Understanding Viatical Settlements A Guide for the Seriously Ill

Viatical settlement provides a financial lifeline for individuals with a serious or terminal illness, allowing them to sell their life insurance policy for a lump sum of cash. This transaction offers immediate funds to cover medical costs and improve quality of life. For investors in the US, Canada, and the UK, it represents a unique, albeit complex, alternative asset class tied to life expectancy.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | The sale of a life insurance policy by a terminally or chronically ill person (the viator) to a third party for a lump-sum payment. |

| Also Known As | Life settlement for the terminally ill. |

| Main Used In | Personal Finance, Alternative Investments, Insurance. |

| Key Takeaway | It provides crucial liquidity for the ill but involves selling a death benefit at a discount and requires careful ethical and financial consideration. |

| Related Concepts |

What is a Viatical Settlement

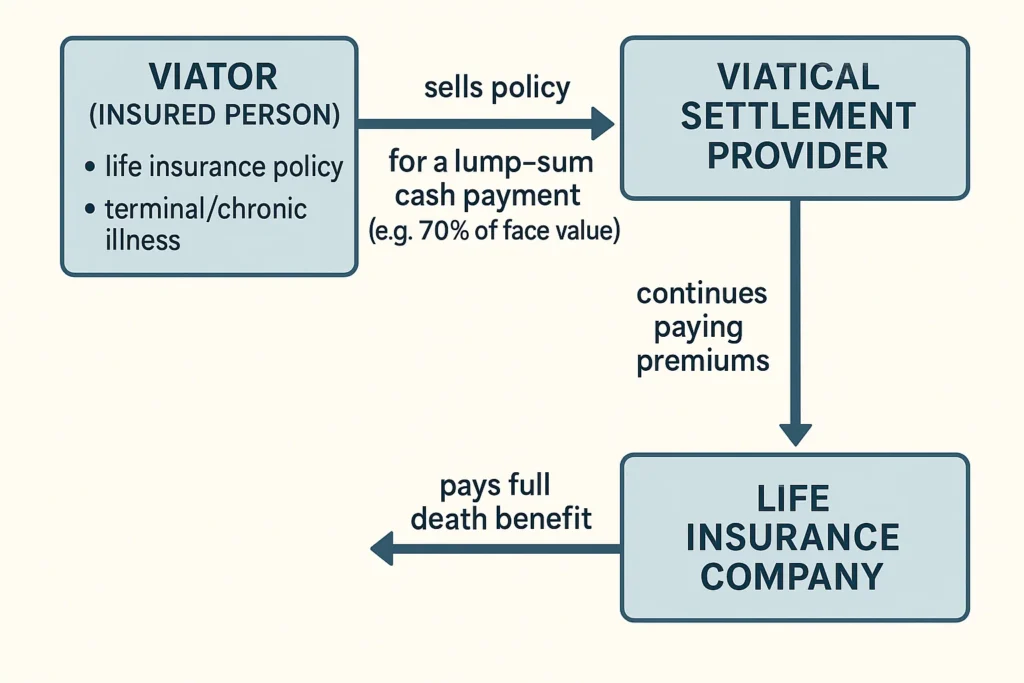

A viatical settlement is a financial agreement where a person diagnosed with a terminal or chronic illness sells their life insurance policy to a licensed company. In exchange for a lump-sum payment, which is a percentage of the policy’s face value, the viator transfers ownership and beneficiary rights to the purchasing company. The company then becomes responsible for all future premium payments and collects the full death benefit when the insured passes away.

Think of your life insurance policy as a future $100 bill. A viatical settlement company might offer you $70 today because you need the money immediately for medical care. They then wait to receive the full $100 themselves. You get immediate relief, and they make a profit.

Key Takeaways

The Core Concept Explained

The core of a viatical settlement is the transfer of risk and benefit. The viator, facing a shortened life expectancy, trades a future, illiquid asset for present-day liquidity. The purchasing company accepts the risk of paying premiums and the uncertainty of the actual lifespan in exchange for a potential return.

The payout percentage is directly tied to the insured’s life expectancy (LE). A shorter LE results in a higher payout percentage, as the investor expects to recoup their investment sooner.

How a Viatical Settlement Works

A viatical settlement isn’t calculated with a single formula but is determined through a process of underwriting and negotiation.

The Step-by-Step Process

- Qualification: The insured must typically have a life expectancy of 24 months or less, as certified by a physician. Some chronic illness qualifications may also apply.

- Application & Consent: The viator applies with a licensed viatical settlement provider and provides extensive medical records and policy details. Strict privacy and consent laws govern this process.

- Underwriting & Offer: The provider’s underwriters analyze the medical data to estimate life expectancy. Based on this LE, premium costs, and the policy’s face value, they make a cash offer. For example, an offer might be 70-80% of the face value for a very short LE, or 50-60% for a longer one.

- Acceptance & Transfer: If the offer is accepted, the viator signs ownership transfer documents. The provider pays the lump sum and begins paying the policy premiums.

- Monitoring & Payout: The provider monitors the viator’s health (through legal means) and, upon their passing, submits a claim to the insurance company to receive the death benefit.

The Ethical Landscape of Viatical Settlements

This industry operates at the intersection of finance and mortality, raising important ethical questions.

- Informed Consent: Is the viator, who may be under duress, truly able to understand the long-term consequences for their estate? Regulations mandate cooling-off periods and disclosures to protect them.

