Ask Price - What It Is and How It Impacts Your Trades

The ask price is the lowest price a seller is willing to accept for a security, forming one half of the vital bid-ask spread. For active traders and long-term investors in the US, UK, and other major markets, understanding the ask is fundamental to executing orders efficiently and managing transaction costs. It is the price you pay to buy an asset, making it a cornerstone of market liquidity and price discovery.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | The lowest price at which a seller is willing to sell a security. |

| Also Known As | Offer price, Ask |

| Main Used In | Stock Trading, Forex, Options, Crypto, Bonds |

| Key Takeaway | The ask price is what you BUY at; it’s always higher than the bid price, and the difference (the spread) is a key transaction cost. |

| Formula | N/A (Market-driven price) |

| Related Concepts |

What is the Ask Price

In the simplest terms, the ask price (or offer price) is the price tag a seller places on a stock, currency pair, or any other traded asset. It is the minimum price they are willing to accept to part with it. When you decide to buy a share, you will pay the current ask price to acquire it immediately.

Think of it like a marketplace: a seller has a item for sale with a sign that says “Asking $50.” If you agree to that price, the transaction occurs. In the electronic stock market, this happens millions of times per second on exchanges like the NYSE and Nasdaq.

Key Takeaways

The Core Concept Explained

The ask price is not a single fixed number but a constantly moving target based on supply and demand. It represents the selling pressure in the market. Alongside its counterpart, the bid price (what buyers are willing to pay), it forms a quote.

- A lower ask price relative to the bid can indicate higher willingness to sell, potentially signaling less bullish sentiment or higher liquidity.

- A higher ask price can indicate sellers are confident and are not desperate to sell, often seen in rising markets.

The difference between the bid and ask is called the spread, which represents an immediate cost to the trader and a profit for the market makers facilitating the trade.

How is the Ask Price Set

The ask price is not calculated by a formula but is determined by the market’s sellers. It is set by:

- Market Makers: These are institutions obligated to provide liquidity by always being ready to buy (at the bid) and sell (at the ask). Their ask prices are based on the current market price, expected volatility, and their own inventory.

- Other Traders: Individual and institutional traders place limit orders to sell their shares at a specific price. These collective orders form the “ask side” of the order book.

