Your credit score isn’t just a number, it’s a crucial measure of your overall financial standing and can significantly influence major milestones like securing a mortgage, buying a car, or getting a credit card. This score reflects how lenders, landlords, and even employers assess your trustworthiness with money. Gaining a deep understanding of what a credit score is, how credit scores function, and ways to improve your credit score can empower you to take charge of your financial future. In this guide, we break down everything from beginner basics to advanced tips, so you can confidently build, manage, and protect your credit profile.

KEY TAKEAWAYS

What Is a Credit Score

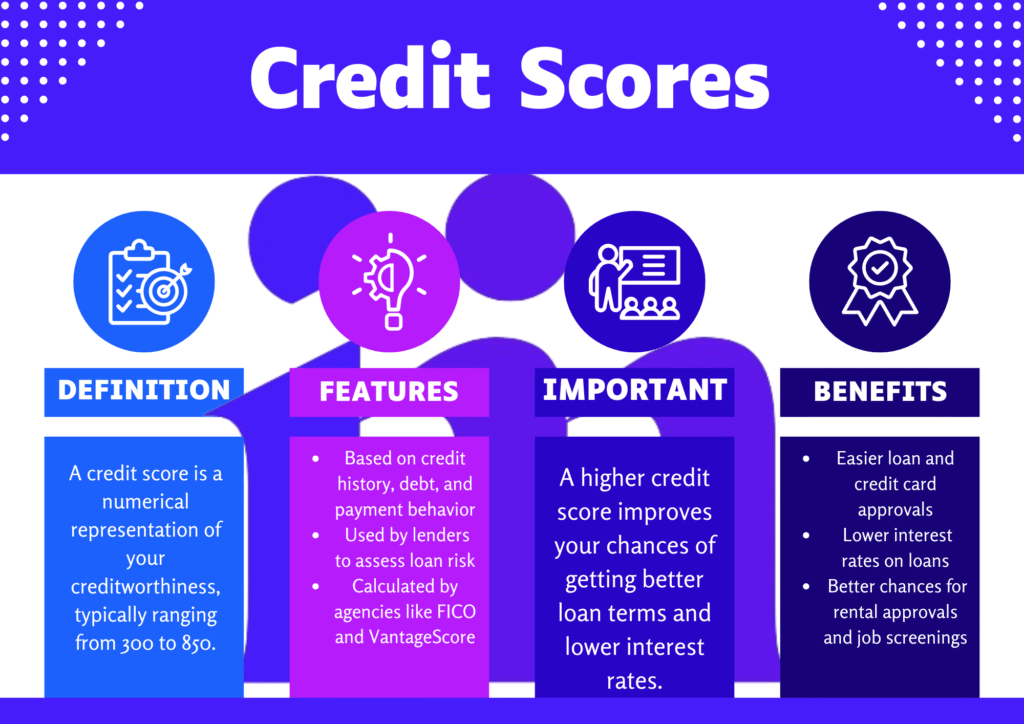

A credit score is a three-digit figure that gauges your ability to manage borrowed money responsibly. It reflects how likely you are to repay borrowed money based on your financial history. Scores usually fall between 300 and 850 and are used by financial institutions, landlords, and sometimes employers to evaluate how reliably you handle debt.

You can think of a credit score as your financial report card, the higher your number, the more likely you are to be approved for loans, credit cards, and other financial benefits with better terms.

Your credit score is not static. It can change every month based on your financial activity, so regular monitoring is key to improvement and protection against fraud.

How Credit Scores Work

To understand how credit scores work, you need to know the key players:

- Credit Bureaus: These are companies that collect and maintain your credit information, mainly Experian, Equifax, and TransUnion.

- Credit Scoring Models: The most widely used systems for calculating scores are FICO and VantageScore.

Credit Score Calculation (FICO Model)

| Factor | Weight |

| Payment History | 35% |

| Amounts Owed | 30% |

| Length of Credit History | 15% |

| Credit Mix | 10% |

| New Credit | 10% |

Each category contributes differently, meaning that missing a payment has a greater impact than applying for a new credit card.

As someone who built their credit from scratch after college, I can attest that small, consistent steps like paying a $300 secured credit card in full each month can build a score from 580 to 750+ in under 18 months.

Credit Score Ranges Explained

Credit scores are usually categorized into the following ranges:

| Score Range | Rating |

| 300 – 579 | Poor |

| 580 – 669 | Fair |

| 670 – 739 | Good |

| 740 – 799 | Very Good |

| 800 – 850 | Excellent |

- A score over 700 is typically seen as good credit.

- Reaching a score above 800 puts you in an elite tier, qualifying you for the best available credit offers and terms.

Why Credit Scores Matter

Your credit score isn’t just a number, it’s a powerful tool that can impact many areas of your financial life:

- Loan Approvals: Higher scores mean faster approvals.

- Lower Interest Rates: A strong score can help reduce borrowing costs across personal loans, auto loans, and mortgages.

- Rental Applications: Landlords may reject low-score applicants.

- Career Considerations: Some employers may review your credit report during the hiring process (with your consent).

- Insurance Benefits: Good credit might also reduce what you pay for auto or homeowners insurance.

