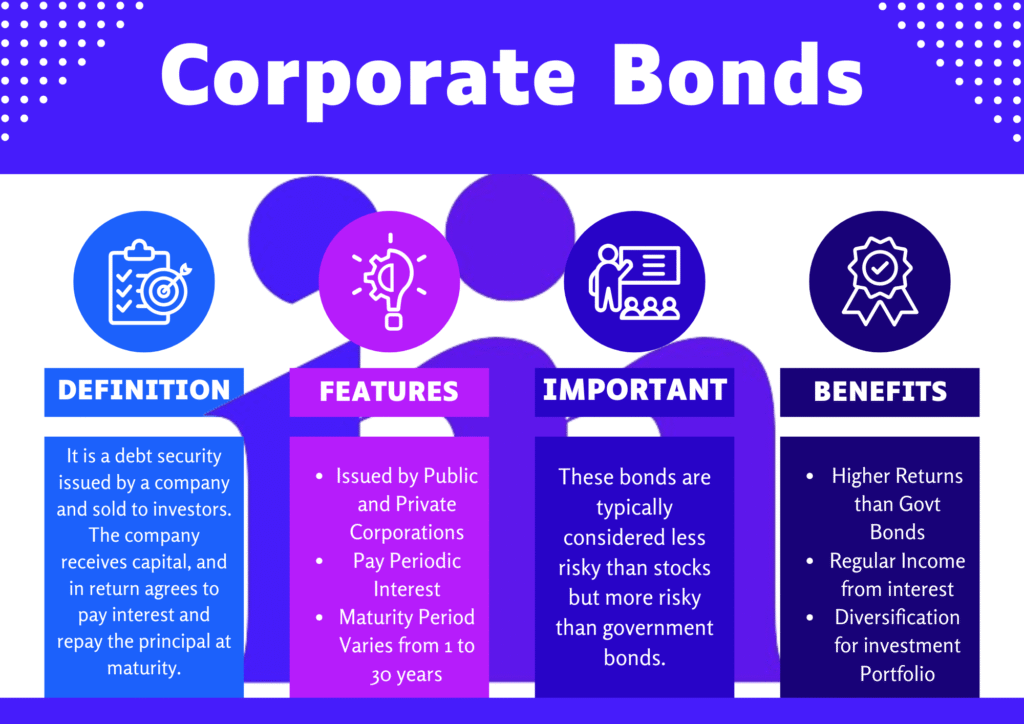

Businesses issue corporate bonds as a method of borrowing money from investors to fund their operations or expansion. Instead of borrowing money from a bank, corporations can issue bonds directly to investors, promising to repay the principal with interest at a later date.

Gaining knowledge about corporate bonds is essential for investors aiming to create a well-balanced and diversified portfolio. They offer a middle ground between the safety of government bonds and the high return potential of stocks.

Key Takeaways

What Is a Corporate Bond

When an investor purchases a corporate bond, they are effectively lending money to a business. In return, the company agrees to pay back the loan at a fixed maturity date, along with regular interest payments (called coupon payments).

Key Characteristics:

- Issuer: A publicly traded or private company

- Face Value: Most corporate bonds are issued in denominations of $1,000 each

- Coupon Rate: The interest, either set or adjustable, that bondholders receive periodically

- Maturity: The specified date when the bond issuer must return the initial investment amount

- Credit Rating: Determines risk level (AAA to junk)

Always evaluate the issuer’s credit rating and financial health before investing. Even large corporations can face financial downturns that impact their ability to repay debt.

How Corporate Bonds Work

To understand how corporate bonds work, imagine this scenario:

A company wants to raise $50 million for a new factory. Rather than diluting ownership by issuing stock, it issues 50,000 bonds at $1,000 each with a 5% annual coupon and 10-year maturity.

The Bond Lifecycle:

- Issuance: Investors buy bonds and the company receives capital.

- Interest Payments: Investors earn interest (e.g., $50/year per bond).

- Maturity: After 10 years, investors get back their $1,000 principal.

Who Buys Corporate Bonds

- Institutional investors (pension funds, mutual funds)

- High-net-worth individuals

- Individual investors can access corporate bonds through mutual funds or exchange-traded funds (ETFs)

When I first added corporate bonds to my portfolio, I underestimated how much stability they brought during volatile market periods. While my stocks fluctuated wildly, my bond income remained steady—reinforcing the value of a diversified approach.

Types of Corporate Bonds

Understanding the types of corporate bonds helps investors match products to risk tolerance and financial goals.

1. Investment-Grade Bonds

- Rated BBB- or higher by S&P

- Issued by financially stable companies

- Lower yields, lower risk

2. High-Yield (Junk) Bonds

- Rated BB+ or lower

- Higher default risk, but higher yields

- Suitable for aggressive investors

3. Convertible Bonds

- Can be converted into company stock

- Offers potential equity upside

- Lower interest rates than standard bonds

4. Callable Bonds

- Issuer can redeem before maturity

- Risk of reinvestment at lower rates

- Typically offer higher coupons

5. Puttable Bonds

- Investors can sell back to issuer before maturity

- Protects against interest rate rises

- Offers flexibility for the bondholder

6. Zero-Coupon Bonds

- No periodic interest

- Purchased below face value and redeemed at full value upon maturity

- Higher interest rate risk

Use a bond laddering strategy—buying bonds with staggered maturities—to minimize interest rate risk and create consistent cash flow without locking all funds into one maturity date.

