Arbitrage What Is It, How It Work, and Make Profit From It

Arbitrage is the simultaneous buying and selling of an asset in different markets to profit from tiny price discrepancies. It is the closest thing to a “risk-free profit” in finance, acting as a fundamental force that keeps markets efficient and prices consistent across the globe.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | The practice of buying and selling the same asset in different markets at the same time to profit from a price difference. |

| Also Known As | Arb, Risk-Free Profit, Market Neutral Strategy |

| Main Used In | All asset classes: Stock Trading, Forex, Crypto, Derivatives, Commodities. |

| Key Takeaway | Arbitrage opportunities are rare and short-lived, as the act of exploiting them corrects the price imbalance. |

| Formula | Profit = (Sale Price in Market B – Purchase Price in Market A) – Transaction Costs |

| Related Concepts |

What is Arbitrage

In its simplest form, arbitrage is like finding a gold coin being sold for $1,900 in one shop and knowing you can immediately sell it to the shop next door for $2,000. You pocket the $100 difference with virtually no risk. In finance, the “shops” are different exchanges or markets, and the “gold coin” is a stock, currency, or any other tradable asset.

Key Takeaways

The Core Concept Explained

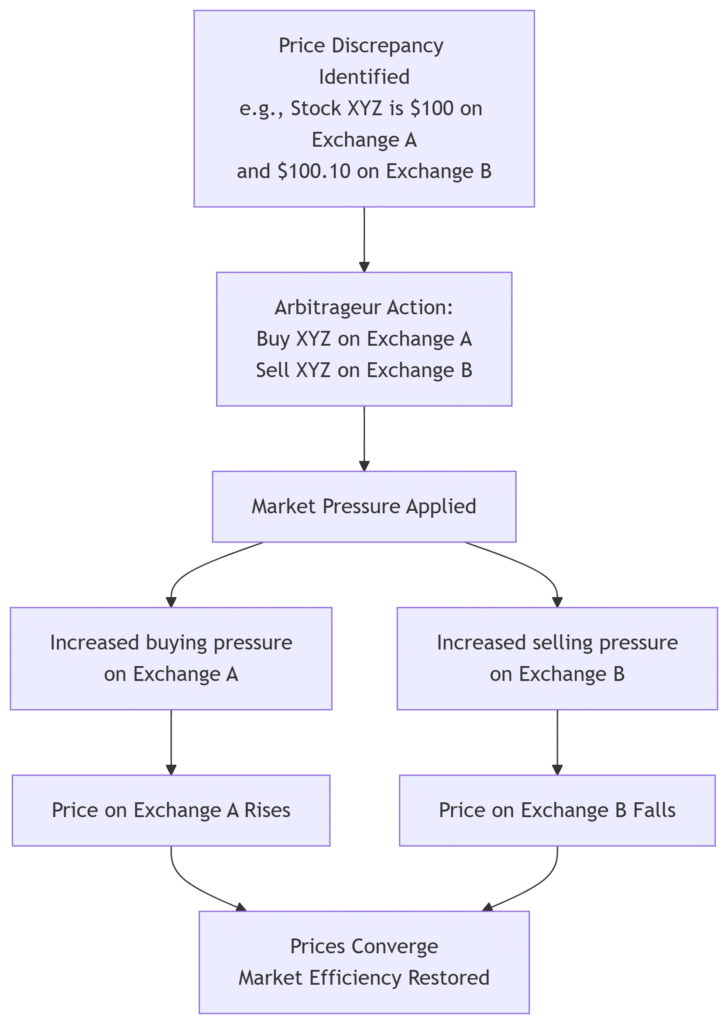

The core concept hinges on one principle: the law of one price. This economic rule states that an identical asset must trade for the same price in all markets. When this law is briefly violated, due to slow information flow, liquidity differences, or market events, arbitrageurs step in.

They buy the undervalued asset in the cheaper market while simultaneously selling it in the more expensive market. This buying pressure raises the price in the cheap market, and the selling pressure lowers the price in the expensive market until the prices converge, eliminating the opportunity. In this way, arbitrageurs are the market’s mechanics, fixing tiny pricing errors and making the entire system more efficient.

How to Calculate Arbitrage Profit

The formula for calculating arbitrage profit is straightforward, but the devil is in the details (transaction costs).

Arbitrage Profit = (Sale Price in Market B – Purchase Price in Market A) – Total Transaction Costs

Step-by-Step Calculation Guide

Breakdown:

- Purchase Price in Market A: The price you pay to buy the asset in the cheaper market.

- Sale Price in Market B: The price you receive for selling the asset in the more expensive market.

- Total Transaction Costs: This is the critical part. It includes brokerage commissions, exchange fees, bid-ask spreads, taxes, and any funding costs. If this sum is greater than the price difference, the arbitrage is unprofitable.

