Asset Classes What It Is, Why It Matter, and How Do You Use Them

Imagine constructing a house: you need different materials like wood, concrete, and steel, each serving a unique purpose. In investing, asset classes are these essential materials. They are groups of investments that share common traits and react similarly to market events. Mastering their use is the first step toward crafting a sturdy financial future.

For individuals building wealth in the US, Canada, the UK, and Australia, grasping asset classes is non-negotiable for effectively engaging with major exchanges like the Nasdaq, TSX, FTSE, and ASX and securing long-term objectives.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | A category of investments that exhibit similar financial characteristics and behave in a comparable way within the marketplace. |

| Also Known As | Investment Category, Security Type |

| Main Used In | Portfolio Construction, Strategic Asset Allocation, Risk Management |

| Key Takeaway | Blending various asset classes is the most effective strategy to mitigate portfolio risk while positioning for growth. |

| Formula | N/A (A conceptual grouping, not a quantitative measure) |

| Related Concepts |

What Are Asset Classes

At its heart, an asset class is a way to categorize investments that share a common DNA. Think of it like grouping vehicles: sedans, trucks, and motorcycles all serve the purpose of transportation but have different designs, risks, and uses. Similarly, stocks, bonds, and real estate are all investment vehicles but belong to different classes based on their risk, return potential, and market behavior.

