Limit Order What It Is, How It Works, and Why You Need It

A limit order is a foundational tool for precise and disciplined trading, allowing you to set the maximum price you’re willing to pay for a security or the minimum you’re willing to sell it for. It grants you control over your trade execution price, protecting you from the whims of volatile market movements. For active traders and long-term investors across the US, UK, Canada, and Australia, mastering the limit order is essential for executing a strategic and cost-effective investment plan on exchanges like the NYSE, NASDAQ, and LSE.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | An order to buy or sell a security at a specified price or better. |

| Also Known As | Price-Controlled Order |

| Main Used In | Stock Trading, Options Trading, Forex, Crypto Trading |

| Key Takeaway | It guarantees price but does not guarantee execution. |

| Related Concepts |

What is a Limit Order

A limit order is an instruction you give to your broker to buy or sell a specific asset only at a specified price or a more favorable one. In simple terms, you set a price “limit,” and the trade will only execute if the market reaches that price.

Imagine you want to buy a specific book, but you’re only willing to pay $20 for it. Instead of buying it at the current store price of $25, you set a limit order with the bookstore. You tell them, “Only sell me this book if the price drops to $20 or lower.” You might get the book if the price falls, but if it never does, you don’t buy it. The same logic applies to selling.

Key Takeaways

The Core Concept Explained

The core concept revolves around control versus certainty. A market order prioritizes certainty of execution but gives up control over the price. A limit order does the opposite: it prioritizes control over the price but sacrifices the certainty of execution.

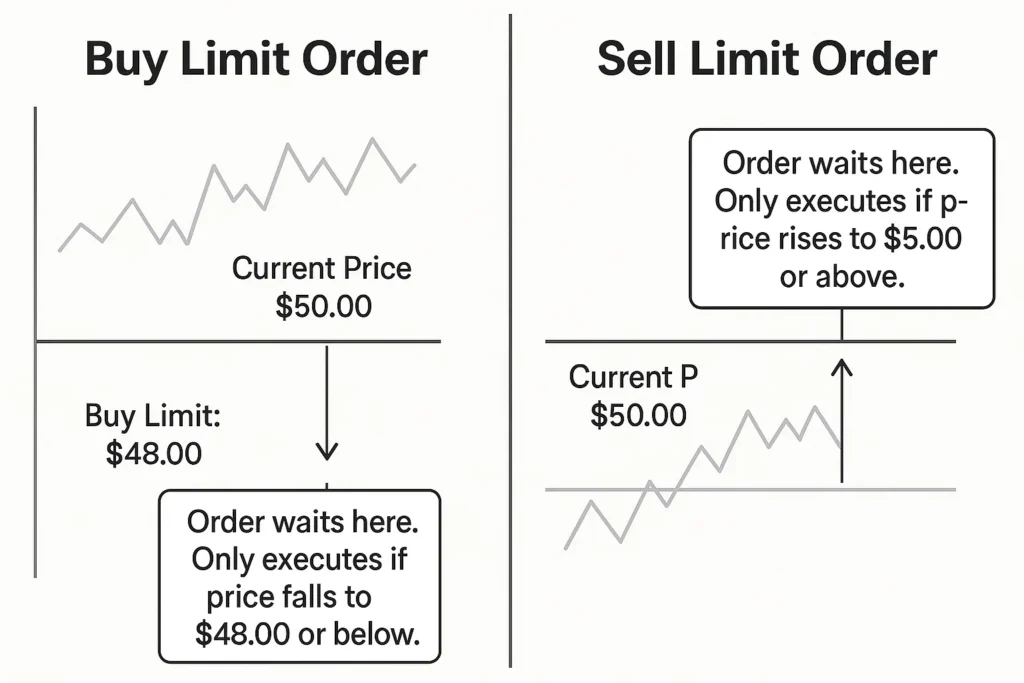

When you place a limit order, it is sent to the exchange’s order book. A buy limit order will only be executed at the limit price or lower. A sell limit order will only be executed at the limit price or higher.

The Psychology of the Limit Order: Trading with Discipline

Most articles miss the psychological component. A limit order is more than a tool; it’s a commitment to a plan.

- Combating FOMO (Fear Of Missing Out): When a stock is skyrocketing, the urge to chase it with a market order is strong. A buy limit order set at a logical support level forces you to wait for a pullback, preventing emotional, impulsive buys at the top.

- Enforcing Profit-Taking: It’s easy to become greedy when a trade is in the money. Pre-setting a sell limit order at a target price automates the process of taking profits, locking in gains before a reversal can erode them.

- The Patience Factor: Limit orders teach patience, a trader’s greatest virtue. They allow the market to come to you, reinforcing a strategy-driven approach over a reactive one.

How to Place a Limit Order

Placing a limit order is a straightforward process on any major brokerage platform like Fidelity, Charles Schwab, or Interactive Brokers.

