Liquid Funds What Are They and How Can They Improve Your Cash Flow

Liquid funds are a type of debt mutual fund designed for supreme stability and immediate access to your cash. They are the go-to vehicle for parking short-term savings, offering better returns than a traditional savings account while maintaining high safety. For investors in the US, UK, Canada, and Australia looking to optimize their idle cash, liquid funds are a cornerstone of efficient personal finance and treasury management.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | A debt mutual fund that invests in ultra-short-term securities with maturities of up to 91 days. |

| Also Known As | Money Market Funds (a very close equivalent), Liquidity Funds |

| Main Used In | Cash Management, Emergency Funds, Short-Term Savings, Corporate Treasury |

| Key Takeaway | They provide higher liquidity and marginally better returns than a savings account with very low risk, but are not FDIC insured. |

| Related Concepts |

What are Liquid Funds

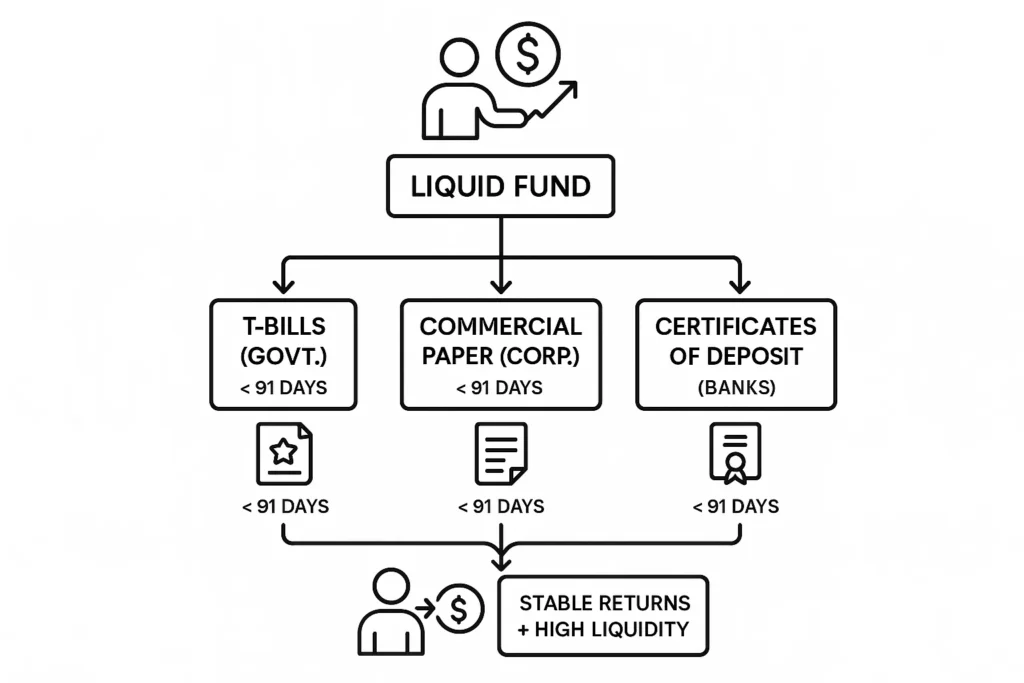

A liquid fund is a type of mutual fund that invests your money in very short-term debt instruments. Think of it as a collective pool where thousands of investors put their spare cash, which is then used to buy high-quality, short-maturity assets like Treasury Bills (T-Bills), commercial paper, and certificates of deposit.

The primary goal isn’t aggressive growth but capital preservation and liquidity. This means your initial investment is very safe, and you can get your money back quickly, often within one business day.

If a savings account is your wallet for daily expenses, and a fixed deposit is a locked safe, a liquid fund is like a high-security, quick-access vault for your larger, short-term cash reserves. Your money isn’t sitting idle; it’s earning a small but steady return while waiting to be deployed.

Key Takeaways

The Core Concept Explained

Liquid funds work by investing in debt securities that are about to mature. Because the maturity dates are so close (within 91 days), the value of these securities is very stable and not significantly affected by changes in market interest rates. This stability is reflected in the fund’s Net Asset Value (NAV), which experiences minimal fluctuation.

- What does it measure? It’s not a metric you calculate, but a product you use. Its performance is tracked by its 7-day or 30-day yield, which annualizes the recent returns to give you an expected return figure.

- What does a high or low value indicate? A higher yield indicates the fund is taking on slightly more risk (e.g., by investing in lower-rated corporate paper) to generate returns. A lower yield typically signifies a more conservative portfolio (e.g., heavy in government T-Bills).

How is Liquid Fund Performance Measured

Since there’s no single formula for liquid funds, investors focus on key metrics to assess performance and cost.