Example Calculation: Currency Triangular Arbitrage

An arbitrageur spots a discrepancy in currency cross-rates between USD/EUR and EUR/GBP.

- Input Values:

- They start with $1,000,000.

- The market’s implied exchange rate for USD/GBP is off.

- Transaction Costs = 0.1% per trade.

- Calculation (simplified):

- Convert USD to EUR: $1,000,000 * (EUR/USD rate) = €910,000

- Convert EUR to GBP: €910,000 * (GBP/EUR rate) = £780,000

- Convert GBP back to USD: £780,000 * (USD/GBP rate) = $1,001,000

- Subtract Costs: $1,001,000 – ($1,000,000 * 0.003) = $998,000

- Interpretation: In this simplified example, the net result is a loss of $2,000 after costs, proving the opportunity was not truly arbitrage. A profitable arb would yield a positive return after all costs.

Why Arbitrage Matters to Traders and Investors

- For Traders/Arbitrageurs: It represents a strategy that aims to generate profits with theoretically no market risk (though operational risk remains). It’s a volume game; small profits per trade are scaled up with large amounts of capital.

- For Investors: Arbitrage ensures market efficiency. An investor can be more confident that the price they see for a stock on the NYSE is the same as its price on the LSE, preventing them from overpaying. It also keeps ETF prices closely tied to the value of their underlying assets (NAV).

- For Analysts: Understanding arbitrage is key to understanding fundamental valuation models. The concept of “arbitrage-free pricing” is central to pricing complex derivatives like options, ensuring there’s no way to game the system.

How to Use Arbitrage in Your Strategy

Modern arbitrage is not done by hand; it’s dominated by sophisticated algorithms and high-frequency trading (HFT) firms with ultra-low latency connections to exchanges.

