Crude Oil Price Analysis - Key Targets and Seasonal Trends

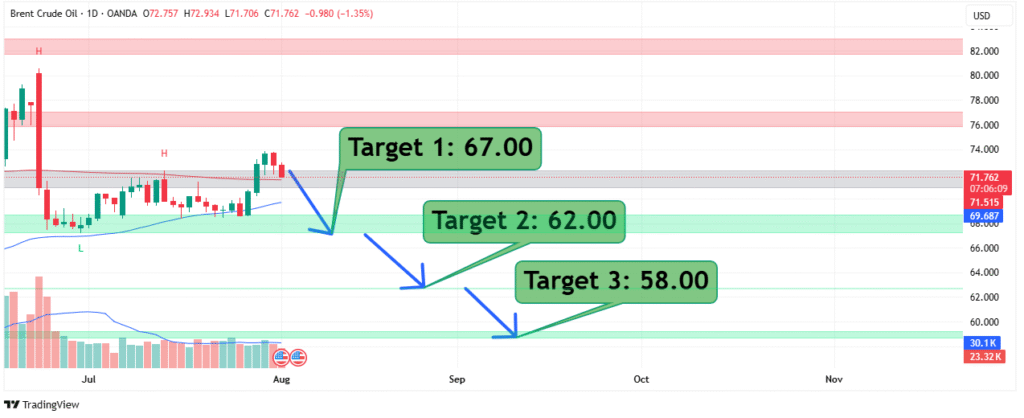

Crude oil prices are influenced by a variety of factors, including geopolitical events, supply-demand dynamics, and seasonal trends. This analysis highlights key price targets for crude oil 67.00, 62.00, 58.00, and 61.00, and examines their relevance across different months, particularly from July to November. Understanding these levels can help traders and investors make informed decisions.

Key Price Targets

1. Target 1: $67.00

- Significance: This level acts as a major resistance or support, depending on market conditions. A breakout above $67.00 could signal bullish momentum, while a rejection may indicate a bearish reversal.

- Seasonal Trends:

- July-November: Historically, prices near this level in late summer or early fall may reflect supply adjustments or geopolitical tensions.

2. Target 2: $62.00

- Significance: A critical mid-range level, often serving as a pivot point. A drop below $62.00 could lead to further declines toward $58.00.

- Seasonal Trends:

- July-November: This level is frequently tested during periods of demand uncertainty, such as shifts in global economic growth expectations.

3. Target 3: $58.00

- Significance: A strong support zone. If breached, it may trigger accelerated selling, potentially leading to new yearly lows.

- Seasonal Trends:

- July-November: Often tested in late autumn as refinery maintenance reduces demand.

4. Target 4: $61.00

- Significance: An intermediate level between $62.00 and $58.00, acting as a short-term benchmark for traders.

- Seasonal Trends:

- July-November: Frequently revisited during volatile periods, such as hurricane season disruptions in the Gulf of Mexico.

Seasonal Analysis (July – November)

- July: Prices often stabilize or rise due to peak summer demand for gasoline.

- August: Volatility may increase as hurricane season begins, impacting production.

- September: Refinery maintenance starts, potentially lowering demand and pressuring prices.

- October: Geopolitical events (e.g., OPEC meetings) often dictate price movements.

- November: Winter demand forecasts and inventory levels become key drivers.

Trading Strategies

- Bullish Scenario:

- If prices hold above $67.00, consider long positions with targets at higher resistance levels.

- Monitor inventory reports and OPEC announcements for confirmation.

- Bearish Scenario:

- A break below $58.00 could signal further downside, with potential short opportunities.

- Watch for demand slowdowns or unexpected supply surges.

- Range-Bound Market:

- Trade between $62.00 and $58.00, using these levels as entry and exit points.

Conclusion

The crude oil market is poised at critical levels, with $67.00, $62.00, $58.00, and $61.00 serving as pivotal targets. Seasonal trends from July to November add another layer of complexity, requiring traders to stay alert to geopolitical and macroeconomic developments. By aligning strategies with these key levels and seasonal patterns, market participants can better navigate the volatile oil markets.

Final Tip: Always use risk management tools like stop-loss orders to protect against unexpected price swings.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Always conduct your own research before trading.