GBPUSD Price Analysis Pound Holds Key Support as Dollar Wavers

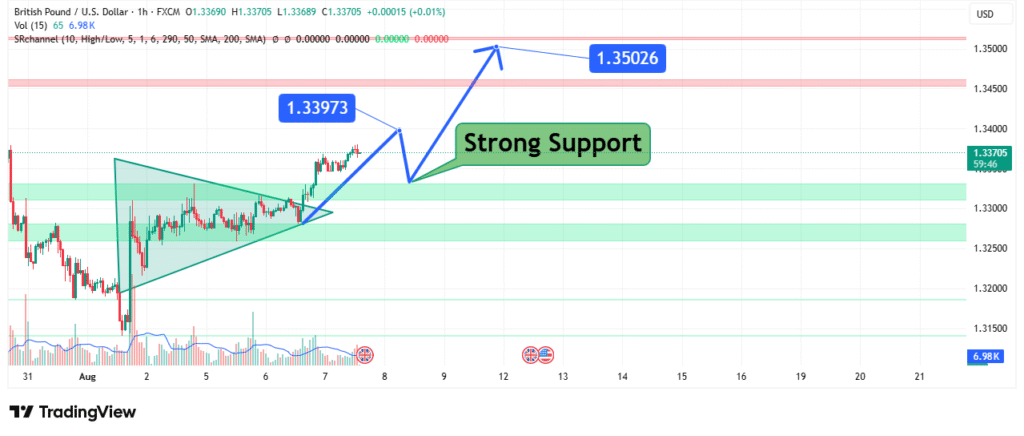

The British Pound Sterling (GBP) is showing resilience against the U.S. Dollar (USD) in today’s trading session, currently hovering around 1.33705 after a minor 0.01% decline. This technical analysis examines the critical support and resistance levels that could determine the currency pair’s next major move, along with the fundamental factors influencing this important forex market.

Current Market Position: Consolidation or Reversal?

The GBP/USD pair is currently in a tight trading range between 1.33689 and 1.33705, indicating indecision among traders. Key observations from the 1-hour chart:

- Current Price: 1.33705 (testing minor resistance)

- Session High: 1.33705 (immediate ceiling)

- Session Low: 1.33689 (floor support)

- Volume: Light at 6.98K contracts

The critical question facing traders: Will GBP/USD break higher or retreat towards stronger support levels?

Key Support Levels: Where Could the Pound Find Stability?

The pair has several important support zones that could provide buying opportunities:

Immediate Support Levels

- 1.33689 – Today’s intraday low

- 1.33500 – Psychological round number

- 1.33073 – Strong technical support (recent swing low)

Major Historical Support

- 1.32000 – Previous consolidation zone

- 1.31500 – Long-term trendline support

- 1.30000 – Critical psychological level

Trading Insight: A break below 1.33073 could accelerate selling pressure toward 1.32000, while holding above this level maintains bullish potential.

Resistance Levels: Where Could Gains Be Capped?

For GBP/USD to continue its upward momentum, it must overcome:

- 1.33705 – Immediate resistance (today’s high)

- 1.34000 – Psychological barrier

- 1.35026 – Recent swing high

- 1.4000 – Major long-term resistance

A decisive break above 1.34000 could open the door for a test of 1.35026.

Technical Indicators: Mixed Signals

Moving Averages

- Price trading above 50 SMA suggests short-term bullish bias

- 200 SMA at 1.33000 provides strong support

Volume Analysis

- Light volume suggests cautious trading

- Need volume confirmation for breakout moves

RSI (Relative Strength Index)

- Currently neutral around 50

- Above 60 would indicate overbought conditions

- Below 40 could signal oversold bounce potential

Fundamental Drivers to Watch

Several macroeconomic factors could influence GBP/USD direction:

Bank of England Policy Outlook

- Interest rate expectations

- Inflation data impact on monetary policy

U.S. Dollar Strength

- Fed rate hike expectations

- Safe-haven flows

UK Economic Data

- GDP growth figures

- Employment and wage data

Geopolitical Factors

- UK-EU relations

- Global risk sentiment

Trading Strategies for GBP/USD

Bullish Scenario (If Support Holds)

- Entry: Near 1.33500 with tight stop

- Target: 1.34000 → 1.35000

- Stop-loss: Below 1.33000

Bearish Scenario (If Support Breaks)

- Entry: Below 1.33000

- Target: 1.32000 → 1.31500

- Stop-loss: Above 1.33500

Range Trading Approach

- Buy near 1.33500, sell near 1.34000

- Tight stops required

Risk Management Considerations

- Use appropriate position sizing

- Implement stop-loss orders

- Watch for news-driven volatility

- Be cautious around major economic releases

Final Verdict: What’s Next for GBP/USD?

The pair is at a technical crossroads:

✅ If 1.33500 holds: Potential rally to 1.34000+

❌ If 1.33000 breaks: Risk of decline to 1.32000

Traders should monitor:

🔹 Bank of England commentary

🔹 U.S. economic data releases

🔹 Risk sentiment in broader markets

Final Thought: “In forex trading, patience and discipline often outweigh prediction. Wait for confirmation before committing to GBP/USD’s next move.”