Key Performance and Cost Metrics

- Net Asset Value (NAV): The per-unit price of the fund. It changes daily based on the market value of the underlying securities. In liquid funds, this change is very slight.

- Yield (7-day or 30-day): This is the annualized return the fund has generated over the past 7 or 30 days. It gives a standardized way to compare different liquid funds.

- Formula (Conceptual): Yield = (Net earnings over 7 days / Average NAV) * (365 / 7) * 100

- Expense Ratio: The annual fee incriminated by the fund house to control your investment. A lower expense ratio means more of the returns end up in your pocket.

Example Comparison:

Let’s compare two hypothetical funds for an investment of $10,000.

| Metric | Conservative Liquid Fund | Higher-Yield Liquid Fund |

|---|---|---|

| 30-Day Yield | 3.5% | 4.2% |

| Expense Ratio | 0.20% | 0.40% |

| Primary Holdings | US Treasury Bills | Corporate Commercial Paper |

| Interpretation | Lower risk, lower cost, slightly lower return. | Slightly higher risk/cost for a higher potential return. |

For investors in the UK, funds holding UK government gilts would be a common example, while in Canada, funds holding Bank of Canada treasury bills would be the equivalent.

The Impact of Central Bank Policies on Liquid Funds

The returns from liquid funds are directly influenced by the interest rate decisions of central banks like the Federal Reserve (US) or the Bank of England (UK).

- In a Rising Rate Environment: When central banks hike rates, the yields on new short-term debt instruments (T-Bills, CP) also rise. This can lead to higher yields for liquid funds over subsequent weeks as the fund manager reinvests maturing proceeds into these new, higher-yielding papers.

- In a Falling Rate Environment: When central banks cut rates, the opposite occurs. The fund will have to reinvest at lower rates, leading to a gradual decline in the fund’s yield.

This dynamic makes liquid funds more attractive during monetary tightening cycles.

Why Liquid Funds Matter to Savers and Investors

- For Individual Investors: They solve the problem of “dead cash” in a savings account. Instead of earning minimal interest, your emergency fund or short-term savings can work harder for you without sacrificing safety or accessibility.

- For Traders: They are a perfect parking spot for capital waiting for the next investment opportunity. Instead of holding uninvested cash in a brokerage account earning zero interest, it can be swept into a liquid fund to generate a return.

- For Businesses (Corporate Treasury): Companies use liquid funds to manage their operational cash flow efficiently, earning a return on their temporary cash surpluses before they need to pay expenses or suppliers.

How to Use Liquid Funds in Your Financial Strategy

Use Case 1: Building Your Emergency Fund

Instead of keeping 6 months of expenses in a savings account, park it in a liquid fund. The money remains accessible for genuine emergencies but earns a better return day-to-day.

Use Case 2: Staging Area for a Large Purchase

Saving for a house down payment, a car, or a vacation in the next 6-12 months? A liquid fund is an ideal place to accumulate and hold that capital until you need it.

Use Case 3: Systematic Transfer Plan (STP) for Equity Investing

If you have a lump sum to invest in equities but are wary of market timing, you can place the entire amount in a liquid fund. Then, set up an STP to automatically transfer a fixed amount each month from the liquid fund to your chosen equity fund. This averages your purchase cost while your money earns a return in the interim.

