Credit What It Is, How It Works, Types, Pros and Cons, FAQs

Credit is the ability to borrow money or access goods and services with the understanding you’ll pay later. For individuals and businesses across the US, UK, Canada, and Australia, it is the fundamental engine of financial growth, enabling everything from buying a home to scaling a company. Understanding how to manage credit responsibly is the cornerstone of a healthy financial life.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | A contractual agreement where a borrower receives something of value now and agrees to repay the lender later, typically with interest. |

| Also Known As | Debt, Borrowing, Loan, Line of Credit |

| Main Used In | Personal Finance, Mortgages, Auto Loans, Credit Cards, Business Lending |

| Key Takeaway | Credit is a powerful financial tool that can build wealth or create debilitating debt, depending entirely on how it’s managed. |

| Related Concepts |

What is Credit

At its core, credit is trust. It’s a measure of the trust a lender (like a bank or credit card company) has that you will repay the money they lend you. This trust isn’t given blindly; it’s built on your financial history and proven responsibility. Think of it like a friend agreeing to lend you money for a car repair. Their willingness to do so is based on their trust that you’ll pay them back. Credit institutions formalize this trust into a legal agreement.

Key Takeaways

The Core Concept Explained

Credit operates on the principle of deferred payment. A lender assesses your creditworthiness—the likelihood you’ll repay the debt. This assessment results in a credit report and a credit score. A high score indicates low risk, meaning you’ll qualify for lower interest rates and better terms. A low score signals high risk, leading to higher rates or outright denial. The primary components lenders evaluate are your payment history, amounts owed, length of credit history, new credit, and credit mix.

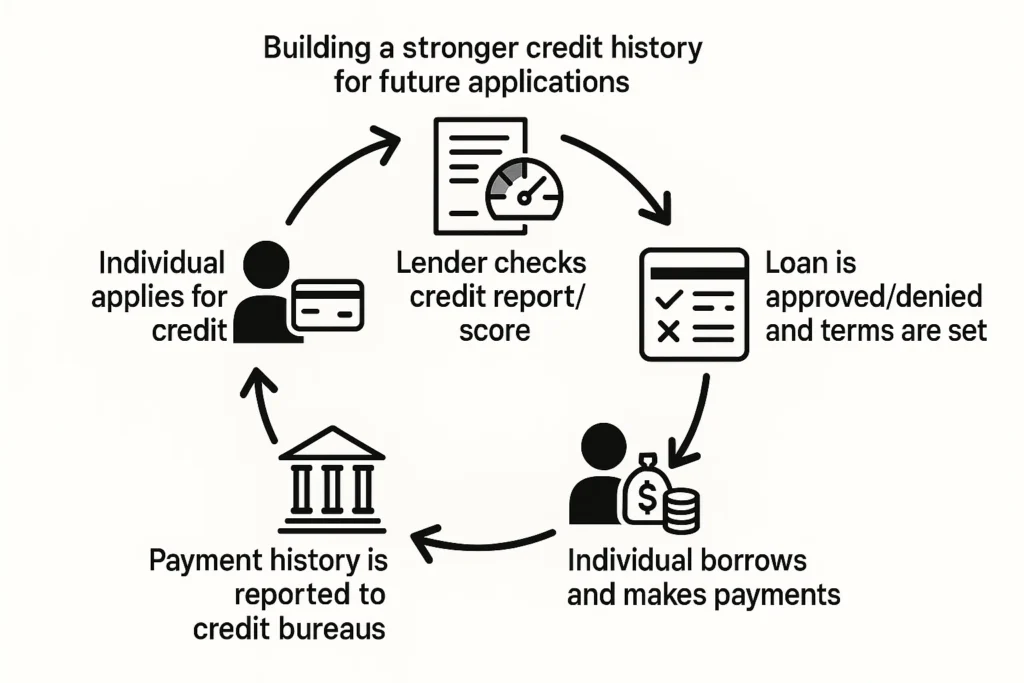

How Credit Works

While there’s no single formula, the process is systematic. When you apply for a loan or credit card, the lender requests your credit file from one or more of the major credit bureaus (Experian, Equifax, and TransUnion in the US; similar entities exist in other Tier-1 countries). They use this data, along with your application information, to make a decision.

The Step-by-Step Process

- Application: You submit a formal application detailing your income, employment, and existing debts.

- Credit Check: The lender performs a hard inquiry on your credit report.

- Risk Assessment: They analyze your credit score, payment history, and debt-to-income (DTI) ratio to gauge risk.

