The 5 Main Types of Trading Orders and When to Use Them

Knowing what to trade is only half the battle; knowing how to trade it is just as critical. From basic Market Orders to advanced Trailing Stops, the types of orders you use can significantly impact your entry price, risk management, and overall profitability. This guide will demystify them all, giving you the confidence to execute trades like a seasoned pro.

For active traders in the US and UK, mastering these orders is essential for navigating fast-moving markets on platforms like Fidelity, Charles Schwab, Interactive Brokers, or Trading 212.

Summary Table

| Aspect | Detail |

|---|---|

| Number of Primary Types | 5 Core Order Types |

| Most Common For Beginners | Market Order, Limit Order |

| Most Complex / Advanced | Trailing Stop Order, Stop-Limit Order |

| Key Decision Factor | Trading Goal (Speed vs. Price Control vs. Risk Management) |

| Key Takeaway | Using the right order type for the situation is a fundamental skill that protects your capital and executes your strategy precisely. |

Placing a trade isn’t just about clicking “buy.” Using the wrong order type can lead to paying more than you intended (slippage), missing an entry point entirely, or failing to protect your profits from a sudden downturn. This knowledge is the bedrock of disciplined trading, transforming you from a passive investor into an active strategist. It’s the difference between saying “I want to buy Apple” and saying “I want to buy Apple only if it drops to $150, and I want to automatically sell it if it falls 10% from its peak.” We’ll break down orders by their primary function: Execution, Price Control, and Risk Management.

How to Break Down the World of Stock Market Orders

To make sense of the various orders, it helps to categorize them by their core purpose. This framework allows you to quickly select the right tool for the job.

- Criterion 1: Execution Certainty – These orders prioritize the completion of the trade above all else. The primary example is the Market Order.

- Criterion 2: Price Control – These orders prioritize getting a specific price (or better) over the certainty of immediate execution. The primary example is the Limit Order.

- Criterion 3: Risk Management & Automation – These orders are designed to automatically protect your capital or lock in profits based on changing market conditions. Examples include Stop-Loss, Stop-Limit, and Trailing Stop Orders.

Types of Stock Market Orders

Before you place your first trade, it’s crucial to understand that “buy” and “sell” are just the beginning. The type of order you use to execute your trade is a critical strategic decision. Stock market orders are the tools that translate your investment strategy into action, giving you control over the timing, price, and risk of your trades.

From guaranteeing an immediate execution to automating your exit strategy, each order type serves a distinct purpose. Mastering them is the key to moving from a passive investor to an active, disciplined trader.

1. Market Order

A market order is an instruction to buy or sell a stock immediately at the best available current market price. It prioritizes speed and execution certainty over price control.

Key Characteristics

- Execution: Immediate (during market hours).

- Price: Not guaranteed; you get the current ask price for buys and “bid” price for sells.

- Certainty: High certainty of execution, low certainty of price.

- Best Use: Highly liquid stocks, when speed is more important than a specific price.

- Guaranteed Execution: The order will almost always be filled.

- Simplicity: The easiest order to place.

- Speed: Ideal for entering or exiting a position quickly.

- Price Slippage: You may pay more (or receive less) than expected, especially in volatile or illiquid markets.

- No Control: You surrender control over the final execution price.

Who Is It Best For

Beginners making their first trades, and any trader who needs to get in or out of a position quickly and is trading a highly liquid stock (like an S&P 500 company).

2. Limit Order

A limit order is an instruction to buy or sell a stock only at a specified price (the “limit price”) or better. It gives you total price control but does not guarantee execution.

Key Characteristics

- Execution: Not guaranteed; only executes if the market reaches your limit price.

- Price: Fully guaranteed (you will never pay more or receive less than your limit).

- Certainty: High certainty of price, low certainty of execution.

- Best Use: When you have a specific target price in mind and are willing to wait.

- Total Price Control: You set the maximum you’ll pay or the minimum you’ll accept.

- No Slippage: Protects you from unfavorable price moves between order and execution.

- Strategic Entry/Exit: Perfect for buying on dips or selling into rallies.

- No Execution Guarantee: The stock may never hit your limit price, and you miss the trade entirely.

- Patience Required: Requires a disciplined, patient approach to trading.

