o How to Use a Stock Simulator A Beginner's Guide to Virtual Trading

A Stock Simulator is a powerful software tool that replicates live financial markets, allowing you to practice trading and investing with virtual money. It provides a risk-free environment to test strategies, learn platform mechanics, and build confidence before committing real capital. For aspiring traders and investors in the US, UK, Canada, and Australia, mastering a Stock Simulator is the critical first step toward navigating major exchanges like the NYSE, NASDAQ, FTSE, and ASX.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | A software program that mimics real financial markets for the purpose of practice and education using virtual currency. |

| Also Known As | Paper Trading, Virtual Trading, Demo Account, Mock Trading |

| Main Used In | Stock Trading, Options Trading, Forex Trading, Crypto Trading, Portfolio Management |

| Key Takeaway | It is the safest and most effective way to learn how to trade and test investment strategies without financial risk. |

| Formula | N/A |

| Related Concepts |

What is a Stock Simulator

A Stock Simulator is essentially a financial markets “flight simulator.” Instead of risking a real plane, you practice flying in a virtual one that reacts to your controls just like the real thing. In this case, the “plane” is the stock market, and the “controls” are your buy and sell orders.

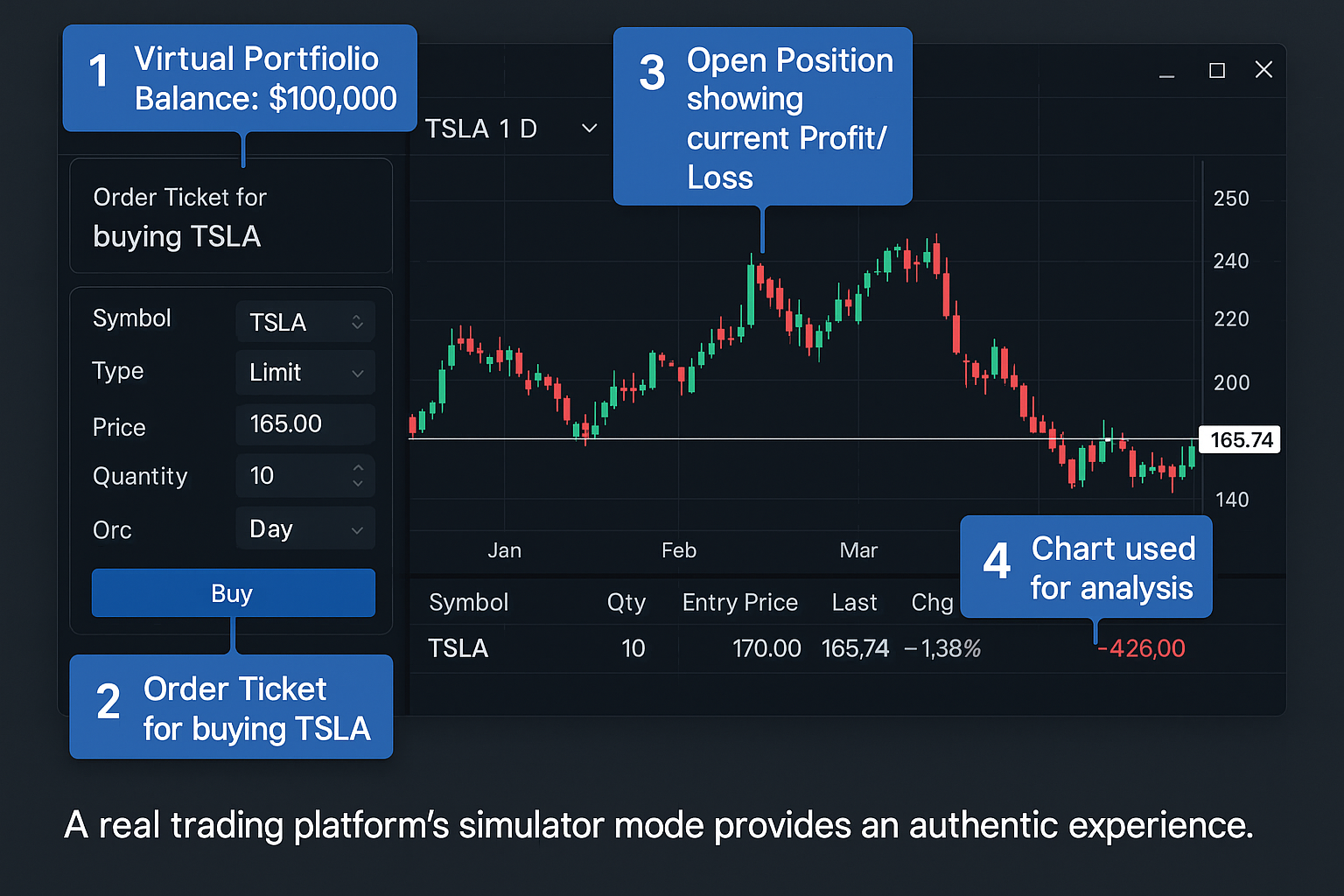

You are given a starting balance of virtual money, say, $100,000 in USD, GBP, or CAD, and can place trades that are executed at real-time or delayed market prices. The simulator tracks your portfolio’s performance, including profits, losses, commissions, and margin requirements, giving you a realistic experience of what it’s like to manage real money.

