Appreciation What Is It, How Is It Calculated, and Why Does It Matter

Appreciation refers to the growth in an asset’s worth throughout the duration it is held. It is the fundamental force that drives wealth creation for long-term investors, turning patient capital into significant gains. Understanding how and why assets appreciate is crucial for building a successful investment portfolio and achieving financial goals.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | This describes the profit earned from the difference between an asset’s selling price and its original purchase cost. |

| Also Known As | Capital Gain (once realized), Growth, Upside |

| Main Used In | Real Estate, Stock Investing, Bond Trading, Collectibles, Currency Markets (Forex) |

| Key Takeaway | Appreciation is the primary goal of most investing strategies and represents unrealized profit until the asset is sold. |

| Formula | (Final Value – Initial Value) / Initial Value |

| Related Concepts |

What is Appreciation

Fundamentally, appreciation occurs when an asset’s fair market value climbs upward. When you buy something as an investment, be it a stock, a house, or a bond, you hope that its worth will be higher when you decide to sell it. That increase in worth is appreciation This process is the direct inverse of depreciation, where an asset’s value experiences a decrease.

Key Takeaways

The Core Concept Explained

At its core, appreciation measures the growth of your investment. It is typically expressed as a percentage. For example, if you buy a share of stock for $100 and its price rises to $150, it has appreciated by 50%.

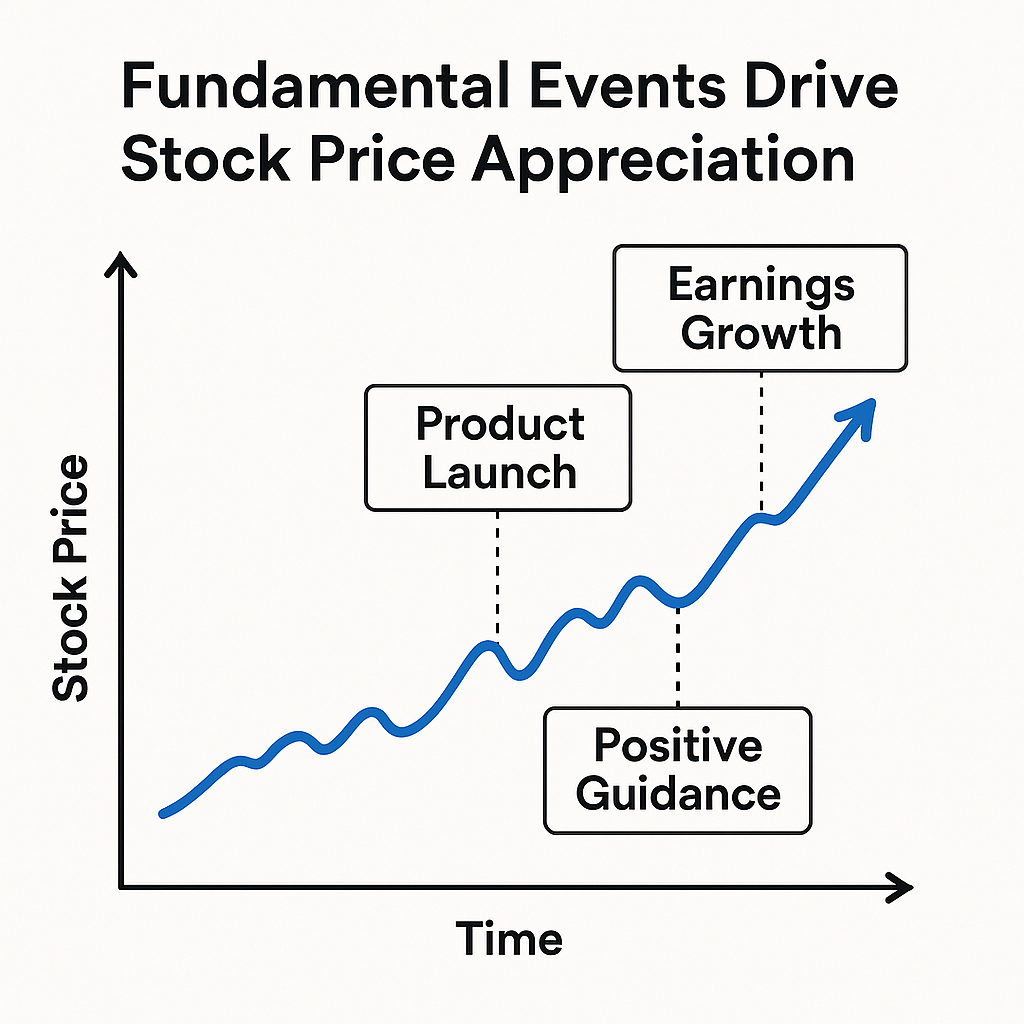

Appreciation can occur for various reasons:

- Supply and Demand: Increased desire for a limited asset (like a popular stock or a house in a booming neighborhood) pushes its price up.

- Improved Fundamentals: A company’s earnings grow, making its stock more valuable.

- Market Sentiment: Overall optimism in the market can lift the prices of most assets.

- External Factors: Low interest rates or inflation can make hard assets like real estate more attractive, causing them to appreciate.

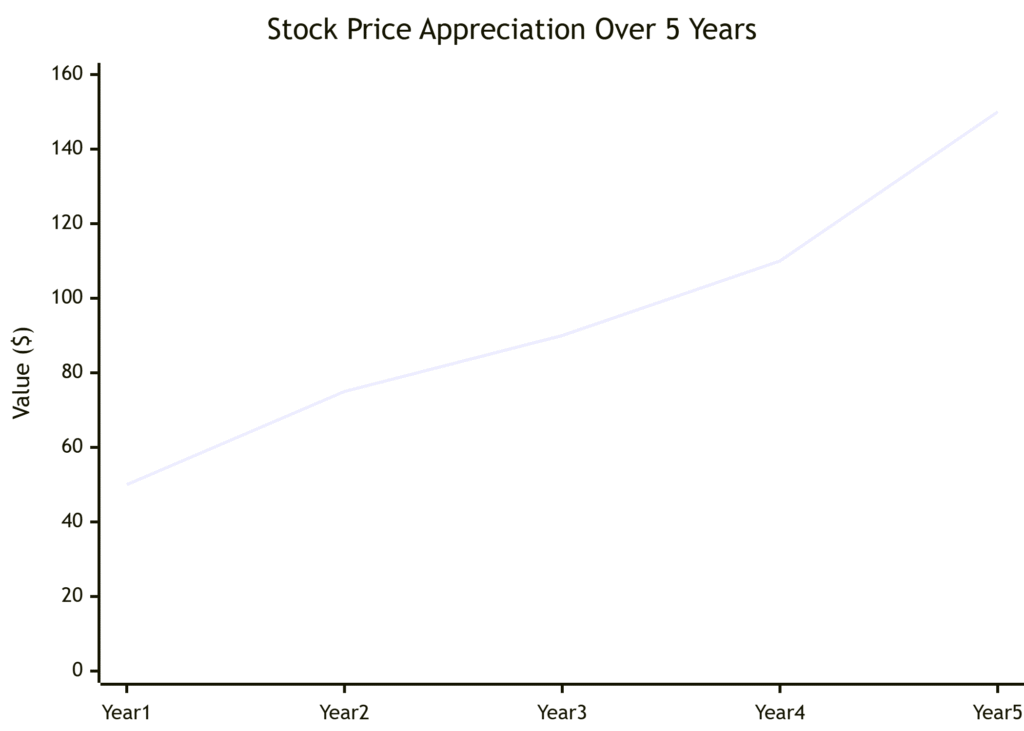

This chart illustrates how a hypothetical stock appreciates over a five-year period. The gain isn’t always linear, but the overall trend is upward.

How to Calculate Appreciation

The formula to calculate the appreciation rate is straightforward:

Appreciation Rate = ((Final Value – Initial Value) / Initial Value) x 100

Step-by-Step Calculation Guide

Let’s break down the formula:

- Final Value: The current or selling price of the asset.

- Initial Value: The original purchase price of the asset.

- The Calculation: You subtract the initial value from the final value to get the nominal dollar gain. This dollar amount gain is then divided by the original cost to determine the rate of growth in decimal form. Multiplying by 100 converts it to a percentage.

