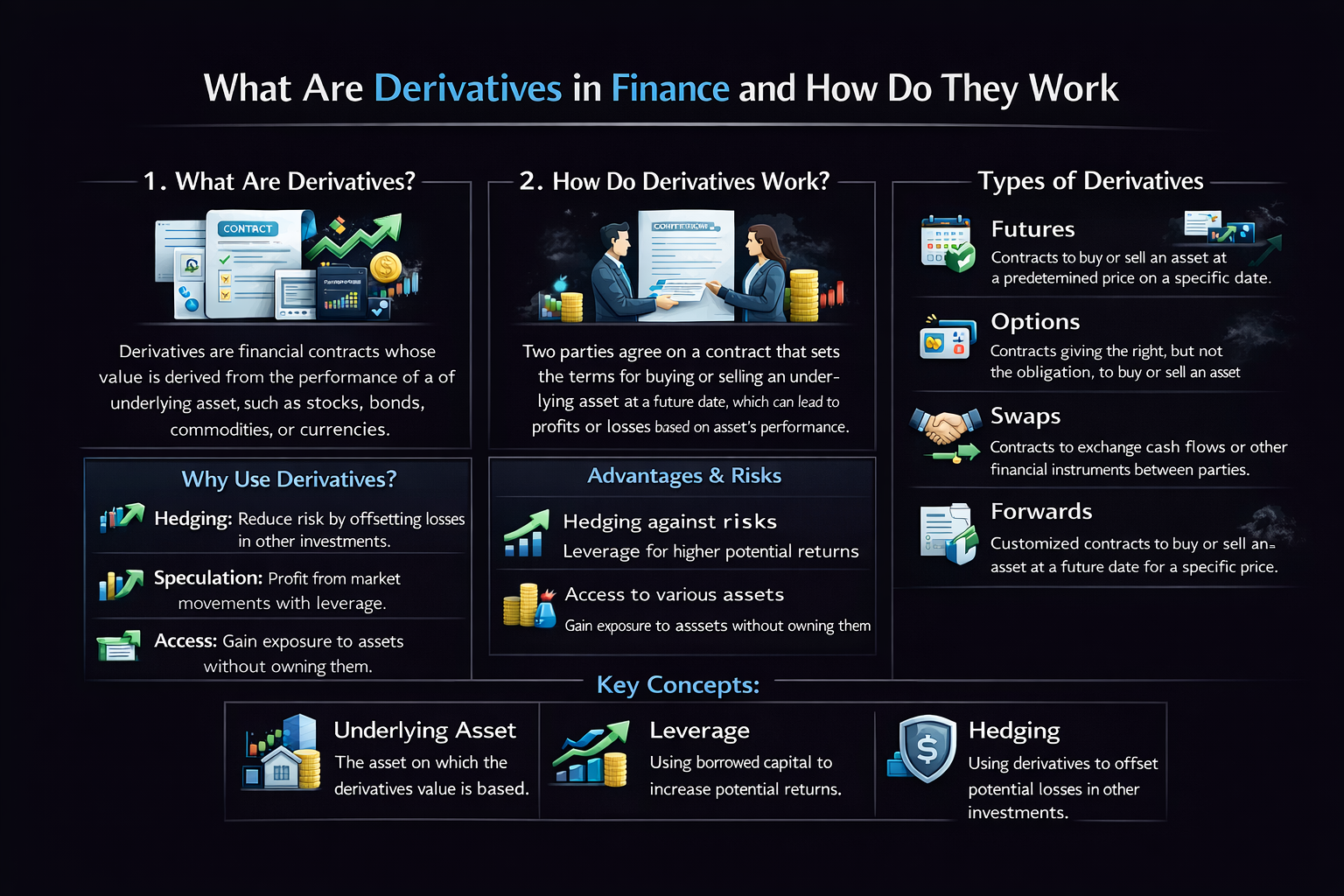

What Are Derivatives in Finance and How Do They Work

A derivative is a powerful financial contract whose value is derived from the performance of an underlying asset, such as a stock, bond, commodity, currency, or index. It’s a cornerstone of modern finance, used for hedging risk, speculating on price movements, and unlocking market efficiency. From Wall Street institutions in the US to individual traders in the UK, understanding these instruments is crucial for navigating complex markets.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | A financial contract whose value is dependent on, or derived from, an underlying asset. |