If you’re planning a major purchase (like a home or car), avoid opening new credit accounts or taking on new debt 3–6 months prior. This helps keep your score stable when lenders review your profile.

What Affects Your Credit Score

Understanding what drives your score is crucial when learning how to improve your credit scores.

1. Payment History (35%)

Your track record of making payments on time. Failing to make payments on time will harm your score significantly.

2. Credit Utilization (30%)

The percentage of available credit you’re using. Keeping it below 30% is ideal.

3. Length of Credit History (15%)

How long your accounts have been open. Older accounts can boost your score.

4. Credit Mix (10%)

Keeping a balanced combination of credit types such as credit cards, fixed-term loans, and mortgages can positively affect your credit profile.

5. New Credit Inquiries (10%)

However, applying for several credit lines in a short time frame may raise red flags for lenders and result in a temporary dip in your score.

A self-employed individual in her late 20s applied for a home loan with a score of 650 and was approved at a 7.2% interest rate. By paying off debt and raising her score to 760 within a year, she refinanced at just 5.1%, saving over $40,000 in interest over the life of the loan.

Pros and Cons of Credit Score

| Pros of Having a High Credit Score | Cons of a Low Credit Score |

|---|---|

| ✔ Easier Loan Approvals | ✘ Loan Rejections |

| ✔ Higher Credit Limits | ✘ Higher Borrowing Costs |

| ✔ Better Insurance Premiums | ✘ Fewer Employment Opportunities |

| ✔ More Rental Options | ✘ Stress and Financial Insecurity |

How to Improve Your Credit Scores

If you’re looking for actionable ways to boost your credit scores, here’s a breakdown of proven strategies:

1. Pay Bills On Time

Set reminders or automate payments. Your payment history plays the most significant role in determining your score, so paying all bills on time is critical.

2. Lower Your Credit Utilization Ratio

Keep your credit utilization below 30% of your total available limit. Ideally, pay off your balances completely each month to avoid interest charges and keep your usage ratio low.

3. Keep Old Accounts Open

Unless there’s a compelling reason, don’t close old credit accounts. They help lengthen your credit history.

4. Avoid Unnecessary Hard Inquiries

Multiple applications for credit in a short span can signal risk to lenders.

5. Diversify Your Credit Mix

Use different types of credit responsibly. Lenders prefer to see a variety of credit types, a healthy mix of revolving accounts (like credit cards) and installment loans (such as auto loans or personal loans).

6. Dispute Inaccuracies on Credit Reports

Make it a habit to review your credit reports from Experian, Equifax, and TransUnion. Dispute any inaccuracies, especially negative entries that don’t belong, they can hurt your score unnecessarily.

Best Tips to Boost Credit Scores

Here are expert-approved tips to boost credit scores quickly and sustainably:

- Consider secured credit cards if you’re rebuilding or establishing credit.

- Become an authorized user on a trusted family member’s or friend’s credit card to benefit from their positive history.

- Ask for a credit limit increase to lower your credit usage percentage, just avoid taking on new debt.

- Pay twice a month instead of once to keep balances lower.

- Use rent and utility reporting services like Experian Boost.

Each of these strategies directly targets core credit score components and can lead to rapid improvement.

According to Experian, the average U.S. credit score in 2025 is 715, a good score by most standards.

Common Credit Score Mistakes to Avoid

Avoid these pitfalls if you’re serious about building and maintaining a high score:

- Ignoring due dates – even a single missed payment can cause a 100-point drop.

- Maxing out credit cards – this spikes your utilization ratio.

- Avoid closing older accounts, especially if they’ve been managed responsibly. The length of your credit history matters, and older accounts can help boost your average account age.

- Applying for multiple loans at once – it generates multiple hard inquiries.

- Not checking your reports – errors go unnoticed and uncorrected.

How to Check Your Credit Score at No Cost

It’s essential to track your credit regularly. Here’s how to check your credit score for free:

Free Credit Report Providers

| Platform | Type | Frequency |

| AnnualCreditReport.com | Full report (no score) | Weekly |

| Credit Karma | VantageScore | Real-time |

| Experian | FICO Score | Monthly |

| Credit Sesame | VantageScore | Monthly |

You’re entitled to one free report per week from each bureau via AnnualCreditReport.com, especially useful for dispute resolution.

Credit repair scams are common. Be wary of companies promising to “instantly boost your credit score.” Legitimate credit repair takes time, consistency, and often professional guidance, not magic fixes.

Final Thoughts

Understanding what is credit score, how credit scores work, and the best ways to improve it is key to long-term financial health. Whether you’re applying for a mortgage, renting an apartment, or just trying to lower your interest rates, your credit score is a silent yet powerful partner.

Improving your credit isn’t an overnight process but with discipline, awareness, and the right tips to boost credit scores, you can build a strong financial foundation. Start by reviewing your reports, paying your bills on time, and maintaining responsible credit habits.

Remember, your credit scores isn’t just about access to money, it’s about financial freedom and peace of mind.

Frequently Asked Questions

Related Readings

- How to Build Credit from Scratch: A Step-by-Step Guide

- Best Credit Cards for Beginners to Start Building Credit

- What Is a Good Credit Score to Buy a House in 2025?