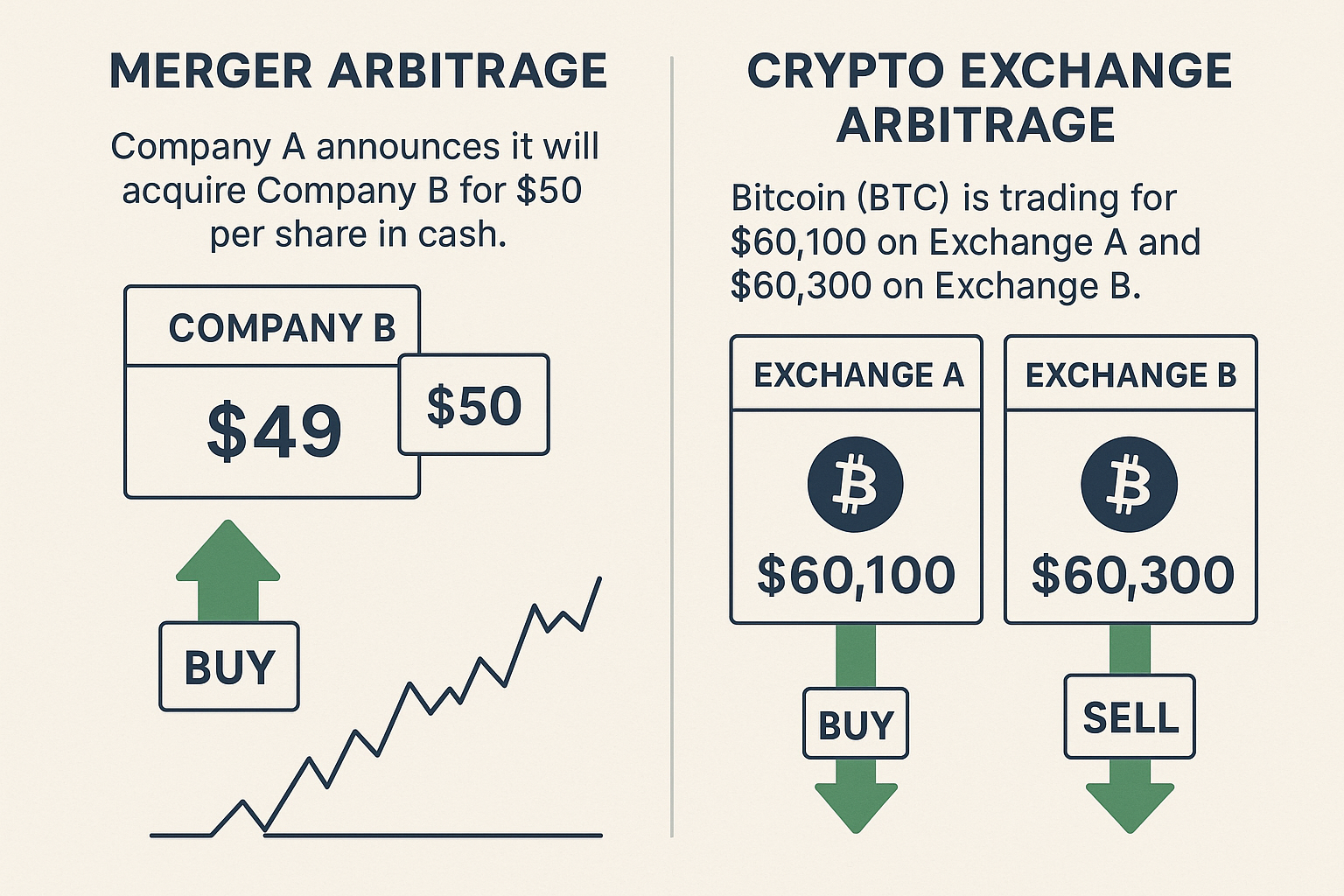

- Use Case 1: Merger Arbitrage

- Scenario: Company A announces it will acquire Company B for $50 per share in cash. Company B’s stock jumps to $49, but not $50, reflecting the risk the deal might fail.

- Action: An arbitrageur buys Company B’s stock at $49. If the deal closes successfully, they receive $50, profiting $1 per share. Their risk is the deal falling through, causing the stock to crash.

- Use Case 2: Crypto Exchange Arbitrage

- Scenario: Bitcoin (BTC) is trading for $60,100 on Exchange A and $60,300 on Exchange B.

- Action: A trader buys 1 BTC on Exchange A and simultaneously sells 1 BTC on Exchange B. Before costs, they profit $200. The challenge is executing both trades fast enough before the price moves and ensuring funds are on both exchanges.

Pros and Cons of Arbitrage

- Theoretically Risk-Free: The primary profit is locked in the moment the trades are executed, as they are simultaneous.

- Market Neutral: Profit comes from the price difference, not from the overall market’s direction (bull or bear).

- Improves Market Health: Arbitrage trading helps correct pricing errors and contributes to market efficiency.

- Extremely Competitive: Opportunities are spotted and erased by algorithms in milliseconds.

- High Barrier to Entry: Requires significant capital to make small percentage profits worthwhile and advanced technology to execute trades instantly.

- Execution Risk: The risk that one leg of the trade fails or that prices change between the moment of discovery and execution (slippage).

