How Do Market Makers Work A Trader's Guide to Liquidity

A Market Maker is a firm or individual that stands ready to buy and sell a security continuously at quoted prices. They are the lifeblood of financial markets, providing the essential liquidity that allows investors in the US, UK, Canada, and Australia to execute trades instantly on exchanges like the NYSE and NASDAQ. Without market makers, modern electronic trading would grind to a halt.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | A firm that provides liquidity to a market by continuously quoting both a buy (bid) and sell (ask) price for a security. |

| Also Known As | Liquidity Provider, Specialist (historically on NYSE) |

| Main Used In | Stock Trading, Options Trading, Forex, Crypto, ETFs |

| Key Takeaway | Market makers facilitate smooth and efficient trading by ensuring there is always a buyer for every seller and vice versa, profiting from the bid-ask spread. |

| Related Concepts |

What is a Market Maker

In its simplest form, a market maker is like a financial wholesaler. Imagine a busy supermarket. Shoppers (traders) expect to be able to buy milk (a stock) whenever they want, without having to wait for another shopper who wants to sell milk to arrive. The supermarket (the market maker) buys milk in bulk from producers (sellers) and stocks it on its shelves, offering it for sale to any customer (buyer) at a fixed price. The supermarket makes a small profit on each carton sold, the difference between what it paid the producer and what it charges the customer.

In financial markets, market makers perform this same essential function. They commit to always being there to buy when you want to sell and to sell when you want to buy, ensuring the market functions smoothly.

Key Takeaways

The Core Concept Explained

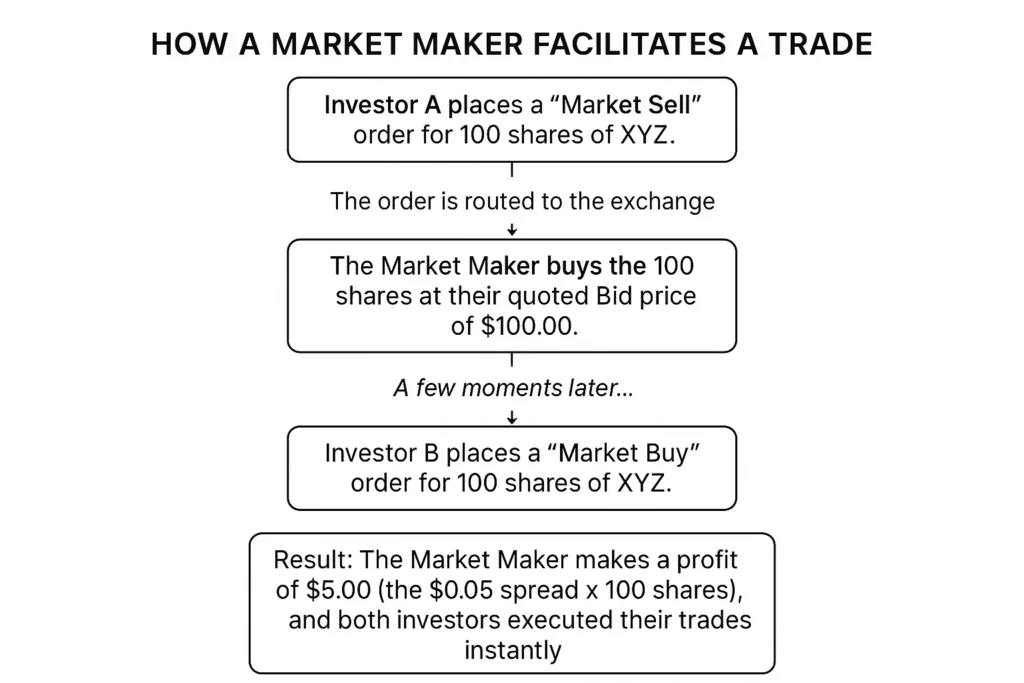

Market makers are typically large institutions like investment banks or specialized trading firms (e.g., Citadel Securities, Virtu Financial). They post two prices for a security: the bid (the price they will pay to buy it) and the ask or offer (the price they will charge to sell it). The ask is always slightly higher than the bid, and this difference is the spread.

