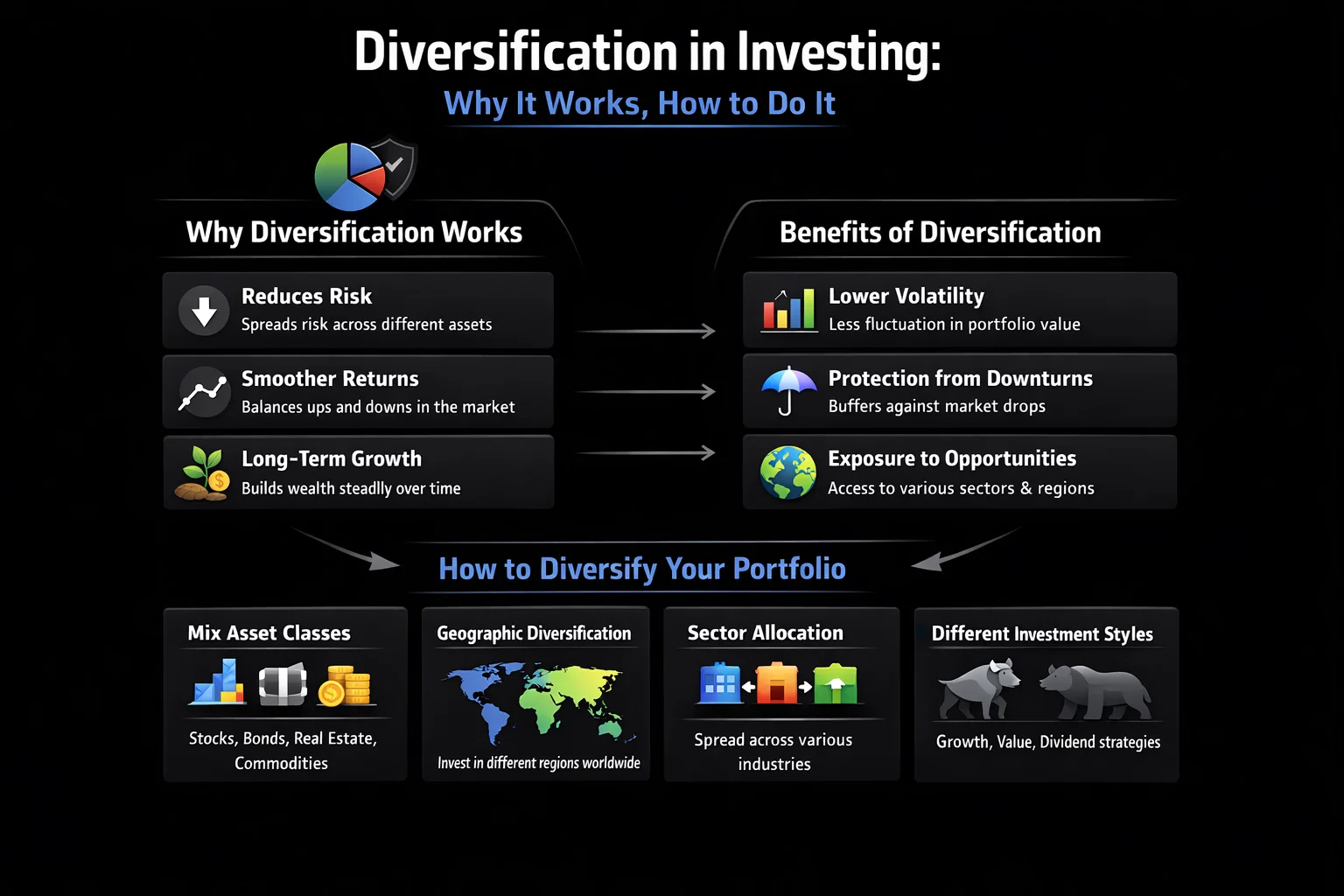

Diversification in Investing Why It Works, How to Do It

Diversification is the foundational principle of not putting all your eggs in one basket. It’s the strategic allocation of investments across various asset classes, sectors, and geographies to reduce risk without proportionally sacrificing potential returns. For investors in the US, UK, Canada, and Australia, mastering diversification is the key to building a resilient portfolio that can weather market storms and achieve long-term financial goals.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | An investment strategy that mixes a wide variety of investments within a portfolio to reduce exposure to any single asset or risk. |

| Also Known As | Portfolio diversification, asset allocation, risk spreading. |

| Main Used In | Portfolio Management, Long-Term Investing, Retirement Planning, Risk Management |