Why Do Companies Issue Corporate Bonds

1. Raise Capital

To fund expansion, acquisitions, or product development without giving up equity.

2. Refinancing Existing Debt

Firms often refinance by issuing new bonds to settle existing ones with higher interest rates.

3. Operational Liquidity

In times of cash flow crunch, bonds provide quick access to funds.

With a market size surpassing $14 trillion, corporate bonds represent a major pillar of the global fixed-income investment space.

Pros and Cons of Corporate Bonds

| Pros | Cons |

|---|---|

| ✔ Predictable interest payments | ✘ Issuer may default |

| ✔ Generally, offer better yields | ✘ Bond values typically decline when rates go up |

| ✔ From conservative to aggressive options | ✘ Issuers can buy back bonds before maturity, affecting returns |

| ✔ Many are tradable in the secondary market | ✘ Inflation can erode the real value of fixed bond payments |

How to Invest in Corporate Bonds

Investors can gain exposure through:

1. Direct Bond Purchases

Buy individual bonds via brokers or bond desks. Suited for high-net-worth individuals.

2. Bond Mutual Funds

Professionally managed portfolios with diversification.

3. Bond ETFs

Trade like stocks on exchanges. Low-cost and accessible.

4. Robo-Advisors and Platforms

Automated investing tools may include corporate bond exposure.

In 2020, Apple Inc. issued $8 billion in corporate bonds at historically low rates to finance share buybacks and dividends—even though it had over $200 billion in cash reserves. This demonstrates how even cash-rich companies use bonds strategically.

Understanding Bond Ratings

Bond ratings assess the creditworthiness of the issuer.

| Rating | Category | Risk Level |

| AAA | Prime | Lowest Risk |

| AA | High Grade | Very Low Risk |

| A | Upper Medium | Low Risk |

| BBB | Lower Medium | Moderate Risk |

| BB | Non-Investment | High Risk |

| B | Highly Speculative | Very High Risk |

| CCC or lower | Default Imminent | Extremely High Risk |

Corporate Bonds vs. Other Investments

| Feature | Corporate Bonds | Stocks | Treasury Bonds |

| Income | Fixed interest | Dividends (variable) | Fixed interest |

| Risk Level | Moderate | High | Low |

| Return Potential | Moderate | High | Low |

| Liquidity | Medium | High | High |

| Volatility | Low to medium | High | Low |

| Tax Treatment | Taxable income | Capital gains/dividends | Taxable or tax-advantaged |

Tax Considerations

- Interest Income: Earnings from bond interest are subject to standard income tax rates.

- Capital Gains: If sold before maturity at a profit

- Municipal vs. Corporate: In contrast to municipal bonds, income from corporate bonds is fully taxable.

Advanced Concepts in Corporate Bonds

1. Yield to Maturity (YTM)

- Represents the full anticipated return on a bond if you keep it until it matures.

- Calculated by factoring in the bond’s purchase price, interest payments, and remaining term.

2. Duration and Convexity

- Duration indicates how much a bond’s price might change in response to interest rate shifts.

- Convexity improves duration estimates by accounting for bigger movements in interest rates.

3. Credit Spread

- The yield spread reflects how much more corporate bonds pay compared to U.S. Treasuries.

- Wider spreads = higher perceived risk

4. Bond Laddering

- Diversifying maturity dates to reduce reinvestment risk and improve liquidity

5. Secondary Market Trading

- Investors can buy/sell corporate bonds post-issuance

- Market pricing fluctuates with interest rates and credit outlook

Risks Associated with Corporate Bonds

1. Default Risk

Issuer may fail to make payments.

2. Interest Rate Risk

Rates rise → bond prices fall.

3. Inflation Risk

Reduces purchasing power of future interest payments.

4. Liquidity Risk

Some bonds may be difficult to sell without discounts.

5. Reinvestment Risk

Early redemption (callable bonds) could lead to lower reinvestment rates.

How to Analyze a Corporate Bond

Key Metrics:

- Credit Rating: Indicates risk level

- Coupon Rate vs. Market Rate

- Yield to Maturity

- Call or Put Features

- Issuer Financial Health: Revenue, debt levels, earnings

- Market Conditions: Inflation, Fed policy, economic cycles

Real-World Examples

Apple Inc. Bonds

- Regular issuer of investment-grade bonds

- Used for share buybacks, dividend payments

Tesla High-Yield Bonds

- Historically carried higher yields due to lower credit ratings

- Attracted risk-tolerant investors

Don’t chase yield blindly. High-yield (junk) bonds can default. Always balance return expectations with credit quality, especially in uncertain economic times.

Who Should Invest in Corporate Bonds

Corporate bonds are ideal for:

- Income-focused investors

- Risk-averse investors seeking better returns than Treasuries

- Retirees wanting predictable cash flow

- Diversified portfolio builders

Not Ideal For:

- Short-term speculators

- Investors uncomfortable with credit risk

Conclusion

Corporate bonds are a versatile, income-generating investment vehicle suitable for investors seeking a balance between risk and return. Understanding what is a corporate bond, how corporate bonds work, and the types of corporate bonds available is essential to making informed investment decisions.

From conservative retirees to aggressive income seekers, corporate bonds offer a tailored option for almost every portfolio strategy—provided you understand the pros and cons of corporate bonds and manage the associated risks wisely.

Frequently Asked Questions

Related Reading Material

- Government Bonds vs. Corporate Bonds: Key Differences

- How to Build a Bond Ladder for Steady Income

- Top Bond ETFs for Income Investors in 2025