For example, a market maker might quote a stock as: Bid: $100.00 | Ask: $100.05.

If you immediately buy 100 shares and then sell them, you would lose $5 ($0.05 per share) due to the spread. This spread is the market maker’s primary compensation for providing liquidity and taking on risk.

The Evolution of Market Making: From Floor Traders to AI

Market making has evolved dramatically. Historically, it was done by specialists on the floor of the NYSE, shouting bids and offers. Today, it is dominated by quantitative firms using complex algorithms and high-frequency trading (HFT) systems. These AI-driven models can adjust quotes thousands of times per second in response to market data, news feeds, and order flow, making the process incredibly efficient but also raising questions about fairness and market stability during “flash crashes.”

How Market Makers Make Money

Market makers do not typically aim to predict the market’s direction. Their goal is to trade neutrally and profit from the volume of trades, not from price movements.

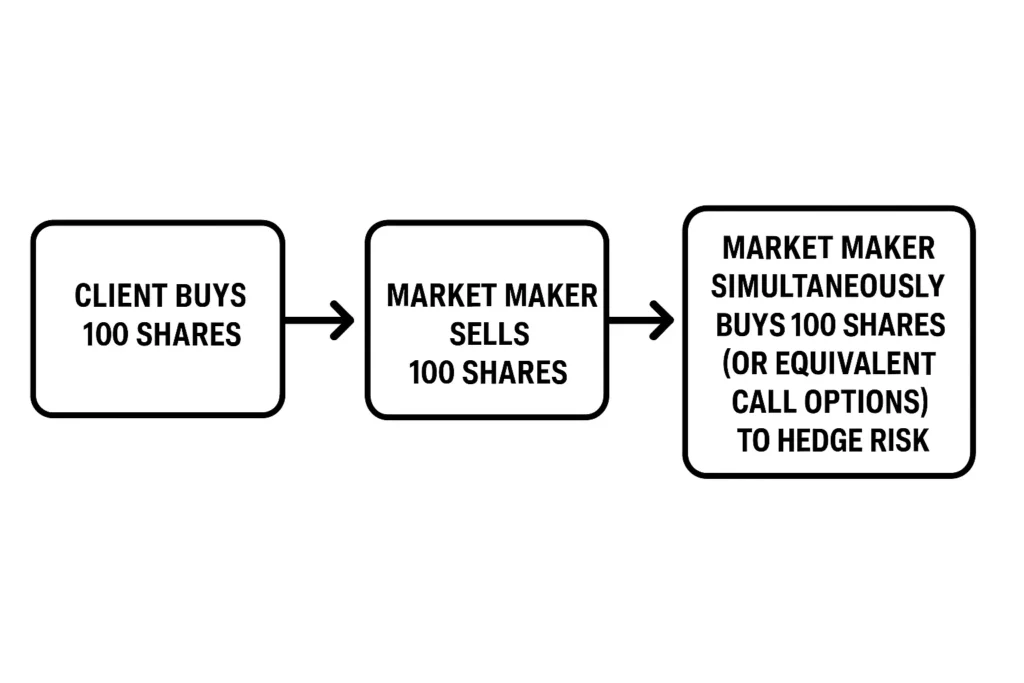

The Inventory Model and Hedging

When a market maker buys a stock from a seller, it adds to its inventory. This is risky, if the stock price falls, the inventory loses value. To moderate this “inventory risk,” market makers aggressively hedge their positions. They might use derivatives like options or short-sell related securities to offset the price risk. Their sophisticated algorithms are constantly adjusting quotes and hedging positions to remain market-neutral and lock in the spread as profit.

For a trader in the US using a platform like Fidelity or Charles Schwab, the speed and efficiency provided by market makers are a given. However, the cost of their service, the spread; is a direct drag on returns, especially for high-frequency strategies. Understanding this cost is crucial when choosing between market and limit orders.

Why Market Makers Matter to Traders and Investors

- For All Market Participants: They create a functional market. Without them, you might have to wait hours or days to find a counterparty for your trade, and prices would be far more volatile.