| Also Known As | Derivatives contracts, financial derivatives |

| Main Used In | Risk Management, Speculation, Institutional Trading, Hedging, Portfolio Optimization |

| Key Takeaway | Derivatives are powerful tools that can be used to both manage risk and amplify gains, but they also carry significant leverage and complexity that can lead to substantial losses. |

| Formula | N/A (Value derived from underlying asset price) |

| Related Concepts |

What is a Derivative

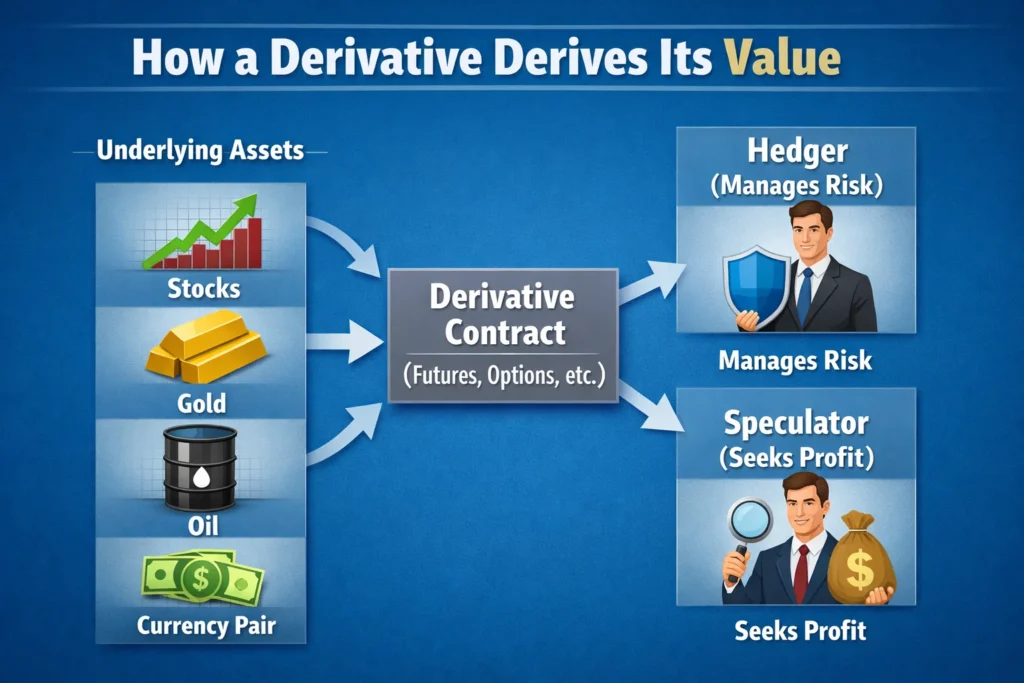

At its core, a derivative is a financial security that doesn’t have intrinsic value on its own. Instead, its value is derived from the price movements of something else—its underlying asset. Think of it like a bet on the future price of an asset, formalized into a binding contract. For instance, a crude oil futures contract’s value is tied to the future price of a barrel of oil. These contracts are traded on formal exchanges like the Chicago Mercantile Exchange (CME) or over-the-counter (OTC) between private parties. Their primary functions are to transfer risk (hedging) or to take on risk for potential profit (speculation).

Key Takeaways

The Core Concept Explained

Imagine you’re a farmer in Canada growing wheat. You’re worried the price might fall by harvest. Simultaneously, a bakery in the UK is worried the price might rise. A futures contract acts as a handshake: the farmer agrees to sell, and the bakery agrees to buy, a set amount of wheat at a fixed price on a future date. The derivative (the futures contract) now has a value that fluctuates with the market’s expectation of the future wheat price. If wheat prices soar, the contract becomes more valuable to the bakery (the buyer) and less valuable to the farmer (the seller). This simple transfer of price risk is the essence of derivatives.

A high value in a long derivative position (like owning a call option) indicates the market move is in your favor relative to the contract’s strike price. A low or negative value indicates an unfavorable move. Crucially, the value is zero-sum between the counterparties—one’s gain is the other’s loss, excluding transaction costs.

How Are Derivatives Priced and Traded?