Who Is It Best For

Value investors, swing traders, and anyone who wants to automate their entry and exit points without constantly watching the market.

Ready to start using limit orders to control your trades? The first step is choosing a broker with a robust and reliable trading platform. We’ve reviewed the top brokers for active traders to help you decide.

3. Stop-Loss Order (Stop Order)

A stop-loss order (or stop order) becomes a market order to sell once a specified “stop price” is reached. It is designed to limit an investor’s loss on a position.

Key Characteristics

- Execution: Triggers a market order once the stop price is hit.

- Price: Not guaranteed after trigger; subject to slippage.

- Function: Purely for risk management.

- Best Use: Protecting capital from significant losses on a position you already own.

- Automatic Risk Management: Removes emotion from selling during a downturn.

- Capital Protection: The single most important tool for preserving your trading capital.

- Peace of Mind: Allows you to hold a position without constant monitoring.

- Slippage Risk: In a fast-falling market, the final sale price can be well below your stop price.

- Whipsaws: Normal volatility can trigger the stop, only for the price to immediately rebound.

Who Is It Best For

Every single trader and investor who holds a position overnight. It is a non-negotiable tool for prudent risk management.

4. Stop-Limit Order

A stop-limit order combines features of a stop and a limit order. It becomes a limit order to sell only at a specified limit price or better once the “stop price” is triggered. It adds a layer of price control to the stop-loss.

Key Characteristics

- Execution: Not guaranteed; only becomes an active limit order after the stop is hit.

- Price: Controlled by the limit price after trigger.

- Function: Risk management with price control.

- Best Use: When you want to cap your loss but want to avoid the slippage of a plain stop-loss order.

- Price Protection: Prevents the worst-case slippage of a stop-loss order.

- Greater Precision: You define both the trigger point and the minimum acceptable sale price.

- Risk of No Execution: If the price gaps down through your limit price, the order may not fill, leaving you in a falling position.

- More Complex: Requires setting two prices correctly.

Who Is It Best For

More advanced traders who are comfortable with the trade-off of potentially not exiting a position in exchange for guaranteed price control. Often used in less volatile markets.

5. Trailing Stop Order

A trailing stop order is a dynamic stop-loss that follows the market price by a specified percentage or dollar amount. It automatically adjusts upward as the price rises, locking in profits, but holds steady if the price falls.

Key Characteristics

- Execution: Can be set as a trailing stop market or trailing stop limit order.

- Price: Dynamic; the stop price recalculates with each new high.

- Function: Lets profits run while cutting losses.

- Best Use: Capturing gains in a trending market without manually moving your stop-loss.

- Automates Profit-Taking: Systematically locks in unrealized gains as the stock rises.

- Removes Emotion: Takes the guesswork out of “when to sell” a winning trade.

- Ideal for Trends: Perfect for strong, momentum-driven stocks.

- Can Be Triggered Early: Normal pullbacks can stop you out of a continuing trend.

- Complexity: More complex to set up than a static stop.

Who Is It Best For

Momentum traders, swing traders, and any investor in a strong bull market who wants a disciplined, automated method for protecting their profits.