| Key Takeaway | The primary goal is to minimize unsystematic risk (company or sector-specific risk); it’s the closest thing to a “free lunch” in finance. |

| Formula | N/A |

| Related Concepts |

What is Diversification

Diversification is the practice of spreading your investments around so that your exposure to any one type of asset, industry, or geographic region is limited. The core idea is simple: different investments will react differently to the same economic event. When tech stocks are down, consumer staples or bonds might be holding steady or rising. By holding a mix, the poor performance of some investments is (hopefully) offset by the better performance of others. Think of it like a sports team—you need a mix of defenders, midfielders, and attackers to win consistently, not just 11 star strikers.

Key Takeaways

The Core Concept Explained

Diversification works on the statistical principle of correlation. Correlation measures how two assets move in relation to each other, ranging from +1 (perfectly in sync) to -1 (perfect opposites). If you own two tech stocks with a correlation near +1, they will likely crash together in a tech downturn. However, if you own a tech stock and a utility stock (which often have low or negative correlation), a tech slump may not drag down your utility holding. The goal of asset allocation is to construct a portfolio where the correlations between holdings are less than +1, smoothing out the overall ride. A well-diversified stock portfolio minimizes the impact of any single company’s bankruptcy or scandal, protecting your capital from catastrophic loss.

The Pillars of a Diversified Portfolio

While there’s no single formula, diversification is built through a structured framework. For an investor in the US or UK, this means constructing a portfolio across multiple dimensions to manage portfolio risk.

The Diversification Checklist

- Across Asset Classes: Don’t just buy stocks. Allocate to bonds, cash equivalents, real estate (via REITs), and possibly commodities. Bonds, for example, often rise when stocks fall, providing a cushion.

- Within Asset Classes (Stocks):

- By Sector: Spread investments across technology, healthcare, finance, consumer goods, industrials, etc. Don’t just buy five software companies.

- By Market Capitalization: Include large-cap (stable giants), mid-cap, and small-cap (growth potential) stocks.

- By Geography: Invest domestically (e.g., S&P 500 / FTSE 100), internationally in developed markets (Europe, Japan), and in emerging markets (India, Brazil).

- Across Investment Styles: Blend growth stocks (high potential) with value stocks (undervalued).

- Time Diversification: Use dollar-cost averaging (investing fixed amounts regularly) to avoid buying all your shares at a market peak.

The Hidden Power: The Psychology of Diversification

True diversification serves a dual purpose: it’s both a financial risk management tool and a powerful psychological safeguard against our worst investing impulses. Understanding the behavioral finance aspects can make you a more disciplined investor.

Fights Overconfidence Bias

The belief that “I know which stock will soar” leads to dangerous concentration. Diversification forces humility by acknowledging uncertainty and spreading bets across multiple outcomes.

Prevents Panic Selling

When one sector crashes (like tech in 2022), a diversified portfolio shows stability elsewhere. This prevents the emotional spiral that leads to selling at the bottom—the #1 wealth destroyer.

Counters Recency Bias

We naturally chase yesterday’s winners. Diversification’s rebalancing discipline forces you to sell some winners and buy recent losers—mechanically executing “buy low, sell high.”

The “Sleep Test” Metric:

The ultimate test of your portfolio’s diversification isn’t its Sharpe ratio—it’s whether market volatility keeps you awake at night. A properly diversified portfolio should pass the “sleep test” even during turbulent markets.

Why Diversification Matters to Every Investor

- For the Long-Term Investor: It is the bedrock of retirement planning. A diversified investment strategy helps ensure your life savings aren’t wiped out by a single black swan event, like the 2008 financial crisis or the 2022 tech sell-off. It promotes steady, compound growth over decades.

- For the Active Trader: Even traders can use “tactical diversification” within their watchlists. Understanding correlation helps in hedging positions—e.g., taking a long position in oil stocks while shorting airline stocks, which are negatively correlated to oil prices.

- For the Risk-Averse Individual: It provides peace of mind. Knowing your portfolio is built to withstand sector-specific shocks allows you to sleep well at night and avoid panic selling during downturns, which is often the biggest destroyer of wealth.

- For the Analyst: It’s fundamental to Modern Portfolio Theory (MPT) and constructing an “efficient frontier”—the set of optimal portfolios offering the highest expected return for a defined level of risk management.