Step-by-Step Order Placement

- Select the Security: Choose the stock, ETF, or other asset you wish to trade.

- Choose Action: Select “Buy” or “Sell.”

- Select Order Type: Change the default “Market” order to “Limit.”

- Set the Limit Price: Enter your desired maximum purchase price or minimum sale price.

- Set Quantity: Enter the number of shares or units.

- Choose Duration (Time in Force): Select how long the order should remain active (e.g., “Day” for until market close, or “GTC” for Good ‘Til Canceled).

Example: Buying Apple (AAPL) Stock

- Scenario: AAPL is currently trading at $185. You believe it’s a good buy at $180 but don’t want to pay more.

- Input Values:

- Action: Buy

- Order Type: Limit

- Limit Price: $180.00

- Quantity: 10 shares

- Duration: GTC

- Interpretation: Your broker will only purchase shares of AAPL if the price drops to $180 or lower. If the price never reaches $180, your order will sit open, unfilled.

For an investor in the UK looking to buy a FTSE 100 company like Unilever (ULVR), they might place a buy limit order at 4,100p when the current price is 4,200p to get a better entry point.

Why Limit Orders Matter to Traders and Investors

- For All Investors: They prevent overpaying for assets during rapid price increases (for buys) and prevent selling for too low during flash crashes (for sells). This is a key risk management tool.

- For Traders: They allow for the execution of precise strategies. A day trader might use a limit order to take profits at a predetermined resistance level, while a swing trader might use one to accumulate a position on a dip.

- For Long-Term Investors: It automates the process of buying into great companies at a “discount.” A value investor can set a buy limit order at their calculated intrinsic value and wait for the market to come to them, enforcing patience and discipline.

How to Use Limit Orders in Your Strategy

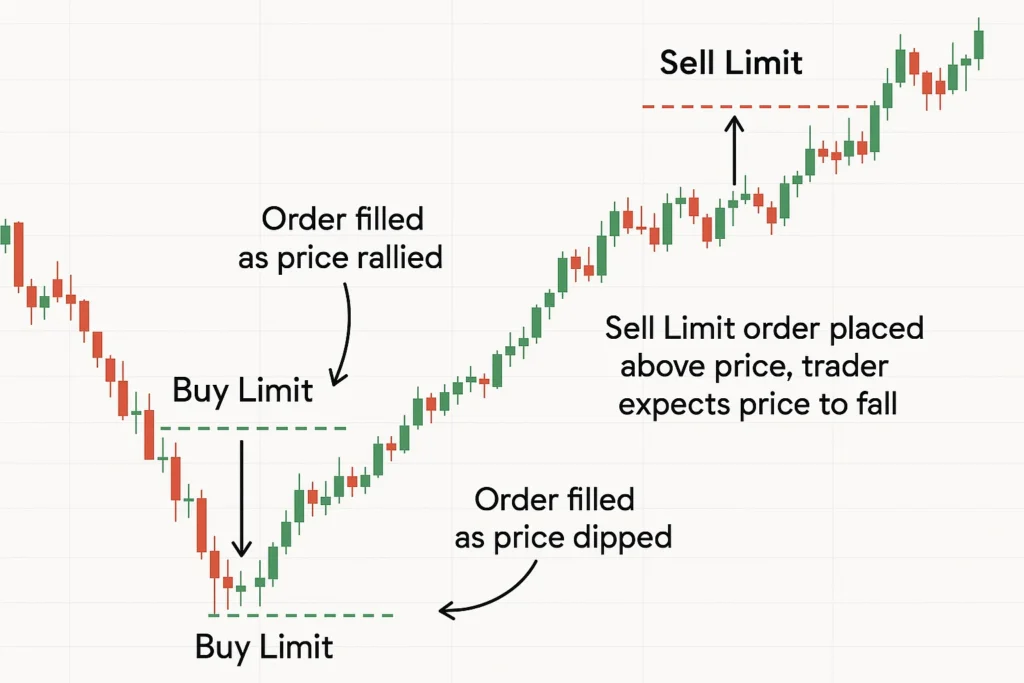

Use Case 1: Accumulating a Position on a Pullback

- Scenario: You want to buy more shares of a Vanguard S&P 500 ETF (VOO) but believe a short-term market pullback is likely.

- Action: Place a buy limit order 2-3% below the current price. This allows you to automatically buy the dip without constantly monitoring the charts.

Use Case 2: Taking Profits at a Target Price

- Scenario: You bought Microsoft (MSFT) at $250, and your analysis suggests $320 is a strong resistance level where you’d like to take profits.

- Action: Place a sell limit order at $320. If the price rallies to that level, your shares will be sold automatically, locking in your gains.

To start using limit orders effectively, you need a brokerage platform with reliable order execution and advanced charting tools to identify your entry and exit points.

