10 Best Financial Planning Tools You Should Know About

Taking control of your financial future starts with the right tools. This guide cuts through the noise to review the best financial planning software, budgeting apps, and investment platforms available today. We help you find the perfect fit for your goals, whether you’re in the US, UK, or Canada, to build wealth and achieve financial freedom.

What are Financial Planning Tools

Financial planning tools are digital platforms that provide a centralized view of your financial life. They go beyond simple budgeting to connect your bank accounts, investment portfolios, loans, and credit cards, giving you a real-time picture of your cash flow and net worth. Think of them as a command center for your money, helping you make informed decisions to reach goals like buying a house or retiring comfortably.

Key Takeaways

| Your Primary Goal | Best Tool Type | Key Feature to Look For |

|---|---|---|

| Basic Budgeting | Free App | Simple UI, spending alerts, categorization |

| Debt Paydown | Goal-Based App | Debt snowball/avalanche calculator, progress tracking |

| Investment Growth | Robust Platform | Portfolio analysis, fee tracking, performance reporting |

| Comprehensive Planning | Paid Software | Retirement modeling, tax planning, scenario analysis |

For investors in the UK, ensure the platform supports connections to major banks like HSBC, Barclays, and brokers like Hargreaves Lansdown. US users should check for compatibility with Chase, Bank of America, and Vanguard.

Our Top 10 Financial Planning Tools Picks

We’ve tested the most popular platforms on the market to bring you unbiased, detailed reviews. Here are our top 10 picks for 2025, broken down by their strengths, ideal user, and key features.

1. Empower

Overall Score: 4.8/5

Best For: Comprehensive wealth management and investment tracking for US-based investors.

Pricing: Free financial tools; paid wealth management services (0.49% – 0.89% AUM)

Empower is a powerhouse for investment and net worth tracking. Its free suite of tools is designed to give you a deep, analytical view of your entire financial picture, with a special focus on your portfolio’s performance and fees.

Key Features:

- Real-time net worth tracking.

- Industry-leading retirement planner.

- Investment fee analyzer.

- Portfolio allocation and performance tracker.

- Cash flow monitoring.

- Incredibly robust and free investment analysis.

- The retirement planner is one of the best available.

- Strong security protocols and data encryption.

- Can be overwhelming for absolute beginners focused only on budgeting.

- You may receive calls to upsell their paid advisory service.

Why We Picked It: We chose Empower for the #1 spot because its free offering is more powerful than most paid software, particularly for investors with growing portfolios who need deep analytics.

It is the best free tool for serious investors who want a detailed view of their investment fees and retirement trajectory.

Check Latest Price on Empower.com

2. You Need A Budget (YNAB)

Overall Score: 4.7/5

Best For: Proactive, zero-based budgeting and getting out of debt.

Pricing: $14.99/month or $99/year (free 34-day trial)

YNAB is a philosophy and a tool built around giving every dollar a job. It forces you to be intentional with your money, breaking the paycheck-to-paycheck cycle and helping you build savings.

Key Features:

- Zero-based budgeting methodology.

- Goal tracking and debt paydown tools.

- Real-time sync across mobile and desktop.

- Detailed reports and spending trends.

- Educational resources and live workshops.

- Highly effective for changing financial habits and eliminating debt.

- Excellent customer support and educational content.

- Simple, intuitive interface.

- Subscription model is more expensive than some competitors.

- Steep learning curve for those new to zero-based budgeting.

Why We Picked It: YNAB earns its spot for its proven, methodical approach to budgeting that genuinely changes users’ relationships with money.

It is the ultimate tool for hands-on budgeters committed to taking control of their cash flow.

Check Latest Price on YNAB.com

3. Quicken

Overall Score: 4.3/5

Best For: Comprehensive, all-in-one financial planning with robust reporting.

Pricing: Starts at $3.99/month (Simplifi) to $8.99/month (Premier)

A veteran in personal finance software, Quicken offers a range of products from simple spending tracking (Simplifi) to advanced investment and property management (Premier).

Key Features:

- Detailed income and expense tracking.

- Bill pay and investment tracking (on higher tiers).

- Customizable reports.

- Tax planning tools.

- Rental property management features.

- Extremely feature-rich and customizable.

- One-time purchase option is available for desktop versions.

- Handles complex financial situations well.

