What is Finance A Complete Guide for Beginners

Finance is the lifeblood of every economy and the strategic framework for managing your money. It encompasses everything from saving for a family vacation to a multinational corporation’s multi-billion dollar merger. Understanding finance is not just for Wall Street experts; it’s the fundamental skill for achieving financial security and making informed decisions, whether you’re in the US, UK, Canada, or Australia.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | The study and system of creating, managing, and investing money, assets, and liabilities. |

| Also Known As | The Financial System, Economics (related but distinct) |

| Main Used In | Personal Banking, Corporate Strategy, Investment Management, Public Policy |

| Key Takeaway | Finance is the practice of allocating scarce resources over time, balancing risk and reward to achieve specific goals. |

| Related Concepts |

What is Finance

At its core, finance is the art and science of managing money. It involves the processes by which individuals, businesses, and governments raise, allocate, and use monetary resources over time, while also considering the risks involved. Think of it as the roadmap for your financial journey, it helps you decide where you are, where you want to go, and the best route to get there, navigating obstacles like inflation, market volatility, and unexpected expenses along the way.

The History and Evolution of Finance

Finance is not a modern invention; it is as old as civilization itself. Understanding its history reveals how the complex systems we use today, from digital banking to global stock markets, evolved from simple beginnings. This journey highlights humanity’s enduring need to manage resources, trade value, and assess risk.

The timeline of finance can be broken into several key revolutions:

- Ancient Origins (3000 BC – 1000 AD): The earliest known financial records are cuneiform tablets from Mesopotamia (modern-day Iraq) detailing loans of grain and silver with interest. The Lydians (in modern-day Turkey) are credited with creating the first standardized metal coins, solving the problem of bartering with uneven goods.

- The Medieval & Renaissance Leap (1200 – 1600): In Medieval Europe, Italian merchants and moneylenders in cities like Florence and Venice developed many modern tools. The most influential were the Medici Bank, who pioneered the double-entry bookkeeping system and established a network that facilitated international trade. This period also saw the first government bonds, issued by the Venetian government.

- The Birth of Formal Markets (1600 – 1800): The Dutch East India Company became the first company to issue stocks and bonds to the public in the early 1600s. This led to the creation of the Amsterdam Stock Exchange, considered the world’s first official stock market. In the 1700s, the London Stock Exchange and the New York Stock Exchange were formed, creating centralized places for capital formation.

- The 20th Century: Regulation and Innovation: The Great Crash of 1929 led to the creation of the U.S. Securities and Exchange Commission (SEC) to restore investor confidence and regulate markets. The latter half of the century saw the rise of credit cards, modern portfolio theory, and the Black-Scholes model for options pricing.

- The Digital Revolution (21st Century – Present): The internet democratized access to markets through online brokerages. The 2008 financial crisis, followed by the invention of Bitcoin, introduced blockchain technology and Decentralized Finance (DeFi), challenging the very notion of centralized financial intermediaries. FinTech (Financial Technology) companies now use AI and big data to offer everything from mobile payments to automated investing (robo-advisors).

Key Takeaways

The Core Concept Explained

Finance revolves around the concept of value creation and preservation. It answers critical questions: How can an individual grow their savings? How should a company fund a new factory? How can a government pay for public services? It provides the framework for these decisions by focusing on cash flows; the timing, amount, and uncertainty of money moving in and out.

A high level of financial literacy indicates a strong ability to manage these cash flows effectively, leading to wealth accumulation. In contrast, a poor understanding can lead to debt, missed opportunities, and financial distress.