Key Takeaways

The Principle in Practice

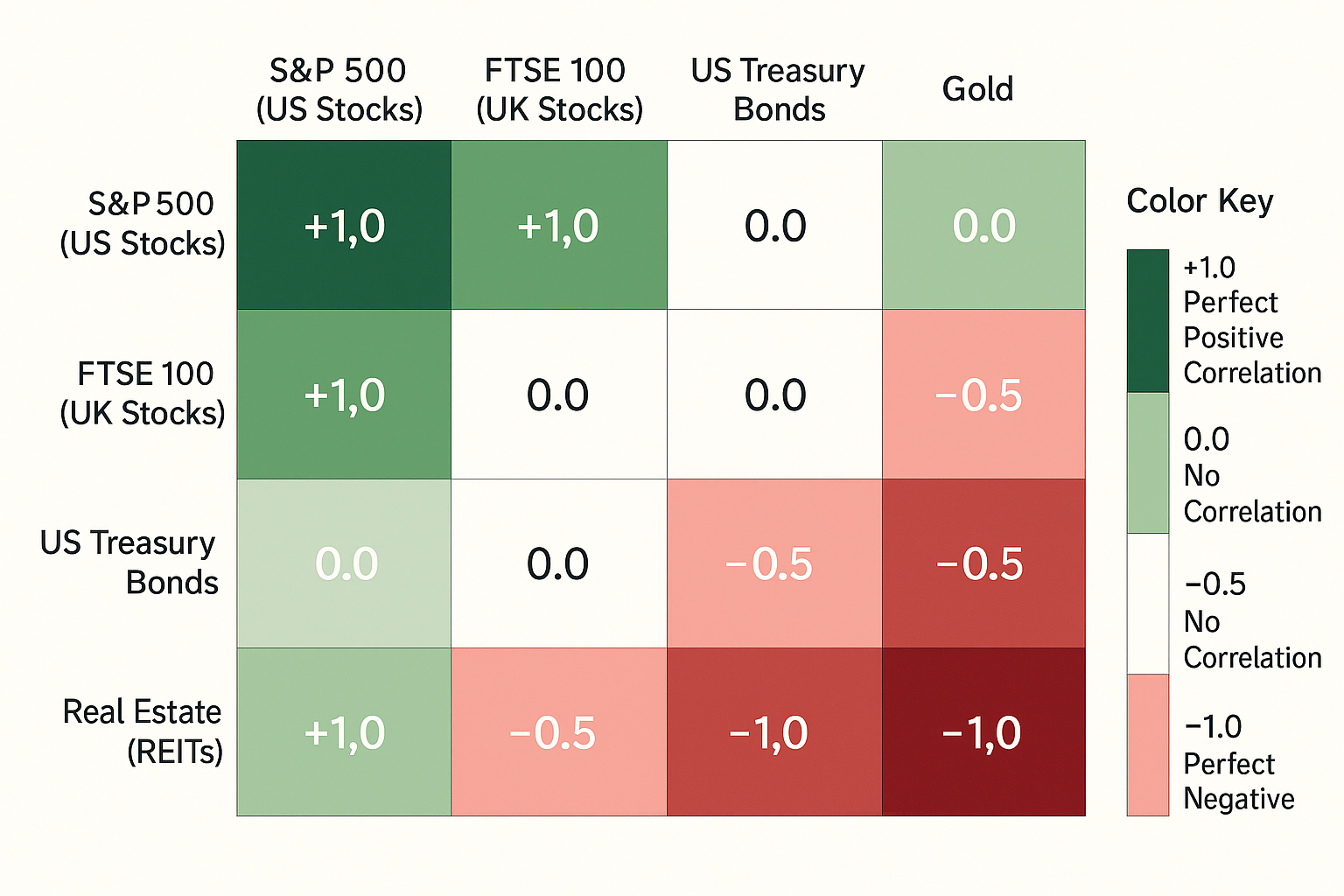

The power of this classification lies in the fact that different categories rarely move in perfect sync. When economic news boosts stock prices, the same conditions might cause bonds to dip, or vice versa. This tendency to move independently is what savvy investors harness.

By spreading your capital across these non-synchronized categories, you create a natural buffer. A downturn in one area of your portfolio can be offset by stability or gains in another, smoothing out your overall investment journey. This practice is the essence of diversification.