Advanced Limit Order Strategies

Move beyond the basics with these powerful tactics used by professional traders.

- Strategy 1: Scaling In and Out with Multiple Limit Orders

- Concept: Instead of buying your entire position at one price, use a series of staggered limit orders.

- Example: You want to buy 300 shares of Google (GOOGL) and believe $140 is a fair value. Instead of one order for 300 shares at $140, you could place:

- Buy 100 shares @ $142.00 (getting an early entry if momentum continues)

- Buy 100 shares @ $140.00 (your primary target)

- Buy 100 shares @ $138.00 (adding more if it dips further)

- Benefit: This “averages” your entry price and allows you to build a position dynamically as the price moves.

- Strategy 2: The “Limit Order Iceberg”

- Concept: For large orders, displaying the full size can move the market against you. An iceberg order (available on many advanced platforms) only shows a small portion of your total limit order size in the public order book.

- Example: You want to sell 10,000 shares of a company. A standard sell limit order would show the entire 10,000 shares, potentially scaring away buyers. An iceberg order might only display 500 shares at a time. As those 500 shares are filled, the next 500 are automatically displayed.

- Benefit: Minimizes market impact and hides your full trading intention.

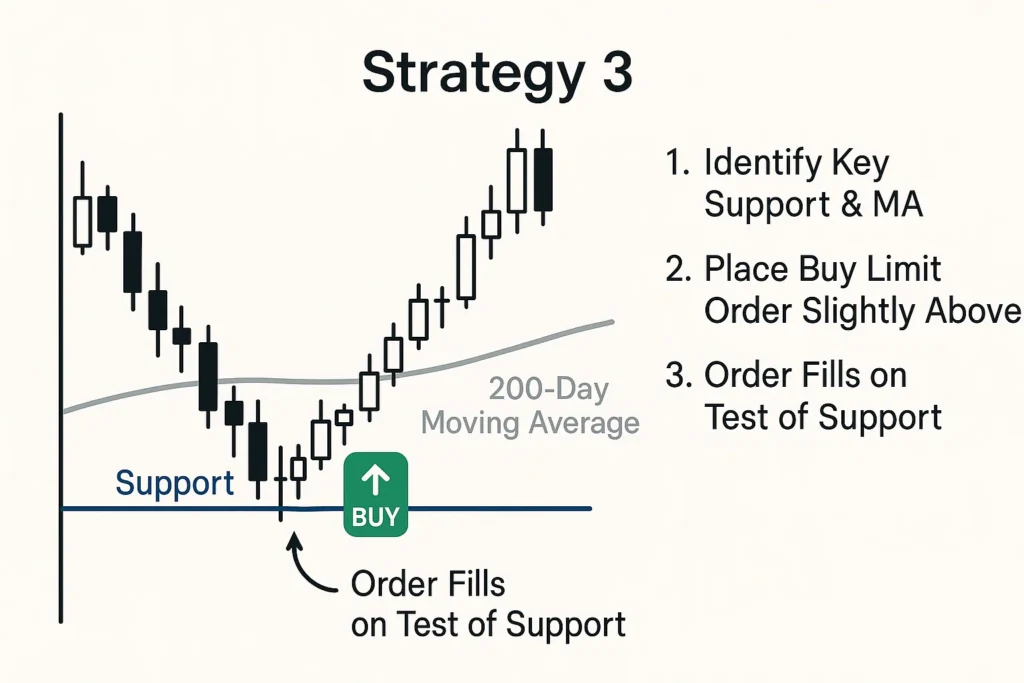

- Strategy 3: Pairing with Technical Analysis for High-Probability Entries

- Concept: Use technical indicators to make your limit orders smarter.

- Example: You identify a strong support level on Tesla (TSLA) at $220, coinciding with its 200-day moving average. Placing a buy limit order just above support, say at $221.50, increases the probability of your order being filled on a touch of support without waiting for a full breakdown.

Advantages and Limitations of Limit Orders

- Price Control: The primary benefit. You know your exact entry or exit price upfront.

- Cost-Effectiveness: Helps avoid slippage (the difference between the expected and actual execution price), especially in volatile or illiquid markets.

- Discipline: Automates your strategy and removes emotional decision-making from the execution process.

- Opportunity to Get a Better Price: Can result in a better fill than the current market price.

- No Execution Guarantee: The biggest risk is that the price never reaches your limit, and the order goes unfilled, causing you to miss a move entirely.

- Partial Fills: In fast-moving markets, you might only get a portion of your order filled at your limit price.

- Requires More Knowledge: You need to have a view on what a “good” price is, which requires analysis.