- Decision & Terms: Based on the assessment, they approve or deny the application. If approved, they set the credit limit, Annual Percentage Rate (APR), and repayment schedule.

- Usage & Reporting: You use the credit and make payments. Your activity is reported monthly to the credit bureaus, influencing your future score.

A borrower in New York applying for a mortgage from Chase Bank will have their credit checked by the three US bureaus. Their DTI ratio will be scrutinized against Federal Reserve guidelines to ensure they can manage the monthly payments in USD.

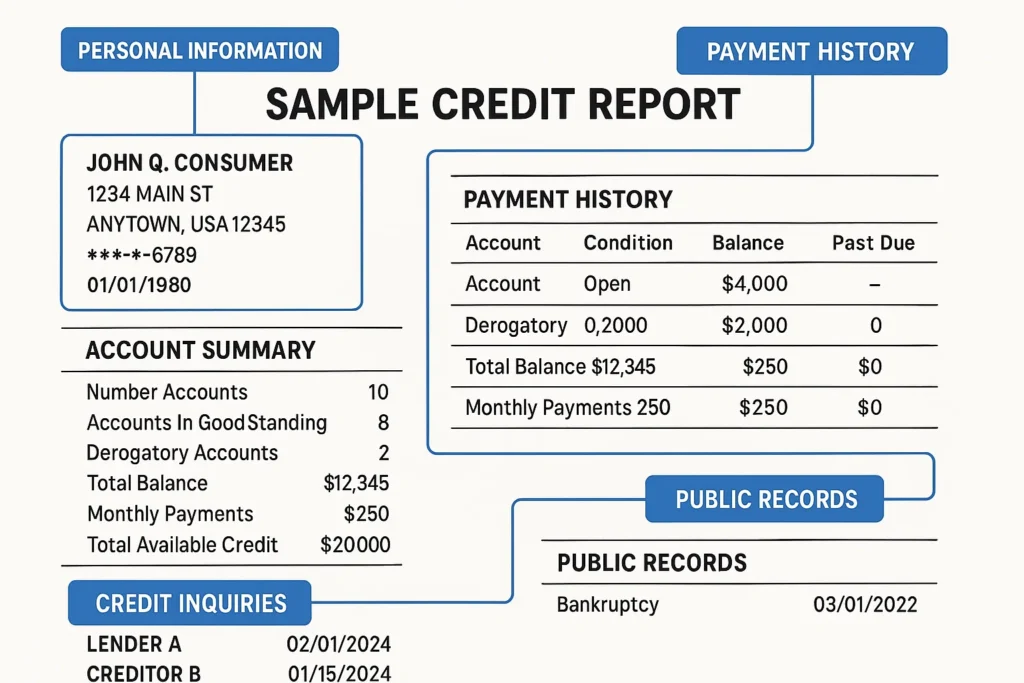

Understanding Your Credit Report

Your credit report is the detailed transcript of your financial life that lenders use to create your credit score. It’s a record of how you’ve managed debt over time. In the US, the three major bureaus are Experian, Equifax, and TransUnion. In the UK, the main agencies are Experian, Equifax, and TransUnion (formerly Callcredit). You are entitled to a free copy of your report annually from these bureaus.

Your report is divided into several key sections:

1. Personal Information

This includes your name, current and previous addresses, date of birth, and Social Security Number (or National Insurance Number in the UK). This data is used to identify you and ensure your credit history is associated with the correct person.

What it means for your score: This section itself doesn’t affect your score, but discrepancies (e.g., an address you never lived at) could indicate a mix-up with someone else’s file or potential fraud.

2. Account History

This is a list of your current and past credit accounts, known as tradelines. For each account (e.g., your Chase credit card or Wells Fargo mortgage), it shows:

- Type of Account: Revolving or installment.

- Credit Limit or Loan Amount: Your total available credit.

- Account Status: Open, closed, paid off, etc.

- Payment History: A month-by-month record showing whether you paid on time. Late payments (30, 60, 90 days late) are prominently marked.

- Current Balance: How much you currently owe.

What it means for your score: This section is the core of your score. Payment history (35% of FICO) and credit utilization (30% of FICO) are derived directly from this data. Consistently on-time payments and low balances relative to your limits are crucial.

3. Credit Inquiries

This section lists everyone who has accessed your credit report. There are two types:

- Hard Inquiries: Occur when a lender checks your report as part of a credit application (e.g., for a mortgage, auto loan, or new credit card).

- Soft Inquiries: Occur when you check your own report, a lender pre-approves you for an offer, or a potential employer does a background check.