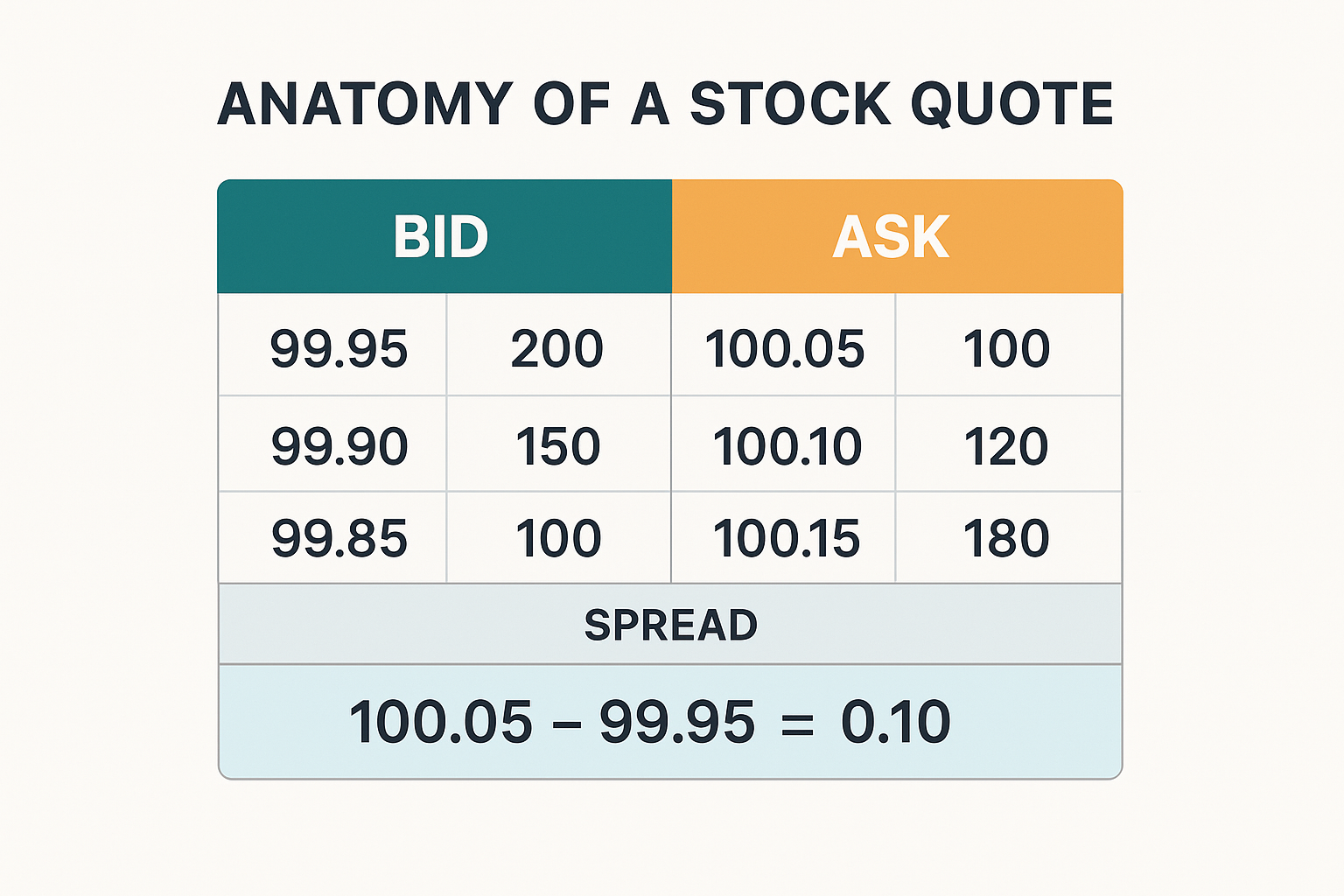

The Role of the Order Book

The order book is a real-time list of all outstanding buy and sell orders for a security. The lowest sell order in the book becomes the current ask price. As those shares are bought up, the ask price moves to the next lowest available sell order.