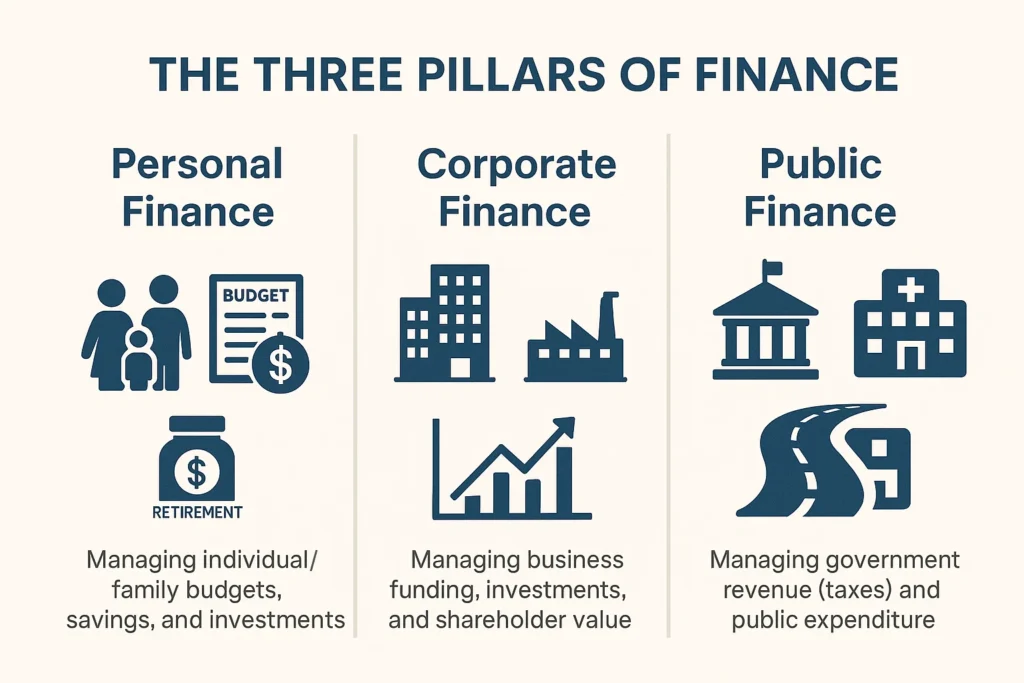

Primary Types of Finance

While “finance” is a single term, it’s practically divided into three distinct disciplines, each with its own focus, goals, and participants. Understanding these categories is crucial to grasping the full scope of the field.

1. Personal Finance

This is the domain of the individual and the household. It involves managing your money to meet personal goals, from daily survival to long-term dreams.

Key Activities:

- Budgeting & Saving: Tracking income and expenses to ensure you live within your means and build savings.

- Retirement Planning: Investing in pensions, 401(k)s (in the US), or ISAs (in the UK) to ensure financial security in later years.

- Insurance: Protecting against financial loss from events like illness, accident, or death.

- Tax Planning: Understanding and optimizing your tax liabilities.

- Goal: Financial security, freedom, and achieving personal life goals.

2. Corporate Finance (or Business Finance)

This area focuses on funding a company’s activities and maximizing its value for shareholders.

Key Activities:

- Capital Budgeting: Deciding which long-term projects or investments (e.g., a new factory, a product line) to pursue.

- Capital Structure: Determining the right mix of debt (loans, bonds) and equity (selling stock) to fund the company’s operations.

- Working Capital Management: Managing short-term assets and liabilities to ensure the company has sufficient cash flow for day-to-day operations.

- Goal: Maximizing shareholder value and ensuring the firm’s financial health.

3. Public Finance (or Government Finance)

This type deals with the role of government in the economy, how it raises money and how it spends it.

Key Activities:

- Taxation: Raising revenue through income taxes, sales taxes, corporate taxes, etc.

- Budgeting: Allocating public funds to sectors like defense, education, healthcare, and infrastructure.

- Debt Management: Issuing government bonds (like US Treasuries or UK Gilts) to finance budget deficits and manage national debt.

- Stabilization Policy: Using fiscal policy (taxation and spending) to influence economic growth, inflation, and employment.

- Goal: Providing public services, ensuring economic stability, and redistributing income.

The Fundamental Principles of Finance

Beyond its types, finance is governed by a set of universal principles that guide every financial decision, from your personal savings to a CEO’s multi-billion dollar investment.

1. The Time Value of Money (TVM)

This is the most important concept in finance. TVM states that a dollar in your hand today is worth more than a dollar promised in the future. This is because money available today can be invested to earn interest, generating more money over time. This principle is the foundation for concepts like compound interest, retirement planning, and stock valuation.

- Example: Being given the choice between receiving $10,000 today or $10,000 in 5 years. The rational choice is to take it today because you can invest it and it will be worth more than $10,000 in five years.

