Do You Need Financial Guidance or Financial Advice

Financial guidance is the process of receiving educated advice and direction to make informed decisions about your money. It’s not about picking stocks for you, but about empowering you with the knowledge and framework to achieve your own financial goals. For individuals in the US, UK, Canada, and Australia, navigating complex tax laws and investment landscapes makes sound financial guidance not just a luxury, but a necessity for building long-term wealth.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | Advice and education that empowers individuals to make their own informed financial decisions. |

| Also Known As | Financial coaching, financial advice (distinction is key) |

| Main Used In | Personal Finance, Retirement Planning, Debt Management |

| Key Takeaway | Guidance empowers you to act; advice tells you what to do. It’s about education and strategy, not product placement. |

| Related Concepts |

What is Financial Guidance?

At its core, financial guidance is a collaborative and educational process. Think of it less as a doctor writing a prescription and more as a personal trainer for your finances. A good guide won’t just tell you what to do; they will teach you about different financial concepts, help you understand the pros and cons of various paths, and provide you with the tools and confidence to execute a plan yourself. The ultimate goal is to increase your financial literacy and self-sufficiency.

Key Takeaways

The Core Concept Explained

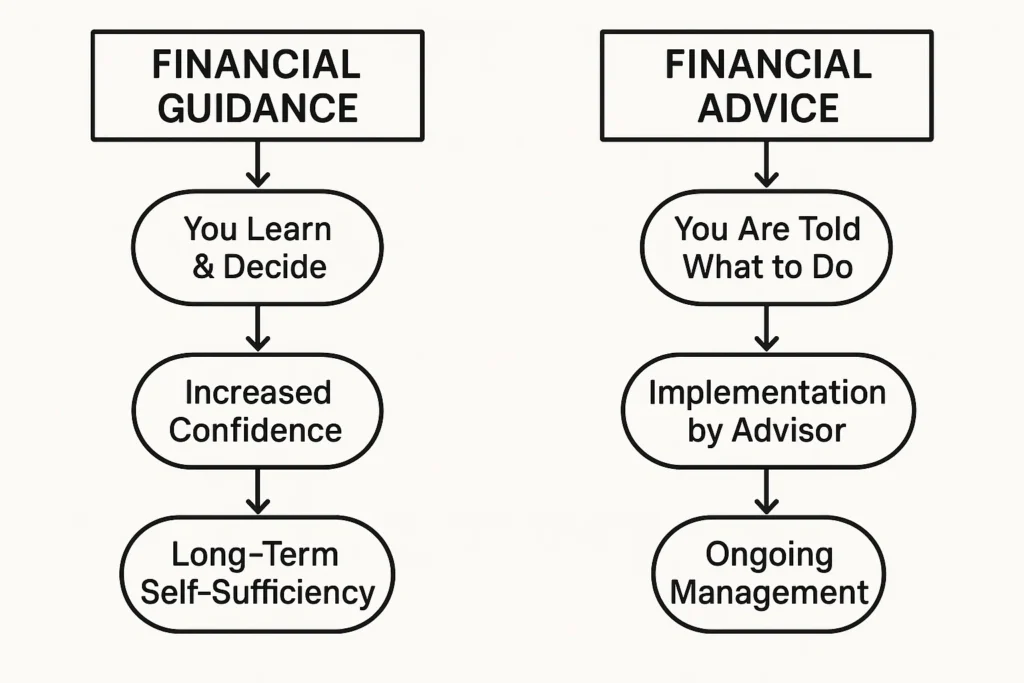

The core concept revolves around the distinction between guidance and advice. In many jurisdictions like the US and UK, financial advice is a regulated activity. When someone gives formal advice, they are making a personal recommendation to you, which carries a legal liability and often requires specific licenses (e.g., from the SEC or FCA).

Guidance, on the other hand, is about providing general, non-personalized information. A guide might say, Here are the different types of retirement accounts (IRAs, 401(k)s) and the general rules and tax implications for each. An advisor would say, Based on your income and age, you should open a Roth IRA and contribute $500 a month to Fund X.

A high-quality financial guidance relationship provides a clear, actionable financial plan, educates you on the why behind the strategy, and holds you accountable to your goals.

How Financial Guidance is Structured

Since financial guidance isn’t a numerical metric, it isn’t calculated. Instead, it’s delivered through a structured process. A reputable financial guide or platform will follow a clear framework.

The Step-by-Step Guidance Process

- Discovery & Goal Setting: This is the initial fact-finding stage. A guide will help you articulate your short-term and long-term goals, whether it’s buying a house in the UK, saving for a child’s education in Canada, or achieving financial independence in Australia.

