In the modern digital age, credit cards have become a vital component of personal finance management. Whether you’re building credit, earning rewards, or managing cash flow, the right credit card can significantly impact your financial health. This all-in-one guide will walk you through the fundamentals of credit cards, including how they function, how to select the right one, the advantages they offer, and a review of top-rated credit cards available today.

KEY TAKEAWAYS

What Are Credit Cards

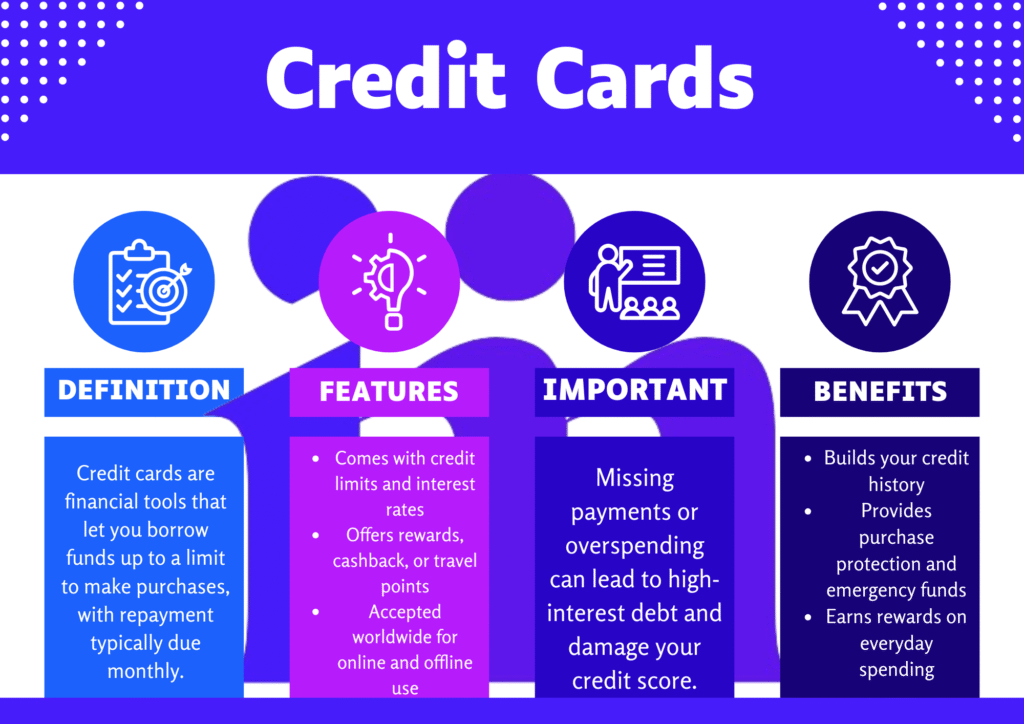

A credit card is a borrowing tool issued by banks or financial institutions that enables users to make purchases on credit. In contrast to debit cards, which withdraw funds directly from your bank account, credit cards allow you to borrow against a set credit limit on an ongoing basis.

Credit cards are widely accepted across the globe and offer a flexible method of payment. They are also a major component in building and maintaining a strong credit history.

Be sure to thoroughly review the terms and conditions before submitting a credit card application. Hidden fees, interest rate hikes after introductory periods, and strict reward redemption rules can reduce the value of even the most attractive-looking offers.

How Credit Cards Work

When you pay with a credit card, you’re essentially using borrowed money from the issuing bank. Here’s how it works:

- Credit Limit: This refers to the maximum amount you can charge on the card.

- Billing Cycle: Typically 30 days, during which all purchases are recorded.

- Grace Period: If you pay your balance in full by the due date, you won’t incur interest charges.

- Minimum Payment: This is the lowest amount you need to pay each billing cycle to keep your account in good standing.

- Interest Rate (APR): Applied to unpaid balances after the grace period.

Understanding how credit cards work is key to managing your finances effectively and avoiding unnecessary debt.

When I first got my credit card, I focused only on the rewards. I overlooked the APR and ended up carrying a balance that cost me more in interest than I earned in perks. Now, I prioritize low-interest cards and pay in full every month—it’s the most financially sound approach.

Types of Credit Cards

Credit cards are not one-size-fits-all. They vary widely based on features, benefits, and usage. Here’s an overview of the most popular card categories:

1. Rewards Credit Cards

- Cashback Cards: Earn a percentage back on eligible purchases.

- Travel Rewards Cards: Earn miles or points redeemable for travel-related expenses.

- Points Cards: Earn flexible points on purchases, often tied to specific retailers or networks.

2. Low-Interest and Balance Transfer Cards

- Ideal for people carrying a balance or consolidating debt.

- Offers 0% introductory APR for a set period.

3. Secured Credit Cards

- Requires a refundable security deposit.

- Best suited for individuals building or rebuilding credit.

- Great for credit-building purposes.

4. Business Credit Cards

- Tailored to business expenses.

- Offers tracking tools, employee cards, and business-related rewards.

5. Student Credit Cards

- Precisely planned for undergraduates who are unfamiliar to credit.

- Tailored for students who are just beginning to build their credit history.

Set up autopay to cover at least the minimum payment each month to avoid penalties. This one simple move can safeguard your credit score by avoiding late payments—even if you forget the due date.

