Image Source: [https://www.freepik.com]

Fiscal scheduling is a vital component of managing private fortune, and it’s becoming more detailed as a person’s economic aims develop. Whether you’re saving for pension, acquiring a residence, or capitalizing for extended term objectives, a certified financial planner (CFP) can aid you navigate the complexities of managing your funds. This article will dip deep into what a certified financial planner is, the pros and cons of hiring one, the roles and responsibilities of a CFP, and frequently asked concerns to guide you to grasp the role and decide if it’s the appropriate option for you.

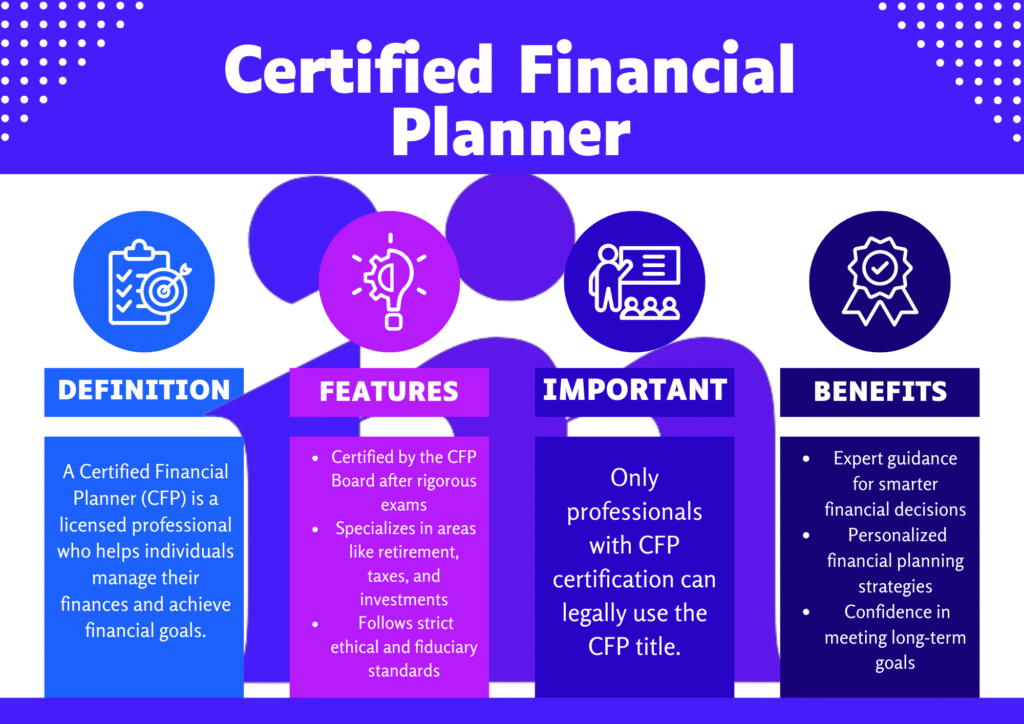

A Certified Financial Planner (CFP) is held to strict fiduciary standards and must complete rigorous education, experience, and ethics requirements. Unlike general advisors, CFPs are bound to act in your best financial interest at all times.

Key Takeaways

Who Is a Certified Financial Planner

A Certified Financial Planner (CFP) is a skilled person who has met the required standards for economic scheduling, passed a rigorous certification exam, and adheres to a strict ethical code. CFPs guide people and families to build an extensive monetary strategy that aligns with their objectives, salary, and risk tolerance. They are trained to deliver advice in multiple areas, including funding tactics, superannuation scheduling, tax direction, estate scheduling, insurance needs, and expense tracking.

When I was comparing financial professionals, I quickly realized that the CFP® designation was a key differentiator. My CFP helped me build a tax-efficient retirement strategy I hadn’t considered—and explained it in plain language I could actually understand.

The CFP certification is awarded by the certified financial planner Board of Standards, Inc., which assures that only qualified humans who pass an extensive exam and maintain relevant skills in the fiscal scheduling industry can bear the title. The certification is recognized globally, generating it a respectable benchmark in monetary advisory facilities.