2. Risk and Return Trade-Off

This principle dictates that potential return rises with an increase in risk. Low levels of uncertainty (low risk) are associated with low potential returns (e.g., government bonds). High levels of uncertainty (high risk) are associated with high potential returns (e.g., cryptocurrency, startup investing). Every investor must find their own comfort level on this risk-return spectrum.

3. Diversification

The classic adage “don’t put all your eggs in one basket” is a core financial principle. Diversification means spreading your investments across various asset classes, industries, and geographic regions to reduce the overall risk in your portfolio. If one investment performs poorly, others may perform well, offsetting the loss.

4. The Cost of Capital

For companies, this is a critical concept. It refers to the cost of obtaining funding, whether through debt (interest payments) or equity (sharing ownership and future profits). A company will only pursue a new project if the expected return is higher than its cost of capital.

5. Liquidity

Liquidity refers to how quickly and easily an asset can be converted into cash without significantly affecting its price. Cash is the most liquid asset. Real estate is very illiquid. Maintaining adequate liquidity is crucial for both individuals (emergency fund) and corporations (cash for payroll) to meet short-term obligations.

The Core Pillars of the Financial System

Since “finance” is a conceptual field, it’s not calculated with a single formula but is understood through its core components and principles. The entire financial system is built upon these interconnected pillars.

The Central Players and Markets

- Financial Institutions: Banks, credit unions, and insurance companies act as intermediaries, taking deposits and providing loans and protection. For investors in the US and UK, entities like JPMorgan Chase or HSBC are foundational.

- Financial Markets: These are venues where assets are traded. The NYSE and NASDAQ in the US, the LSE in London, and the ASX in Australia are primary examples for stocks. Bond markets and derivatives markets are other key components.

- Financial Instruments: These are the “products” traded, such as stocks (equity), bonds (debt), loans, and currencies (Forex).

- Regulators: Bodies like the SEC (Securities and Exchange Commission) in the US or the FCA (Financial Conduct Authority) in the UK ensure market integrity and protect investors.

Why Finance Matters to Traders and Investors

For Individuals: It’s the foundation of financial well-being. It empowers you to create a budget, save for a down payment on a house, plan for retirement, and protect your family with insurance. It helps you understand the impact of compound interest on your savings.

For Traders: Finance provides the analytical tools, like technical and fundamental analysis, to assess securities. Understanding market microstructure, leverage, and risk management is essential for identifying entry and exit points.

For Investors & Analysts: It’s the basis for valuation. Concepts like Discounted Cash Flow (DCF) and financial ratio analysis are used to determine the intrinsic value of a company, influencing long-term investment decisions and portfolio construction.

