Bid Price What It Is and How It Affects Your Trades

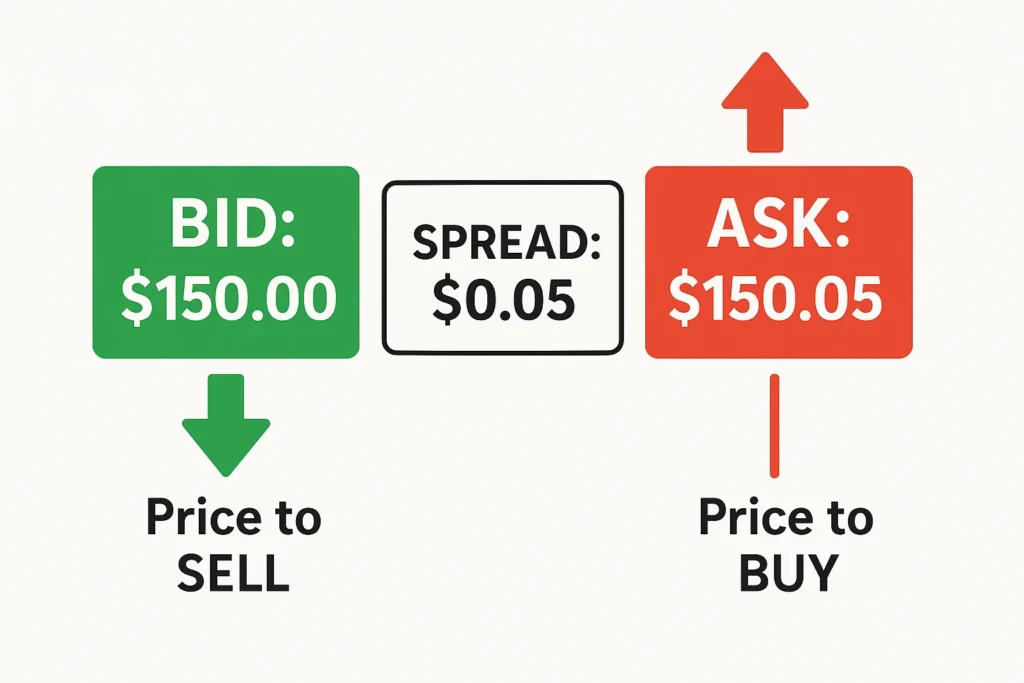

The bid price is the maximum price a buyer is willing to pay for a security, such as a stock, bond, or currency. It is the foundational number you see when you’re looking to sell an asset and is always paired with the ask price, which is the minimum a seller will accept. For active traders and long-term investors in the US, UK, Canadian, and Australian markets, understanding the bid price is critical for executing profitable trades and managing transaction costs on exchanges like the NYSE, NASDAQ, and LSE.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | The highest price a buyer is willing to pay for a security at a given time. |

| Also Known As | Bid, Buy Price |

| Main Used In | Stock Trading, Forex, Options, Crypto, Bond Markets |

| Key Takeaway | The bid price is what you get when you sell a security immediately (market sell). The difference between the bid and ask price (the spread) is a key transaction cost. |

| Formula | N/A (Determined by market supply and demand) |

| Related Concepts |

What is a Bid Price

In simple terms, the bid price is the “buy now” price from the market’s perspective. If you own a share of Apple (AAPL) and want to sell it immediately, the bid price is the amount a buyer is currently ready to pay to purchase it from you. It represents the current demand for an asset. You will always find the bid price quoted alongside the ask price (the price to buy immediately), and together they form the core of any financial quote.

Analogy: Imagine a pawn shop. You want to sell a guitar. The pawnbroker offers you $100. That offer is their “bid price” for your guitar. If you agree to sell, you get the $100. The price tag they would put on the guitar to sell it to someone else ($150) would be the “ask price.” The difference ($50) is their profit margin, similar to the bid-ask spread in financial markets.