- Financial Snapshot & Analysis: You’ll work together to assess your complete financial picture, income, expenses, assets, liabilities (debts), and current investments.

- Education & Option Exploration: Here, the guide educates you on relevant strategies. For example, they may explain the benefits of tax-advantaged accounts like a 401(k) in the US or an ISA in the UK, or different methods for tackling debt.

- Action Plan Creation: The guide helps you create a personalized, step-by-step plan. This is your roadmap, but you are the driver.

- Accountability & Ongoing Support: The guide checks in periodically to review progress, help you adjust the plan for life changes, and provide continued education.

For individuals in the US, understanding this process is critical when evaluating services from a certified financial planner (CFP) or a robo-advisor that emphasizes guidance.

Why Financial Guidance Matters to You

Everyone, from a new graduate to a pre-retiree, can benefit from financial guidance.

- For Beginners: It demystifies complex topics and provides a starting point, preventing costly early mistakes.

- For DIY Investors: It acts as a valuable second opinion, helping to identify blind spots in your strategy and ensuring your asset allocation aligns with your risk tolerance.

- For Anyone with Debt: Guidance provides structured, proven methods (like the debt snowball or avalanche) to become debt-free faster.

- For Retirement Planning: It helps you project your needs, understand your retirement account options, and create a sustainable withdrawal strategy.

The Psychology of Financial Guidance: Why a Coach Works

Understanding the numbers is only half the battle; the other half is understanding your own brain. Financial guidance is so effective because it directly addresses the behavioral and psychological barriers that often derail financial plans.

- The Intention-Action Gap: Most people intend to save more or invest wisely, but few follow through. This is known as the intention-action gap. A financial guide acts as an accountability partner, creating a system of regular check-ins that transforms vague intentions into committed actions. Knowing you have to report your progress to someone else is a powerful motivator.

- Cognitive Bias Correction: We are all prone to mental shortcuts (heuristics) and biases that lead to poor financial decisions. A guide helps you recognize and counteract these:

- Loss Aversion: The pain of losing $100 is psychologically twice as powerful as the pleasure of gaining $100. This can make you overly conservative or cause you to panic-sell in a downturn. A guide provides perspective and historical context to keep you invested.

- Anchoring: Getting stuck on a past price (e.g., I won’t sell this stock until it gets back to $50!). A guide helps you re-anchor to current fundamentals and future prospects.

- Confirmation Bias: Seeking out information that confirms our existing beliefs. A guide intentionally presents alternative viewpoints and challenges your assumptions to ensure your strategy is robust.

- Habit Formation: Financial success is less about one-off grand gestures and more about consistent, positive habits. A guide helps you design and stick to micro-habits, like automatically transferring $50 to savings every payday, that compound into significant wealth over time. They provide the external structure needed until these behaviors become internalized.

A financial guide is part educator, part strategist, and part behavioral coach. They provide the objective, external perspective needed to overcome the internal hurdles that often sabotage financial success.

How to Use Financial Guidance in Your Strategy

Use Case 1: Creating a Debt-Free Plan

A financial guide wouldn’t tell you which debt to pay off first, but they would explain the debt avalanche (highest interest rate first) and debt snowball (smallest balance first) methods. They would help you model both in a spreadsheet, see the long-term impact, and then support you in sticking with the method you choose.

Use Case 2: Determining Your Asset Allocation

Guidance is perfect for determining your stock/bond mix. A guide provides educational resources on risk tolerance questionnaires and explains the historical performance of different allocations. They help you understand why a 80/20 portfolio is different from a 60/40, empowering you to make the final allocation decision yourself.

