Fidelity Roth IRA What It Is, How It Works, and Why You Need One

A Fidelity Roth IRA is a powerful individual retirement account that offers tax-free growth and tax-free withdrawals in retirement. For investors in the US, opening a Roth IRA with a leading provider like Fidelity Investments is a strategic move to build a tax-efficient nest egg, leveraging their extensive investment options and research tools.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | A tax-advantaged retirement savings account offered by Fidelity Investments, where contributions are made with after-tax dollars for potential tax-free growth and withdrawals. |

| Also Known As | Roth Individual Retirement Account |

| Main Used In | Retirement Planning, Long-Term Investing, Tax-Efficient Savings |

| Key Takeaway | The primary benefit is tax-free income in retirement, making it ideal for those who expect to be in a higher tax bracket later in life. |

| Related Concepts |

What is a Fidelity Roth IRA

A Fidelity Roth IRA is not an investment itself, but a type of container or account that holds your investments. Think of it as a special, tax-advantaged box provided by Fidelity Investments. You put investments like stocks, bonds, and mutual funds inside this box. The key feature of this “Roth” box is that any growth, dividends, or interest your investments earn while inside are shielded from taxes, and you can take them out tax-free in retirement.

The “Fidelity” part means you’re using one of the world’s largest and most respected brokerage firms to custody this account, giving you access to their platform, research, and customer service.

Key Takeaways

The Core Concept Explained

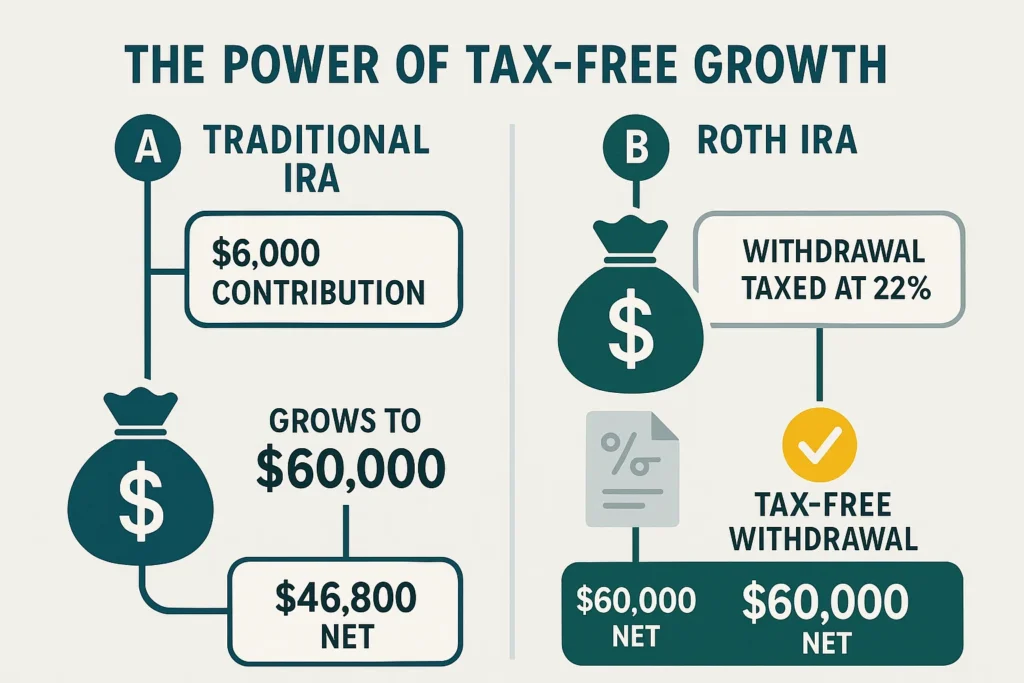

The core concept hinges on paying taxes now instead of later. With a Traditional IRA or 401(k), you get a tax deduction when you contribute but pay income tax on withdrawals. The Roth IRA flips this model. You contribute after-tax dollars, forgoing an immediate tax break, in exchange for a future where all your qualified withdrawals are tax-free. This is powerful because it means the potentially massive compounded growth of your investments over decades will never be taxed by the IRS.

How to Open a Fidelity Roth IRA

Opening an account is a straightforward online process that takes about 10 minutes.

Step-by-Step Account Creation Guide

- Gather Your Information: You’ll need your Social Security Number, driver’s license, employment information, and banking details for funding.