- The user interface appears somewhat outdated when measured against more modern applications.

- Can be complex and pricey for basic needs.

Why We Picked It: Quicken remains a top choice for users who want a powerful, desktop-first solution that can handle nearly every aspect of their finances.

It is a powerful, comprehensive suite for those who want deep-dive reporting and don’t mind a denser interface.

Check Latest Price on Quicken.com

4. Mint

Overall Score: 4.0/5

Best For: Free, basic budgeting and spending overview for beginners.

Pricing: Free (ad-supported)

Mint is one of the original free budgeting apps. It automatically categorizes transactions from linked accounts, giving you a quick snapshot of your spending and budget status.

Key Features:

- Automatic transaction categorization.

- Basic budgeting tools.

- Free credit score monitoring.

- Bill payment reminders.

- Investment tracking (basic).

- Completely free to use.

- Very easy to set up and use for beginners.

- Good for getting a high-level view of finances.

- Ad-supported, which can be intrusive.

- Limited goal-setting and investment features.

- Less hands-on than other tools.

Why We Picked It: Mint is a classic for a reason, it’s the easiest, most accessible free tool for someone just starting their financial tracking journey.

It is the best free starting point for basic budgeting and spending awareness.

Check Latest Price on Mint.com

5. Snoop

Overall Score: 4.4/5

Best For: UK-based users seeking a smart, modern money-saving and budgeting app.

Pricing: Free core services; Snoop Plus subscription for £4.99/month (adds custom categories, bill reminders, etc.)

Built by ex-Virgin Money executives, Snoop is a clever, UK-focused app that uses Open Banking. It goes beyond simple budgeting to actively find you savings, switch to better deals, and alert you to wasteful spending through its AI-powered insights.

Key Features:

- Connects to all major UK banks securely via Open Banking.

- “Snoop” alerts that find savings on bills, subscriptions, and banking fees.

- Personalized spending insights and customizable budgets.

- Bill reminders and cash flow forecasting.

- Ability to create separate “pots” for saving towards goals.

- Proactively works to save you money, making it more than just a tracker.

- User-friendly, engaging, and modern interface.

- Strong focus on UK-specific spending and saving opportunities.

- The most powerful features (like custom categories and extra bill reminders) require a paid subscription.

- Primarily focused on day-to-day spending and saving rather than deep investment analysis.

Why We Picked It: For our UK readers, Snoop is a fantastic and innovative choice. It doesn’t just show you your money; it uses AI to give you actionable advice to improve it, all within a platform built specifically for the UK market.

It is a top smart money-saving companion for proactive UK consumers.

Check Latest Price on Snoop

6. PocketSmith

Overall Score: 4.2/5

Best For: Financial forecasting and calendar-based budgeting.

Pricing: Free Basic plan; Premium from $9.95/month

PocketSmith’s superpower is its ability to forecast your bank balance months or even years into the future based on your scheduled and recurring transactions.

Key Features:

- Advanced financial calendar and forecasting.

- Scenario modeling (“what-if” analysis).

- Multi-currency support.

- Automated bank feeds and manual tracking.

- Detailed income vs. expense reports.

- Unparalleled future cash flow forecasting.

- Great for freelancers with variable income.

- Supports over 14,000 banks globally.

- The most powerful features require a paid plan.

- Interface has a steeper learning curve.

Why We Picked It: We included PocketSmith for its unique focus on forecasting, which is a game-changer for planning large purchases or navigating irregular income.

It is the best tool for anyone who wants to see the future of their finances.

Check Latest Price on PocketSmith.com

7. Monarch Money

Overall Score: 4.6/5

Best For: Modern, collaborative financial planning for couples and families.

Pricing: $14.99/month or $99/year

Founded by a former Mint product manager, Monarch is a modern, subscription-based platform designed to be a collaborative hub for your entire financial life.

Key Features:

- Shared access for couples.

- Customizable rules for transaction categorization.

- Beautiful net worth and cash flow charts.

- Goal tracking and recommendations.

- Monthly reports recapping your progress.

- Clean, intuitive, and modern user interface.

- Excellent for couples to manage money together.

- Responsive customer support and active development.

- No free plan, only a 7-day trial.

- Younger company than some competitors.

Why We Picked It: Monarch fills the gap for a modern, user-friendly, and collaborative tool that feels like a premium upgrade from free apps.