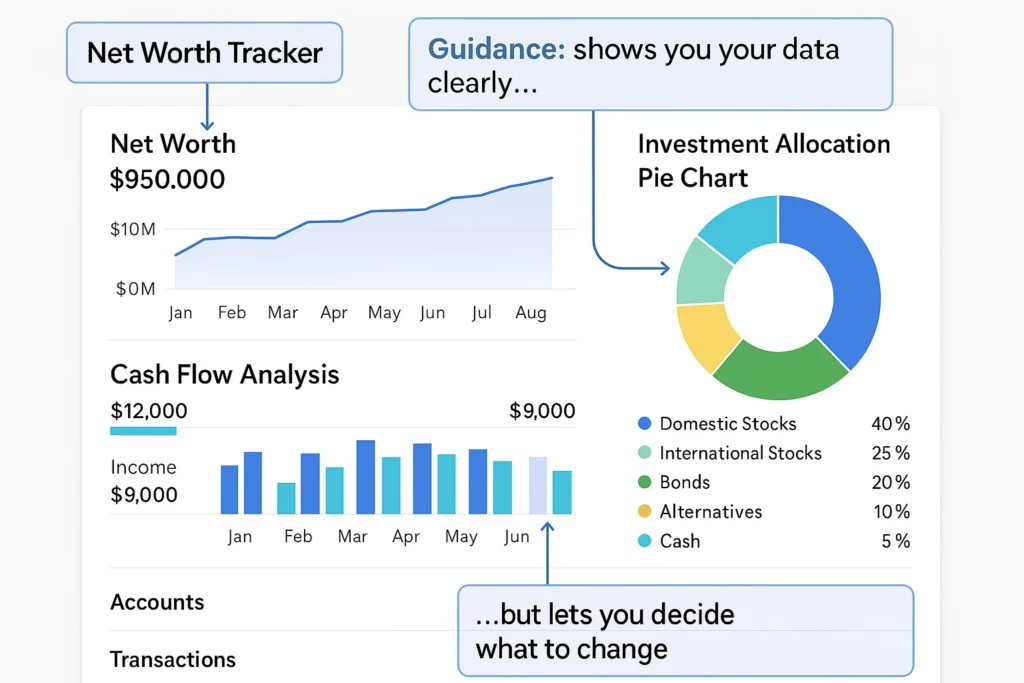

To start implementing the guidance you receive, you need a clear view of your finances. Using a robust budgeting app is the first step. We’ve tested the top personal finance apps to help you find the right one for tracking your budget and net worth.

A Sample Financial Guidance Conversation

To make the concept tangible, let’s listen in on a conversation between Alex, a client, and Taylor, a financial guide. The topic is tackling $12,000 in credit card debt.

Alex: I just feel overwhelmed. I make the minimum payments, but the balance never seems to go down. I don’t know where to start.

Taylor (Guide): That’s a very common feeling, Alex, and acknowledging it is the first step. Let’s forget the ‘perfect’ solution for a moment. Tell me, how does carrying this debt make you feel on a day-to-day basis?

(Taylor starts with an open-ended question to understand the emotional impact, not just the numbers.)

Alex: It’s like a dark cloud. I feel anxious when I check my balance. I just want it gone.

Taylor: That’s powerful motivation. Now, let’s talk about how to attack it. There are two main methods people use. I’ll explain both, and you can tell me which one resonates with you.

- The Debt Avalanche focuses on math: you list your debts by interest rate and throw every extra dollar at the highest-rate debt first. This saves you the most money on interest over time.

- The Debt Snowball focuses on momentum: you list your debts by balance and attack the smallest one first. When you pay it off, you roll that payment into the next smallest debt. This gives you quick wins and builds psychological momentum.

(Taylor educates instead of dictates, presenting options clearly.)

Alex: Honestly, the snowball method sounds better. I think seeing one card get paid off completely would keep me going.

Taylor: That’s an excellent choice. The best strategy is the one you’ll actually stick with. Now, let’s look at your budget. Where do you think you could find an extra $200 per month to accelerate this snowball?

(Taylor affirms Alex’s choice and immediately moves to co-creating an action plan, putting Alex in the driver’s seat.)

Alex: Well, I probably spend too much on food delivery… I could cut that back and maybe find a cheaper gym.

Taylor: Perfect. So, your action plan is this: 1) List your credit cards by balance. 2) Continue making minimums on all, but put every extra dollar, starting with that $200, toward the card with the smallest balance. 3) We’ll meet again in one month. Your ‘homework’ is to track your spending to lock in that $200 saving. How does that sound?

(The guide provides a clear, simple plan and establishes accountability with a follow-up.)

Alex: That sounds… actually doable. I can do that.

This conversation illustrates the core of guidance: Taylor never told Alex what to do. Instead, Taylor provided education, options, and a framework, empowering Alex to create and commit to their own personalized plan.

- Cost-Effective: Often significantly cheaper than full-scale, ongoing financial management and advice.

- Empowerment: Builds your financial literacy and confidence, leading to better lifelong habits.

- Objectivity: Since guides aren’t selling products, their guidance is often more objective and focused on your best interest.

- Clarity and Accountability: Provides a clear roadmap and a system of accountability to keep you on track.

- Not Personalized Advice: It cannot provide specific, legally binding recommendations to buy this stock or invest in that fund.

- Requires Self-Management: You are ultimately responsible for executing the plan. The guide won’t place trades for you.

- Varying Quality: The term “financial guide” is not a protected title, so the quality and expertise of individuals can vary widely.

- May Not Be Sufficient for Complex Situations: Those with very high net worth, complex estate planning needs, or tax situations may require a fiduciary financial advisor.