What it means for your score: Hard inquiries can temporarily lower your score by a few points and stay on your report for two years. Too many in a short period can signal to lenders that you are a higher-risk borrower. Soft inquiries have no impact on your score.

4. Public Records and Collections

This section contains serious financial delinquencies that have become matters of public record.

- Bankruptcies: Can remain on your report for 7-10 years.

- Tax Liens: Unpaid tax judgments (though rules on reporting these have changed).

- Civil Judgments: Court-ordered debts from lawsuits.

- Collections Accounts: Unpaid debts that have been sold to a collection agency.

What it means for your score: Information in this section is severely damaging to your credit score and indicates a high risk to lenders. These items can make it very difficult and expensive to obtain new credit.

5. How to Dispute Errors

If you find inaccurate information (e.g., a late payment you know you made on time, an account you don’t recognize), you have the right to dispute it.

- Step 1: File a dispute directly with the credit bureau (Experian, Equifax, or TransUnion) online, by phone, or by mail. Clearly identify the error and provide supporting documents.

- Step 2: Also contact the company that provided the inaccurate information (e.g., the bank that issued the credit card). They are known as the “furnisher” and are required to investigate.

- Step 3: The bureau typically has 30 days to investigate your claim. If the information is found to be inaccurate, it must be corrected or deleted.

Why Credit Matters to Your Financial Life

Your access to credit and its terms directly impact your financial flexibility and cost of living.

- For Major Purchases: It’s nearly impossible to buy a home (mortgage) or a car (auto loan) without credit. Good credit can protect your tens of thousands of dollars over the lifespan of a loan.

- For Renting & Utilities: Landlords often check credit to screen tenants. Poor credit may require a larger security deposit or lead to denial. Utility companies may also require deposits.

- For Insurance & Employment: In many regions, insurance premiums (like car insurance) and even some employment opportunities can be influenced by your credit-based insurance score or credit history.

- For Business Growth: Entrepreneurs rely on business loans and lines of credit to start and expand their operations.

Types of Credit

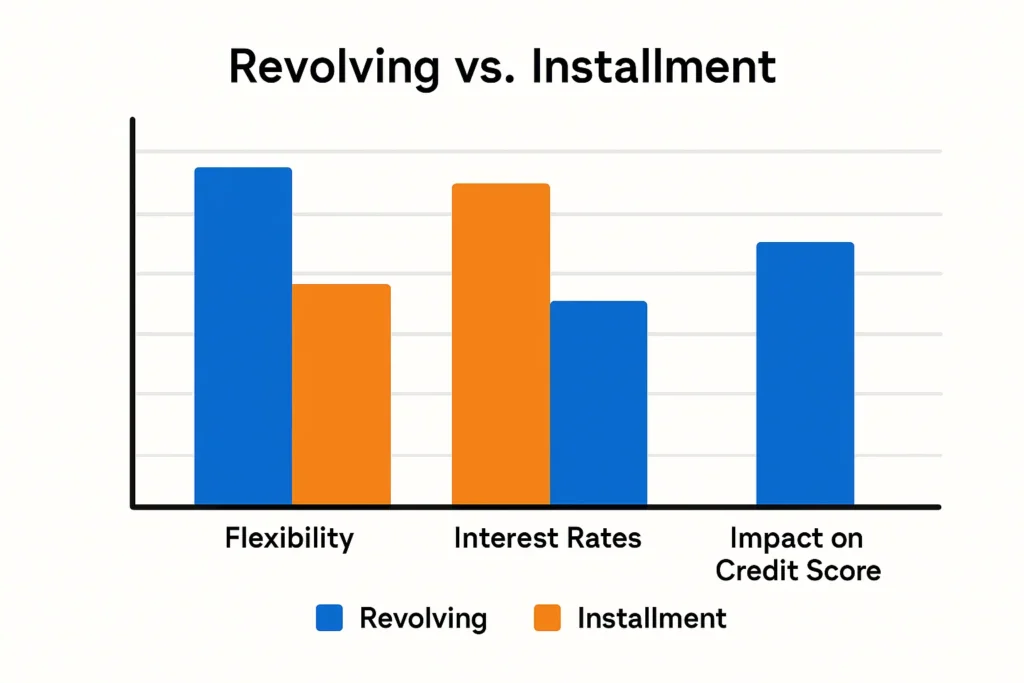

Understanding the different forms of credit is key to using them effectively.

- Revolving Credit: You have a set credit limit and can borrow up to that amount repeatedly as you pay it down. The most common example is a credit card. Minimum payments are required each month.

