Stock Market Investing A Beginner's Guide to Building Wealth

The stock market is the dynamic engine of the global economy, where public companies raise capital and individuals can build wealth by owning a piece of them. For investors in the US, UK, Canada, and Australia, it provides access to world-leading exchanges like the NYSE, NASDAQ, and LSE, serving as a primary vehicle for achieving long-term financial goals like retirement.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | A public network of exchanges and markets where shares of publicly-held companies are issued, bought, and sold. |

| Also Known As | Equity Market, Share Market |

| Main Used In | Investing, Trading, Portfolio Management, Retirement Planning |

| Key Takeaway | The stock market is a powerful tool for wealth creation over the long term, but it inherently carries risk and volatility. |

| Related Concepts |

A Quick Glossary

Before you dive in, understanding the common language is key.

- Bull Market: A sustained period of rising prices and investor optimism.

- Bear Market: A sustained period of falling prices (typically 20%+ from highs) and pessimism.

- Market Order: An order to buy or sell a stock immediately at the best available current price.

- Limit Order: An order to buy or sell a stock only at a specific price or better, giving you control over execution price.

- Blue-Chip Stock: Shares of a large, well-established, and financially sound company with a history of stable performance (e.g., Johnson & Johnson, Microsoft).

What is the Stock Market

Think of the stock market not as a single entity, but as a network of global marketplaces—like a vast, 24/7 farmers’ market for securities. Instead of vegetables, people are buying and selling small ownership stakes, called shares or equities, in publicly-traded companies. When you buy a share of a company, you become a part-owner, or shareholder. The primary function of this market is capital formation: it allows companies to access capital from investors to fund expansion, research, and hiring. In return, investors get the potential to share in the company’s future profits through dividends and capital appreciation.

Key Takeaways

The Core Concept Explained

At its core, the stock market is an auction. On one side, you have investors who believe a company’s value (and its share price) will rise, they are the buyers. On the other, you have investors who believe the price will fall or want to cash out, they are the sellers. The constant interaction between these groups determines the price of a stock at any given moment.

A high or rising price generally indicates strong investor confidence in a company’s future earnings potential. A low or falling price suggests concerns about its prospects. The market as a whole aggregates all this information, making it a powerful, if sometimes emotional, discounting mechanism for the future.

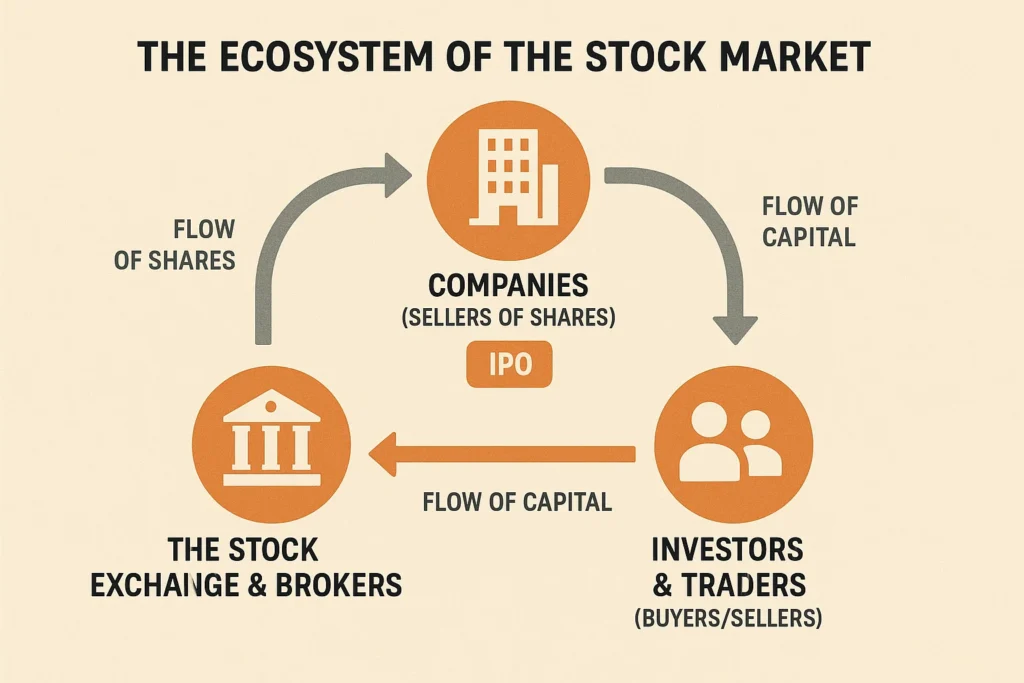

How the Stock Market Works

The market operates through a interconnected system. Companies first list their shares through an Initial Public Offering (IPO) on a primary market. Once listed, those shares trade between investors on the secondary market, which is what we typically think of as “the stock market.” This trading is facilitated by exchanges (e.g., the NYSE, a physical auction floor, or the NASDAQ, an electronic network) and executed through brokerage firms who act as intermediaries for investors.

The Role of Key Players

- Listed Companies: Sell ownership stakes to raise capital (e.g., Apple on the NASDAQ, HSBC on the LSE).