Why the Ask Price Matters to Traders and Investors

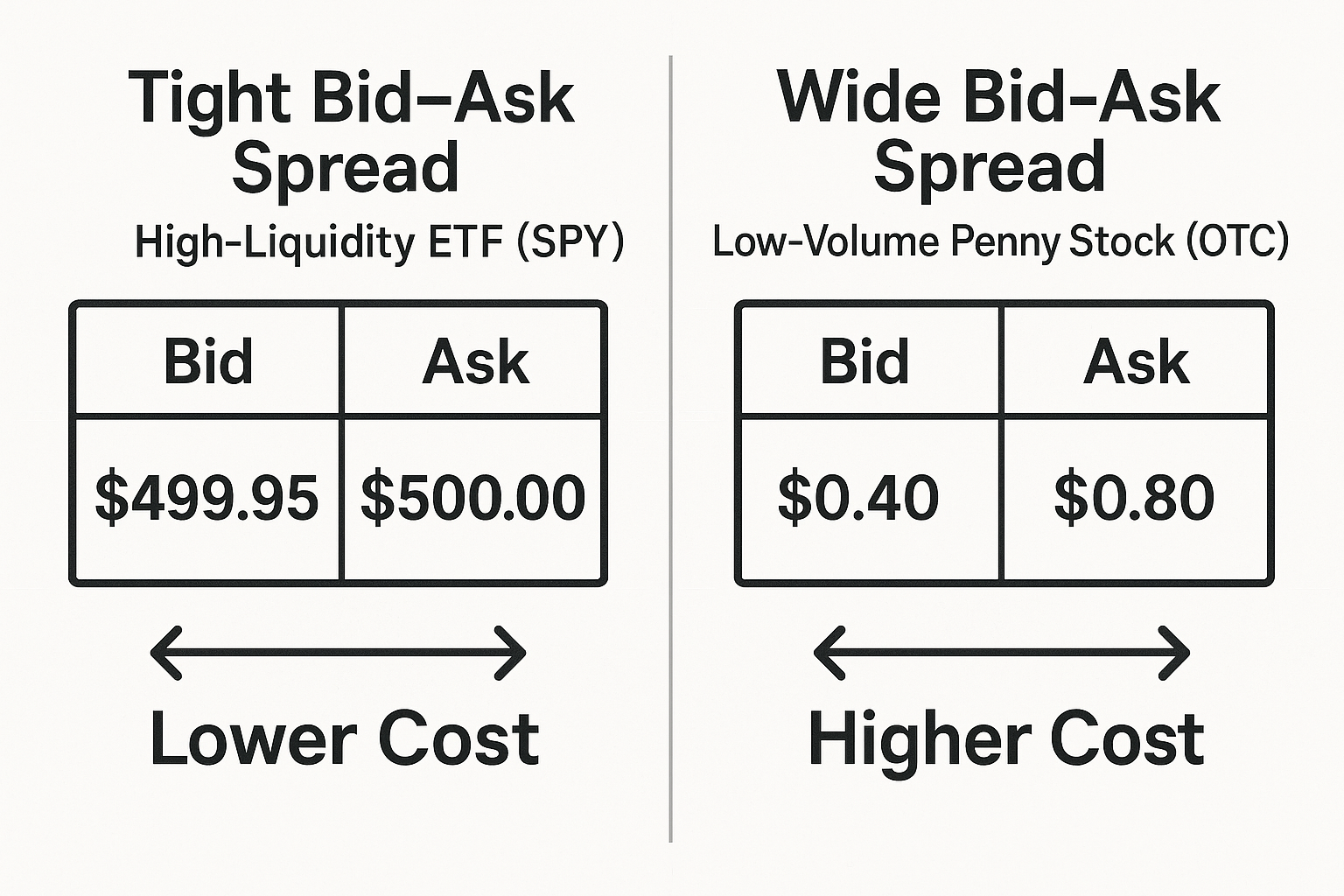

- For Traders: The ask price is your entry point for long positions. A narrow spread (small difference between bid and ask) means lower costs for frequent trading. Scalpers and day traders live and die by the spread.

- For Investors: While less critical for long-term buy-and-hold strategies, a wide spread on a low-volume stock can significantly impact the initial cost basis of an investment.

- For Everyone: The ask price, in relation to the bid, is a direct measure of an asset’s liquidity. Highly liquid stocks like Apple (AAPL) on the Nasdaq have very tight spreads, while illiquid penny stocks can have very wide ones.