Role of Asset Classes

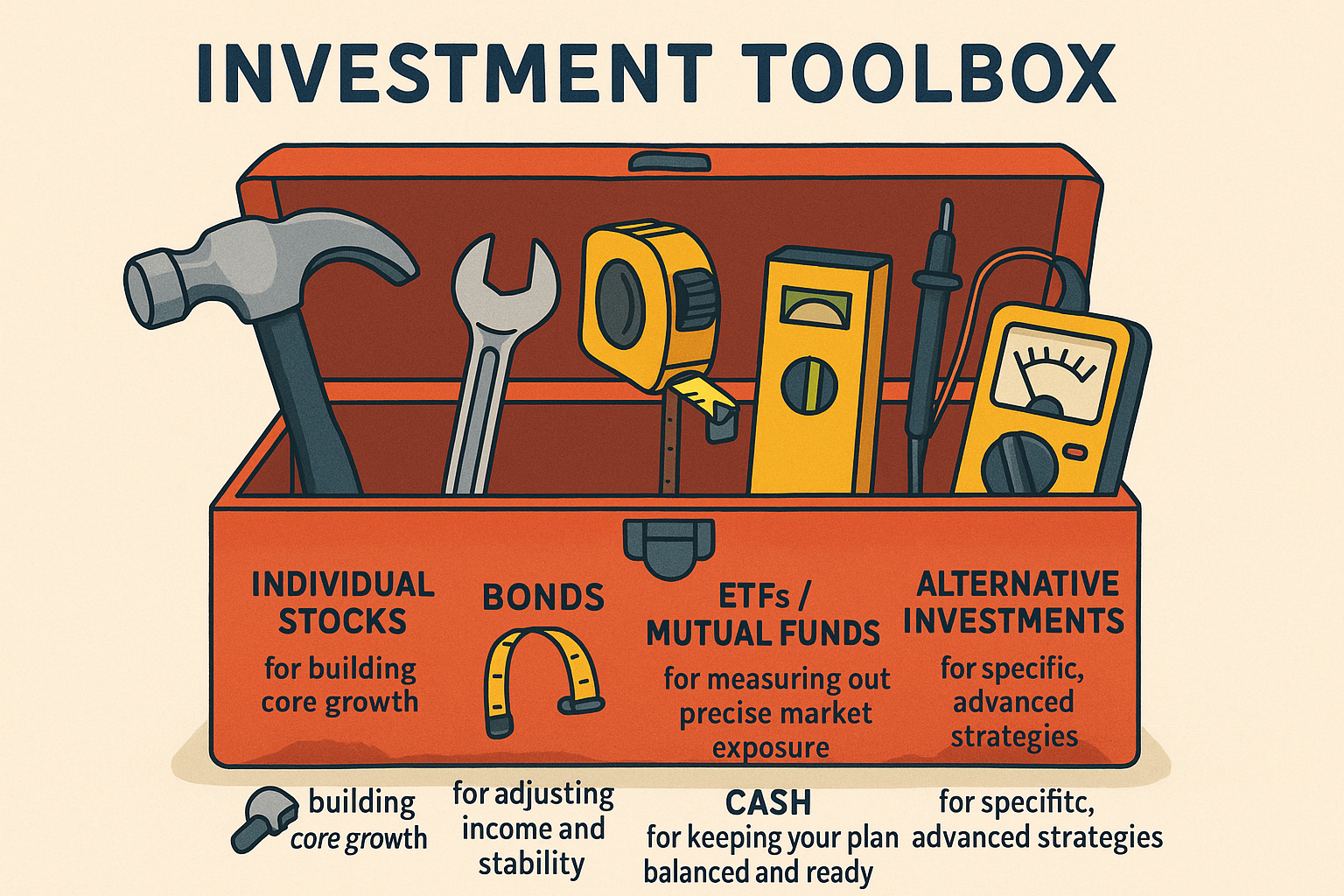

These categories are far more than just labels; they are the fundamental tools for constructing a robust financial plan. They enable you to:

- Control Risk: Spreading investments across uncorrelated categories is the most proven method to reduce the impact of a slump in any single investment.

- Target Returns: Each category carries a different historical return profile. Your choice of mix should reflect the growth or income you aim to achieve.

- Build with Intention: They allow you to move from random stock-picking to a deliberate strategy of asset allocation, deciding what percentage of your wealth to dedicate to each category.

For American and British investors, this strategic approach is vital for optimizing tax-advantaged accounts like IRAs and Self-Invested Personal Pensions (SIPPs), where asset selection directly influences net returns.

Categories of Asset Classes

The foundation of most portfolios is built upon three long-established categories:

- Equities (Stocks): Buying a stock means acquiring a small ownership stake in a company. Shareholders benefit from capital appreciation and dividends, but this class is subject to significant price swings, making it the most volatile of the three.

- Examples: Shares of Apple (AAPL), an S&P 500 index fund, an emerging markets ETF.

- Fixed-Income (Bonds): Purchasing a bond is essentially loaning money to an entity (a government or corporation) for a fixed period. In return, you receive regular interest payments and get your principal back at maturity. Bonds are generally prized for providing steady income and capital preservation.

- Examples: U.S. Treasury bonds, corporate bonds from a firm like IBM, municipal bonds.

- Cash and Cash Equivalents: This group encompasses the most liquid and lowest-risk holdings, including currency, savings deposits, and Treasury bills. The trade-off for supreme safety is very low returns, which often struggle to outpace inflation.

Alternative Categories of Asset Classes

For further diversification, investors often look to alternatives that don’t fit the traditional mold.

- Real Estate: Investors can gain exposure by directly purchasing property or through Real Estate Investment Trusts (REITs), which are companies that own and operate real estate and trade on stock exchanges.

- Commodities: This category covers raw materials and agricultural products, such as crude oil, gold, and wheat. They often serve as a protective hedge when inflation rises.

- Cryptocurrencies: A modern and highly volatile digital asset class, including Bitcoin and Ethereum, representing a speculative technological bet for many portfolios.