Red Flags: When Guidance is Actually a Sales Pitch

Because financial guide is not a legally protected term, anyone can use it. Protecting yourself requires vigilance. Here are critical red flags that signal a guide may not have your best interests at heart.

- Red Flag 1: The Product Pusher. They quickly steer the conversation toward a specific, often complex, insurance or investment product (e.g., whole life insurance, a non-traded REIT, or a proprietary fund) before fully understanding your situation. True guidance is product-agnostic.

- Red Flag 2: The Jargon Jockey. If you constantly hear acronyms and complex terms that aren’t clearly explained, it may be a tactic to confuse you and create a dependency. A true guide demystifies finance and uses plain language.

- Red Flag 3: The Fee Phantom. They are evasive, unclear, or contradictory about how they are compensated. If they can’t simply explain how they get paid, it’s a major warning sign. Legitimate professionals are transparent about fees (hourly, flat-fee, subscription).

- Red Flag 4: The Guarantee Guru. Anyone who promises specific, high, or risk-free returns is violating a fundamental principle of investing. Markets are inherently uncertain. Such promises are hallmarks of scams or extremely unsuitable sales tactics.

- Red Flag 5: The Credential Cloaker. They use impressive-sounding but meaningless certifications from self-appointing organizations. Always verify credentials with the issuing body (e.g., the CFP Board for a CFP designation).

- Red Flag 6: The Pressure Cooker. They create a false sense of urgency, claiming this opportunity won’t last. This is a high-pressure sales tactic designed to short-circuit your rational decision-making process. A real guide encourages you to take your time and do your own due diligence.

Your Action Plan: If you encounter even one of these red flags, walk away. The cost of a bad financial relationship far exceeds the cost of doing nothing at all.

The Rise of Robo-Advisors as Guidance Tools

Companies like Betterment and Wealthfront in the US or Nutmeg in the UK are prime examples of financial guidance scaled through technology. They don’t give personalized advice, but they provide immense guidance.

A user answers questions about their goal (e.g., retirement in 30 years), risk tolerance, and time horizon. The platform then:

- Educates: It explains the principles of modern portfolio theory and diversification.

- Provides a Plan: It suggests a specific, pre-built portfolio of ETFs based on the user’s inputs.

- Automates the Process: It offers automated features like tax-loss harvesting and rebalancing.

The user is guided every step of the way but retains control and understanding of their portfolio. This model has empowered millions to start investing with a sound, strategic foundation without the high cost of a human advisor.

Ready to explore a guided investing approach? We compare the top robo-advisors for US investors, breaking down their fees, features, and investment philosophies.

Conclusion

Ultimately, financial guidance is a powerful tool for democratizing financial wellness. It shifts the dynamic from dependence to informed self-reliance. While it has limitations for highly complex scenarios and requires you to be an active participant, the benefits of empowerment, cost savings, and clarity are profound. By seeking out quality financial guidance, you equip yourself with the knowledge and strategic framework to navigate market volatility and make confident decisions. Start by using a free budgeting app to get a clear snapshot of your finances, your first step in a self-guided journey.

Taking control of your financial future starts with the right partner. Whether you’re looking for a human coach or a sophisticated digital platform, our curated list of the best financial guidance services can help you find the perfect fit.

How Financial Guidance Relates to Other Concepts

The most common point of confusion is between Guidance and Advice.

| Feature | Financial Guidance | Financial Advice |

|---|---|---|

| What it provides | Education, tools, and a strategic framework. | Specific, personalized recommendations. |

| Regulation | Largely unregulated. | Highly regulated (e.g., by SEC, FCA). |

| Client Role | Active participant and decision-maker. | Often a more passive recipient. |

| Cost Structure | Often flat-fee, subscription, or low AUM fee. | Commission-based or a percentage of AUM. |

| Primary Use | Building knowledge and self-management skills. | Delegating management and complex planning. |

Related Terms

- Fiduciary Duty: A legal obligation to act in a client’s best interest. Some financial guides are fiduciaries, but it’s a core requirement for registered investment advisors (RIAs).

- Financial Planner: A professional who helps clients meet long-term goals, often using a blend of guidance and formal advice.

- Asset Allocation: The strategic distribution of investments across asset classes, a key concept you will learn through financial guidance.

- Robo-Advisor: An automated platform that provides financial guidance and portfolio management at a low cost.

Frequently Asked Questions

Recommended Resources

- How to Choose Between a Financial Advisor and a Robo-Advisor

- Top 5 Personal Finance Books for Beginners

- SEC.gov, Investor.gov: For educational resources and advisor background checks.

- CFP Board: To find and verify Certified Financial Planners.

- The National Foundation for Credit Counseling (NFCC): A non-profit for credit and debt guidance.