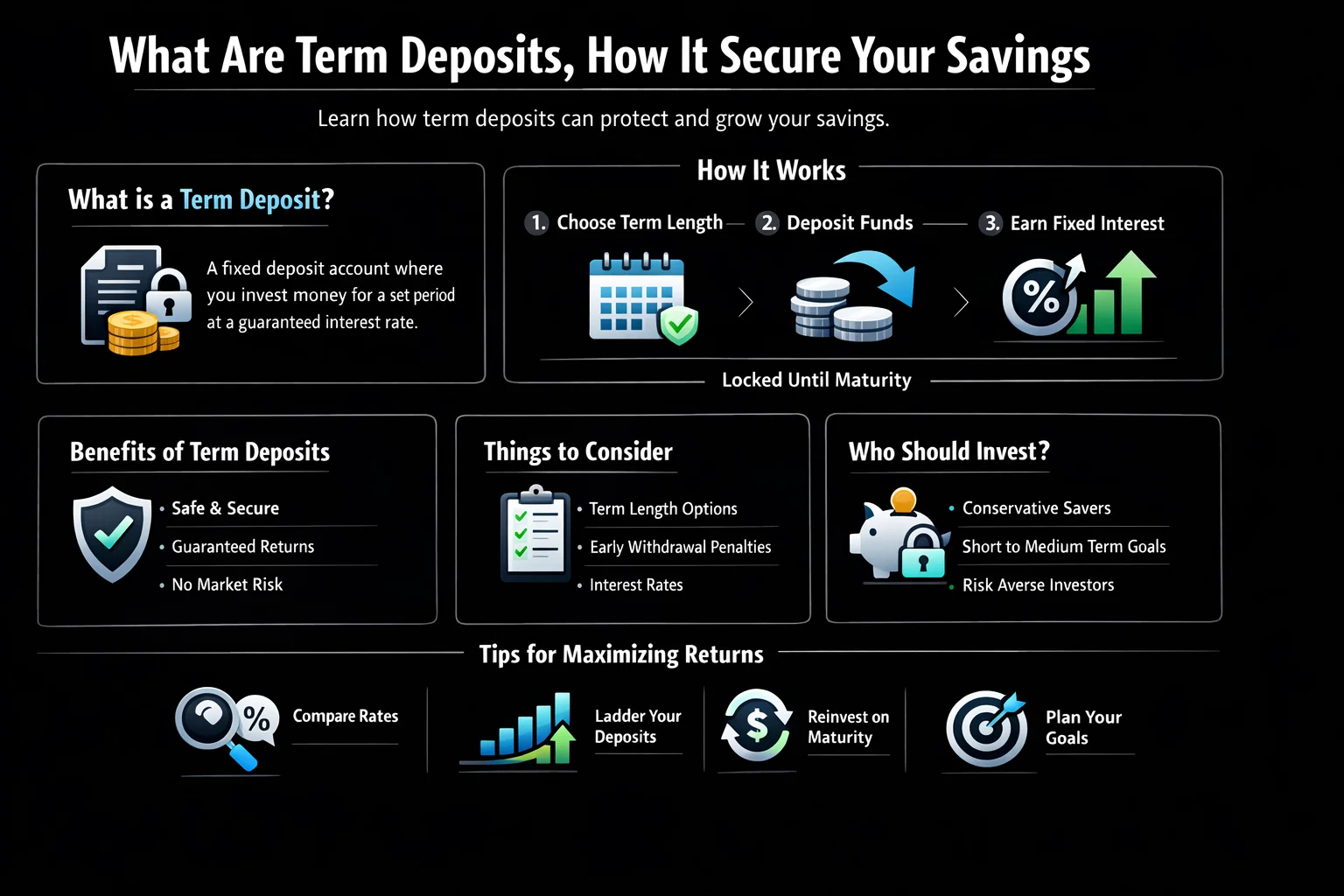

What Are Term Deposits, How It Secure Your Savings

A Term Deposit is a low-risk savings product offered by banks and credit unions where you lock away your money for a fixed period in exchange for a guaranteed, higher interest rate. It’s a cornerstone of conservative financial planning, providing a predictable return and capital preservation.

For savers in the US, UK, Canada, and Australia looking for a safe haven from market volatility, term deposits offered by institutions like JPMorgan Chase (US), Barclays (UK), or the Big Four banks in Australia are a fundamental tool for securing your financial goals.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | A fixed-term investment with a financial institution that pays a guaranteed interest rate upon maturity. |

| Also Known As | Certificate of Deposit (CD), Fixed Deposit (FD), Time Deposit |

| Main Used In | Personal Savings, Risk-Averse Investing, Emergency Funds, Retirement Planning |

| Key Takeaway | It offers capital safety and predictable returns but sacrifices liquidity, as early withdrawal typically incurs a significant penalty. |

| Formula | A = P(1 + r/n)^(nt) |

| Related Concepts |

What is a Term Deposit

A Term Deposit is a contract between you and a bank. You agree to deposit a specific sum of money for a predetermined length of time—anywhere from one month to five years or more. In return, the bank guarantees to pay you a fixed, pre-agreed interest rate. Your initial deposit, known as the principal, is returned to you in full at the end of the “term,” along with the accrued interest. Think of it as lending money to the bank for a set period; they pay you rent for using your money, and they promise to give it all back on a specific date.