Key Takeaways

The Core Concept Explained

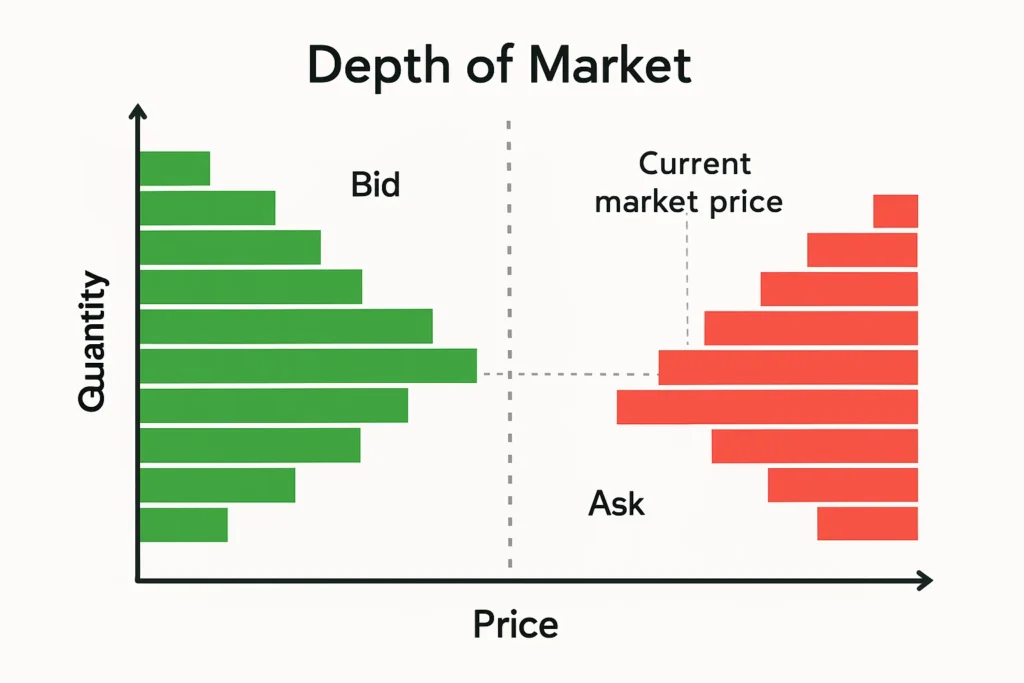

The bid price is not a single, fixed number but an aggregate of all the best buy orders currently in the market’s order book. When you look at a Level 2 quote, you see a list of all bid prices and the number of shares buyers are willing to purchase at each price point. The highest of these prices becomes the official “bid.” When you place a market order to sell, your order is filled at the best available bid price.

What does a high or low bid price indicate? A rising bid price suggests increasing demand and buying pressure, often pushing the asset’s market price upward. A falling bid price indicates weakening demand and selling pressure, which can lead to a price decline.

How is the Bid Price Determined

The bid price isn’t calculated with a formula but is determined dynamically by the forces of supply and demand in an auction-style market. It is set by the collective actions of buyers, including individual investors, institutional traders, and market makers.

Market makers play a crucial role. To ensure liquidity, they are constantly quoting both a bid and an ask price. For example, a market maker for Tesla (TSLA) might quote a bid of $240.00 and an ask of $240.10. They profit from the $0.10 spread while facilitating smooth trading.

- Depth of Market

For a stock listed on the London Stock Exchange (LSE), like HSBC, the bid price will be in GBP (pence). Similarly, a stock on the Australian Securities Exchange (ASX) will have a bid in AUD.

Why Bid Price Matters to Traders and Investors

- For Traders: The bid price is your instant exit. If you need to close a position quickly, the bid is the price you’ll receive. Scalpers and day traders live and die by the bid-ask spread, as a wide spread can turn a potentially profitable trade into a loss.

- For Investors: Long-term investors use the bid price to gauge the true value they can realize from their holdings at any moment. When reviewing a portfolio, the “current price” is often the last-trade price, but the bid price is what you would actually get if you sold.

- For Analysts: The relationship between bid and ask prices (the spread) is a key indicator of liquidity and market health. A widening spread can signal increasing uncertainty or risk around a particular asset.

