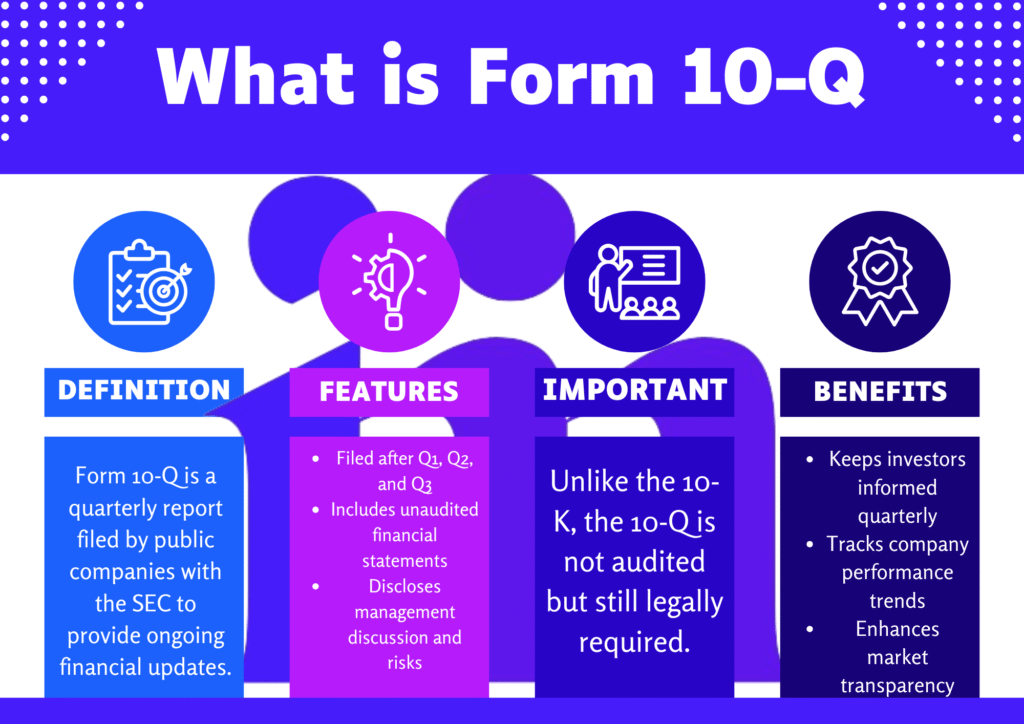

Definition

Public companies submit Form 10-Q to the SEC every quarter to disclose financial performance. It provides a snapshot of financial performance between annual reports, offering investors timely updates on revenue, expenses, and risks.

Key Features of Form 10-Q

- Quarterly Updates: It’s filed three times a year, covering the first, second, and third quarters, while the fourth is included in the 10-K.

- Unaudited Data: Contains preliminary financial statements, unlike audited 10-Ks.

- Management Analysis: Includes MD&A (Management’s Discussion & Analysis) section.

- Regulatory Mandate: Required by the SEC for all publicly traded U.S. firms.

- Standardized Deadlines: Large companies file within 40 days; others get 45 days.

How Form 10-Q Works

Companies follow a structured process:

- Data Compilation: Gather quarterly financials (income statements, balance sheets).

- MD&A Drafting: Explain results, risks, and outlook.

- Internal Review: Legal and finance teams verify accuracy.

- SEC Submission: The form is submitted online through the SEC’s EDGAR platform.

Form 10-Q vs. Form 10-K: Key Differences

| Aspect | Form 10-Q | Form 10-K |

|---|---|---|

| Frequency | Quarterly | Annual |

| Detail Level | Condensed financials | Comprehensive analysis |

| Audit Status | Unaudited | Audited |

| Filing Deadline | 40/45 days post-quarter | 60-90 days post-year-end |

| Primary Purpose | Quarterly snapshot | Annual performance review |

Pros and Cons of Form 10-Q

Pros

- Transparency: Regular updates keep investors informed.

- Early Risk Detection: Highlights emerging issues (e.g., cash flow dips).

- Market Confidence: Demonstrates regulatory compliance.

Cons

- Limited Scope: Less detailed than annual 10-K reports.

- Unaudited Risks: Mistakes may occur if the report isn’t reviewed by an independent party.

Real-World Example: GreenTech Innovations Q3 2023 Filing

In November 2023, GreenTech filed its 10-Q, revealing a 15% revenue jump driven by solar product sales. The MD&A section flagged rising R&D costs, causing analysts to adjust growth forecasts. Investors used this data to assess the stock’s short-term potential.

Why Form 10-Q Matters in Finance

These filings democratize access to corporate health checks, enabling smarter investment decisions. They ensure market transparency, help regulators monitor compliance, and let companies showcase progress between annual disclosures.

Takeaway: Form 10-Q is the pulse check of public companies, offering investors timely insights to navigate markets between annual reports.