firmly bearish. The price has established a definitive lower high near $58.64 and has now sliced through the immediate support floor. The current price (~$57.44) is trading well below the session’s midpoint, indicating strong intraday selling pressure. The sharp red candle on the chart (implied by the 2.51% move from the labeled high) demonstrates high momentum to the downside. This price action suggests the market is not finding significant bids at current levels, paving the way for a continuation move lower.

Identification of the Key Resistance Zone

The most critical technical element is the new Strong Resistance Zone between $57.70 and $58.10. The strength of this zone is derived from:

- Historical Significance: This area served as the floor of the recent multi-session consolidation. The breakdown invalidates this support, which should now flip to act as resistance.

- Technical Confluence: The zone contains the session’s breakdown point ($57.70) and aligns with the prior day’s low, creating a multi-faceted resistance barrier.

- Market Psychology: The rapid failure at this support level likely trapped bullish participants. Any retracement back to this zone will be viewed as a “second chance to exit” for bulls and an opportunity for bears to re-enter, creating selling pressure.

This confluence makes it a high-probability level for bearish rejections on any relief rally.

Technical Targets and Rationale

Our analysis identifies the following price target:

Primary Target (PT1): $55.60

This is a measured move target derived from the recent bear flag pattern. The flag pole (initial decline) projected downward from the point of breakdown gives a target in the $55.50 – $55.70 region. Furthermore, $55.60 represents a major psychological level and a zone where significant buying emerged during previous declines in this cycle. It is the logical next destination for this wave of selling.

Prediction: We forecast that the bearish momentum will carry the price directly towards PT1 at $55.60. The lack of strong support between the current price and this target suggests the move could be rapid. A decisive break and close below $55.60 would open the path towards the $54.50 region.

Risk Management Considerations

A professional strategy is defined by its risk management.

- Invalidation Level (Stop-Loss): The entire bearish breakdown thesis is invalidated if the price achieves a daily close above $58.65. This level is above the most recent lower high and would constitute a break of the bearish market structure, suggesting the breakdown was a false move (bear trap).

- Position Sizing: Any short positions considered should be sized so that a loss triggered at the invalidation level represents a small, pre-defined percentage of your total trading capital (typically 1-2%).

Fundamental Backdrop

The technical breakdown is occurring within a supportive fundamental context for bears:

- Supply Overhang: Persistent increases in U.S. crude inventories and strong domestic production are underscoring concerns about a supply surplus.

- Demand Concerns: Mounting evidence of a global economic slowdown in major economies is weighing on the outlook for oil consumption growth.

- Geopolitical Premium Fade: While always a risk, the market appears to be discounting ongoing geopolitical tensions, focusing instead on tangible supply-demand balances.

- USD Impact: A strong U.S. Dollar continues to make oil more expensive for holders of other currencies, potentially dampening international demand.

These factors collectively contribute to the bearish sentiment permeating the oil market, lending fundamental credence to the technical breakdown.

Conclusion

Crude oil is in the midst of a high-momentum bearish breakdown. The weight of evidence points to a continued decline targeting the $55.60 support zone. Traders should view any retracement towards the $57.70-$58.10 resistance area as a potential opportunity to align with the prevailing downtrend. Risk must be managed diligently, with a clear invalidation point set at $58.65. The market’s reaction at the $55.60 target will be critical for determining whether the bearish trend will extend into the $54s or stage a technical rebound.

Chart Source: TradingView

Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice or a recommendation to buy or sell any security. All trading and investing involves significant risk, including the possible loss of your entire investment. Always conduct your own research (DYOR) and consider seeking advice from an independent financial professional before making any trading decisions.