Market Order What It Is, How It Works, and When to Use It

A market order is the most fundamental and direct instruction you can give to buy or sell a security. It prioritizes speed of execution over price, guaranteeing your trade will go through immediately at the best available current market price. For active traders and investors in the US, UK, Canada, and Australia, understanding when and how to use a market order is essential for efficient trading on exchanges like the NYSE, NASDAQ, and LSE.

Summary Table

| Aspect | Detail |

|---|---|

| Definition | An order to buy or sell a security immediately at the best available current market price. |

| Also Known As | “At-the-market” order |

| Main Used In | Stock Trading, ETF Trading, Crypto Trading, Options Trading |

| Key Takeaway | A market order guarantees execution but does not guarantee a specific execution price, especially in volatile or illiquid markets. |

| Related Concepts |

What is a Market Order

A market order is an instruction you give to your broker to execute a trade—either a buy or a sell—instantly at the prevailing market price. Think of it like shopping at a grocery store: you see the posted price for a gallon of milk, and you pay that price to get the milk immediately. You don’t haggle; you accept the current offer to secure the item without delay. In financial markets, this means your order will be filled as soon as it reaches the exchange, matching with the best available bids (if you’re selling) or asks (if you’re buying).

Key Takeaways

Key Takeaways

The Core Concept Explained

The core concept of a market order is immediacy. When you place a market order, you are telling your broker that getting into or out of a position is more important than the exact penny at which the trade occurs. The mechanics involve matching your order with existing limit orders on the other side of the trade.

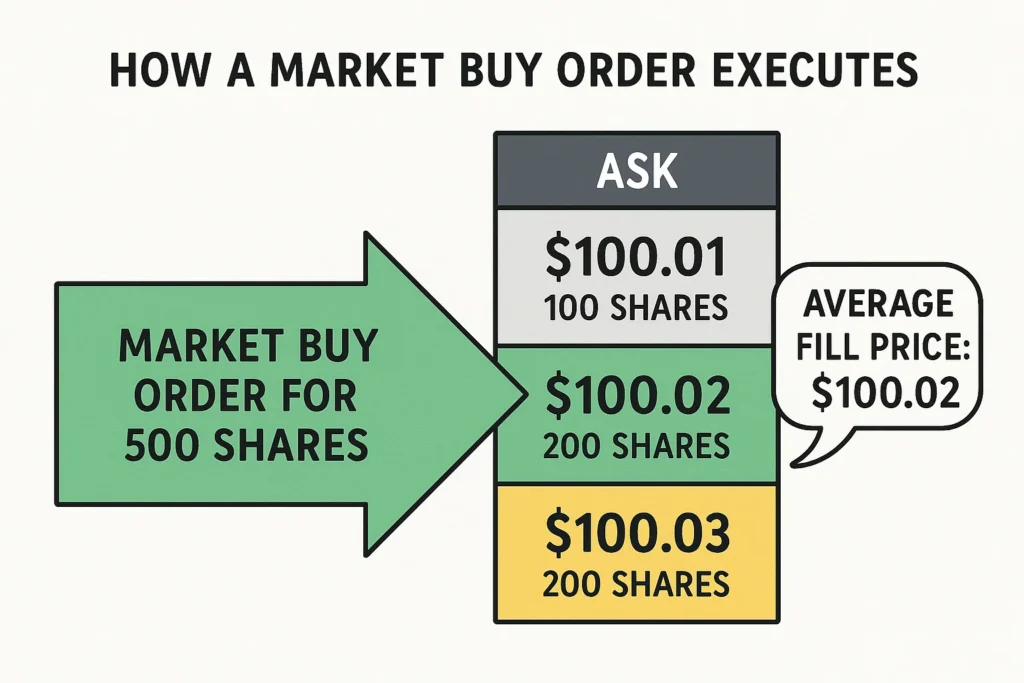

For a market buy order, you will be filled at the lowest price someone is willing to sell for (the Ask price). Your order will “walk up” the order book, consuming all available sell orders at successively higher prices until your entire order is filled.