Implementing Asset Classes in Your Plan

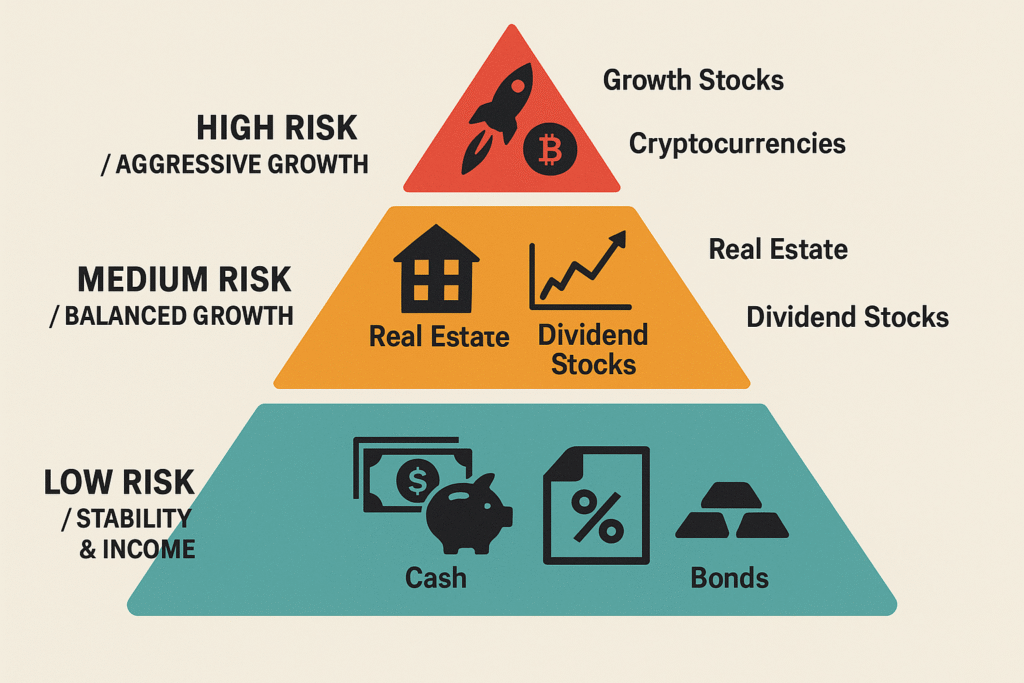

Your personalized asset allocation blueprint should be built on three pillars:

- Risk Capacity: How much market volatility can you emotionally and financially withstand?

- Investment Timeline: When will you need to access these funds? A longer horizon allows for more risk.

- Financial Targets: Is your aim aggressive growth, reliable income, or capital preservation?

Strategic Applications:

- The Growth-Oriented Investor: With a long timeline and high risk tolerance, a allocation might lean heavily into equities, including international markets for added diversity.

- The Income-Focused Investor: Someone in or near retirement might prioritize bonds and dividend-paying stocks to generate consistent cash flow.

- The Conservative Investor: An individual with short-term goals would anchor their portfolio in cash equivalents and high-quality bonds to protect their principal.

Designing your allocation is the strategic part; implementing it requires the right tools. To build a portfolio with these asset classes, you need a broker that offers a wide selection of low-cost funds. Discover our top-ranked platforms in our guide to the Best Investment Platforms for Portfolio Construction.

Pros and Cons of Asset Classes

Advantages

- Framework for Clarity: Transforms investing from overwhelming complexity into a structured, manageable process.

- Engine for Diversification: Directly tackles specific risk by ensuring no single investment’s poor performance can cripple your entire portfolio.

- Customizable Risk Exposure: Empowers you to design a portfolio whose overall volatility matches your comfort level.

- Correlation Fluidity: In times of extreme market panic, the normal relationships between classes can break down, causing many to fall simultaneously.

- Potential for Dilution: Excessive diversification can lead to average returns that simply mirror the overall market.

- Market Risk remains: While it mitigates specific risks, it cannot eliminate broad market (systemic) risk that affects nearly all investments.

