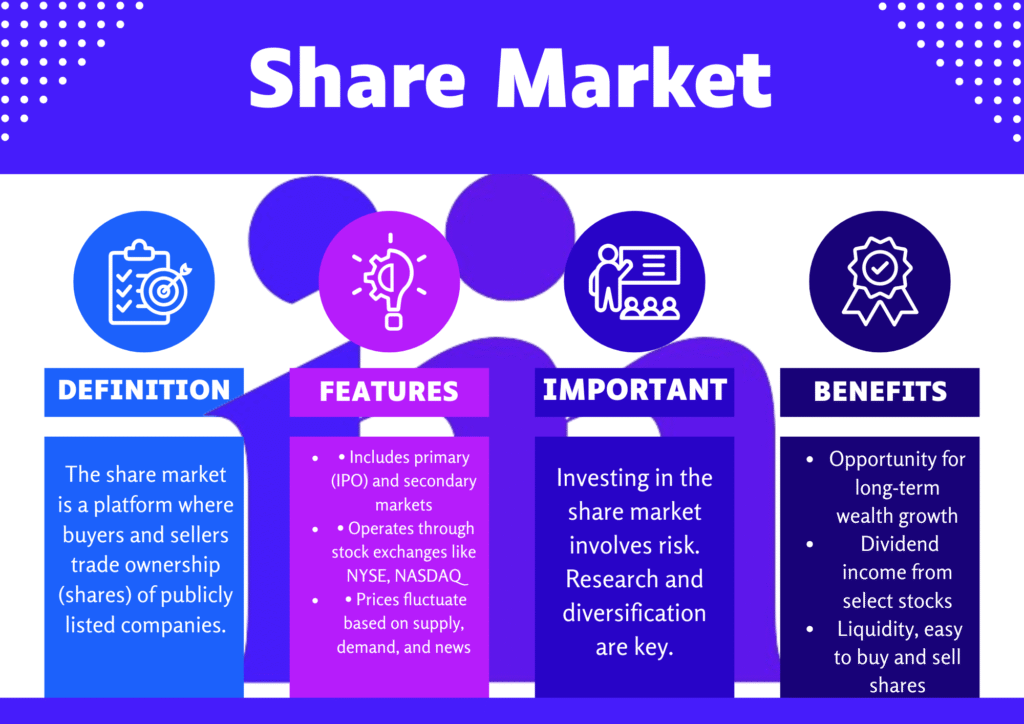

A trading space where purchasers and vendors trade equities of publicly exchanged organizations is recognized as a share market, sometimes classified as the shares platform or equity venue. It is essential to the fiscal system because it makes it possible for enterprises to enhance resources and for participants to acquire and exchange possession shares in these firms. This article will go over the essentials of the shares exchange, including how it functions, the different categories of markets, the participants, and key theories you should know.

KEY TAKEAWAYS

What Is the Share Market

The share market is fundamentally a shares or equity platform. A business issues equity when it goes public in order to increase investment for liability repayment, research, or expansion. These portions can be purchased by backers, who will then own a portion of the business. They anticipate that the business will expand and turn a profit in return, which could enhance the value of their securities.

How The Share Market Operates

There comprise two primary segments in which the share trading space operates:

1. Primary Markets

Companies apply initial public offerings (IPOs) to distribute new interest in the primary exchange. The company creates its securities available to the public for the first time. During the IPO, participants hold the option to attain stock straight from the company.

2. Secondary Market

Stakeholders can acquire and transfer the equity on the equities marketplace once they are listed during the initial public providing (IPO). The secondary trading space serves as the venue for frequent holdings transactions between purchasers and vendors and is where the majority of trading activity takes place. The New York Stock Exchange (NYSE), NASDAQ, the London Stock Exchange (LSE), and the National Stock Exchange (NSE) in India are all well – familiar shares venues.

Key Participants in The Share Market

The pursuing important participants navigate the share venue run smoothly:

1. Participants

Assets are bought and sold in the trading space by both individual and institutional backers. Retail capitalists, hedge capital, mutual assets, pension money, and so forth are examples of them.

2. Representatives

A broker is a qualified individual or business that serves as a go between for shareholders and the equities marketplace. representatives navigate shareholders in carrying out acquire or sale orders.

3. Stock Exchanges

These platforms are used for listing and trading portions. They guarantee that transactions are completed in an orderly and transparent manner. NASDAQ, NSE, and NYSE are a few examples.

4. Market Makers

These organizations or persons present to acquire or exchange shares at prices that are publicly quoted in order to continue trading space tradability.