Role of a Certified Financial Planner

A certified financial planner is not just someone who gives economic advice, they contain a broad establishment of roles and responsibilities that go beyond the fundamentals of financial planning and saving. Here are some of the essential responsibilities of a CFP:

1. Creating a Comprehensive Financial Plan

One of the core responsibilities of a CFP is to build a fiscal scheme that addresses all aspects of a client’s economic life. This entails understanding your revenue, costs, arrears, securities, insurance needs, and extended term monetary aims. The CFP then develops a personalized tactic that integrates all of these elements into one cohesive strategy.

Always verify a planner’s certification using the CFP Board’s official verification tool. This ensures your advisor is not only certified but also in good standing with no disciplinary history.

2. Investment Planning and Management

CFPs support clients with capital allocation scheduling and asset base supervision, recommending funding approaches that synchronize with the client’s risk tolerance, time horizon, and goals. This could embrace advice on stocks, bonds, mutual capital, marketplace traded money (ETFs), and other funding vehicles. The CFP continuously monitors the asset base’s achievement and suggests adjustments based on trading space state and client aims.

3. Retirement Planning

Planning for superannuation is a critical responsibility of a certified financial planner. CFPs aid clients evaluate how much they need to set aside to fulfill a secure superannuation, suggest the optimal pension accounts (such as IRAs or 401(k)s), and establish disbursement approaches to ensure the client does not outlive their reserves.

4. Tax Planning

A meaningful part of monetary scheduling involves tax efficiency. A certified financial planner analyzes a client’s current tax condition and recommends methods to decrease tax obligation. This might incorporate tax deferred securities, tax economical disbursement tactics, and tax advantaged accounts such as Roth IRAs.

There are over 95,000 CFP® professionals in the U.S. as of 2025, yet not all financial advisors hold this designation—highlighting the CFP as a mark of higher professional credibility.

5. Estate Planning and Wealth Transfer

CFPs assist clients’ approach for the distribution of their holdings after death, assuring that estates are settled in a tax effective method. They often perform in conjunction with attorneys to establish wills, trusts, and powers of attorney to ensure the client’s wishes are followed and to reduce capacity estate taxes.

6. Insurance Planning

Insurance is a critical part of risk supervision. Certified financial planners judge their clients’ insurance needs, including life, condition, disability, and prolonged term care insurance. They offer suitable policies to protect against economic dangers that could derail a client’s fiscal objectives.

7. Cash Flow and Budgeting Assistance

CFPs assist clients determine successful expense tracking tactics, supervise cash flow, and ensure that their cost aligns with extended term monetary aims. A CFP can support you to build a scheme to set aside for major outgoings like acquiring a house, teaching charges, or vacations, while keeping deficit levels in check.

8. Delivering Ongoing Financial Advice and Reviews

A certified financial planner’s role is not just restricted to one-time advice. They extend continuous assistance and reviews to ensure that the monetary approach stays aligned with evolving life circumstances, financial changes, or shifting economic aims. Regular examinations ensure that clients remain on monitor to attain their fiscal goals.

9. Fiduciary Duty

CFPs are required to act as fiduciaries, meaning they are legally obligated to act in the superior interests of their clients. This fiduciary duty is one of the essential distinctions between certified financial planners and other fiscal advisors who may not be required to comply with this elevated ethical benchmark.

10. Education and Communication

Certified financial planners also have the role of educating clients. They ensure clients interpret their monetary scheme, the reasons behind certain recommendations, and the hazards involved in diverse tactics. A positive CFP communicates detailed economic theories in a way that is easy to grasp, empowering clients to produce knowledgeable determinations.

A single mother profiled by CNBC credited her CFP with helping her eliminate debt, build an emergency fund, and start college savings for her child—achievements she thought were impossible on her income before getting professional guidance.

Who Can Benefit from A Certified Financial Planner?

Individuals at diverse stages of their fiscal adventure can yield from working with a certified financial planner:

- Individuals with Complicated Fiscal Situations: If you own many sources of salary, considerable property, or intricate tax challenges, a CFP can guide and build a scheme to improve your funds.