Key Takeaways

The Core Concept Explained

The core concept of a Stock Simulator is experiential learning. Reading about a stop-loss order is one thing; actually placing one and watching it automatically execute to save your virtual portfolio from a downturn is a far more powerful lesson. It measures your ability to apply theoretical knowledge in a dynamic, market-like setting.

A high-performing simulator portfolio indicates a potentially sound strategy and good risk management. Conversely, consistently losing virtual money is a clear signal that more education and practice are needed before going live, effectively saving you from real financial loss.

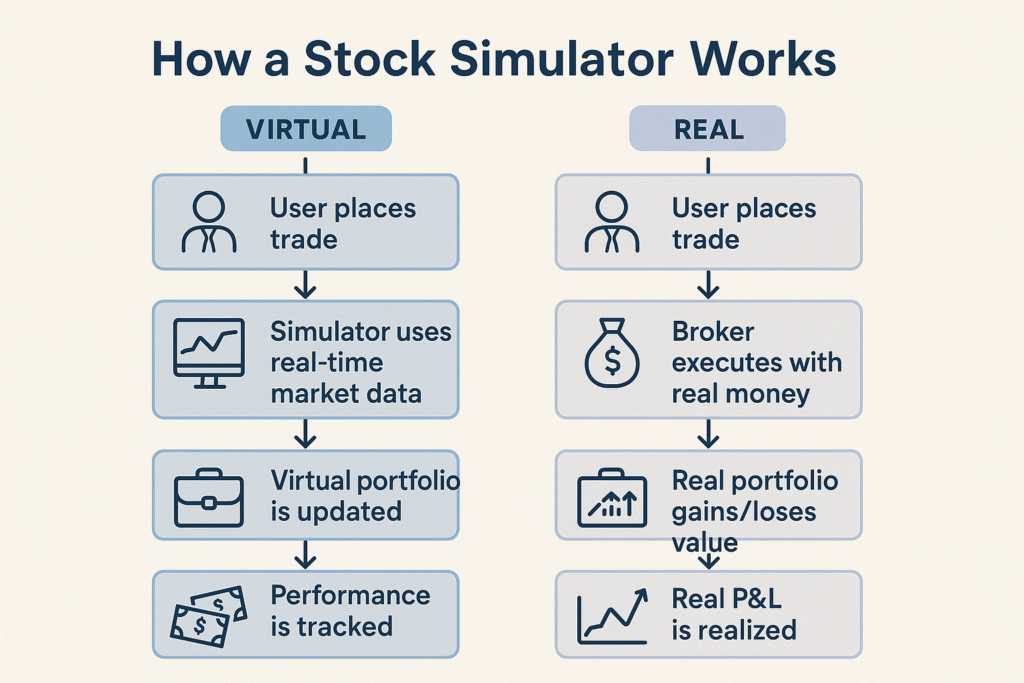

How a Stock Simulator Works

While there’s no formula to calculate, understanding the mechanics is key. A Stock Simulator works by integrating three core components:

- Market Data Feed: The simulator is connected to a live or delayed data feed from major exchanges (e.g., NASDAQ, LSE). This provides the real-time prices that drive all virtual trades.

- Virtual Trading Engine: This is the software’s brain. It processes your orders, checks your virtual buying power, executes the trade at the current market price, and instantly updates your portfolio value.

- User Interface (UI): This is the platform you interact with, it looks and functions almost identically to a real brokerage platform from firms like Fidelity or Interactive Brokers, complete with charts, order tickets, and a portfolio window.

The User Experience

- Sign Up: You create a free account on a platform that offers a simulator.

- Receive Capital: You are granted a virtual cash balance (e.g., $100,000 USD).

- Research & Decide: You analyze real stocks (e.g., Apple on the NASDAQ) using the tool’s charts and data.