5. Oversight Bodies

Market operations are monitored and controlled by regulatory agencies such as the Securities and Exchange Board of India (SEBI) or the Securities and Exchange Commission (SEC) in the United States in order to retain investor protection, equity, and transparency.

Types of Share Markets

1. Primary Markets

This is where firms first distribute new portions, as was previously mentioned. corporations can elevate assets on the primary venue, and shareholders can buy part before others do.

2. Secondary Market

The secondary exchange is where stock is bought after they are issued in the primary exchange. It gives shareholders cash flow, enabling them to obtain and trade equity in response to changes in the exchange and business result.

3. Stock Indices and Their Importance

Stock indexes, like the Dow Jones Industrial Average, the S&P 500, or the Nifty 50, are collections of assets that are used to determine the general condition of a given exchange or industry. indexes supervise the success of a collection of shares, providing a snapshot of exchange patterns. The movement of shares indexes can give capitalists an awareness of how the venue is performing as a whole.

Types of Investments in The Share Market

There are two main types into which assets in the share market can be divided:

1. Common Assets

Common stockholders can attend annual meetings and maintain the ability to vote. Although they are not guaranteed, they are eligible for returns, which are distributed from the company’s profits.

2. Preferred Investments

Preferred stockholders are entitled to a greater share of the company’s properties and returns in the event of bankruptcy. But they typically do not possess the ability to vote.

3. Factors Influencing Stock Prices

Numerous factors impact assets prices, such as:

- Company Outcome: Assets prices can develop in response to good announcements, business expansion, or strong earnings reports, while they can decline in response to scandals or subpar outcomes.

- Economic Factors: A number of fiscal factors, including unemployment, expense increase, and interest rates, hold an effect on shares prices. The cost of equities usually rises when the economy is doing well.

- Market Sentiment: Changes in asset prices are significantly influenced by investor emotions. amount swings can be caused by fear, greed, and speculation.

- External Occurrences: Shares prices may be impacted by natural disasters, unstable political environments, or universe occurrences like pandemics or wars.

Uncertainty and Payouts in The Share Market

- High Return Potential: When compared to other securities options, the assets venue has historically provided some of the highest returns. Purchasing shares in companies with robust development opportunities can end result in substantial returns for capitalists over time.

- Loss Uncertainty: Because of the share market’s variation, prices can fluctuate drastically. If shares prices decrease or the company performs poorly, shareholders may lose all or a portion of their money. capitalists must grasp that there appears a chance of losing assets even though there appears also a chance for massive returns.

Ways to Invest in The Share Market

Individuals can use in the assets environment in a number of ways:

- Direct Stock Investment: This entails using a stockbroker to obtain part of exact firms. Capitalists need to learn about the company’s environment, opportunity and foundations.

- Mutual Funds: A mutual fund combines the money of multiple capitalists to acquire a variety of shares. This option allocates the asset allocation across multiple firms, making it less hazardous than individual investments.

- Exchange Traded Funds (ETFs): ETFs are bought on equities venues like individual assets, but they work the same as mutual investment. They are more liquid and provide variation.

- Index Funds: An ETF or mutual fund type identified as an index fund searches to replicate the outcome of a particular index, such as the S&P 500 or the Nifty 50. They grant a wide variety of equities exposure.

Methods for Success in The Share Market

Participants who want to advance in the securities platform should consider about the chasing tactics:

- Long Term Sponsoring: Shareholders can evade trading space fluctuations and gain from the company’s steady progress by acquiring and holding investments for a long time.

- Variation: Capitalizing in a range of securities, markets, and asset classes diminishes danger.

- Research and Analysis: Before making a safety, capitalists should examine a company’s balance sheets, the state of the environment, and its outlook for the future. It can be beneficial to leverage technical examination (examining amount patterns) and fundamental inspection (examining statements, direction, etc.).

- Risk Management: Managing hazard involves diversifying your investment mix, using stop loss orders, and retaining only a portion of your equities venue portfolios in accordance with your danger tolerance.

Conclusion

The share market is a crucial part of the global monetary system because it gives enterprises the chance to enhance investment and gives persons the chance to allot and enhance their resources. It is crucial for shareholders to understand the risks and make well knowledgeable choices.

This dynamic venue can be successfully navigated by practicing sound security schemes, keeping up with budgetary reports, and educating yourself about the shared platform. realizing how the share market operates will support you make wise choices and take the chances in this fascinating budgetary universe, regardless of your level of encounter.