- Families Scheduling for The Possibilities: A CFP can benefit families with cost management, training reserves, and prolonged term economic objectives such as obtaining a residence or saving for their children’s college schooling.

- Retirees or Those Nearing Superannuation: As you plan superannuation, the necessity for proper estate scheduling, tax direction, and salary plans grows into more urgent. A CFP can benefit direct you through these choices.

- Young Professionals or Those Starting Their Monetary Voyage: Even if you are just starting out in your career, a CFP can support you in creating positive monetary routines, building an allocation, and establishing prolonged term monetary aims.

Pros of Hiring A Certified Financial Planner

Hiring a certified financial planner has many benefits that can produce a considerable variation in your fiscal life. Here are some of the most notable gains:

1. Expertise and Knowledge

CFPs are equipped with in-depth expertise of monetary scheduling principles. They are highly trained in topics like funding approaches, taxes, insurance, superannuation, and estate scheduling. Their specialization assures that you get sound advice based on the most up to time fiscal methods.

2. Comprehensive Financial Planning

A certified financial planner does not target just one aspect of your fiscal life; instead, they obtain a holistic technique to address all areas of your funds. This approach that they look at to accomplish a fiscal picture, including revenue, expenditures, assets, liabilities, insurance, taxes, and estate scheduling.

3. Objectivity and Professionalism

CFPs are required to pursue ethical standards and function in the superior cost of borrowing of their clients. This approach they are expected to deliver objective advice and dodge conflicts of loan charges. Additionally, they are bound by a fiduciary duty, which is that they must always act on your optimal loan charges, rather than simply recommending products or offerings that may gain them.

4. Personalized Financial Strategies

Every person’s monetary circumstance is unique, and a CFP can tailor a monetary approach specifically for your needs, objectives, and risk tolerance. Whether you are targeted on growing assets, defending your resources, or scheduling for pension, the CFP will craft an approach that aligns your individual circumstances.

5. Extended Term Financial Guidance

A certified financial planner does not just present a one-time consultation and send you on your way. They can supply as a prolonged term advisor, delivering uninterrupted guidance as your economic objectives evolve and fresh fiscal challenges arise. They guide you to continue on track to meet your aims and create obligatory adjustments along the way.

Cons of Hiring A Certified Financial Planner

Despite the many benefits, hiring a certified financial planner may not be the superior decision for everyone. Here are some promised downsides to evaluate:

1. Price of Services

CFPs typically charge for their assistance, which can be costly, especially for those with relatively effortless fiscal needs. Depending on the compensation structure, costs can be hourly, flat cost, or a percentage of resources under control. While you may collect beneficial advice, the price can be prohibitive for some.

2. Limited Scope of Expertise

While CFPs are well versed in many aspects of economic scheduling, some may hold more specialized understanding in particular areas, such as superannuation scheduling or tax plans. If you demand deep skill in a particular area, you may require to confer other professionals in addition to a CFP.

3. Prospects Conflicts of Interest

Although certified financial planners are fiduciaries and must act in your optimal cost of borrowing, some may still own incentives that could guide to conflicts of loan charges. For example, a CFP may accept commissions for recommending certain monetary products. It’s vital to decide on a CFP who operates transparently and discloses any opportunity conflicts.

4. Dependence on Advice

While a CFP delivers precious understandings, relying solely on their advice may direct to a lack of monetary education on your part. It’s also significant to train yourself about the fundamentals of private finance so that you can create knowledgeable determinations, rather than blindly tracking advice.

Not all CFPs are fee-only; some may still earn commissions. If transparency is a priority, ask whether they’re fee-only, fee-based, or commission-based—as this directly impacts the objectivity of their advice.

Conclusion

A certified financial planner can be an invaluable capital for managing your capital, especially if you own sophisticated economic targets. With their proficiency and ability to provide a thorough economic plan, a CFP can assist you to produce more effective economic determinations and persist on track to accomplish your objectives. However, it’s significant to carefully think about the charges and possible constraints of hiring a CFP. If you are looking for prolonged term monetary guidance and are willing to put money into expert advice, a certified financial planner may be an excellent selection to benefit you to attain economic protection and harmony of mind.