- Installment Credit: You borrow a fixed amount of money and repay it in equal, scheduled payments (installments) over a set period. Examples include mortgages, student loans, and personal loans.

- Open Credit (Less Common): The full balance must be paid in full each month, with no option to carry a balance. American Express charge cards are a classic example.

- Service Credit: Agreements with service providers like electricity, internet, and cell phone companies. You use the service throughout the month and pay the bill later.

Credit and Life Stages: A Strategic Guide

Your credit needs and strategies should evolve as you move through different phases of life. Here’s how to manage credit strategically at each stage.

For Young Adults (18-25): Building a Foundation from Scratch

The goal at this stage is to establish a positive credit history where none exists.

- Become an Authorized User: Ask a parent with a long-standing credit card in good standing to add you as an authorized user. You “inherit” the positive history of that account.

- Apply for a Student or Secured Credit Card: Student cards are designed for those with limited income. A secured card requires a cash deposit that acts as your credit limit, making it low-risk for the issuer and an excellent tool for building history.

- Strategy: Use the card for small, recurring purchases (like a streaming subscription) and set up autopay to pay the balance in full every month. This builds a perfect payment history without accruing interest.

- Key Focus: Establish a track record of on-time payments and keep your credit utilization below 30%.

For Families (26-50): Leveraging Credit for Major Life Goals

This stage is about using credit as a tool to build wealth and stability.

- Mortgages and Auto Loans: Your credit score is now critical for securing large loans with favorable terms. A difference of even 0.5% on a mortgage rate can save you tens of thousands over the loan’s life.

- Managing Cash Flow: Rewards credit cards can be highly beneficial, providing cash back or travel points on family expenses. The discipline remains the same: pay off the balance monthly to avoid interest charges that negate the rewards.

- Strategy: Avoid the temptation to finance lifestyle inflation. As your income grows, don’t automatically increase your debt. Use credit strategically for needs and planned purchases, not for funding a spending deficit.

- Key Focus: Maintain a strong credit profile by managing a mix of installment and revolving credit, and keep your overall debt-to-income (DTI) ratio low to qualify for the best rates.

For Pre-Retirees (50+): Protecting and Optimizing Credit

The focus shifts from building credit to preserving wealth, protecting assets, and enjoying the benefits.

- Protecting Against Fraud: You are a prime target for identity theft. Monitor your credit reports vigilantly and consider a credit freeze or fraud alert. Scrutinize statements for unauthorized charges.

- Using Rewards Cards for Travel: With potentially more disposable income and time, travel rewards cards can be optimized for vacations and visiting family. Look for cards with perks like lounge access and travel insurance.

- The Dangers of Co-Signing: Think twice before co-signing a loan for an adult child or grandchild. You are 100% liable for the debt if they fail to pay, and any missed payments will severely damage your own credit score right when you need it to be rock-solid.

- Strategy: Aim to enter retirement with as little high-interest debt as possible. The goal is to live on a fixed income without the burden of significant credit card or loan payments.

- Key Focus: Protection, optimization, and debt reduction. Your credit should be a tool for convenience and security, not a source of financial strain.

- Convenience & Safety: Safer than carrying large amounts of cash and essential for online purchases.

- Builds Credit History: Responsible use is the only way to build a strong credit score.

- Financial Flexibility: Allows you to manage cash flow and handle emergencies without having full savings.

- Rewards and Perks: Many credit cards offer cash back, travel points, and purchase protection.

- Ability to Make Large Purchases: Enables life goals like homeownership and education.

- Debt and Overspending: Easy to spend beyond your means, leading to a cycle of debt.

- Interest and Fees: Can be extremely expensive if balances are not paid in full. Compound interest works against you when you carry debt.

- Credit Damage: Late or missed payments severely harm your credit score and can stay on your report for years.

- Complexity: Terms and conditions can be complex, with hidden fees and penalty APRs.

- Security Risks: Exposes you to potential identity theft and fraud.

Struggling to manage multiple credit cards and their high APRs? A debt consolidation loan can simplify your payments and potentially lower your interest rate.

