Money management is one of the most effective financial tools anyone can master whether you’re just beginning your financial journey or seeking to refine your existing strategy. It forms the foundation for controlling expenses, building savings, and achieving financial independence. If you’re new to budgeting or struggling to keep track of your finances, this budgeting for beginners guide will help you get started, stay on course, and make personal financial planning a consistent habit.

Key Takeaways

Why Budgeting Matters

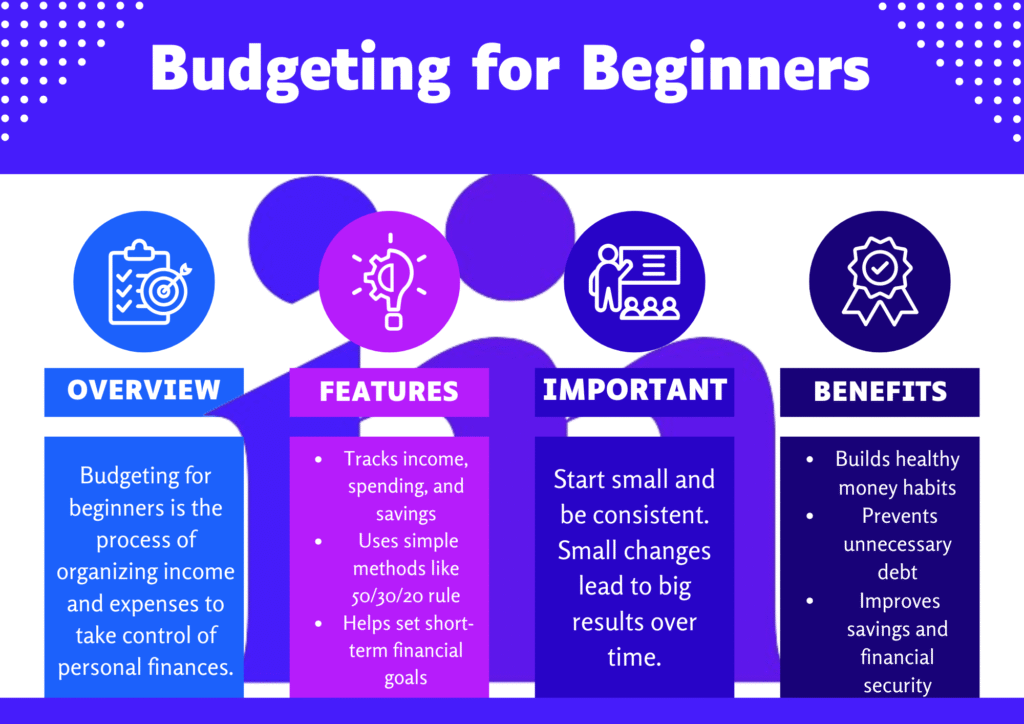

Budgeting is the process of creating a structured plan for your money, ensuring that every dollar is accounted for. It helps you:

- Control Your Spending: Understanding your income allows you to make deliberate decisions about where your money goes.

- Save for the Future: Budgeting enables consistent contributions to emergency funds, retirement accounts, and long-term financial goals.

- Reduce and Eliminate Debt: A well-structured budget prioritizes debt repayment, helping you become debt-free faster.

If you’re new to personal finance, learning how to manage your income and expenses is the first step to building financial stability.

Budgeting isn’t about restriction, it’s about intentional spending. Many people associate budgets with sacrifice, but the true goal is to align your money with your values and goals. A well-structured budget gives you the freedom to spend confidently, not the pressure to cut everything.

Step 1: Understand Your Income and Expenses

Before creating a budget, you need a clear picture of your income sources and monthly expenditures which is an essential part in budgeting for beginners. Begin by tracking your income and expenses for at least one to two months to understand your financial habits.

Track Your Income

List all sources of revenue, including:

- Full-time or part-time employment

- Freelance work or side gigs

- Include passive income sources like rental earnings or dividend payouts when calculating your total monthly income

Calculate your total monthly net income this is your take-home pay after taxes and deductions.

Track Your Expenses

Categorize your monthly expenses into:

- Fixed Expenses: Consistent monthly obligations such as rent, mortgage payments, utilities, insurance premiums, and loan installments.

- Variable Expenses: Fluctuating costs like groceries, fuel, entertainment, and dining out.

- Debt Obligations: Monthly payments on credit cards, student loans, personal loans, or car loans.

At month’s end, compare your total spending to your income to evaluate where your money is going and adjust as needed.

“I had no idea I was spending more than $300 monthly on takeout until I tracked every expense during my first month of budgeting. Once I tracked everything, I adjusted to cooking more at home and redirected that money toward an emergency fund. Within six months, I had $2,000 saved.” A real experience from a beginner who started with the 50/30/20 rule.

Step 2: Choose a Budgeting Method

Different budgeting techniques cater to various financial goals and preferences. Here are four commonly used methods in budgeting for beginners:

1. The 50/30/20 Rule

The 50/30/20 rule, great for newcomers; divides after-tax income into three categories:

- 50% for Essentials: Rent, groceries, transportation, healthcare.