Pros and Cons of Credit Cards

| Pros | Cons |

|---|---|

| ✔ Builds credit history when used responsibly. | ✘ Complex reward structures may reduce actual benefits. |

| ✔ Offers fraud protection and chargeback rights. | ✘ Missed payments hurt your credit score. |

| ✔ Provides rewards like cash back or travel points. | ✘ Poor management can result in significant debt accumulation. |

| ✔ Useful in emergencies or for large purchases. | ✘ High-interest rates if balances are carried. |

How to Choose the Right Credit Card

Choosing the best credit card depends on your financial goals, lifestyle, and credit profile. Here’s a step-by-step guide:

1. Check Your Credit Score

Your credit score influences the types of cards you’ll qualify for. Use free credit monitoring tools offered by Experian, Equifax, or TransUnion.

2. Identify Your Spending Habits

- Do your monthly expenses include a lot of grocery, fuel, or travel spending?

- Are you planning a big-ticket purchase and want to take advantage of a 0% interest offer?

Matching your spending to the right rewards category is essential.

3. Compare Fees and Interest Rates

- Annual Fees: Some cards offer premium rewards but charge a yearly fee.

- APR: Look for low interest if you plan to carry a balance.

- Foreign Transaction Fees: Important for frequent travelers.

4. Look at Sign-Up Bonuses

Many cards offer welcome bonuses if you spend a certain amount within the first few months.

5. Check Additional Perks

- Extended warranties

- Purchase protection

- Travel insurance

- Lounge access

- Concierge services

According to the Federal Reserve, the average U.S. credit card interest rate as of early 2025 is 21.5% APR, making it one of the most expensive forms of debt when not managed properly.

Benefits of Credit Cards

When used responsibly, credit cards offer a wide range of financial and lifestyle advantages.

1. Credit Building

Timely payments and responsible use help build a strong credit history, which is crucial for loans, mortgages, and renting.

2. Rewards and Cashback

Earn rewards on everyday spending, sometimes up to 5% or more in certain categories.

3. Fraud Protection

Zero-liability policies protect you from unauthorized charges.

4. Emergency Credit Access

Gives you immediate funds in unforeseen financial situations.

5. Purchase and Travel Protections

Provides protection for lost baggage, trip interruptions, and extended product warranties.

Risks and Pitfalls to Avoid from Credit Cards

Although credit cards come with a host of benefits, improper use can cause serious financial issues.

1. High-Interest Debt

Carrying a balance incurs interest, which can accumulate rapidly.

2. Overspending

Easy credit access can tempt users to spend beyond their means.

3. Impact on Credit Score

Paying late, using a large portion of your credit limit, or applying for too many cards can negatively impact your credit profile.

4. Hidden Fees

Watch out for late fees, foreign transaction fees, and over-limit charges.

How to Use a Credit Card Responsibly

Credit cards are powerful tools when managed correctly. Follow these practices:

1. Pay Your Balance in Full

Avoid interest by clearing your statement balance each month.

2. Keep Credit Utilization Low

To keep your credit score in good shape, aim to use less than 30% of your total credit limit.

3. Monitor Statements

Regularly check for errors or fraudulent activity.

4. Set Up Alerts and Auto-Pay

Helps avoid missed payments and fees.

5. Don’t Max Out Your Card

Reaching your card’s maximum limit can hurt your credit score and raise your financial risk.

A friend used a 0% intro APR card to finance $4,000 worth of home office upgrades during the pandemic. By paying it off over 12 months without interest, he essentially took an interest-free loan—a strategic use of credit that saved hundreds.

Best Credit Cards of 2025

Here’s a curated list of the best credit cards for different needs:

1. Best Overall: Chase Sapphire Preferred® Card

- 2x points on travel and dining

- 60,000 bonus points offer

- Travel protections included

2. Best Cashback: Citi® Double Cash Card

- Earn 2% cash back, 1% at the time of purchase and another 1% when the balance is paid off.

- No annual fee

3. Top Travel Card: Capital One Venture Rewards Credit Card

- 2x miles on all purchases

- Global Entry/TSA PreCheck credit

- No foreign transaction fees

4. Best for Balance Transfers: Wells Fargo Reflect® Card

- 0% intro APR for 21 months

- No annual fee

5. Ideal for Students: Discover it® Student Cash Back

- 5% cashback on rotating categories

- First-year cashback match

6. Top Secured Card: Discover it® Secured Credit Card

- Reports to all 3 bureaus

- Cashback on purchases

- Transition to unsecured card available

7. Best for Premium Perks: The Platinum Card® from American Express

- Airport lounge access

- Uber credits

- Earn 5x reward points on travel booked directly through American Express.

Using nearly all your available credit can significantly lower your score and signal risk to lenders—even if you consistently make on-time payments.

Final Thoughts

When managed wisely, credit cards can serve as a powerful financial resource. They offer a wide range of benefits, from earning rewards and improving credit scores to providing convenience and financial flexibility. However, they also come with risks that require discipline and knowledge to manage.

Whether you’re a student, a seasoned traveler, or someone looking to build credit, there’s a credit card out there designed to meet your needs. By understanding the mechanics, comparing options, and using your card wisely, you can make credit cards work in your favor and unlock significant value along the way.