It is a top-tier paid option for individuals and families who value design and shared access.

Check Latest Price on MonarchMoney.com

8. Emma

Overall Score: 4.1/5

Best For: UK & Canadian users focused on avoiding overdrafts, canceling subscriptions, and budgeting.

Pricing: Free plan; Pro from £4.99/month

Emma is a popular budgeting app in the UK and Canada that helps you avoid nasty fees, track subscriptions, and stay on top of your spending with a fun, social-media-like interface.

Key Features:

- Subscription tracking and cancellation.

- Overdraft avoidance alerts.

- Budgeting and categorization.

- “Anti-Budget” feature for flexible savers.

- Connects to UK, US, and Canadian banks.

- Focus on saving money by finding wasteful spending.

- Engaging and easy-to-use mobile app.

- Strong community and brand presence.

- Net worth and investment features are not its core strength.

- Some key features locked behind the paywall.

Why We Picked It: Emma is a fantastic, modern choice for a specific audience: those who want to stop overspending and find hidden subscriptions draining their accounts.

It is the best tool for subscription cancellation and avoiding bank fees for UK/Canada users.

Check Latest Price on EmmaApp.com

9. Tiller Money

Overall Score: 4.4/5

Best For: Spreadsheet lovers who want automated data feeds into customizable Google Sheets or Excel templates.

Pricing: $79/year

Tiller automates the most tedious part of spreadsheet budgeting: data entry. It automatically feeds your daily transactions into customizable Google Sheets or Excel templates.

Key Features:

- Automated daily transaction feeds to spreadsheets.

- Pre-built templates for budgets, net worth, and more.

- Fully customizable categories and sheets.

- Email summaries of your daily finances.

- Strong customer support community.

- Ultimate flexibility and customization.

- Your data stays in your spreadsheet; no proprietary platform.

- No ads or upsells.

- Requires comfort with spreadsheets.

- Lacks the slick UI of other apps.

Why We Picked It: Tiller is unique and deserves a spot for serving the niche of users who want the power of automation with the flexibility of a spreadsheet.

It is the perfect solution for spreadsheet power users who want to automate their custom financial system.

Check Latest Price on TillerHQ.com

10. Honeydue

Overall Score: 4.0/5

Best For: Couples who want to manage their finances together simply and without friction.

Pricing: Free

Honeydue is a budgeting app built specifically for couples. It allows you to see both partners’ accounts in one place while deciding what to share and what to keep private.

Key Features:

- Joint and individual account tracking.

- Customizable spending limits by category.

- In-app chat to discuss specific transactions.

- Bill payment reminders and tracking.

- Free to use.

- Designed from the ground up for couples.

- Respects financial privacy within a relationship.

- Simple, straightforward, and free.

- Less robust for individual, in-depth financial planning.

- Investment tracking is basic.

Why We Picked It: We included Honeydue because managing money as a couple is a common pain point, and this tool addresses it directly and effectively.

It is the best free app for couples to transparently manage their shared and individual finances.