- Navigate to Fidelity’s Website: Go to Fidelity.com and find the “Open an Account” section.

- Select “Roth IRA”: Choose the Roth IRA from the list of account types.

- Complete the Application: Fill in your personal, financial, and beneficiary information.

- Agree to Terms: Read and sign the account agreements.

- Fund Your Account: Link your bank account and transfer an initial contribution. For the 2024 tax year, the maximum you can contribute is $7,000 ($8,000 if you’re age 50 or older).

- Choose Your Investments: This is the most critical step. Simply funding the account is not enough; you must select the specific investments (e.g., mutual funds, ETFs) to purchase.

The contribution limits mentioned are for US investors as set by the IRS. Investors in the UK would explore an ISA, while those in Canada would look at a TFSA, though the principles are similar.

Why a Fidelity Roth IRA Matters to Investors

- For Retirement Savers: It provides a source of tax-free income, which can significantly lower your tax burden in retirement and make your retirement planning more predictable.

- For Young Investors: You likely are in a lower tax bracket now than you will be later in your career. Paying taxes at your current low rate is a huge advantage.

- For Tax Diversification: It diversifies your tax exposure. Having money in both tax-deferred (like a 401(k)) and tax-free (Roth) accounts gives you flexibility to manage your taxable income in retirement.

- For Estate Planning: Roth IRAs have no required minimum distributions (RMDs) during your lifetime, allowing the money to continue growing tax-free. You can also pass the entire account to your heirs, who can take tax-free distributions.

How to Use a Fidelity Roth IRA in Your Strategy

- Case 1: The Aggressive Growth Investor: A young investor can use their Fidelity Roth IRA to buy growth-oriented, low-cost ETFs like Fidelity’s ZERO funds. Since all gains are tax-free, they can be more aggressive without worrying about tax implications from frequent trading or high dividends.

- Case 2: The Retirement Income Supplement: A retiree with a 401(k) can use their Roth IRA for discretionary spending. Withdrawals from the Roth won’t increase their taxable income, which can help keep them in a lower tax bracket and prevent their Social Security benefits from being taxed.

To start building your Roth IRA portfolio, you need a brokerage that offers a wide selection of low-cost investment choices. Fidelity is renowned for its suite of commission-free ETFs and mutual funds.

Advanced Fidelity Roth IRA Strategies

- The Mega Backdoor Roth (for 401(k) participants): Explain how some employer 401(k) plans allow for after-tax contributions (different from Roth) that can be rolled into a Roth IRA, allowing for contributions far exceeding the standard limit.

- Roth IRA as an Emergency Fund (The Two-Bucket System): Elaborate on the strategy of keeping your contributions as a potential emergency fund while investing the money for growth. This provides safety without sacrificing long-term potential.

- Tax-Loss Harvesting in a Taxable Account to Fund Your Roth IRA: Suggest a strategy where an investor realizes losses in a regular brokerage account to offset gains/income and uses the tax savings to fund their Roth IRA contribution, maximizing tax efficiency across accounts.