- For Traders: They enable high-frequency trading and strategies that rely on immediate execution. The tightness of the bid-ask spread is a key metric for a trade’s cost-effectiveness.

- For Investors: They provide the liquidity that makes ETFs (Exchange-Traded Funds) possible. When you buy an ETF share, a market maker is often on the other side, ensuring the ETF price closely tracks its underlying net asset value (NAV).

- For Companies: A stock with multiple active market makers will have higher liquidity, making it more attractive to institutional investors and potentially lowering the company’s cost of capital.

How to Use Market Maker Dynamics in Your Strategy

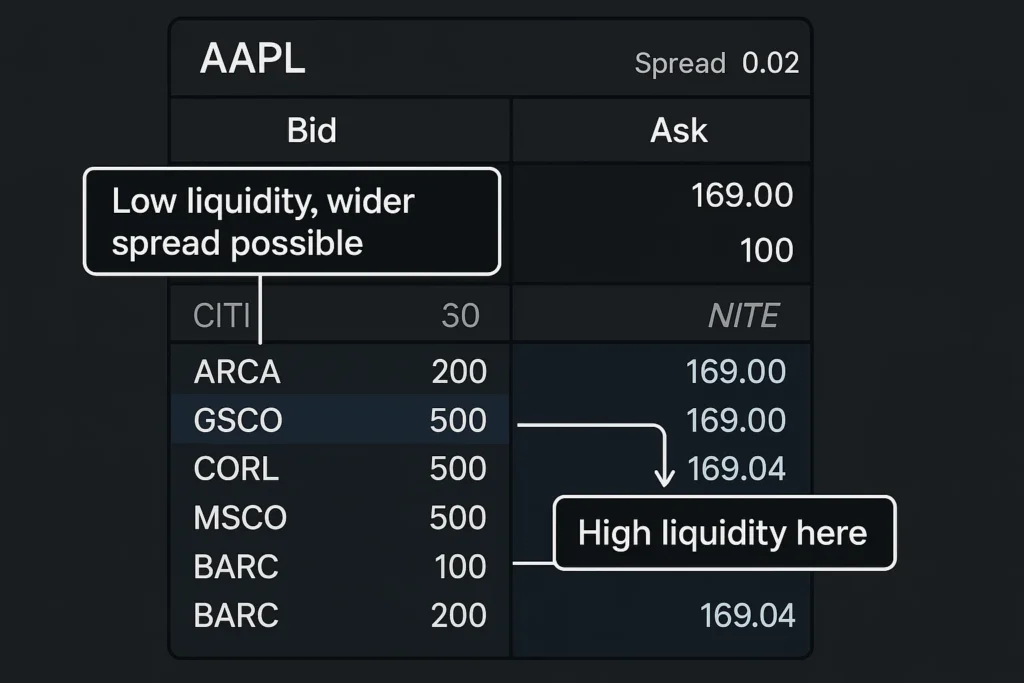

- Case 1: Reading the Level 2 Quote: The “Level 2” data on your trading platform shows the live bid and ask prices from all market makers. A deep order book with large sizes at each price level indicates high liquidity and a stable spread. A thin order book suggests lower liquidity and potentially wider, more volatile spreads.

- Case 2: Understanding Slippage: In a fast-moving market or a low-liquidity stock, the quoted spread might not be the price you get. A market maker’s algorithm may adjust its quote between the time your order is sent and executed, causing “slippage.” Using limit orders can protect you from this.

To start analyzing Level 2 data and making more informed decisions, you need a brokerage platform with advanced trading tools. We’ve meticulously reviewed and ranked the best online brokers for active traders to help you get started.

A Day in the Life of a Market Making Algorithm

Let’s anthropomorphize an algorithm, “Algo-MM,” responsible for making markets in an ETF like the SPDR S&P 500 ETF (SPY).

- Pre-Market (4:00 AM – 9:30 AM ET): Algo-MM analyzes overnight news, global market moves, and futures data to model an opening price for SPY. It calculates its initial inventory risk from the previous day.

- Market Open (9:30 AM): A volatile period. Algo-MM provides wide quotes initially to protect against uncertainty, then rapidly narrows them as volume and price discovery stabilize.