It’s like a financial “time capsule.” You seal your money away, and you’re not supposed to open it until a future date. If you do break it open early, you pay a penalty, but if you wait, you’re rewarded with a guaranteed treasure.

Key Takeaways

The Core Concept Explained

The core mechanic of a term deposit is the trade-off: liquidity for yield. A regular savings account gives you instant access to your money but pays minimal interest. A term deposit offers a higher interest rate as a reward for you relinquishing access to that money for a set period. The bank can then use your committed funds for longer-term lending (like mortgages), which earns them a higher return, a portion of which they pass back to you. Generally, the longer the term you commit to, the higher the interest rate you will receive, compensating you for the increased loss of liquidity.

How to Calculate Term Deposit Interest

Term deposit interest is typically calculated using the standard compound interest formula. While some term deposits pay simple interest, most compound interest either daily, monthly, quarterly, or at maturity.

The Formula:

A = P(1 + r/n)^(nt)

Step-by-Step Calculation Guide

Let’s break down the formula:

- A = the future value of the investment/loan, including interest

- P = the principal investment amount (the initial deposit)

- r = the annual interest rate (decimal)

- n = the number of times that interest is compounded per year

- t = the number of years the money is invested for

Example Calculation:

Let’s say you invest $10,000 in a 2-year term deposit with an annual interest rate of 4.5%, compounded monthly.

- Input Values:

- P = $10,000

- r = 4.5/100 = 0.045

- n = 12 (monthly)

- t = 2

- Calculation:

- A = 10000 (1 + 0.045/12)^(12 * 2)

- A = 10000 (1 + 0.00375)^(24)

- A = 10000 (1.00375)^24

- A = 10000 * 1.0938

- A = $10,938

- Interpretation: Your $10,000 investment would grow to approximately $10,938 after 2 years. The total interest earned is $938.

For a saver in the UK using a GBP Fixed Deposit or in Canada using a CAD GIC, the principle is identical, though rates are set by institutions like the Bank of England or the Bank of Canada, influencing the returns from high-street banks like HSBC or RBC.

Why Term Deposits Matter to Savers and Investors

Term deposits are a critical tool for prudent financial management, serving specific roles for different financial personalities.

- For the Conservative Saver: They are a safe harbor. If the stock market’s volatility causes anxiety, a term deposit provides peace of mind. Your returns are contractually guaranteed, and your principal is secure (and insured).

- For the Strategic Investor: They are a tool for asset allocation. Investors use term deposits to park a portion of their portfolio in a zero-risk asset, balancing out the risk from stocks, ETFs, or crypto. This is crucial for those nearing a financial goal, like retirement, where capital preservation becomes paramount.

- For Financial Planners: They are a predictable building block. When constructing a financial plan with defined future cash needs (e.g., a down payment in 3 years), a term deposit maturing at that exact time provides certainty that the required funds will be available.

How to Use Term Deposits in Your Financial Strategy

Use Case 1: The Emergency Fund Ladder

You have a $15,000 emergency fund sitting in a low-interest account. Instead, you can create a “CD Ladder.”

- Action: Split the $15,000 into three $5,000 deposits. Open a 1-year, 2-year, and 3-year term deposit.

- Benefit: Every year, one CD matures, giving you access to $5,000 + interest if needed. If you don’t need it, you reinvest it into a new 3-year CD at the current rate. This strategy maintains liquidity while capturing higher long-term rates.

Use Case 2: Saving for a Specific Goal

You plan to buy a car in 18 months and have saved $8,000 for the down payment.

- Action: Place the $8,000 in an 18-month term deposit.

- Benefit: The money is safely set aside, preventing impulsive spending, and it earns a guaranteed return that will help pay for taxes and fees on the car.

Use Case 3: Retirement Income Supplement

A retiree needs predictable, low-risk income.

- Action: Invest a portion of their nest egg in a series of 1-year term deposits that mature at different times throughout the year.

- Benefit: This creates a predictable stream of cash flow to cover living expenses without having to sell other investments in a down market.

To start building your own CD ladder, you’ll need an account with a bank that offers competitive rates and flexible terms. We’ve reviewed the best platforms for conservative investors to help you get started.

- Safety of Principal: Your initial investment is not at risk of market loss.

- Predictable Returns: You know the exact return on your investment from day one.

- FDIC/NCUA Insurance: US deposits are insured up to $250,000, providing a government-backed safety net.

- Higher Returns: They consistently offer better yields than standard savings accounts.

- Forces Discipline: The withdrawal penalty discourages dipping into your savings.

- Liquidity Risk: Accessing money before maturity is costly and can result in lost principal.

- Interest Rate Risk: If market rates rise, you are stuck with your lower, locked-in rate.

- Inflation Risk: The fixed return might not keep pace with inflation, eroding purchasing power.

- Lower Potential Returns: Long-term growth potential is much lower than riskier assets like stocks.