While there’s no single “Derivative =” formula, sophisticated models determine their fair value, primarily based on the price of the underlying asset. The most famous is the Black-Scholes model for pricing options, which considers the current stock price, strike price, time to expiration, risk-free interest rates (like the US Treasury yield), and volatility.

Step-by-Step Logic for a Call Option:

- Intrinsic Value: This is the immediate profit if exercised. Call Option Intrinsic Value = Current Stock Price – Strike Price (if positive; otherwise, it’s zero).

- Time Value: This is the premium for the potential of future profit before expiration. It decays as the expiry date approaches—a process called “time decay” or “theta.”

- Other Factors: Implied volatility (expected future volatility) and interest rates significantly affect the premium.

Example: Pricing a Call Option on an NYSE Stock

- Underlying Asset: Shares of Company XYZ, trading at $100.

- Derivative: A call option contract giving the right to buy 100 shares at a $105 strike price, expiring in 3 months.

- Input Values:

- Stock Price (S) = $100

- Strike Price (K) = $105

- Time to Expiry (T) = 0.25 years

- Implied Volatility (σ) = 20%

- Risk-Free Rate (r) = 1.5% (e.g., US Treasury bill)

- Calculation (using Black-Scholes logic): The model would output a theoretical option premium, say $2.50 per share.

- Interpretation: To control the right to buy 100 shares (worth $10,000) for the next 3 months, a trader would pay a $250 premium ($2.50 x 100 shares). This leverage allows significant exposure with limited upfront capital.

Derivative Trading Checklist for Beginners

Before placing your first derivative trade, run through this essential checklist

Knowledge & Education

- ✅ Understand the specific contract specifications (expiry, multiplier, settlement type)

- ✅ Know your maximum potential loss (especially important for options sellers)

- ✅ Understand the Greeks (Delta, Gamma, Theta, Vega) relevant to your strategy

- ✅ Have practiced with paper trading for at least 2-4 weeks

Risk Management Setup

- ✅ Position size is ≤ 5% of total trading capital per trade

- ✅ Stop-loss or exit criteria are defined BEFORE entering the trade

- ✅ You’re using a broker with appropriate risk controls and alerts

- ✅ You understand the margin requirements and have sufficient buffer

Market Conditions & Timing

- ✅ Checked implied volatility levels (IV Rank/Percentile for options)

- ✅ Verified liquidity (bid/ask spreads, open interest, volume)

- ✅ Considered upcoming earnings, dividends, or economic events

- ✅ Time to expiry aligns with your forecast timeframe

Remember: If you can’t check all these boxes, reconsider the trade. Derivatives amplify both gains AND mistakes.

Need help tracking these factors? Many platforms like TradingView offer comprehensive market scanners and analytics tools.

Why Derivatives Matter to Traders and Investors

Derivatives are not just for Wall Street elites; they permeate the entire financial ecosystem relevant to traders and investors in the US, UK, Canada, and Australia.

- For Hedgers & Corporations: A US airline uses fuel futures to lock in jet fuel prices, protecting its bottom line from oil price spikes. A UK company with revenue in EUR and costs in GBP uses currency swaps to manage forex risk. This stability is crucial for business planning and is a key reason derivatives markets are so vast.

- For Speculators & Traders: They provide leveraged exposure. Instead of buying $50,000 of gold bullion, a trader might buy a gold futures contract with $5,000 margin. This amplifies returns (and losses). They also enable strategies impossible with stocks alone, like betting a stock will stay flat or fall slowly (via option spreads).

- For Portfolio Investors: ETFs and mutual funds often use derivatives like index futures for efficient cash management or to replicate exposure. Options can be used for “covered call” strategies to generate income on an existing stock portfolio.

- For Market Efficiency: Derivatives facilitate price discovery by reflecting future expectations of asset prices, and they enhance liquidity by allowing more participants to express views with less capital.

How to Use Derivatives in Your Strategy

Use Case 1: Hedging a Stock Portfolio (Protective Put)

An investor holds $100,000 of an S&P 500 ETF (like SPY) but fears a short-term downturn. Instead of selling, they can buy put options on SPY. This acts as an insurance policy: if the market falls, the gain in the put option offsets losses in the portfolio. The cost is the option premium.

Use Case 2: Income Generation (Covered Call)

An investor owns 500 shares of Apple (AAPL) trading at $170 and expects it to trade sideways. They can sell (write) call options with a $180 strike price expiring next month, collecting the premium. If AAPL stays below $180, they keep the premium as income. If it rises above $180, their shares may be called away, capping their upside but realizing a profit.