Arbitrage in the Real World: A Case Study

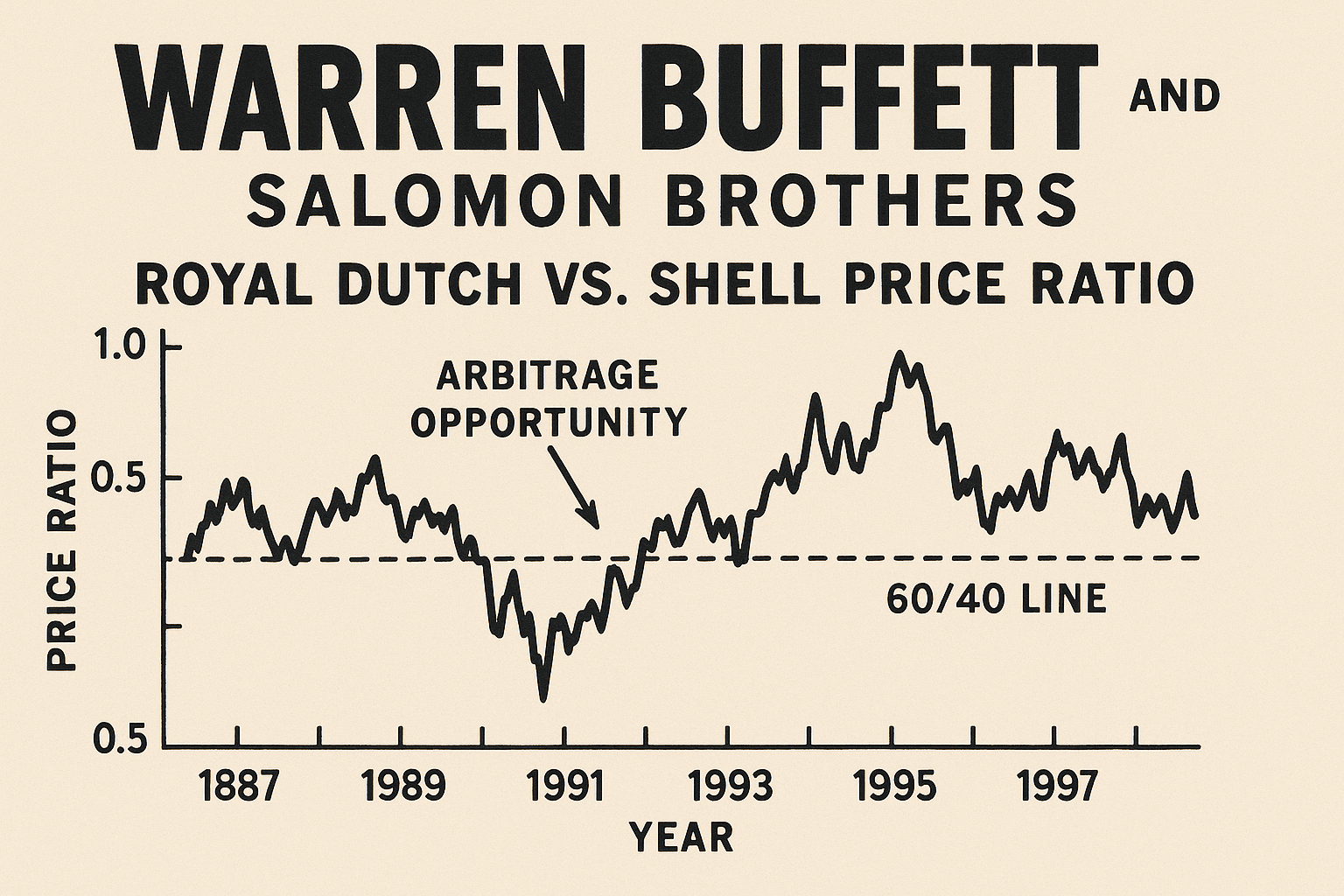

The King of Arbitrage: Warren Buffett and Salomon Brothers (1987)

A classic example involves preferred stock of oil companies Royal Dutch Petroleum and Shell Transport & Trading. Though functioning as a unified entity, Royal Dutch Shell was comprised of two separate listed companies. A legally binding agreement stipulated that 60% of the total earnings were allocated to Royal Dutch, with the remaining 40% going to Shell Transport. Their stock prices should have traded in a perfect 60/40 ratio.

However, for complex reasons (tax treatments, investor sentiment), the market prices frequently deviated from this ratio. By the end of the 1990s, the valuation gap between the two sister shares had widened to exceed ten percent. Arbitrageurs like Buffett’s fund could go long the undervalued part of the pair and short the overvalued part, betting that the historical 60/40 relationship would eventually correct itself. This is a prime example of statistical arbitrage, betting on the convergence of a historical relationship, not an identical asset.

Arbitrage vs Speculation

The most common confusion is between Arbitrage and Speculation.

| Feature | Arbitrage | Speculation |

|---|---|---|

| Core Principle | Exploiting a current price difference for a guaranteed profit. | Betting on future price movements. |

| Risk Profile | Theoretically risk-free (price discrepancy is real and simultaneous). | Inherently high risk (future is uncertain). |

| Time Horizon | Milliseconds to minutes (for pure arb). | Days, weeks, months, or years. |

| Basis | Market inefficiency | Analysis, prediction, and intuition. |

| Capital | Large amounts required to profit from small discrepancies. | Varies widely |

Conclusion

In essence, arbitrage is the financial world’s ultimate efficiency engine, a sophisticated practice that ensures prices remain consistent across global markets. While the romantic idea of a risk-free profit is largely a theoretical concept for the individual retail trader, understanding arbitrage is crucial. It provides a foundational insight into how modern markets operate, revealing the complex, high-speed mechanisms that work behind the scenes to create a more orderly and rational financial system. For the average investor, this knowledge offers confidence that the prices they see are fair, a stability won by the constant, invisible actions of arbitrageurs.

Related Terms

- Market Efficiency: Arbitrage is the mechanism that enforces the Efficient Market Hypothesis (EMH).

- Statistical Arbitrage: This sophisticated approach relies on quantitative models to detect temporary price divergences between correlated assets, a technique often implemented through pairs trading.

- Latency: The speed of data transmission and execution. This is the most critical factor in modern arbitrage.

- Bid-Ask Spread: The difference between the buying and selling price; a transaction cost that arbitrage must overcome.

- Risk-Free Rate: The theoretical return on an investment with zero risk; arbitrage profit should be compared to this benchmark.

Frequently Asked Questions

Recommended Resources

- Investopedia: “Arbitrage” Definition and Examples – A comprehensive overview.

- SEC.gov: Investor Bulletin on Algorithmic Trading – Explains the technology that drives modern arb.

- The New York Times: “Flash Boys” by Michael Lewis – A non-fiction book (and related articles) that explores the world of high-frequency trading and latency arbitrage.

How did this post make you feel?

Thanks for your reaction!