- Opportunity Cost: Locked-up capital means you might miss out on other lucrative investments.

Building a CD Ladder: A Step-by-Step Strategy

A CD ladder is a strategy to maximize returns while maintaining regular access to your funds. It involves dividing your investment across multiple CDs with staggered maturity dates.

Step 1: Determine Your Total Investment. Let’s use $25,000 as an example.

Step 2: Choose Your Ladder Rungs. Decide on the number of CDs and their terms. A common 5-year ladder would have five $5,000 CDs.

Step 3: Purchase the CDs.

- $5,000 in a 1-year CD

- $5,000 in a 2-year CD

- $5,000 in a 3-year CD

- $5,000 in a 4-year CD

- $5,000 in a 5-year CD

Step 4: Manage the Ladder. When the 1-year CD matures, you reinvest that $5,000 plus interest into a new 5-year CD. The next year, the 2-year CD matures, and you repeat the process. After five years, you have a CD maturing every single year, giving you annual liquidity while most of your money is locked in longer-term, higher-yielding CDs.

How to Choose the Best Term Deposit

Not all term deposits are created equal. Here’s a checklist:

- Shop Around: Don’t just use your primary bank. Online banks and credit unions often offer much higher rates.

- Compare APY: The Annual Percentage Yield (APY) includes compounding and is the true measure of your return. Always compare APYs, not just interest rates.

- Understand the Penalty: Ask for the exact early withdrawal penalty formula. It could be a number of months’ interest or a specific fee.

- Check the Fine Print on Renewal: Know the bank’s automatic renewal policy and the grace period length to avoid being locked into a poor rate.

- Verify Insurance: Ensure the institution is FDIC (for banks) or NCUA (for credit unions) insured.

Term Deposits in the Real World: A Post-2008 Case Study

Following the 2008 Financial Crisis and again during the COVID-19 pandemic, central banks like the US Federal Reserve slashed interest rates to historic lows to stimulate the economy. For years, savers were frustrated as term deposit rates fell below 1%, making them unattractive.

The Recent Shift (2023-2024): To combat high inflation, the Fed and other central banks aggressively raised interest rates. This had a direct and positive impact on term deposit rates. Banks suddenly needed to attract deposits to fund their lending activities, leading to a rapid increase in CD rates.

- Example: In early 2022, a 1-year CD might have paid 0.5%. By mid-2023, that same CD was paying over 5.0%. Savers who had been waiting on the sidelines finally had an opportunity to earn a meaningful, risk-free return on their cash.

This scenario perfectly illustrates the interest rate risk and opportunity of term deposits. Those who locked in long-term CDs before the rate hikes were stuck with low returns, while those who were patient and invested as rates peaked secured very attractive, guaranteed yields for their term.

This dynamic played out across Tier-1 markets, with UK savers seeing better rates from Barclays and NatWest as the Bank of England hiked, and Australian depositors benefiting from RBA moves through banks like Commonwealth Bank of Australia.

Term Deposits vs High Yield Savings Account

The most common point of confusion is between Term Deposits and High-Yield Savings Accounts (HYSAs). Both are safe, interest-bearing accounts, but they serve different purposes.

| Feature | Term Deposit (CD) | High-Yield Savings Account (HYSA) |

|---|---|---|

| What it measures | Return for committing funds for a fixed term. | Return on liquid savings with no fixed term. |

| Liquidity | Low (early withdrawal penalty). | High (withdraw anytime). |

| Interest Rate | Fixed for the term. | Variable (can change at any time). |

| Primary Use | Guaranteed growth for known future expenses. | Emergency fund or short-term liquid savings. |

Conclusion

Ultimately, a term deposit is not a tool for getting rich, but for staying financially secure. It serves the vital purpose of capital preservation and providing predictable returns in an otherwise uncertain financial world. While its limitations—namely illiquidity and inflation risk—are significant, its core advantages of safety and certainty are unmatched for a portion of any well-balanced portfolio. By understanding how to strategically use term deposits, whether for a specific savings goal or as part of a CD laddering strategy, you can effectively manage risk and ensure a portion of your wealth is working for you without keeping you up at night. Start by comparing current rates at credit unions and online banks for your next short-term financial goal.

Ready to find the best term deposit rates for your savings? The right platform makes all the difference. We recommend starting your search with authoritative comparison tools from Investopedia’s page on CDs or the FDIC’s official website to ensure you’re making an informed and safe decision.

Related Terms

- Savings Account: The more liquid, lower-yield cousin of the term deposit.

- Bonds: Like a term deposit, but you are lending to a corporation or government instead of a bank. Generally offer higher returns with slightly higher risk.

- Liquidity: The ease with which an asset can be converted to cash. Term deposits have low liquidity.

- Compound Interest: The mechanism by which your money grows in a term deposit, where you earn interest on your interest.

Frequently Asked Questions

Recommended Resources

- FDIC: Learn About CDs – The official US government source for understanding deposit insurance and CDs.

- Investopedia: Certificate of Deposit (CD) – A deep dive into the mechanics and strategies.

- Bankrate: CD Calculator – A useful tool to project your earnings before you invest.