How to Use Financial Principles in Your Strategy

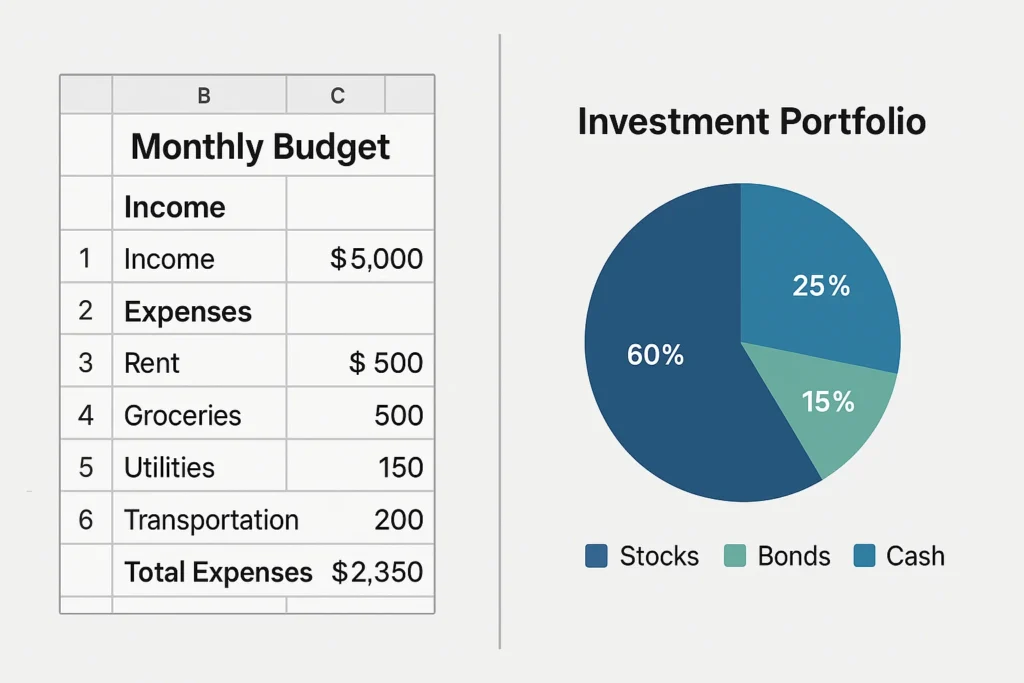

Use Case 1: Personal Budgeting and Emergency Funds

- Action: Apply the corporate finance principle of “cash flow management” to your personal life. Track your income and expenses to create a budget. The goal is to have a positive cash flow (surplus), which can be allocated to an emergency fund, a core tenet of sound personal finance.

- Why it Works: This creates a financial buffer, reducing the risk of having to take on high-interest debt during a crisis.

Use Case 2: Investment Diversification

- Action: Instead of putting all your capital into one stock, use the principle of portfolio management to spread investments across different asset classes (stocks, bonds, real estate). For example, an investor in Canada might hold a mix of TSX-listed stocks, government bonds, and a global ETF.

- Why it Works: Diversification is a fundamental risk management technique that can reduce the volatility of your portfolio.

To build a diversified portfolio, you need a reliable brokerage platform. We’ve reviewed the best brokers for beginner investors to help you get started.

- Capital Formation: Channels savings into productive investments, fueling economic growth and innovation.

- Liquidity Provision: Allows investors to easily buy and sell assets, making markets efficient.

- Risk Management: Provides tools (like insurance and derivatives) to hedge against unforeseen events.

- Price Discovery: Markets determine the value of assets based on supply and demand.

- Systemic Risk: The interconnectedness of the system means the failure of one major institution (e.g., Lehman Brothers in 2008) can trigger a widespread crisis.

- Information Asymmetry: Institutional investors often have an information advantage over retail investors.

- Speculation and Bubbles: Irrational exuberance can drive asset prices far from their intrinsic value, leading to market crashes.

- Complexity and Opacity: Some financial instruments (e.g., certain derivatives) are so complex they can be poorly understood even by those who trade them.

Behavioral Finance: The Human Element

Traditional finance theory is built on the idea of the rational actor, a person who always makes logical decisions to maximize their wealth. However, anyone who has ever sold a stock in a panic or held onto a losing investment for too long knows that humans are not always rational. Behavioral finance is the field that studies how psychological influences and biases cause investors to deviate from logical decision-making.

Understanding these common biases can save you from costly mistakes:

Overconfidence

The tendency to overestimate our own knowledge, ability, and the accuracy of our predictions.

Real-World Impact: An overconfident trader may believe they can time the market, leading them to trade too frequently. This often results in higher transaction fees and lower returns than a simple “buy-and-hold” strategy. Studies consistently show that the more an investor trades, the lower their average returns tend to be.

Loss Aversion

The pain of losing $100 is psychologically about twice as powerful as the pleasure of gaining $100. This leads to a “fear of loss” that can paralyze decision-making.

Real-World Impact: An investor might refuse to sell a stock that has plummeted, hoping it will “break even,” even when all the fundamentals suggest it will fall further. This is known as the “disposition effect”, holding onto losers too long and selling winners too early.

Herd Mentality

The instinct to follow the crowd and mimic the actions of a larger group, often driven by FOMO (Fear Of Missing Out).

Real-World Impact: This bias is the primary driver of asset bubbles, like the Dot-com Bubble or the GameStop short squeeze. Investors pile into a trending asset simply because everyone else is, driving the price far beyond its intrinsic value until the bubble inevitably bursts.

By recognizing these biases in yourself, you can develop strategies to counteract them, such as creating a disciplined investment plan and sticking to it, regardless of short-term market emotions.

Finance in the Real World

The 2008 crisis is a stark, real-world case study of finance gone wrong and then the system’s recovery. It began in the US housing market with the widespread issuance of subprime mortgages (a failure in credit risk assessment). These risky loans were then bundled into complex securities known as Collateralized Debt Obligations (CDOs) and sold to investors worldwide.