Use Case 3: Directional Speculation with Leverage (Long Futures)

A trader is strongly bullish on natural gas prices. Instead of buying and storing physical gas, they buy one natural gas futures contract (e.g., on the CME). With a margin requirement of, say, $5,000, they control gas worth $50,000. A 10% price increase yields a $5,000 gain on the $5,000 margin—a 100% return, versus 10% if they owned the physical asset.

To execute these strategies, you need a brokerage account with derivatives permissions. Platforms like Interactive Brokers, TD Ameritrade’s thinkorswim, or tastyworks offer advanced tools for derivative trading.

- Risk Management: Unparalleled tools for hedging against price, interest rate, and currency fluctuations.

- Leverage & Efficiency: Control large asset values with small capital, increasing potential returns on capital.

- Market Access: Gain exposure to hard-to-trade assets (commodities) and execute complex strategies like arbitrage.

- Price Discovery: Provide vital information about future price expectations for underlying markets.

- Income Generation: Strategies like selling covered calls can generate premium income on existing portfolios.

- Leverage Risk: Can amplify losses, potentially exceeding initial investment and triggering margin calls.

- Counterparty Risk: Risk of the other party defaulting, particularly in unregulated over-the-counter (OTC) trades.

- Complexity: Valuation and strategy require significant knowledge; misunderstanding leads to unexpected losses.

- Speculative Excess: Can encourage speculation detached from fundamentals, contributing to market instability.

- Regulatory & Tax Complexity: Subject to specific reporting rules (e.g., IRS 1256 contracts in the US) and complex tax treatments.

Choosing the Right Derivative for Your Goal

Different objectives call for different instruments. Here’s a strategic breakdown:

Goal: Protect Portfolio

Recommended Instruments:

Example:

Own $100K of SPY. Buy 2 SPY put options ($450 strike, 60 DTE) for ~$800 total. This acts as portfolio insurance for 2 months.

Goal: Generate Income

Recommended Instruments:

Example:

Own 200 AAPL shares at $175. Sell 2 call options ($185 strike, 30 DTE) for $1.50 each → collect $300 premium.

Goal: Leveraged Growth

Recommended Instruments:

Example:

Bullish on TSLA. Instead of buying 100 shares ($18,000), buy 1 call option ($200 strike, 90 DTE) for $1,200. Controls same shares for 1/15th capital.

Derivatives in the Real World: The 2020 Oil Price Crash

A stark, real-world example of derivatives in action was the crude oil price crash in April 2020. With the COVID-19 pandemic collapsing demand, the market for physical oil was glutted. The front-month West Texas Intermediate (WTI) futures contract, set to expire, became a nightmare for holders who couldn’t take physical delivery.

Traders holding long futures contracts were forced to sell at any price to avoid receiving barrels of oil with no place to store them. This caused the price of the expiring May 2020 WTI futures contract to plummet into negative territory—closing at -$37.63 per barrel. This meant sellers were paying buyers to take the contract off their hands. This event, centered on the New York Mercantile Exchange (NYMEX), was a pure derivatives phenomenon, highlighting the extreme pressures that can arise at contract expiry, the importance of understanding contract specifications, and the disconnect that can occur between paper derivatives and physical market logistics.

Tax Considerations for Derivative Trading

Understanding the tax treatment in the US, UK, Canada, and Australia

United States

Section 1256 Contracts

Includes regulated futures, broad-based index options, foreign currency contracts.

- Tax Rate: 60% long-term / 40% short-term capital gains rates, regardless of holding period

- Mark-to-Market: Required – all positions are treated as sold on last trading day of year

- Form: Form 6781

Equity Options

Options on individual stocks and ETFs.

- Tax Rate: Standard capital gains rates (based on holding period)

- Holding Period: Starts when option is exercised, not when purchased

- Wash Sale Rules: Apply to options (30-day rule)

United Kingdom

Spread Betting

Unique to UK/Ireland markets.

- Tax Status: TAX-FREE for individuals (considered gambling)

- No CGT/Income Tax: Profits are exempt from Capital Gains Tax and Income Tax

- Losses: Cannot be offset against other taxable gains

CFDs & Options

Contracts for Difference and traditional options.