- Investors & Traders: Provide capital by buying shares, aiming for profits.

- Brokers: Provide the platform and access to the exchanges for a fee (commission).

- Regulators: Ensure fairness and transparency (e.g., the SEC in the United States, the FCA in the UK).

- Market Indices: Track the performance of a basket of stocks to gauge market trends (e.g., the S&P 500 for large US companies, the FTSE 100 for the UK).

Why the Stock Market Matters to Traders and Investors

The stock market is not just a numbers game; it’s a fundamental component of personal and national economic health.

- For Investors: It is one of the most proven avenues for long-term wealth creation, historically outperforming savings accounts and bonds. It allows for participation in the growth of the global economy and is the bedrock of most retirement plans, like 401(k)s in the US or ISAs in the UK.

- For Traders: It provides a liquid marketplace to profit from short-term price fluctuations across various strategies, from day trading to swing trading.

- For the Economy: It efficiently channels savings from individuals into productive use by companies, fueling innovation, job creation, and economic expansion.

Behavioral Pitfalls: The Investor’s Worst Enemy

Often, the biggest risk in the market is yourself. Being aware of these common psychological biases can save you from costly mistakes.

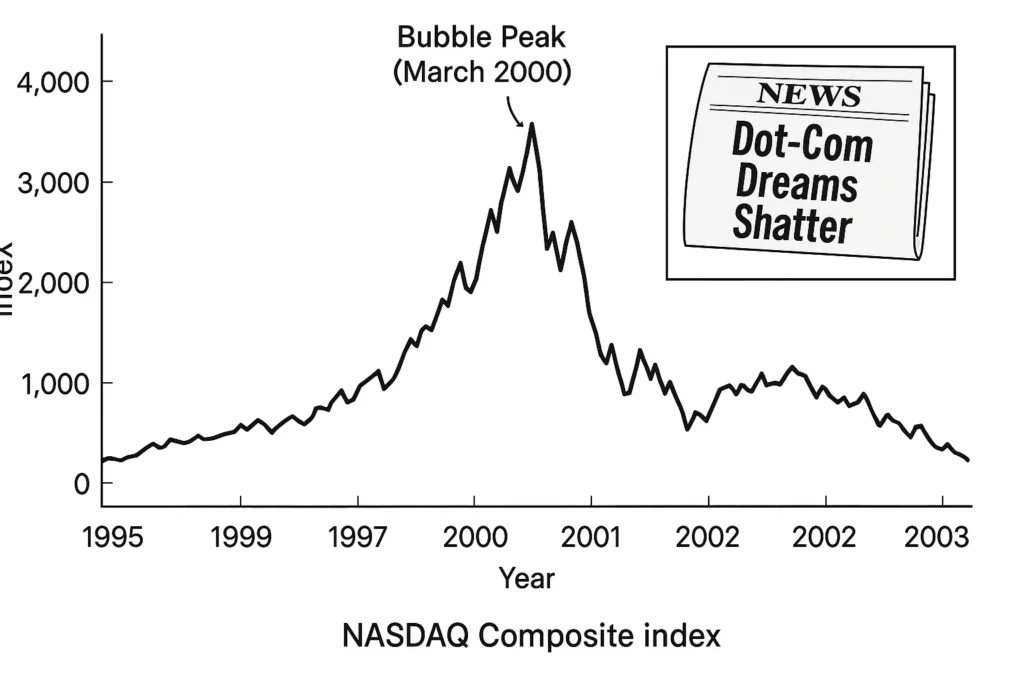

- Herding: Following the crowd into popular investments (like during the dot-com bubble) without your own research.

- Loss Aversion: The pain of a loss feels worse than the pleasure of an equivalent gain. This can cause investors to sell winning stocks too early and hold onto losing stocks for too long, hoping they’ll “break even.”

- Confirmation Bias: Seeking out information that confirms your existing beliefs about an investment while ignoring contradictory evidence.