Market Order vs Limit Order vs Stop-Loss Order

| Feature | Market Order | Limit Order | Stop-Loss Order |

|---|---|---|---|

| Primary Goal | Speed & Execution | Price Control | Risk Management |

| Price Certainty | Low | High | Low (after trigger) |

| Execution Certainty | High | Low | High (after trigger) |

| Risk of Slippage | High | None | High (after trigger) |

| Risk of No Fill | Very Low | High | Low (after trigger) |

| Best For | Fast entry/exit | Specific price targets | Capital protection |

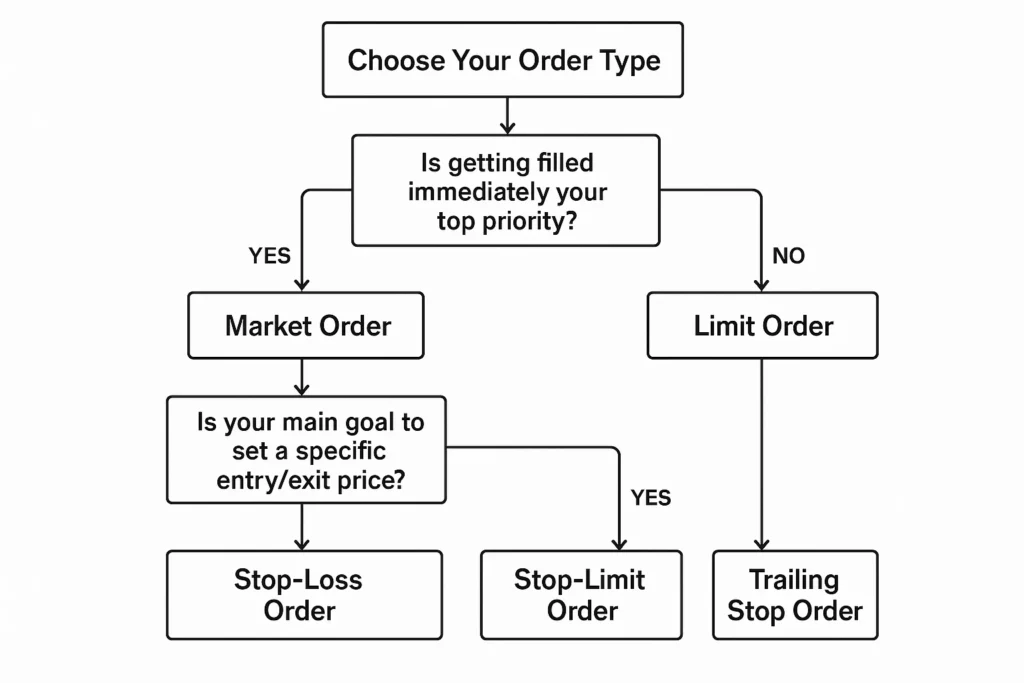

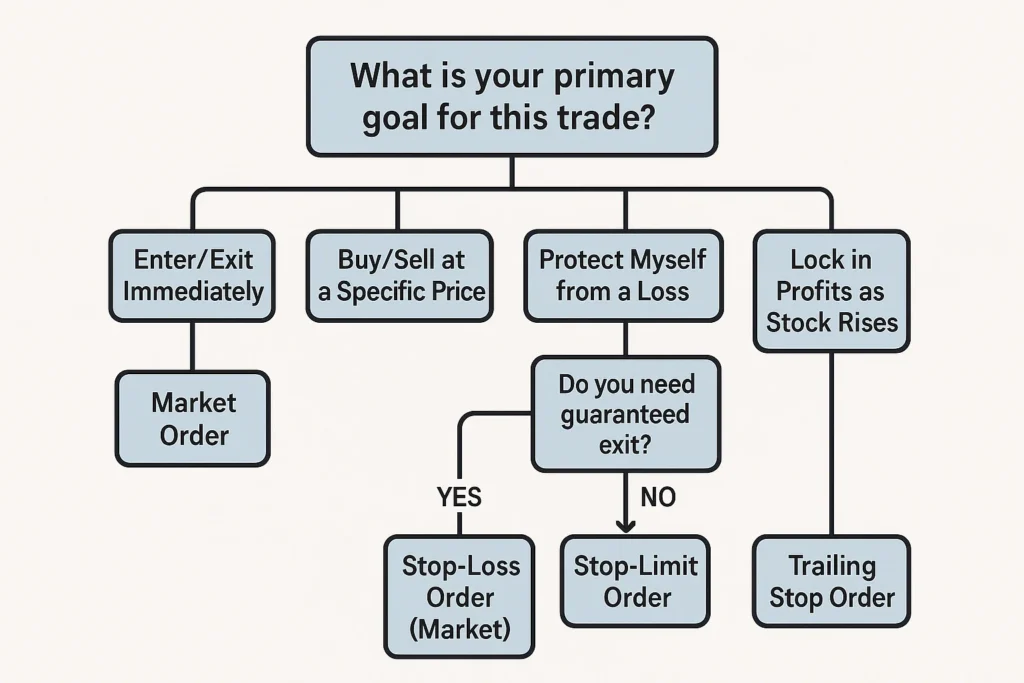

A Step-by-Step Guide to Selecting Your Order Type

Step 1: Define Your Goal. Are you trying to enter a trade quickly, pin down a specific price, or protect your capital? Your goal dictates the order family.