Example Calculation

Imagine you purchased a house for $350,000. Five years later, its estimated market value is $420,000.

| Input Values | Amount |

| Initial Value (Purchase Price) | $350,000 |

| Final Value (Current Value) | $420,000 |

Calculation:

- Dollar Gain = $420,000 – $350,000 = $70,000

- Growth Decimal = $70,000 / $350,000 = 0.20

- Appreciation Rate = 0.20 x 100 = 20%

Interpretation: The property has appreciated by 20% over the five-year holding period.

Why Appreciation Matters to Traders and Investors

Appreciation is the engine of investing. The pursuit of asset growth is a central mechanism for generating wealth through investing.

- For Investors: Long-term investors build their portfolios around the principle of capital appreciation. They buy assets they believe will be worth more in the future, funding retirement, education, and other goals. The power of compounding, earning returns on your past returns, is fueled by appreciation.

- For Traders: Traders seek shorter-term appreciation to generate profit. They use technical and fundamental analysis to identify assets they predict will rise in value quickly, aiming to buy low and sell high.

- For Analysts: Appreciation potential is a key component of valuation models. Analysts project future cash flows and growth rates to determine what an asset should be worth, which guides investment recommendations.

How to Use Appreciation in Your Strategy

- Case 1: Long-Term Growth Investing: An investor identifies companies with strong competitive advantages (moats), innovative products, and growing markets. They buy and hold these stocks for years, banking on the companies’ growth to drive stock price appreciation.

- Case 2: Value Investing: An investor uses financial ratios to find undervalued assets, those trading for less than their intrinsic worth. They purchase these assets and wait for the market to correct the mispricing, leading to appreciation.

- Case 3: Real Estate Investment: An investor buys a property in an emerging neighborhood. They benefit from two types of appreciation: 1) Forced appreciation through renovations and improved management, and 2) Market appreciation as the area becomes more desirable.

Pros and Cons of Chasing Appreciation

- Wealth Creation: It is the primary path to significant wealth building in the markets.

- Passive Growth: Unlike income from dividends or rent, appreciation can happen without any active work from the owner.

- Tax Advantage (in some jurisdictions): In places like the US, long-term capital gains from appreciation are often taxed at a lower rate than ordinary income.

- Unrealized Gains: Appreciation is only “on paper” until the asset is actually sold. The value can disappear just as quickly if the market turns.

- Risk of Loss: The pursuit of high appreciation often involves higher risk. Assets can also depreciate.

- No Cash Flow: An appreciating asset may not provide any income while you hold it. An investor only captures the value of a non-dividend stock or an unoccupied property at the moment of its sale.