How to Use the Ask Price in Your Strategy

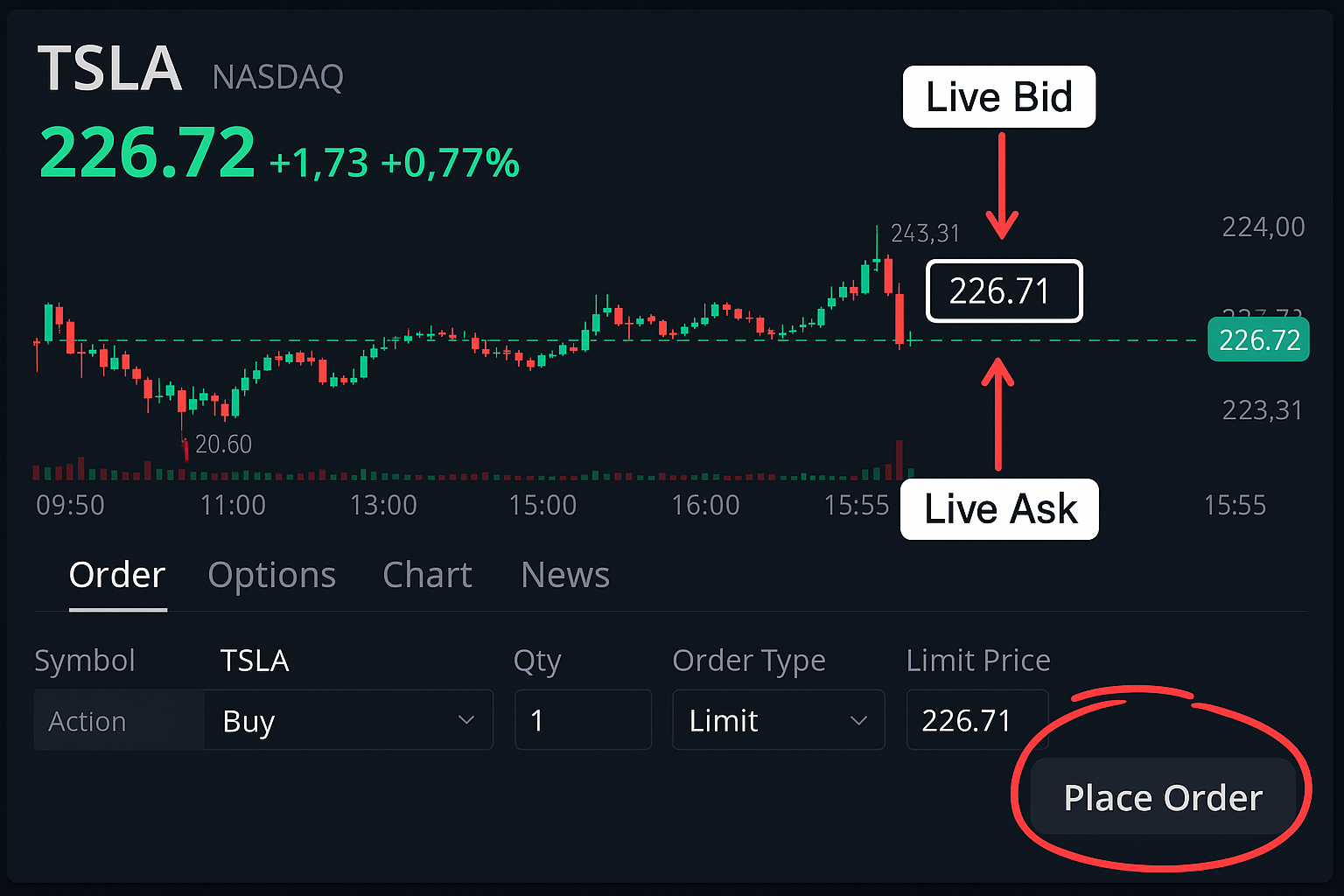

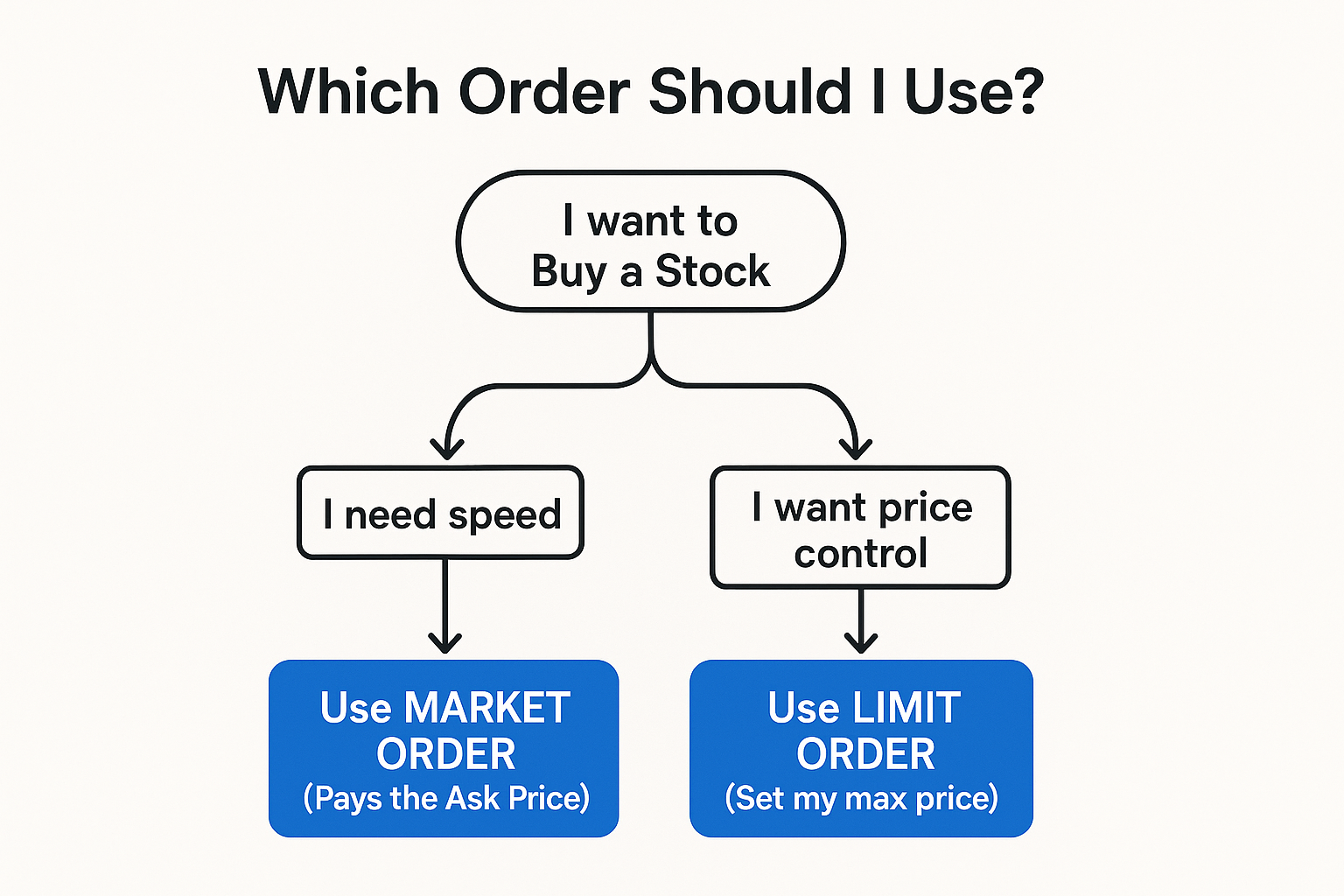

- Case 1: Placing a Market Order: When you place a market order to buy, you are agreeing to pay the current best ask price. This guarantees execution but not price. This is best for highly liquid assets where the spread is tight.

- Case 2: Placing a Limit Order: To control your cost, you can place a limit order to buy at or below a specific price. For example, if the ask is $100.05, you could set a buy limit at $100.00. Your order will only execute if a seller agrees to your price (i.e., if the ask price falls to meet your bid).

To execute these strategies effectively, you need a reliable broker with a robust trading platform. We’ve reviewed the best brokers for active traders to help you find one with low fees and excellent execution speeds.

- Transparency: Provides a clear, real-time price for immediate purchase

- Liquidity Gauge: The size of the spread between bid and ask is a primary indicator of an asset’s liquidity.

- Foundation for Trading: Essential for understanding basic order types like market and limit orders.

- Not the True Value: The ask is just the lowest selling price, not necessarily the asset’s intrinsic value.

- Can Change Instantly: In fast markets, the ask price can change between the time you decide to buy and when your order is executed, leading to slippage.

- Wide Spreads are Costly: For illiquid assets, a wide spread can be a significant hidden cost, eroding profits.

Ask Price in the Real World: A Case Study

Consider a low-volume stock on the London Stock Exchange (LSE), “UKCO.” Its order book might look like this:

- Bid: £9.98 (100 shares) | £9.95 (500 shares)

- Ask: £10.05 (200 shares) | £10.10 (1,000 shares)

The spread is 7 pence (£10.05 – £9.98). An investor placing a market order to buy 500 shares would buy the first 200 at £10.05. To fill the entire order, their broker would have to “walk up the book,” buying the next 300 shares at the next available ask price of £10.10. Their average cost would be higher than the initial ask, demonstrating the impact of low liquidity on execution price.