How to Implement Diversification in Your Strategy

Use Case 1: The Simple ETF Approach (For Beginners)

Instead of picking individual stocks, build your core portfolio with a few broad ETFs. For example:

- VTI (US Total Stock Market): 50%

- VXUS (Total International Stock): 30%

- BND (Total Bond Market): 20%

This instantly gives you thousands of stocks and bonds across the globe.

Use Case 2: The Core-Satellite Approach (For Intermediate Investors)

- Core (70%): Low-cost index funds/ETFs (as above) for broad market exposure.

- Satellites (30%): Actively managed funds or individual stock picks in sectors or themes you believe in (e.g., clean energy, AI). This allows for controlled, targeted bets without jeopardizing your entire investment strategy.

Use Case 3: Rebalancing

Diversification isn’t a “set and forget” strategy. Over time, winning assets will grow to become a larger percentage of your portfolio, increasing your risk. Regularly (e.g., annually) sell a portion of the winners and buy more of the losers to return to your target asset allocation. This forces you to “buy low and sell high” systematically.

- Reduces Specific Risk: Protects against company or industry-specific disasters.

- Smoother Returns: Leads to less volatile portfolio performance, improving investor psychology.

- Widens Opportunity Set: Allows participation in growth across different economies and sectors.

- The “Free Lunch”: Can enhance risk-adjusted returns, as proven by Modern Portfolio Theory.

- Promotes Discipline: Provides a structured framework for investing, reducing emotional decisions.

- No Market Crash Protection: Does not eliminate systematic risk where all correlated assets fall together.

- Caps Maximum Gains: Will never outperform a lucky concentrated bet on a single superstar stock.

- Complexity & Cost: Can lead to higher fees and more complicated portfolio management.

- Di-worsification Risk: Adding too many similar or poor assets dilutes returns without reducing risk.

- Requires Maintenance: Portfolios need periodic rebalancing, which takes time and may incur taxes.

5 Diversification Mistakes That Sabotage Investors

The “Fund Overlap” Trap

The Mistake: Holding multiple ETFs or mutual funds that own the same underlying stocks. Example: Owning both VOO (S&P 500) and SPY (also S&P 500) plus a large-cap growth fund.

The Impact: You’re paying multiple management fees for essentially the same exposure, creating unnecessary costs without true diversification.

Use a portfolio analyzer tool or check fund holdings on Morningstar to identify overlaps. Aim for complementary funds that cover different segments of the market.

Extreme Home Country Bias

The Mistake: Overweighting your home market. US investors with 80%+ in domestic stocks, or UK investors ignoring European and Asian markets.

The Impact: Misses growth opportunities abroad and concentrates risk in your home economy’s specific cycles and political risks.

Aim for a global market-cap weighted approach or a deliberate allocation of 20-40% to international stocks. Consider Vanguard’s VT or similar total world stock ETFs.

“Di-worsification”

The Mistake: Adding more and more investments that are highly correlated, thinking you’re diversifying. Example: Buying 6 different tech sector funds.

The Impact: Increases complexity and costs without meaningful risk reduction. All your “diversified” holdings crash together.

Focus on asset class diversification first (stocks, bonds, real estate), then within asset classes (geography, sectors). Use correlation matrices to check if new additions truly diversify.

Forgetting About Tax Diversification

The Mistake: Only considering traditional taxable brokerage accounts, ignoring tax-advantaged options like Roth IRAs, 401(k)s, or HSAs.

The Impact: Higher tax drag on returns and less flexibility in retirement withdrawal strategies.

Build a “three-bucket” approach: taxable accounts (for flexibility), tax-deferred (Traditional IRA/401(k)), and tax-free (Roth accounts). This creates withdrawal options to minimize lifetime taxes.

Set-and-Forget Neglect

The Mistake: Creating a diversified portfolio but never rebalancing or reviewing it.

The Impact: Winners grow to dominate the portfolio, silently increasing your risk exposure beyond your comfort level.

Schedule annual or semi-annual portfolio reviews. Rebalance when any asset class drifts more than 5% from its target allocation. Many brokerages offer automated rebalancing tools.

✅ Quick Self-Check:

- Do you know the correlation between your largest holdings?

- Have you analyzed your fund overlaps in the last year?

- Is your international allocation appropriate for your home country?

- When did you last rebalance your portfolio?

Diversification in the Real World: The 2000 Dot-Com Bubble

The dot-com bubble burst (2000-2002) is a classic case study. Investors with concentrated risk in overvalued technology and internet stocks saw their portfolios decimated, with the NASDAQ falling over 78%. However, investors with diversified portfolios fared significantly better.