Appreciation in the Real World: A Case Study

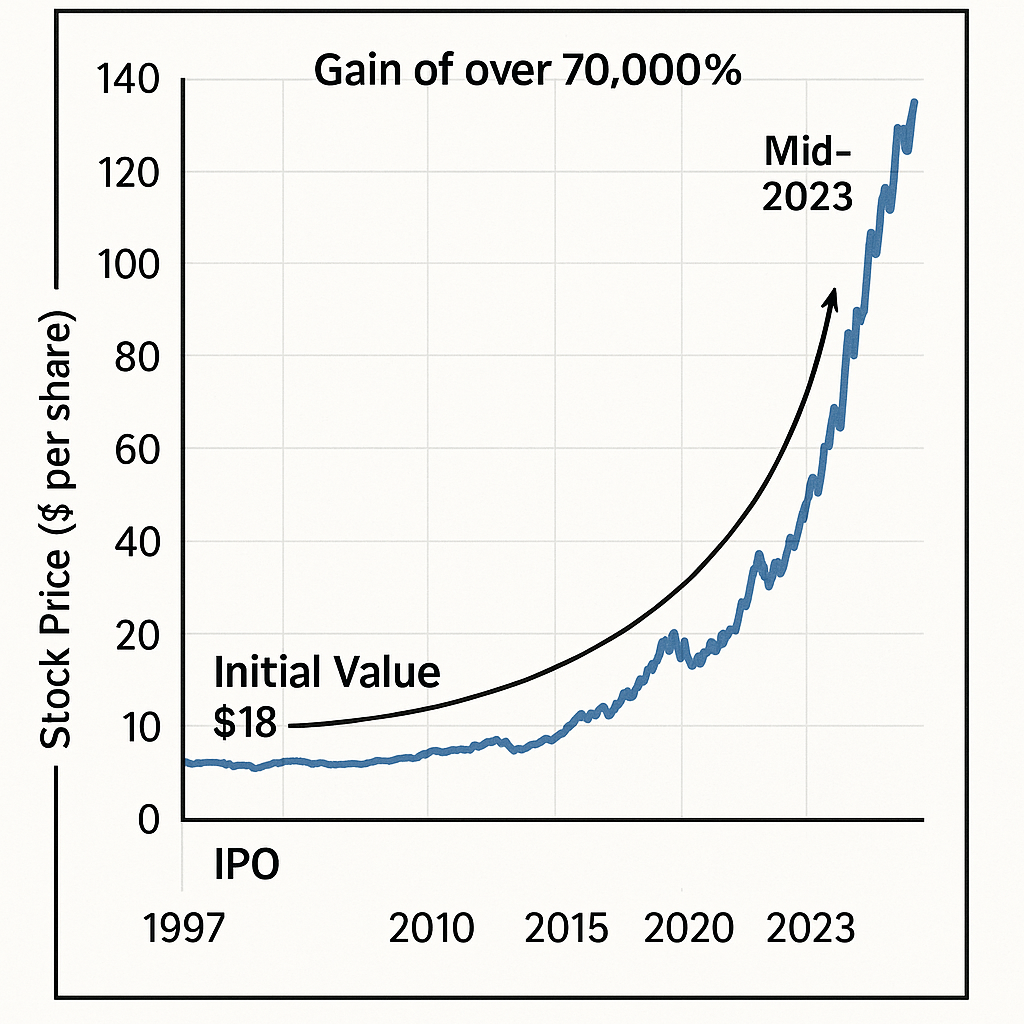

The Amazon Stock Story: One of the most powerful examples of long-term appreciation is Amazon.com (AMZN) stock.

- Initial Value: Following its stock splits, Amazon’s initial public offering (IPO) price in 1997 was equivalent to $18 per share.

- Final Value: As of mid-2023, the stock regularly trades above $130 per share.

- The Appreciation: This represents a gain of over 70,000%. An initial investment of $1,000 during their IPO would have a value exceeding $700,000 now.

This appreciation was driven by relentless revenue growth, market expansion from books to cloud computing (AWS) and beyond, and dominant competitive positioning. It demonstrates the immense power of identifying a transformative company and holding it for the long term.

How Appreciation Relates to Other Concepts

The most common point of confusion is between Appreciation and Depreciation.

| Feature | Appreciation | Depreciation |

|---|---|---|

| What it is | An increase in an asset’s value over time. | A decrease in an asset’s value over time. |

| Primary Cause | Improved fundamentals, high demand, scarcity. | Wear and tear, obsolescence, low demand. |

| Effect on Net Worth | Increases personal or business net worth. | Decreases personal or business net worth. |

| Accounting Treatment | Not deducted as an expense (gain is realized on sale). | Deducted as a non-cash expense to spread an asset’s cost. |

Conclusion

In summary, appreciation is far more than just a financial term; it is the fundamental engine of wealth creation. By understanding its mechanisms, from the basic calculation to its practical application in strategies like growth and value investing, you empower yourself to make more informed decisions. While the pursuit of appreciation inherently involves risk and requires patience, its power, especially when combined with compounding, makes it an indispensable concept for any investor or trader aiming to build long-term financial security.

Related Terms

- Capital Gains: The realized profit from selling an appreciated asset.

- Compound Interest: The process where the appreciation of an investment itself earns more appreciation, leading to exponential growth.

- Return on Investment (ROI): A broader performance metric that often includes both appreciation and income.

- Market Capitalization: A company’s market capitalization grows in tandem with the appreciation of its share price.

Frequently Asked Questions

Recommended Resources

- Investopedia: Capital Appreciation Definition – A detailed overview with examples.

- U.S. Securities and Exchange Commission (SEC): Compound Interest Calculator – See how appreciation compounds over time.

- The Intelligent Investor by Benjamin Graham: The foundational book on value investing and seeking appreciation through fundamental analysis.

How did this post make you feel?

Thanks for your reaction!