Ask Price vs Bid Price

| Feature | Ask Price | Bid Price |

|---|---|---|

| What it represents | The price you BUY at; the seller’s lowest offer. | The price you SELL at; the buyer’s highest offer. |

| Perspective | The seller’s side of the market. | The buyer’s side of the market. |

| In a Quote | The higher number (e.g., $150.10) | The lower number (e.g., $150.00) |

Conclusion

Ultimately, the ask price is not just a number on a screen; it is a fundamental mechanic of how markets function. It defines your cost of entry as a buyer and, together with the bid price, provides a constant snapshot of supply, demand, and liquidity. While a core concept, its effectiveness depends on using it alongside other tools, primarily by employing limit orders to control costs and being mindful of the spread as a real transaction fee. By integrating this knowledge, you transition from simply seeing a price to understanding the mechanics behind it, leading to more informed and cost-effective trading decisions.

Ready to put these concepts into action? The right tools are essential. We’ve meticulously reviewed and ranked the best online brokers for stock trading to help you find a platform with low fees, tight spreads, and advanced order types.

Related Terms

- Bid-Ask Spread: The difference between the bid and ask prices. The core measure of transaction cost.

- Limit Order: An order to buy or sell at a specified price or better. The tool used to interact with the bid/ask.

- Market Order: An order to buy or sell immediately at the best available current price (the ask for buys, the bid for sells).

- Liquidity: The ease of buying/selling an asset without affecting its price. Tight bid-ask spreads indicate high liquidity.

Frequently Asked Questions

Recommended Resources

How did this post make you feel?

Thanks for your reaction!