How to Use the Bid Price in Your Strategy

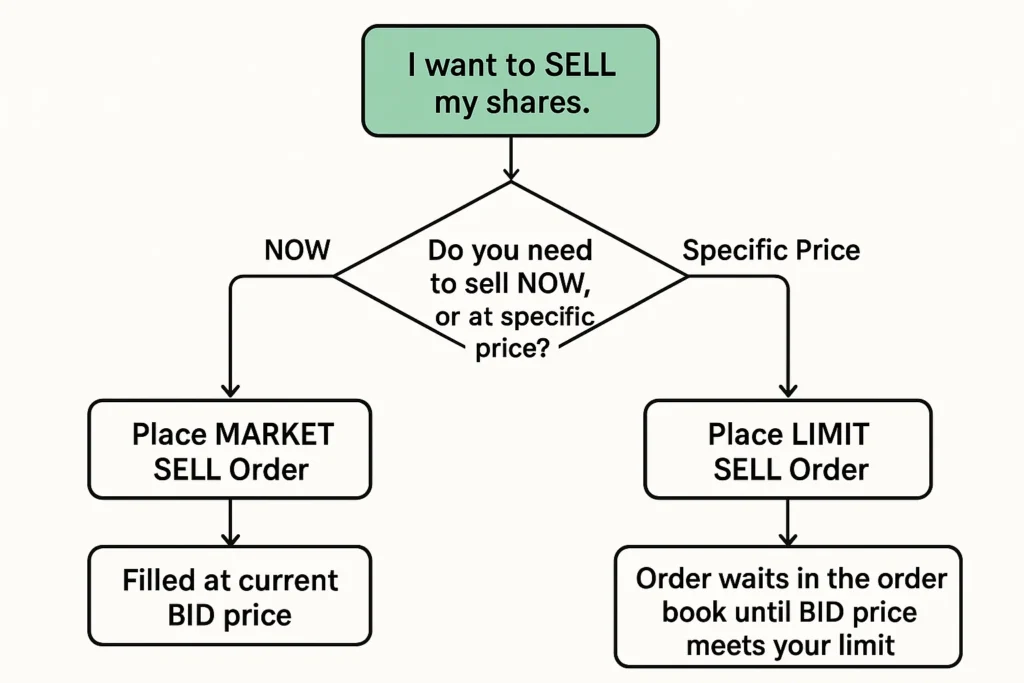

- Case 1: Placing a Sell Order

- Market Sell Order: If you place a market order to sell 100 shares, your order will be filled at the best available bid price. This is immediate but you have no price control.

- Limit Sell Order: If the current bid is $50, but you want at least $51, you can place a limit sell order at $51. Your order will sit on the ask side until a buyer is willing to meet your price.

- Case 2: Assessing Liquidity Before Entering a Trade

Before buying a stock, always check the bid-ask spread. A stock with a bid of $10.00 and an ask of $10.05 has a $0.05 spread (0.5%). To break even, the stock must move up by at least $0.05. A wide spread makes short-term trading much more difficult.

To start using bid and ask prices effectively, you need a brokerage platform with real-time data and advanced charting. We’ve reviewed the best platforms for active traders to help you make an informed choice.

Advantages and Limitations of the Bid Price Concept

- Transparency: Provides a clear, real-time indication of what the market is willing to pay.

- Liquidity Gauge: The bid price (and its relation to the ask) is a direct measure of an asset’s liquidity.

- Execution Certainty: A market sell order at the bid price offers immediate execution.

- Not the “Market Price”: The last-traded price might be between the bid and ask. The bid price only reflects the immediate selling price.

- Can Change Instantly: In fast-moving markets, the bid price can disappear or drop significantly before your sell order is executed (slippage).

- Size Matters: The quoted bid price may only be for a small number of shares (e.g., 100 shares). Selling 10,000 shares might require accepting a lower bid price.

Bid Price in the Real World: A Case Study

Consider a fast-moving news event, like an earnings surprise from a company like Netflix (NFLX) on the NASDAQ.

- Before Earnings: NFLX bid: $500.00, ask: $500.10. The spread is a tight $0.10, indicating high liquidity.

- After Poor Earnings Report: Selling pressure surges. The order book is flooded with market sell orders. These orders hit the existing bid prices, wiping them out. The highest price a buyer is willing to pay quickly drops.

- Result: The new quote might be bid: $450.00, ask: $455.00. The spread has widened to $5.00 due to high volatility and uncertainty. An investor who placed a market sell order after the news would have received approximately $450 per share, not the $500 from minutes before.

This demonstrates how the bid price is not static but a real-time barometer of market sentiment.

Bid Price vs Ask Price

The most critical relationship is with the Ask Price. The following table highlights the differences:

| Feature | Bid Price | Ask Price |

|---|---|---|

| Definition | Highest price a buyer will pay. | Lowest price a seller will accept. |

| Perspective | Price you get when you SELL. | Price you pay when you BUY. |

| Also Known As | Buy Price, Bid | Offer Price, Ask |

| In the Spread | The lower number. | The higher number. |

Conclusion

Ultimately, the bid price is far more than just a number on a screen; it is the definitive measure of an asset’s immediate selling value. Mastering its relationship with the ask price empowers you to understand transaction costs via the spread, assess market liquidity, and execute trades more strategically. While it provides transparency, remember its limitations, it can be volatile and is size-dependent. By consistently monitoring the bid-ask dynamic, you transition from a passive observer to an active, cost-aware market participant. Start by checking the spread on your current holdings and watchlist to gauge their true tradability.

Ready to put these concepts into action? The right tools are essential. We’ve meticulously reviewed and ranked the best online brokers for active trading to help you get started with platforms that offer deep liquidity and tight spreads.

Related Terms

- Ask Price: The counterpart to the bid price.

- Bid-Ask Spread: The difference between the two, representing a key transaction cost.

- Limit Order: An order to buy or sell at a specified price or better, allowing you to set your own bid or ask.

- Market Order: An order to buy or sell immediately at the best available current ask or bid price.

- Liquidity: The ease of buying/selling an asset without affecting its price, directly reflected in the bid-ask spread.

Frequently Asked Questions

Recommended Resources

- U.S. Securities and Exchange Commission (SEC) – Investor Bulletin: Trading Basics

- Order Types: Market vs. Limit

How did this post make you feel?

Thanks for your reaction!