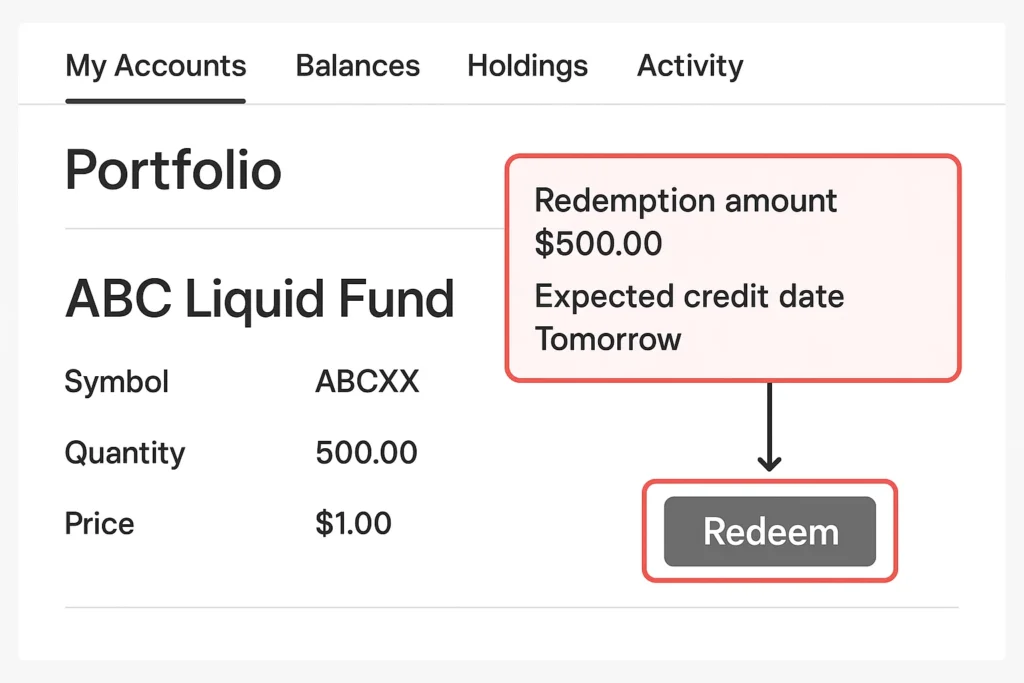

To start investing in liquid funds, you’ll need a demat account or an account with a major mutual fund platform. Best Online Brokerage Accounts for 2026 can help you choose a platform that offers a wide selection of low-cost liquid funds.

How to Vet and Select a Liquid Fund

Don’t just pick the fund with the highest yield. Use this checklist:

- Credit Quality of Portfolio: Look for a fund that predominantly invests in sovereign (government) securities and the highest-rated (e.g., A1+) corporate paper. Avoid funds taking on lower credit for extra yield.

- Expense Ratio: This is a critical differentiator. A fund with a 0.10% expense ratio will deliver higher net returns than an identical fund charging 0.30%. Always choose the lower-cost option.

- Track Record & AUM: Stick with funds from reputable, large fund houses with a long track record and significant Assets Under Management (AUM), indicating trust and operational stability.

- Average Maturity: Within the 91-day limit, a lower average maturity (e.g., 30 days) implies even lower interest rate risk than one with an 85-day average.

- Yield Consistency: Instead of chasing the absolute highest yield, look for a fund that has consistently delivered competitive returns without wild swings, indicating prudent management.

- Low Risk: Minimal impact from interest rate changes and high credit quality of underlying securities.

- Better Returns: Generally outperforms savings and money market account interest rates.

- Professional Management: The fund manager handles the selection and rolling over of securities.

- Not FDIC Insured: Unlike bank deposits, your investment is not government-guaranteed. There is a microscopic risk of capital loss.

- Returns are Not Guaranteed: Yields can fluctuate with prevailing interest rates.

- Inflation Risk: In a high-inflation environment, the post-tax returns may not keep pace with inflation, eroding purchasing power.

Liquid Funds in the Real World: A Corporate Treasury Case Study

Scenario: A mid-sized tech company based in London, “TechNovate Ltd.,” has just received a £2 million payment from a client. Their next major expense, a quarterly tax payment of £1.5 million, is due in 90 days.

The Problem: Parking £1.5 million in a business bank account for three months would earn negligible interest.

The Solution: TechNovate’s CFO invests the £1.5 million in a Sterling-denominated liquid fund that primarily holds UK government gilts and high-grade commercial paper with an average maturity of 60 days.

The Outcome: Over the 90 days, the fund generates a yield of 3.8% annualized. This translates to approximately £14,000 in extra earnings for the company that would have been lost in a current account. The day before the tax payment is due, the CFO redeems the units, and the cash is back in the company’s account, ready to be used.

Liquid Funds vs Ultra Short Duration Funds

Many confuse liquid funds with other low-risk options. Here’s how they differ from a common alternative: Ultra-Short Duration Funds.

| Feature | Liquid Funds | Ultra-Short Duration Funds |

|---|---|---|

| Maturity Period | Up to 91 days | 3 to 6 months |

| Interest Rate Risk | Very Low | Slightly Higher |

| Potential Return | Lower | Slightly Higher |

| Primary Use | Parking cash for days/weeks | Parking cash for a few months |

Conclusion

Ultimately, liquid funds are a powerful tool for intelligent cash management, bridging the gap between the safety of a bank account and the return potential of longer-term investments. While they are not completely risk-free and offer modest returns, their core benefits of high liquidity, capital preservation, and superior yields compared to savings accounts make them indispensable. By incorporating liquid funds as the holding pen for your short-term financial goals and emergency cash, you ensure your money is never sitting idle. Start by reviewing the liquid fund options available on your investment platform today.

Ready to put your cash to work? The right platform is key. We’ve meticulously reviewed and ranked the best online brokers and investment platforms to help you find one with a strong selection of low-cost liquid funds.

Related Terms

- Debt Funds: The broader category that liquid funds belong to.

- Expense Ratio: The annual fee that impacts your net returns from a liquid fund.

- Yield to Maturity (YTM): A key metric to understand the potential return of a debt fund’s portfolio.

- Systematic Transfer Plan (STP): A strategy that often uses a liquid fund as the source for periodic investments.