- The Undiversified Portfolio: An investor who held only tech stocks like Cisco, Intel, and Oracle saw catastrophic losses, with many stocks losing 80-90% of their value and some becoming worthless.

- The Diversified Portfolio: An investor who held a mix of the S&P 500 (which included non-tech sectors) and bonds experienced a severe but survivable drawdown. While the S&P 500 fell about 49%, bonds (as measured by the Aggregate Bond Index) posted positive returns of over 10% per year during that period, cushioning the blow. This demonstrates how asset allocation across classes (stocks and bonds) works in a crisis.

Even legendary investor Warren Buffett, who occasionally makes concentrated bets, holds a massively diversified portfolio through his company Berkshire Hathaway, which owns businesses in insurance, railroads, energy, and consumer goods, not just stocks.

Diversification Evolves: Your Strategy Through Life’s Stages

One-size-fits-all diversification doesn’t exist. Your optimal mix should evolve with your age, income, responsibilities, and goals. Here’s how diversification strategies shift through key life stages.

Early Career (20s-30s)

Optimal Allocation:

Key Diversification Focus:

- Maximize growth exposure: Heavy tilt toward stocks, including higher-risk small-cap and emerging markets

- Sector diversification: Technology, healthcare, consumer discretionary for growth potential

- Human capital diversification: Your earning potential is your biggest asset—invest in career skills

- Account type diversification: Start Roth IRA for tax-free growth, maximize 401(k) match

Mid-Career & Family (40s-50s)

Optimal Allocation:

Key Diversification Focus:

- Balance growth & stability: Begin meaningful bond allocation for volatility reduction

- Real asset diversification: Add REITs or real estate exposure as inflation hedge

- International diversification: Maintain 20-30% in developed international markets

- Liquidity buffer: Keep 6-12 months expenses in cash/cash equivalents

- Tax diversification: Balance between taxable, tax-deferred, and tax-free accounts

Pre-Retirement & Retirement (60s+)

Optimal Allocation:

Key Diversification Focus:

- Income generation: Dividend stocks, bond ladders, annuities for cash flow

- Capital preservation: Higher quality bonds (Treasuries, municipals)

- Sequence of returns risk: Keep 2-3 years of expenses in cash to avoid selling stocks in downturns

- Healthcare hedge: Consider healthcare sector allocation for rising costs

- Withdrawal strategy diversification: Systematic withdrawal from different account types to minimize taxes

⚠️ Important Considerations:

These are general guidelines. Your specific allocation should consider:

Always consult with a qualified financial advisor for personalized advice tailored to your unique situation.

Diversification vs Asset Allocation

| Feature | Diversification | Asset Allocation |

|---|---|---|

| Primary Goal | Reduce risk within an asset class or subgroup. | Define the portfolio’s overall risk/return profile by choosing asset class weights. |

| Scope | The “how” – specific security selection *within* each bucket. | The “what” – high-level decision of percentages for stocks, bonds, cash, etc. |

| Process | Choosing many uncorrelated stocks or using broad index funds. | Deciding on a 60/40 stock/bond split based on age and risk tolerance. |

| Analogy | Planting tomatoes, lettuce, and carrots to ensure a harvest. | Deciding how much garden space to dedicate to vegetables vs. fruits. |

Conclusion

Ultimately, understanding and implementing diversification is not about chasing the highest possible return, but about intelligently managing risk to achieve consistent returns over the long term. It is the essential discipline that separates speculative gambling from prudent investing. While it has limitations and cannot prevent all losses, its power to smooth your financial journey and protect your capital is undeniable. For investors in North America, the UK, and Australia, incorporating these principles through low-cost ETFs and a disciplined rebalancing schedule is one of the most effective steps toward financial security.

Related Terms

- Correlation: The statistical measure that is the engine of diversification. Understanding it is key.

- Modern Portfolio Theory (MPT): The Nobel Prize-winning academic framework that mathematically proves the benefits of diversification.

- Beta (β): Measures a stock’s volatility relative to the market (systematic risk). Diversification aims to eliminate the non-beta (unsystematic) risk.

- Rebalancing: The essential maintenance activity required to keep a diversified portfolio aligned with its target allocation.

Frequently Asked Questions About Diversification

Recommended Resources

- A Random Walk Down Wall Street by Burton Malkiel – The classic book on market efficiency and the role of diversification.

- The SEC’s Investor.gov website has excellent introductory materials on asset allocation and diversification.

- The CFA Institute’s educational resources on Modern Portfolio Theory.