- Trading Day (9:35 AM – 3:55 PM): Algo-MM’s core function. It continuously updates its bid and ask prices based on incoming orders, its inventory level, and the price movement of the underlying S&P 500 index components. If it buys too many shares, it might lower its bid slightly to discourage sellers. Its primary goal is to end the day with a neutral position, having collected millions of tiny spreads.

- Market Close (4:00 PM): Algo-MM participates in the closing auction, offloading any residual inventory to end the day flat, ready to repeat the process tomorrow.

- Enhanced Liquidity: The primary benefit. They ensure continuous trading.

- Price Stability: By being always present, they dampen extreme price volatility.

- Price Discovery: Their constant quoting helps establish a security’s fair market price.

- Efficiency: They enable the fast, electronic markets we have today.

- The Spread as a Cost: The bid-ask spread is a direct, albeit often hidden, cost to retail traders.

- Potential for Conflicts: In some cases (like in the “over-the-counter” market), a market maker trading against its clients can create a conflict of interest, as it profits from their losses.

- Withdrawal of Liquidity: In times of extreme market stress, market makers may widen their spreads dramatically or even withdraw from quoting to protect themselves, which can exacerbate a crash.

Market Makers in the Real World: The GameStop Saga

The GameStop (GME) short squeeze of January 2021 provides a dramatic case study of market makers’ role and risks. As the stock price skyrocketed, driven by retail traders from platforms like Robinhood, market makers faced a massive problem.

The Issue: Market makers who were facilitating the buying of GME shares and call options were required to hedge their positions. When you buy a call option, the market maker on the other side typically buys the underlying stock to hedge their risk. This created a feedback loop: more buying → higher price → more hedging (buying) → even higher price.

The Liquidity Crunch: The sheer volume of trading created enormous capital requirements for these firms. To manage their risk and meet regulatory capital obligations, some brokers temporarily restricted the buying of GME and other “meme” stocks. This action was widely misunderstood as a conspiracy but was, in large part, a direct consequence of the immense pressure on the market makers and clearinghouses providing the backbone for the trades.

Market Maker vs. Broker/Dealer

These terms are often used interchangeably but have distinct roles.

| Feature | Market Maker | Broker/Dealer |

|---|---|---|

| Primary Role | Provides liquidity by quoting bid/ask prices. | Executes trades on behalf of clients. |

| Counterparty | Often is the direct counterparty to your trade. | Acts as an agent, finding a counterparty (like a market maker) for your trade. |

| How they Profit | From the Bid-Ask Spread. | From commissions and fees. |

| Example | Virtu Financial, Susquehanna (SIG). | Fidelity, Interactive Brokers, Robinhood. |

Note: Many large firms, like Morgan Stanley, operate as both brokers and market makers.

Conclusion

Ultimately, understanding the role of market makers provides a critical lens for viewing market structure itself. While the bid-ask spread is a real cost, it is the price paid for the incredible liquidity and efficiency that defines modern exchanges like the NASDAQ and LSE. As we’ve seen, they are not infallible and can become a source of instability during periods of extreme volatility. However, by recognizing their function, traders and investors can make more informed decisions, for instance, by favoring limit orders in volatile markets or understanding the impact of liquidity on their chosen assets. This knowledge transforms them from a mysterious force into a fundamental component of a sound trading strategy.

Ready to put these concepts into action? The right tools are essential. We’ve meticulously reviewed and ranked the best online brokers for technical analysis and active trading to help you get started.

Related Terms

- Bid-Ask Spread: The lifeblood of a market maker’s profit; the difference between the buy and sell price.

- Liquidity: The ease of buying/selling an asset; the primary service provided by market makers.

- Order Book: The real-time list of all buy and sell orders, prominently featuring market maker quotes.

- High-Frequency Trading (HFT): A type of trading that relies on market making and arbitrage, often executed by the same firms.

Frequently Asked Questions

Recommended Resources

- Bid-Ask Spread

- How to Read a Level 2 Quote

- SEC.gov: Information on Market Structure and Regulation.

- FINRA.org: Overview of Market Maker Responsibilities.

- Investopedia: Definition and further reading on market making.