Hidden Pitfalls and How to Avoid Them

Here are some of the hidden pitfalls to avoid from:

- Pitfall 1: The “Penny Wise, Pound Foolish” Mistake

- Scenario: A stock is at $50.10, and you desperately want to buy at $50.00. You set a buy limit at $50.00, but the price dips to $50.05 and then rallies to $60.00. By trying to save $0.10 per share, you missed a $10.00 move.

- Solution: In a strongly trending market, be more flexible with your limit price. Consider setting it a few cents above a key level to ensure a fill.

- Pitfall 2: Illiquid and Volatile Markets

- Scenario: You place a sell limit order on a low-volume penny stock. The price hits your limit, but there are no buyers at that price at that exact moment. Your order doesn’t fill, and the price immediately plunges.

- Solution: Understand that limit orders in illiquid markets are highly unreliable. The “bid-ask spread” is wide, and the displayed “last price” may not reflect the price you can actually transact at.

- Pitfall 3: During Major News Events

- Scenario: You have a sell limit order on a stock at $55.00. Bad earnings are released overnight, and the stock opens at $45.00. Your limit order, now far above the current price, is essentially useless.

- Solution: Be aware that limit orders are ineffective against gap risk. In these cases, a stop-loss order (with its own risks) is the appropriate protective measure.

Limit Order in the Real World: The Flash Crash

The “Flash Crash” of May 6, 2010, is a perfect case study. In a matter of minutes, the Dow Jones Industrial Average plummeted nearly 1,000 points, and many individual stocks, like Procter & Gamble (PG), briefly traded down 30-40% before rapidly recovering.

- Traders with Market Orders: Those who had sell market orders during the crash sold their shares at the drastically lower, panic-induced prices, realizing massive, instantaneous losses.

- Investors with Sell Limit Orders: Those who had sell limit orders set at a specific price floor (e.g., 10% below the market’s pre-crash level) did not have their orders triggered because the price collapse was so swift and deep that it blew straight through their limit price without a fill. However, those with buy limit orders set far below the market were able to purchase high-quality assets at fire-sale prices, which proved highly profitable once the market rebounded minutes later.

This event highlights the double-edged sword: limit orders can protect you from irrational price moves but can also cause you to miss an exit during an extreme, non-orderly market event.

Limit Orders in Different Asset Classes

Showcasing expertise by explaining nuances across markets.

- Forex (Foreign Exchange):

- Known as “Limit Entry Orders.” The OTC (Over-the-Counter) nature of forex means there is no central exchange order book. Your broker is the counterparty, so execution quality is critical.

- Broker Tip: Choose a well-regulated, ECN/STP broker for the best limit order execution, as they have less incentive to manipulate prices.

- Cryptocurrency:

- Functionally identical to stocks but often with 24/7 trading. The extreme volatility means limit orders are essential to avoid massive slippage.

- Advanced Feature: Many crypto exchanges offer “Post-Only” mode for limit orders. This guarantees you pay only the “maker” fee (a rebate in some cases) by ensuring your order adds liquidity to the book and doesn’t fill immediately.

- Options:

- Crucial due to often wide bid-ask spreads. You would never use a market order on a low-volume option. A limit order allows you to set a price in the middle of the spread and wait for a fill.

- Example: An option has a bid of $1.10 and an ask of $1.20. Placing a buy limit order at $1.15 is a strategic way to get a better price than the current offer.

Limit Order vs Stop-Loss Order

The most common point of confusion is between Limit Orders and Stop Orders.

| Feature | Limit Order | Stop-Loss Order (Stop Market) |

|---|---|---|

| Primary Function | Control the execution price. | Control the risk after a price level is broken. |

| Execution Trigger | Executes at the limit price or better. | Becomes a market order when the stop price is hit. |

| Price Guarantee? | Yes. | No. Executes at the next available market price. |

| Best For… | Entering/exiting at a specific price. | Limiting losses on an existing position. |

Conclusion

Ultimately, the limit order is a fundamental tool that provides critical price protection for anyone participating in the financial markets. While it is not a guarantee of execution, its benefits in enforcing discipline, managing costs, and implementing a structured strategy are undeniable. As we’ve seen, it should be your go-to order type for entering and exiting positions according to a pre-defined plan, rather than reacting emotionally to market noise. By consistently using limit orders, you transition from being a passive market participant to an active, strategic investor. Start by replacing your next market order with a limit order and experience the difference in control.

Ready to put these concepts into action with a broker that offers fast, reliable limit order execution? We’ve meticulously reviewed and ranked the best online brokers for active traders to help you get started.

Related Terms

- Market Order: An order to buy or sell immediately at the best available current price.

- Stop-Loss Order: An order designed to limit an investor’s loss on a position.

- Stop-Limit Order: A hybrid order that combines features of both stop and limit orders.

- Good ‘Til Canceled (GTC): A time instruction for how long a limit order remains active.

- Order Book: The real-time list of buy and sell orders on an exchange.