Check Latest Price on Honeydue.com

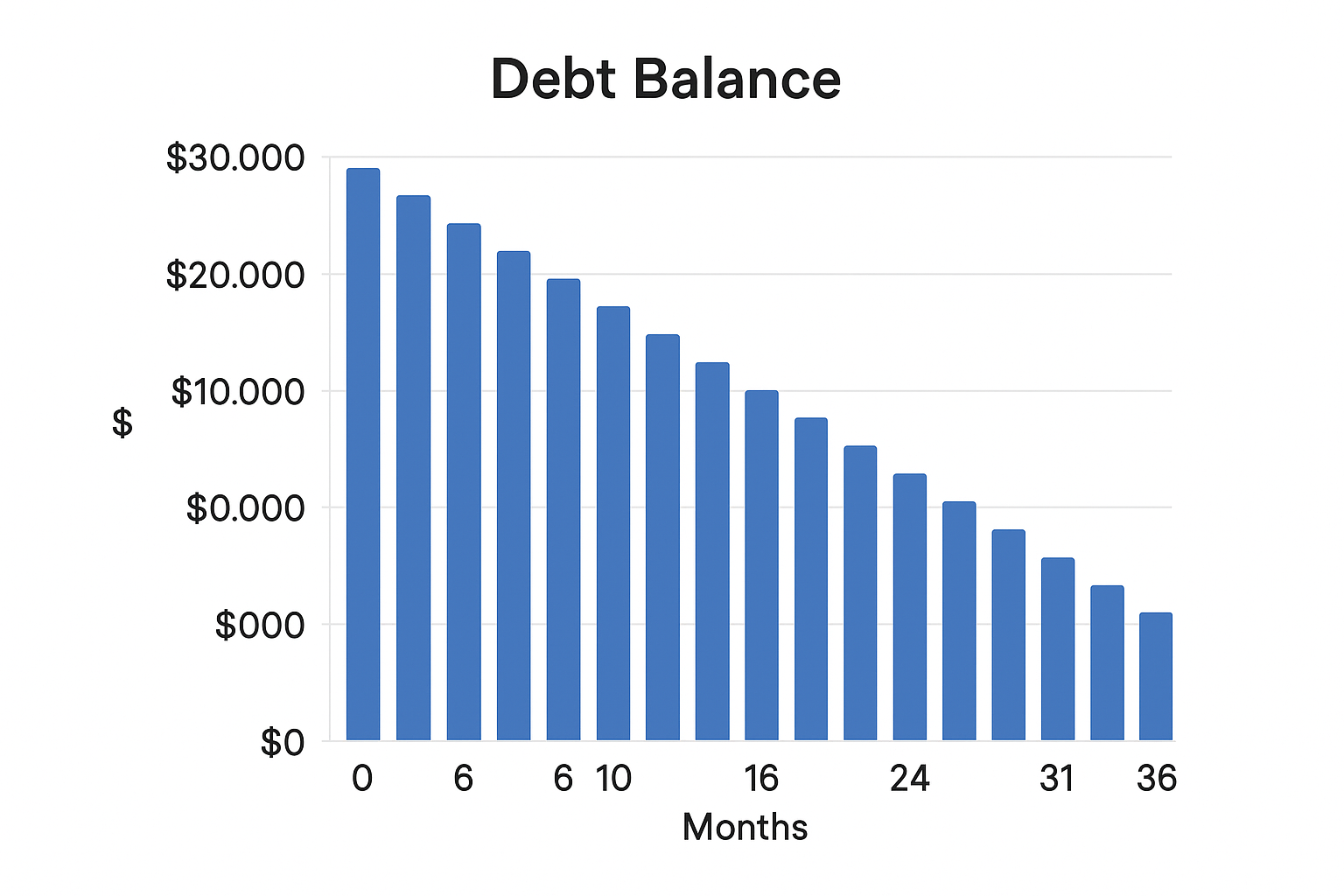

A Real-World Example: Paying Off Debt

Consider Sarah, a graphic designer in Chicago with $30,000 in student loan and credit card debt. She felt overwhelmed. By using YNAB (You Need A Budget), she connected her accounts and saw her true spending patterns. The tool helped her create a strict budget, and she used its goal-tracking feature to focus on her smallest debt first (the debt snowball method). Watching the graph trend downwards kept her motivated. Within three years, she was debt-free and had built a solid emergency fund.

Financial Planning Tools vs Robo-Advisors

| Feature | Financial Planning Tools | Robo-Advisors |

|---|---|---|

| Primary Function | Tracking & Analysis | Automated Investing |

| Hands-On Level | High (You make decisions) | Low (Algorithm manages portfolio) |

| Cost | Subscription fee or free | Annual management fee (AUM) |

| Best For | Holistic financial picture | Hands-off investment management |

Conclusion

Ultimately, the right financial planning tool acts as a force multiplier for your financial intelligence. It provides the data-driven insight and automation needed to transition from reactive money management to proactive wealth building. While the choice depends on your individual needs and comfort with technology, the act of choosing one is a critical step toward financial empowerment. The clarity gained from seeing your entire financial picture in one place is invaluable. Start by trying out a free option to build the habit of tracking, and then level up as your needs become more complex.

Ready to find your perfect financial command center? The best way to start is to pick one from our list above and try it out. Many offer free trials. Once you’ve gained clarity on your finances, the next step is to put your plan into action with a broker that fits your strategy. Check out our reviews of the Best Online Brokers to get started.

Related Terms:

- Asset Allocation

- Emergency Fund

- Retirement Planning

- Net Worth