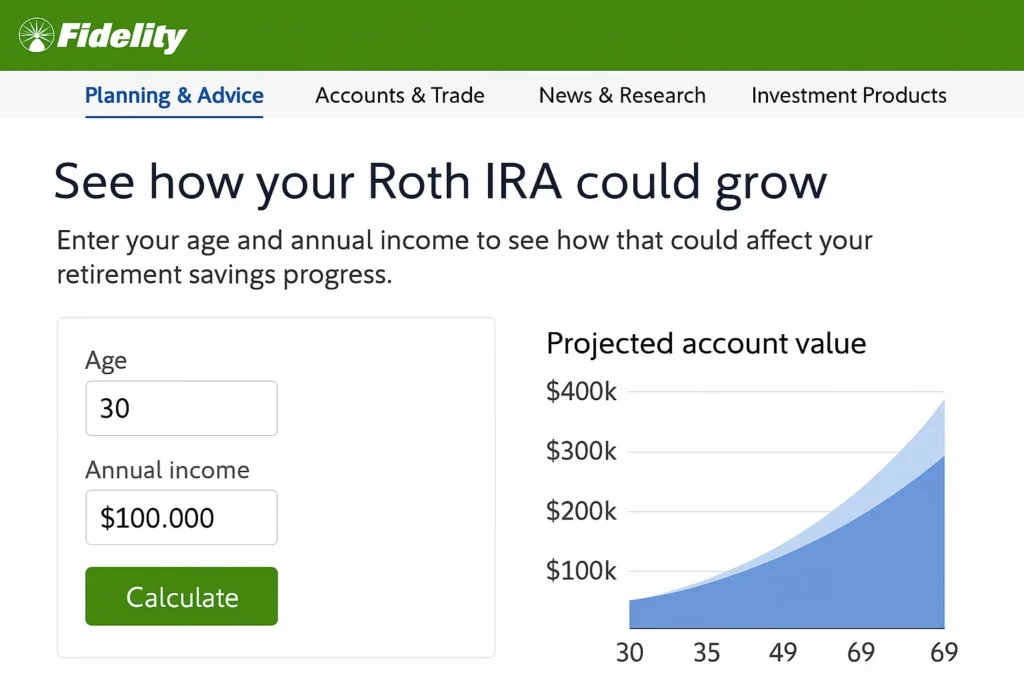

- Using Fidelity’s Tools for Your Roth IRA: Deep dive into specific Fidelity tools like the Retirement Score calculator, Planning & Guidance Center, and the mutual fund comparison tool, showing readers exactly how to use them to manage their Roth IRA effectively.

- Tax-Free Withdrawals: The most significant benefit.

- Contribution Flexibility: You can withdraw what you’ve contributed at any time, for any reason, without tax or penalty.

- No RMDs: You are not forced to take money out at age 73, allowing the account to grow longer.

- Access to Fidelity’s Platform: Robust research, trading tools, educational resources, and 24/7 customer support.

- Wide Investment Selection: Thousands of stocks, ETFs, mutual funds, and more.

- Income Limits: High earners may be prohibited from contributing directly to a Roth IRA.

- No Upfront Tax Deduction: You don’t get an immediate tax break for your contributions.

- Penalties on Early Earnings: Withdrawing earnings before age 59½ typically incurs a 10% penalty and income tax, unless an exception applies.

- Contribution Limits: The annual limit may be lower than what you can save in a 401(k).

Fidelity Roth IRA in the Real World: A Case Study

Assume Sarah, a 25-year-old graphic designer in New York earning $60,000. She opens a Fidelity Roth IRA and contributes $250 per month ($3,000 annually) into a low-cost S&P 500 index fund like the FXAIX. She continues this habit until she retires at 67.

- Assuming a 7% average annual return, her account would grow to approximately $672,000.

- The crucial point: Every single dollar of that ~$669,000 in growth is tax-free. If this had been in a taxable brokerage account, she could have owed hundreds of thousands in capital gains taxes over her lifetime.

Roth IRA vs Traditional IRA

| Feature | Roth IRA | Traditional IRA |

|---|---|---|

| Tax Treatment | Contributions are after-tax; withdrawals are tax-free. | Contributions are often tax-deductible; withdrawals are taxed as income. |

| Required Minimum Distributions (RMDs) | None during the account owner’s lifetime. | Required starting at age 73. |

| Income Limits | Yes, for direct contributions. | Yes, for tax-deductible contributions. |

| Primary Use | Tax-free growth; for those who expect to be in a higher tax bracket in retirement. | Tax deferral; for those who expect to be in a lower tax bracket in retirement. |

Conclusion

Ultimately, a Fidelity Roth IRA is a cornerstone of tax-smart retirement planning. While it offers the unparalleled benefit of tax-free growth, it requires you to forgo an immediate tax deduction and is subject to income and contribution limits. By incorporating a Roth IRA into your long-term strategy, especially during your peak earning years with Fidelity’s powerful tools at your disposal, you can build a substantial source of tax-free income that provides flexibility and security in retirement. Start by checking your eligibility and considering an initial contribution for the current tax year.

Ready to open your tax-free retirement account? The right broker makes all the difference. We’ve meticulously reviewed and ranked the best online brokers for retirement investing to help you compare platforms and find your fit.

Related Terms

- Backdoor Roth IRA: An approach for high-income employees to contribute to a Roth IRA.

- Roth IRA Conversion: The process of moving funds from a Traditional IRA to a Roth IRA.

- Fidelity Go: Fidelity’s robo-advisor service that can manage your Roth IRA for you.