- 30% for Lifestyle Choices: Entertainment, travel, dining out, etc.

- 20% for Financial Growth: Savings contributions, investments, and paying down debt.

2. The Envelope System

A cash-based method that assigns physical envelopes for each spending category (e.g., groceries, gas, entertainment). Once the cash in an envelope is used up, no more spending is allowed in that category for the month.

3. Zero-Based Budgeting

Zero-based budgeting is one of the best technique in budgeting for beginners as it ensures every dollar is assigned a specific job whether it’s for expenses, savings, or debt, so nothing is left unaccounted for. This method ensures total accountability for each dollar earned.

4. The 80/20 Rule

A simplified strategy where 80% of your income covers all living expenses, and 20% is automatically allocated to savings and debt repayment. This is great for individuals seeking a low-maintenance approach.

Select a budgeting framework that aligns with your financial habits and long-term vision.

Step 3: Establish Clear Financial Goals

Setting precise, achievable goals will keep you motivated and provide direction for your budgeting for beginners plan. These goals may include:

- Emergency Fund: Aim to save 3–6 months’ worth of living expenses to cover unexpected situations.

- Debt Repayment: Focus on eliminating high-interest debt first (e.g., credit cards) using strategies like the avalanche or snowball method.

- Retirement Savings: Contribute regularly to retirement accounts such as a 401(k), Roth IRA, or traditional IRA to secure your financial future.

Set clear and actionable goals using the SMART framework; Specific, Measurable, Achievable, Relevant, and Time-bound.

Automate your savings before budgeting the rest. Automate your savings by scheduling a transfer to your savings account right after payday. This “pay yourself first” strategy turns saving into a habit and eliminates the temptation to spend what you intended to save.

Step 4: Cut Unnecessary Spending

Review your variable expenses and identify areas to reduce. Common cost-cutting opportunities include:

- Eating Out: Cook at home more frequently and limit takeout or restaurant visits.

- Subscription Services: Audit all subscriptions (streaming platforms, apps, memberships) and cancel those that are underused.

- Impulse Purchases: Avoid unplanned spending by sticking to a list and implementing a 24-hour rule before making non-essential purchases.

Reallocating these savings toward investments, emergency funds, or debt repayment can significantly improve your financial health.

Meet Carla, a freelance graphic designer. Carla started with irregular income and no financial tracking. By using the zero-based budgeting method, she began assigning every dollar a job, even in fluctuating months. Within a year, she paid off $5,000 in credit card debt, created a 4-month emergency fund, and started saving for retirement through a Roth IRA.

Step 5: Regularly Monitor Your Budget

Consistency is key. Use budgeting tools like YNAB (You Need A Budget), Mint, or PocketGuard to track your income and expenses. If you prefer a manual system, consider maintaining a spreadsheet to keep a detailed record of your finances.

Routinely compare your actual expenses to your planned budget weekly or monthly to stay disciplined and within your spending limits.

Step 6: Make Adjustments as Needed

Your financial circumstances will shift over time due to career changes, unexpected expenses, or personal milestones. Reassess your budget regularly and update it as needed to stay aligned with your financial objectives.

Reassess your financial goals quarterly to ensure they remain in sync with your current life stage and ambitions.

Step 7: Stay Committed to the Process

Successful budgeting requires discipline and long-term consistency. It may feel challenging at first, but over time, budgeting becomes second nature. A clear financial plan gives you greater control, reduces stress, and enables proactive wealth-building.

A 2023 report from U.S. Bank revealed that just 41% of Americans follow a budget, but those who do report feeling twice as financially stable as those who don’t. Budgeting is a low-barrier habit with high-impact results.

Advanced Tips to Enhance Your Budgeting Skills

Once you’re confident in the basics, consider these advanced strategies:

- Pay Yourself First: Automate transfers to savings or retirement accounts before spending on anything else.

- Diversify Income Streams: Explore side hustles, freelancing, or passive income to accelerate savings and wealth accumulation.

- Conduct Quarterly Budget Reviews: Life circumstances change evaluate your budget every three months and adjust where needed.

- Invest in Financial Literacy: Read books, enroll in personal finance courses, and follow reputable financial publications to deepen your understanding of topics like investing, taxes, and wealth management.

Avoid budgeting based on your ideal month. It’s tempting to plan a “perfect” month with no unexpected expenses but that’s unrealistic. Always budget with real numbers, include occasional costs (like car maintenance or gifts), and build in flexibility to avoid frustration and failure.

Conclusion

Budgeting for beginners may seem daunting initially, but with a structured approach, it becomes one of the most empowering financial habits you can adopt. By understanding your income and spending, selecting a budgeting strategy that fits your life, and setting clear financial objectives, you’ll take control of your finances and pave the way for lasting stability.

Whether your goals are debt reduction, emergency preparedness, or long-term wealth creation, consistent budgeting will help you stay organized and focused. Remember, progress takes time, start with small steps, track your progress, and adjust as needed. Over time, budgeting will evolve into a lifelong skill that fuels your financial success.