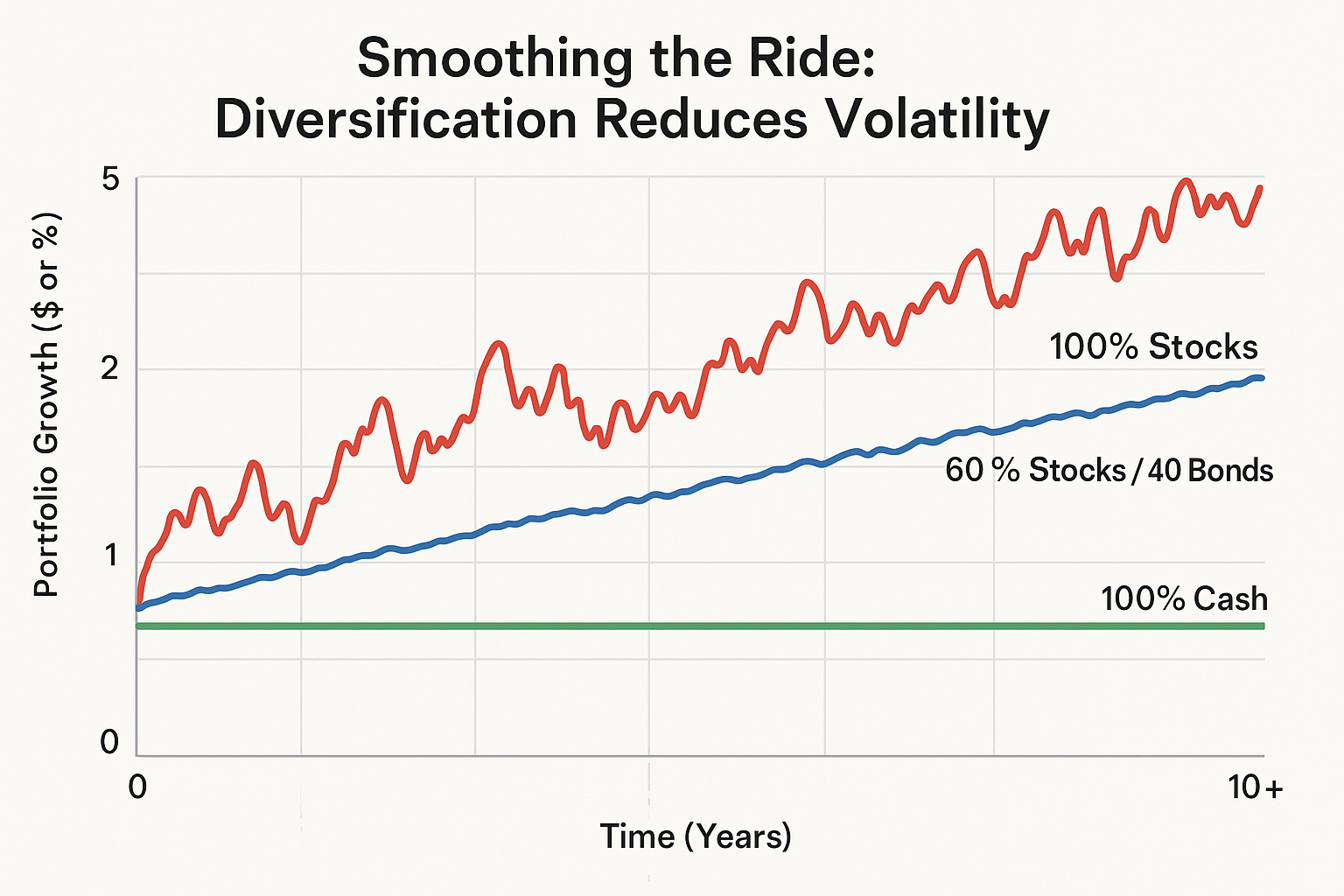

Case Study: The Classic 60/40 Blend

The 60/40 portfolio stands as a timeless example of asset classes in action.

- The Strategy: Allocate 60% of capital to equities for growth and 40% to bonds for income and stability.

- The Mechanism: During bull markets, the equity portion drives portfolio appreciation. During market corrections, the bond portion typically provides a ballast, declining less than stocks or even gaining value, thereby reducing overall portfolio drawdown.

- Modern Context: This model has been a cornerstone of prudent investing. However, its effectiveness hinges on the inverse relationship between stocks and bonds, which can be challenged during periods of rising interest rates, as seen in 2022, when both categories experienced declines.

Asset Class vs Asset Allocation

| Feature | Asset Class | Asset Allocation |

|---|---|---|

| Definition | The ingredients (e.g., Stocks, Bonds). | The recipe that specifies how much of each ingredient to use. |

| Role | Defines the types of investments available. | The active strategy of combining them to meet an objective. |

| Analogy | The different food groups. | Creating a balanced meal plan using those groups. |

Conclusion

Understanding asset classes transforms you from a mere market participant into a strategic portfolio architect. It’s not about chasing the next trend but about constructing a resilient, multi-faceted portfolio designed to meet your objectives through various market conditions. Begin by assessing your personal financial landscape, then use the framework of asset classes to build a portfolio poised for long-term success.

Ready to put this knowledge into action? The right brokerage platform is your essential partner. We’ve analyzed the features, fees, and tools of leading services to help you choose. Start building your diversified portfolio today with our curated selection of the Best Online Brokers for Long-Term Investors.

Related Terms

- Portfolio Diversification: The risk-reduction outcome achieved by investing across multiple asset classes.

- Market Correlation: A statistical measure that quantifies how closely two asset classes move together, which is critical for effective diversification.

- Rebalancing: The process of periodically realigning your portfolio back to your target asset allocation as market movements cause it to drift.

Frequently Asked Questions

Recommended Resources

How did this post make you feel?

Thanks for your reaction!