- Place a Trade: You submit an order to buy 10 shares of AAPL at the market price.

- Track Performance: The simulator fills your order and tracks your investment’s value as the real market price of AAPL fluctuates.

Why Stock Simulators Matter to Traders and Investors

- For Beginners: It’s the single best tool to go from zero knowledge to understanding how markets work. It demystifies the process of placing orders and building a portfolio.

- For Experienced Traders: It allows for the backtesting of new strategies. For example, a trader in the UK can test a momentum strategy on FTSE 100 stocks without risking a single pound.

- For Investors: Long-term investors can test portfolio allocation models (e.g., 60% stocks/40% bonds) and see how they would have performed over a historical period.

- For Everyone: It teaches emotional control. The gut reaction of seeing a position drop 10% is valuable practice, even if the money isn’t real.

How to Use a Stock Simulator in Your Strategy

Use Case 1: Learning the Basics. Use the simulator to master every order type. Practice buying market orders, limit orders, stop-loss orders, and trailing stops. Understand how each affects your entry price and risk.

Use Case 2: Strategy Backtesting. Have a theory that a certain technical indicator (like the RSI) predicts price moves? Use the simulator to paper trade that strategy for a month. Did it work? Your virtual profit and loss will tell you.

Use Case 3: Platform Familiarization. Before funding an account with a new broker, use their demo account to learn where all the features are, how to chart, analyze options chains, or set alerts.

Mastering a platform is key to simulator success. To practice effectively, you need access to a professional-grade tool. We’ve reviewed the best platforms that offer robust stock simulators.

Advantages and Limitations of a Stock Simulator

- Risk-Free Learning: The ultimate benefit. Make mistakes and learn from them without any cost.

- Strategy Validation: Test if your brilliant idea actually works before risking capital.

- Platform Proficiency: Get comfortable with complex trading software without the stress of real money.

- Accessibility: Most simulators are free and open to anyone with an internet connection.

- Lack of Emotional Reality: The psychological pressure of gaining or losing real money is impossible to replicate. This is the biggest gap between simulation and reality.

- Slippage and Execution Issues: Simulators often provide perfect order execution, which isn’t always the case in fast-moving real markets, especially for large orders or volatile stocks.

- Complacency: It can create bad habits if users take on excessive risk because “it’s not real money,” a habit that can be disastrous with a live account.

Stock Simulator in the Real World

Imagine “Jane,” an investor in Canada who wants to start trading but is wary of the 2023 market volatility. Instead of using her CAD, she uses a Stock Simulator with $50,000 in virtual money.

She decides to test a strategy of buying stocks that hit new 52-week highs. Over three months, she diligently paper trades this strategy on the TSX. Her virtual portfolio grows by 15%. Encouraged, she tests a downside scenario by shorting a hyped stock like Bed Bath & Beyond during its decline. The simulator shows her how shorting works and how to manage the immense risk.

After six months of consistent virtual success and learning from her simulated mistakes, Jane feels confident enough to fund a real brokerage account with a small amount of capital, her strategy and risk management skills already honed.

This case study uses a Canadian investor and the TSX to resonate with that high-value audience and reinforce geo-targeting.

Stock Simulator vs Backtesting

A Stock Simulator is often confused with Backtesting. While related, they are distinct tools.

| Feature | Stock Simulator (Forward Testing) | Backtesting |

|---|---|---|

| Process | Applying a strategy to future (unknown) market data in real-time. | Applying a strategy to historical (known) market data. |

| Time Horizon | Forward-looking, real-time. | Backward-looking, historical. |

| Primary Use | Practical experience and emotional training. | Theoretical validation of a strategy’s past performance. |

Conclusion

Ultimately, a Stock Simulator is an indispensable educational tool that bridges the gap between theoretical knowledge and practical experience. It provides a safe sandbox to learn market mechanics, validate strategies, and build the foundational discipline required for trading and investing. While its main limitation is the inability to simulate the true emotions of real financial risk, its benefits are undeniable. By thoroughly leveraging a Stock Simulator, you can develop a tested approach and avoid costly beginner mistakes, significantly increasing your chances of long-term success in the markets.

Ready to start your risk-free trading journey? The right platform is everything. We’ve meticulously reviewed and ranked the best online brokers for beginners based on their simulator quality, fees, and educational resources.

Related Terms

- Paper Trading: This is synonymous with using a Stock Simulator.

- Backtesting: As shown in the table above, a related but different method of strategy testing.

- Demo Account: The term often used by brokers for their proprietary simulator.

- Portfolio Diversification: A key strategy that can be practiced and understood within a simulator.