When homeowners began defaulting, the value of these securities plummeted, causing massive losses for banks and funds. The high degree of leverage (using borrowed money) amplified the losses. The crisis highlighted critical limitations: poor regulation, misaligned incentives, and a failure to understand complex interconnections. The subsequent government bailouts and the creation of new financial regulations by bodies like the SEC demonstrate the public finance response to a systemic collapse.

Careers in Finance

The field of finance offers a vast array of dynamic and high-paying career paths for individuals with strong analytical and problem-solving skills. These roles span across banks, investment firms, corporations, and government agencies, catering to different interests and specializations.

Here’s a brief overview of some key finance careers:

Financial Analyst

Role: Research companies, industries, and economic data to provide recommendations on investment decisions (e.g., “buy,” “sell,” or “hold” a stock). They are the backbone of investment banks and asset management firms.

Key Skills: Financial modeling, Excel proficiency, understanding of accounting, strong written and verbal communication.

Portfolio Manager

Role: Oversee investment portfolios for individuals or institutions (like pension funds). They make the final decisions on which securities to buy and sell to achieve the client’s financial goals.

Key Skills: Deep knowledge of asset classes, risk management, leadership, and client relations. Often requires a CFA charter.

Investment Banker

Role: Assist corporations, governments, and other entities in raising capital (by issuing stocks or bonds) and in executing mergers and acquisitions (M&A).

Key Skills: Intense work ethic, advanced financial modeling, deal structuring, and negotiation. Known for a demanding but highly compensated career path.

Financial Planner/Advisor

Role: Work directly with individuals and families to help them meet their life goals through proper management of finances. This includes retirement planning, tax strategies, and estate planning.

Key Skills: Interpersonal skills, knowledge of tax laws and insurance, integrity, and often requires a CFP certification.

Chief Financial Officer (CFO)

Role: A senior executive responsible for managing the financial actions of a company, including financial planning, risk management, record-keeping, and financial reporting.

Key Skills: Strategic leadership, decades of experience, and a comprehensive understanding of all aspects of corporate finance.

A successful career in finance typically requires a blend of quantitative skills, a continuous learning mindset (often supported by professional certifications like the CFA or CPA), and the ability to perform under pressure.

Finance vs Economics

A common point of confusion is the difference between Finance and Economics.

| Feature | Finance | Economics |

|---|---|---|

| Primary Focus | Management of money and assets. | Production, distribution, and consumption of goods/services in a society. |

| Scope | Often micro-level (a company, an individual). | Often macro-level (a country, the global economy). |

| Time Horizon | Future-oriented (planning and forecasting). | Analyzes past, present, and future trends. |

| Core Question | “How should I allocate my resources?” | “How do societies allocate scarce resources?” |

Conclusion

Ultimately, finance is not an abstract academic subject but a practical toolkit for navigating the economic world. From managing your personal budget to analyzing a company’s stock, its principles guide you in making rational decisions with your money. As we’ve seen, while the financial system is a powerful engine for growth, it is not without its flaws and risks, such as volatility and complexity. By incorporating fundamental financial knowledge into your strategy, whether that’s building an emergency fund or diversifying your investments, you move from being a passive participant to an active manager of your financial future.

Ready to put these financial concepts into action? The right tools are essential. We’ve meticulously reviewed and ranked the best online brokers for long-term investing to help you get started.

Related Terms:

- Investing: The act of committing money or capital to an endeavor with the expectation of obtaining an additional income or profit. This is a key action within finance.

- Financial Planning: The process of framing financial policies and strategies for an individual or organization.

- Capital: The financial assets needed for a company to provide its goods or services.

- Accounting: The process of recording, summarizing, and reporting financial transactions, serving as the language of finance.

- Risk Management: The identification, evaluation, and prioritization of risks followed by coordinated efforts to minimize their impact.

Frequently Asked Questions

Recommended Resources

- A Beginner’s Guide to Building a Personal Budget

- Top 5 Investment Strategies for the Long Term

- Investopedia: For definitions and tutorials on thousands of financial concepts.

- SEC.gov: Authoritative resources for US-based investors on rules and education.

- The Bank of England’s KnowledgeBank: Provides excellent educational material on money and the UK economy.