- “Death Pools”: Critics sometimes unflatteringly refer to funds that invest in these settlements, framing them as betting on death. Proponents argue they provide a valuable service by creating a market for an otherwise illiquid asset when it’s needed most.

- Transparency: Full transparency on fees, offers, and the impact on public benefits is non-negotiable for an ethical transaction. Reputable providers welcome regulation and clear communication.

Why Viatical Settlements Matter

- For the Ill and Their Families: It is a crucial source of funds when facing overwhelming medical bills, experimental treatments not covered by insurance, or end-of-life care. It can provide financial dignity and peace of mind.

- For Financial Advisors: Understanding viatical settlements is essential for providing comprehensive advice to clients in crisis. It’s an option to present alongside accelerated death benefits and policy loans.

- For Investors: It offers a non-correlated asset class, returns are based on life expectancy, not stock market performance. This can potentially diversify an investment portfolio.

How to Navigate a Viatical Settlement

Use Case 1: Accessing Funds for Medical Treatment

A person with a terminal illness needs $150,000 for a specialized treatment abroad. They have a $500,000 life insurance policy. By entering a viatical settlement, they could receive a lump sum of $350,000 (70%) to pay for the treatment immediately, rather than leaving the benefit to their heirs later.

Use Case 2: Comparing Options

Before pursuing a viatical settlement, a policyholder should first explore their policy’s Accelerated Death Benefit (ADB) rider, if available. An ADB allows for an advance from the death benefit without selling the policy, often at a lower cost. A viatical settlement should be pursued if the offer is significantly higher than the ADB or if no ADB is available.

Navigating a viatical settlement requires understanding its long-term impact on your finances and estate. Consulting with a fee-only financial planner who specializes in elder or crisis care planning is a critical first step.

State Regulation and Consumer Protections in the US

Viatical and life settlements are primarily regulated at the state level, leading to a patchwork of rules.

- The Viatical Settlements Model Act: Most states have adopted a version of this model act, which sets standards for licensing, disclosure, and fair marketing.

- Key Protections: These typically include a 15-30 day “rescission period” where the viator can cancel the contract without penalty, privacy protections for medical information, and a requirement for providers to disclose all offers and commissions.

- Actionable Step: The single most important action a consumer can take is to verify the license of any provider or broker with their state’s Department of Insurance before sharing any personal information.

- Immediate Liquidity: Provides tax-free cash (under current US federal law for the terminally ill) to cover pressing expenses.

- Relief from Premiums: The viator is freed from the financial burden of ongoing premium payments.

- Freedom of Use: Funds can be used for anything, medical bills, travel, debt repayment, or creating final memories with family.

- Reduced Inheritance: The policy’s death benefit is no longer available for the viator’s beneficiaries.

- Potential for Exploitation: Unscrupulous buyers may target vulnerable individuals with low-ball offers.

- Privacy Concerns: The buyer will have a financial interest in the viator’s health and may require periodic medical updates.

- Impact on Government Benefits: The lump-sum payment could affect eligibility for means-tested government benefits like Medicaid.

Viatical Settlement in the Real World: A Case Study

During the AIDS crisis in the 1980s and 1990s, viatical settlements became a well-known financial tool. Many young men diagnosed with HIV/AIDS, who faced a certain but not immediate death sentence, found themselves with massive medical bills and an inability to work. Their life insurance policies were a dormant asset. Viatical settlements emerged as a solution, allowing them to sell their policies for 70-80% of the face value, providing crucial funds for treatment and quality-of-life improvements. This period highlighted both the profound humanitarian benefit of the product and the need for strong regulation to prevent fraud and ensure fair pricing, leading to the Viatical Settlements Model Act adopted by the National Association of Insurance Commissioners (NAIC) in the US.

Viatical Settlement vs Life Settlement

The most common point of confusion is between Viatical Settlements and Life Settlements.

| Feature | Viatical Settlement | Life Settlement |

|---|---|---|

| Insured’s Health | Terminally or chronically ill (typically < 24-month LE). | Generally, a senior (often > 65) with a deteriorating health condition but a longer LE (e.g., 2-15 years). |

| Primary Driver | Critical need for funds due to illness. | No longer needing or being able to afford the policy. |

| Payout % | Higher (e.g., 60-80% of face value). | Lower (e.g., 10-25% of face value) due to longer LE and higher premium costs. |

Conclusion

Viatical settlement is a profound financial decision that trades future security for present-day relief. It serves as a vital lifeline for those facing severe illness, offering liquidity and control during a vulnerable time. However, as we’ve seen, it comes with significant trade-offs, including a reduced inheritance and complex ethical considerations. It is not a decision to be made lightly or without expert guidance. By carefully weighing the pros and cons and exploring all alternatives, individuals can determine if this path provides the financial dignity they seek. For investors, it remains a niche asset class demanding rigorous due diligence and a clear understanding of the human element involved.

Making a decision with such lasting impact requires trusted information. We’ve analyzed and compared the best resources for senior financial planning to help you navigate these complex choices.

Related Terms

- Life Settlement: The sale of a policy by a senior who is not terminally ill.

- Accelerated Death Benefit (ADB): A rider within a life insurance policy that allows for an early advance on the death benefit.

- Cash Surrender Value: The amount the insurance company would pay the policyholder if they canceled a whole life policy.

- Underwriting: The process of evaluating risk, in this case, based on medical history.