- Tax Status: Subject to Capital Gains Tax

- Annual Exempt Amount: £6,000 (2023/24) for CGT

- Bed & Breakfast Rule: 30-day rule for buying back similar assets

Canada

General Treatment

Most derivatives are considered capital property.

- Tax Rate: 50% of capital gain included in income

- Superficial Loss Rules: 30-day rule applies

- Mark-to-Market: Optional for traders (election available)

Specific Rules

Special rules for certain derivatives.

- Currency Derivatives: May be treated as income

- Commodity Futures: Canadian derivatives may qualify for lower rates

- TFSA/RRSP: Limited derivative trading allowed

Australia

Retail vs. Wholesale

Different rules based on investor classification.

- Retail Clients: Standard CGT rules apply

- Wholesale Clients: May use hedging rules

- 50% CGT Discount: Available if held >12 months

Specific Considerations

Key Australian-specific rules.

- Wash Sale Rules: Strict anti-avoidance provisions

- Forex Derivatives: Subject to specific translation rules

- Super Funds: Limited derivative use permitted

Universal Tax Tips for Derivative Traders

Keep Meticulous Records

Track every trade: entry/exit dates, prices, commissions, and contract specifications. Most brokers provide annual tax statements, but your own records are essential for verification.

Understand Wash Sale Rules

Most countries have rules preventing “wash sales” – repurchasing the same or substantially identical asset within 30 days to claim artificial losses.

Consider Account Type

Tax-advantaged accounts (IRAs, ISAs, TFSAs) have restrictions. Verify what derivative strategies are permitted before trading.

Professional Help Pays

The cost of a tax professional specializing in securities trading is often worth it to avoid costly mistakes and optimize your tax situation.

Official Tax Resources by Country:

- US: IRS.gov – Publication 550: Investment Income and Expenses

- UK: GOV.UK HMRC – Helpsheet 275: Capital Gains Tax

- Canada: CRA – Guide T4037: Capital Gains

- Australia: ATO – Guide to capital gains tax

Futures Contracts vs Forward Contracts

| Feature | Futures Contracts | Forward Contracts |

|---|---|---|

| Trading Venue | Standardized, traded on regulated exchanges (e.g., CME, Eurex). | Customized, traded Over-The-Counter (OTC) between two parties. |

| Counterparty Risk | Low. The exchange’s clearinghouse guarantees settlement. | High. Dependent on the creditworthiness of the other private party. |

| Contract Terms | Standardized (size, expiry date). | Customizable to the specific needs of the parties. |

| Liquidity | Generally high due to standardization. | Lower, as terms are unique and not easily transferable. |

| Regulation | Heavily regulated (e.g., CFTC in US, FCA in UK). | Less regulated, with more privacy but more risk. |

Conclusion

Ultimately, derivatives are sophisticated financial instruments that serve as a double-edged sword. They are indispensable for managing risk in a globalized economy, allowing businesses from the US to Australia to stabilize costs and revenues. For the informed trader, they offer powerful leveraged strategies and market access. However, their complexity and inherent leverage demand respect and education. They should not be approached as simple lottery tickets but as precision tools. By understanding the mechanics of futures, options, and swaps, you can better analyze market dynamics, protect your investments, or strategically enhance returns—always mindful of the risks. Start by exploring paper trading accounts offered by many brokers to practice derivative strategies risk-free before committing capital.

Related Terms

- Hedging: The primary risk-management strategy derivatives are used for, involving taking an offsetting position to reduce exposure.

- Leverage: The use of borrowed capital or financial instruments (like derivatives) to increase the potential return of an investment.

- Margin: The collateral deposited by a trader with a broker to cover the credit risk of holding a derivative position.

- Volatility: A statistical measure of the dispersion of returns for an asset, critically important in pricing options (as “implied volatility“).

- Clearinghouse: A financial institution that acts as an intermediary and guarantor for futures and options trades, mitigating counterparty risk.

Frequently Asked Questions About Derivatives

Recommended Resources

- The Options Industry Council (OIC) – An excellent, free resource for education on equity options, including webinars and calculators.

- U.S. Commodity Futures Trading Commission (CFTC) – The regulator’s website offers guides on derivatives and market data.

- Options, Futures, and Other Derivatives by John C. Hull – The seminal academic textbook for serious students.