Step 2: Assess the Stock’s Volatility and Liquidity. For highly volatile or illiquid stocks, avoid market orders due to high slippage risk. Use limit orders instead.

Step 3: Determine Your Timeframe. Are you a day trader (needs speed) or a long-term investor (can afford patience)? Market orders suit the former, limit orders the latter.

Step 4: Always Plan Your Exit. Before you even enter a trade, know how you will get out. For every single position you open, you should have a stop-loss order in place to define your risk.

Step 5: Match the Order to the Situation. Use the decision tree below.

Building a Strategy with Different Order Types

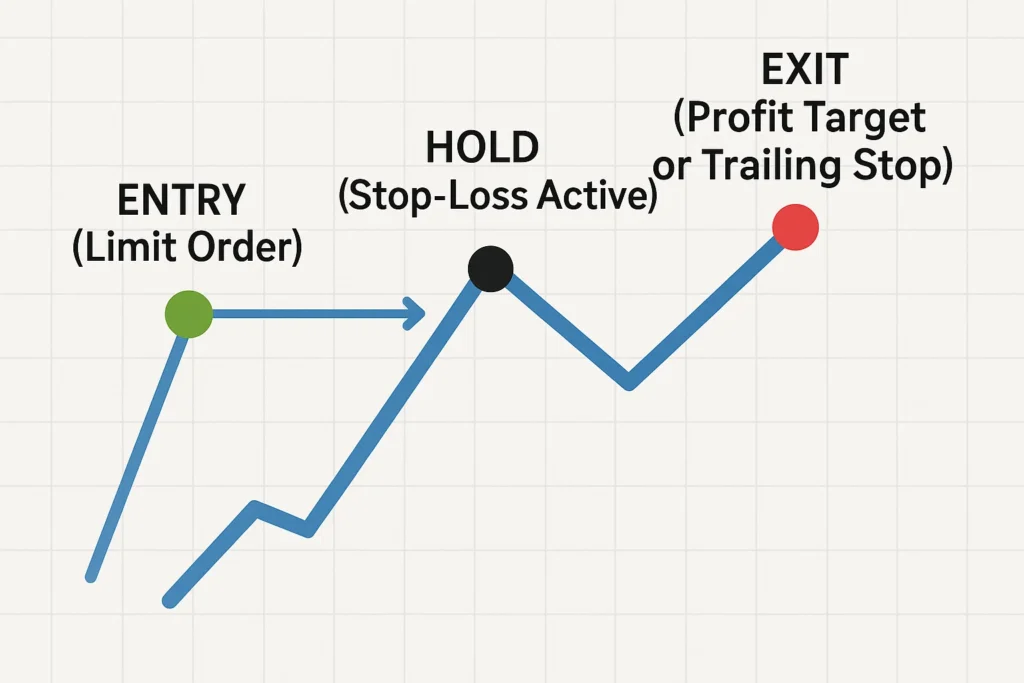

Smart traders don’t use just one order type; they combine them to execute a full strategy from entry to exit.

Example Trade 1: The Disciplined Swing Trade

- Entry: A Buy Limit Order at $50, waiting for a pullback to your target entry zone.

- Initial Risk Management: A Stop-Loss Order at $48, defining a $2 per share risk.

- Profit-Taking: A Sell Limit Order at $60 to take profits at your target, or a Trailing Stop Order 5% below the current price to let profits run.

Example Trade 2: The Long-Term Investor’s Entry

- Strategy: You believe in Company XYZ long-term but think it’s slightly overvalued at $150.

- Action: Place a Buy Limit Order at $145. If the market dips to your price, you get filled automatically. If not, you avoid overpaying. You then place a long-term Stop-Loss Order at $130 to protect your capital.

Conclusion

Ultimately, understanding and skillfully using the five main trading orders transforms you from a passive participant reacting to prices into a strategic operator who controls your entries, exits, and risk with precision. While knowing what each order does is the first step, the real trading edge comes from knowing when and why to deploy each one, aligning your order choice with your specific strategy, risk tolerance, and market conditions.