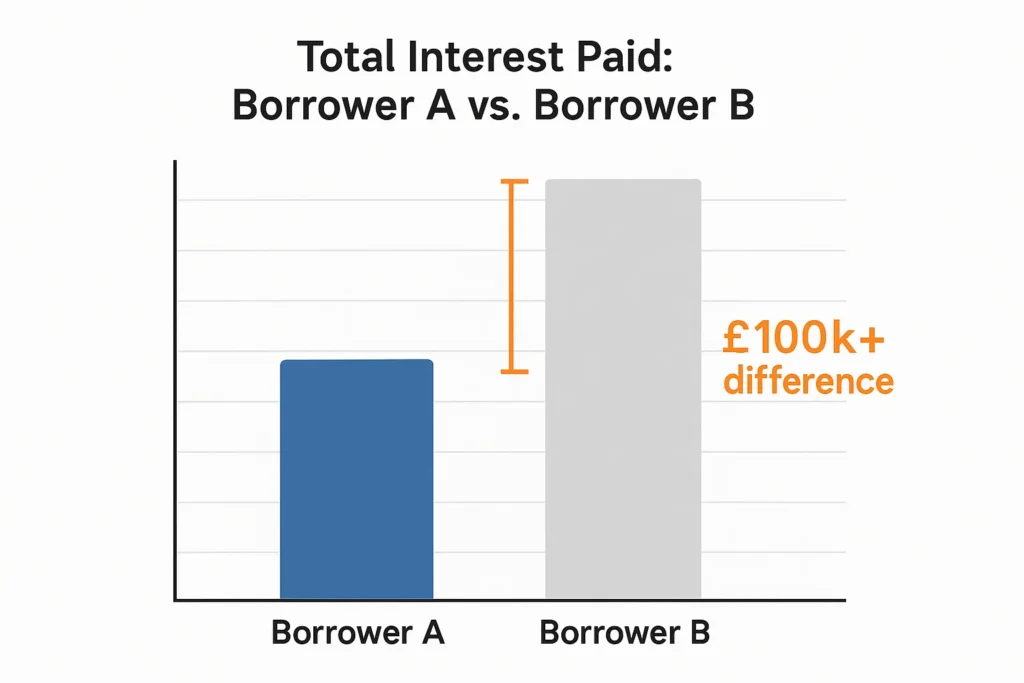

Credit in the Real World: A Tale of Two Borrowers

Consider two individuals in London applying for a £250,000 mortgage.

- Borrower A (Excellent Credit): Has a high credit score from a history of always paying credit cards on time and a low debt-to-income ratio. They are offered an interest rate of 4.0%. Their monthly payment is £1,194, and total interest paid over 25 years is £108,000.

- Borrower B (Poor Credit): Has a lower score due to a few missed payments and high credit utilization. They are offered a rate of 5.5%. Their monthly payment is £1,539, and total interest paid is £211,700.

The Outcome: Borrower B pays £103,700 more in interest over the life of the loan simply due to their credit history. This starkly illustrates the real-world cost of credit.

Conclusion

Ultimately, credit is a double-edged sword that demands respect. As we’ve explored, it is not free money but a responsibility that, when managed wisely, can be the key to achieving significant financial milestones and building a secure future. The benefits of convenience, rewards, and financial leverage are powerful, but they are eclipsed by the risks of debt spirals and credit damage if mismanaged. The key is to use credit strategically—paying balances in full, understanding the terms, and monitoring your credit report regularly. By doing so, you ensure that credit works for you, not against you.

Ready to take control of your credit? The first step is knowing your score and understanding your report. We’ve tested and ranked the best credit monitoring services to help you stay on top of your financial health.

How Credit Relates to Other Concepts

| Feature | Credit Score | Debt-to-Income (DTI) Ratio |

|---|---|---|

| What it measures | Your creditworthiness based on past borrowing behavior. | Your ability to manage monthly payments based on current income and debts. |

| Data Source | Credit Bureaus (Payment history, amounts owed, etc.) | Your reported income and debt obligations. |

| Primary Use | Determines the interest rate you qualify for. | Assesses if you can afford to take on a new payment; crucial for mortgage approval. |

| Scale | Typically 300-850 (FICO Score). | Expressed as a percentage (e.g., 36%). |

Related Terms

- Credit Score: The statistical demonstration of your creditworthiness.

- Interest Rate: The cost of borrowing money, a key term in any credit agreement.

- Debt Consolidation: The strategy of combining multiple debts into a single loan, often to secure a lower interest rate.

- Credit Report: The detailed record of your credit history that forms the basis of your score.

- Bankruptcy: A legal process for individuals or businesses that are unable to repay their outstanding debts, representing a severe failure of credit management.

Frequently Asked Questions

Recommended Resources

- How to Improve Your Credit Score in 30 Days

- Credit Cards: A Beginner’s Guide

- AnnualCreditReport.com (for free weekly credit reports)

- CheckMyFile.com (a multi-agency credit report service)

- Consumer Financial Protection Bureau (CFPB): Educational resources on credit cards and loans.