How to Use the Stock Market in Your Strategy

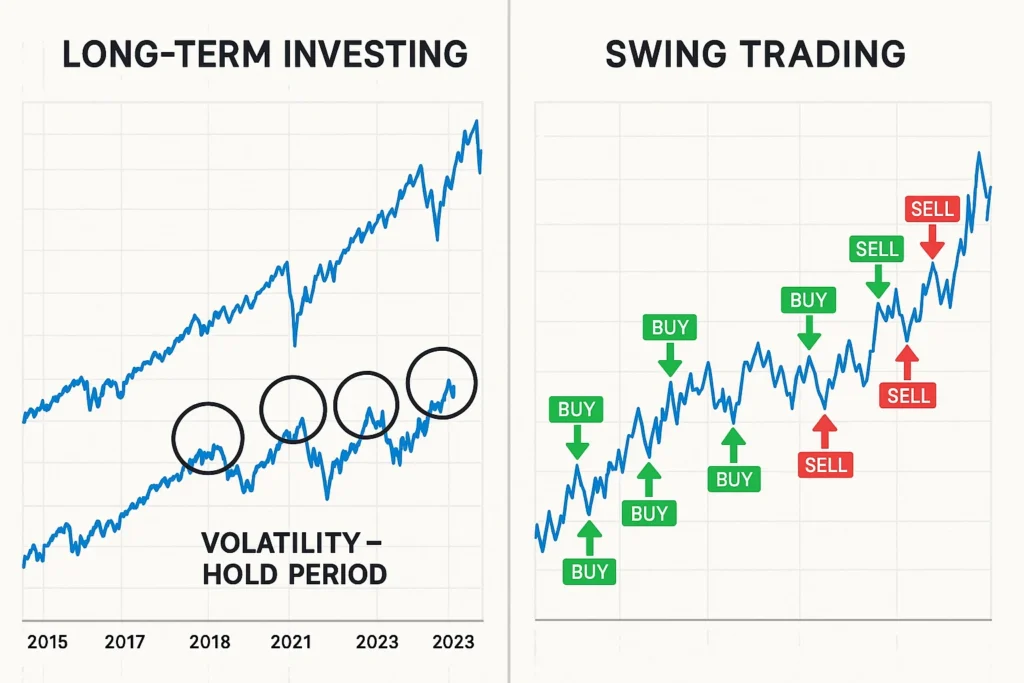

Use Case 1: Long-Term “Buy and Hold” Investing

This strategy involves buying shares of fundamentally strong companies or low-cost index funds (like an S&P 500 ETF) and holding them for many years, compounding returns and riding out short-term volatility. It’s ideal for retirement savings.

Use Case 2: Dividend Investing

Focus on buying stocks of established companies that pay regular dividends. This provides a passive income stream, which can be reinvested to accelerate wealth building.

Use Case 3: Swing Trading

Traders use technical analysis on price charts to identify stocks in a short-term uptrend, buying with the intention of selling after a predicted price swing for a profit.

Executing any of these strategies requires a reliable brokerage account. To find the right platform for your goals, explore our in-depth review of the Best Online Brokers for Beginners in the US.

- High Return Potential: Historically offers one of the highest average returns of any major asset class.

- Liquidity: Allows you to buy and sell investments quickly and easily.

- Ownership & Dividends: Provides a real stake in companies and potential income.

- Diversification: Access to thousands of companies and sectors globally to spread risk.

- Inherent Volatility: Prices can fluctuate wildly in the short term, leading to potential losses.

- Risk of Loss: There is no guarantee of returns; it’s possible to lose your entire principal investment.

- Requires Research & Expertise: Successful investing requires time, knowledge, and emotional discipline.

- Macroeconomic Risks: Recessions, inflation, and geopolitical events can negatively impact the entire market.

The Stock Market in the Real World: The Dot-Com Bubble

The dot-com bubble of the late 1990s and its crash in 2000-2002 is a classic case study of market psychology. Driven by euphoria around the new “internet” sector, investors poured money into any company with a “.com” in its name, regardless of its profitability or business model. This sent valuations, as measured by the Price-to-Earnings (P/E) Ratio, to astronomical levels.

The NASDAQ Composite index, heavy with tech stocks, rocketed from under 1,000 in 1995 to over 5,000 by March 2000. When reality set in and companies failed to deliver profits, the bubble burst. The NASDAQ plummeted by nearly 80%, wiping out trillions in market value. This event underscores the dangers of speculative mania and the importance of fundamental valuation.

Stock Market vs Stock Exchange

A common point of confusion is the difference between a stock market and a stock exchange.

| Feature | Stock Market | Stock Exchange |

|---|---|---|

| Definition | The entire universe of trading equities, including exchanges, OTC markets, and electronic networks. | A specific, organized marketplace where listed securities are traded (e.g., NYSE, LSE). |

| Scope | Broad, overarching term. | A component within the broader stock market. |

| Analogy | The entire “financial district” of a city. | A specific “trading building” within that district. |

Conclusion

Ultimately, the stock market is an indispensable tool for building wealth and participating in economic growth, but it is not a shortcut to riches. As we’ve explored, its advantages of high return potential and liquidity are balanced by inherent volatility and risk. The key to success lies not in timing the market, but in time in the market—adopting a disciplined, long-term strategy tailored to your risk tolerance. By using the market as a mechanism for owning pieces of great businesses or diversified funds, you can work toward your financial objectives. Always remember that knowledge and a well-considered plan are your best defenses against uncertainty.

Ready to take the first step? Navigating the markets starts with choosing the right partner. We’ve done the research for you; compare our top-rated picks on our Best Online Stock Brokers page to find a platform that fits your investment style.

Related Terms

- Bond Market: Where debt securities are traded, generally considered less risky than stocks.

- Exchange-Traded Fund (ETF): A basket of securities that trades on an exchange like a stock, offering instant diversification.

- Bear Market: A period of declining stock prices, typically a 20%+ fall from recent highs.

- Market Capitalization: The total value of a company’s outstanding shares, used to classify company size.

Frequently Asked Questions

Recommended Resources

- Guide to Building a Diversified Investment Portfolio

- Stock Market Basics for Absolute Beginners

- U.S. Securities and Exchange Commission SEC.gov

- The London Stock Exchange LSEG.com

- Investopedia – Stock Basics