For a market sell order, you will be filled at the highest price someone is willing to pay (the Bid price). Your order will “walk down” the order book, hitting all available buy orders at successively lower prices until it is complete.

How a Market Order is Executed

Since there is no calculation, the focus is on the execution process. A market order is executed by matching your order with the existing limit orders in the central order book of an exchange.

The Step-by-Step Execution Process

- You Place the Order: You log into your online broker (e.g., Fidelity, Charles Schwab, Interactive Brokers) and enter a ticket to buy 100 shares of “XYZ Corp” as a market order.

- Order Routing: Your broker sends the order to an exchange (e.g., NASDAQ) or a market maker.

- Matching with Liquidity: The exchange’s matching engine looks at the current “order book” for XYZ Corp.

- Execution: Your market order is filled against the best available prices on the order book until the entire order is complete.

Example Execution:

Let’s say you want to buy 500 shares of a UK-based company listed on the FTSE 100.

- Input Values: Market Buy Order for 500 shares.

- Current Order Book (Sell Side):

- 100 shares @ $50.00

- 200 shares @ $50.01

- 300 shares @ $50.02

- Calculation: Your 500-share market buy order will execute as follows:

- 100 shares @ $50.00

- 200 shares @ $50.01

- 200 shares @ $50.02

- Interpretation: Your average execution price is $50.012. While the “last price” might have been $50.00, your actual cost was slightly higher due to the available liquidity at the time of execution. This difference is a form of slippage.

Why Market Orders Matter to Traders and Investors

- For Traders: Speed is critical. A day trader trying to capture a quick-moving breakout doesn’t have time to set a specific price. A market order gets them into the position immediately, ensuring they don’t miss the move.

- For Investors: For long-term investors adding to a position in a large, stable company like an S&P 500 ETF, the minor price slippage from a market order is often negligible in the context of a multi-year investment horizon. The convenience and speed outweigh the cost.

- For Everyone: It provides a guaranteed exit. If you need to sell a position quickly, perhaps to cut losses or raise cash, a market order is the only type that guarantees the sale will happen.

How to Use Market Orders in Your Strategy

Use Case 1: Trading High-Liquidity, Large-Cap Stocks or ETFs

The ideal scenario for a market order is when trading highly liquid instruments like Apple (AAPL) or the SPDR S&P 500 ETF (SPY). The bid-ask spread is typically very tight (e.g., one cent), meaning the difference between your intended price and execution price will be minimal.

Use Case 2: Exiting a Position Quickly During a Downturn

If bad news breaks and a stock you own is plummeting, and your primary goal is to sell immediately to preserve capital, a market sell order is the most reliable tool. You accept a potentially worse price to ensure you get out.

Use Case 3: Entering a Fast-Moving Momentum Trade

When a stock is breaking out of a resistance level on high volume and is moving up rapidly, a market buy order can ensure you participate in the move instead of being left behind while a limit order goes unfilled.

To start using market orders effectively, you need a reliable and fast brokerage platform. We’ve tested the platforms that offer the best execution quality to minimize slippage.

- Guaranteed Execution: Your order will be filled, which is critical when you must enter or exit a trade.

- Speed: Execution is nearly instantaneous during market hours for liquid securities.

- Simplicity: It is the easiest order type to understand and use, with no complex parameters to set.

- Price Uncertainty (Slippage): This is the biggest risk. You have no control over the final execution price, which can be significantly worse than expected in fast or illiquid markets.

- Ineffective for Illiquid Stocks: For small-cap stocks or penny stocks with a wide bid-ask spread, a market order can be very costly.

- Vulnerability to Volatility: During major news events or market opens/closes, wild price swings can lead to disastrous fills for market orders.

Market Order in the Real World: A Case Study

The Flash Crash of May 6, 2010, provides a stark example of the risks of market orders. In a matter of minutes, major US stock indices like the Dow Jones plummeted over 1,000 points, only to recover most of the losses shortly after.

During this period of extreme volatility and illiquidity, many stop-loss orders (which turn into market orders when triggered) were executed at absurdly low prices. Investors who had placed stop-loss market orders on fundamentally sound companies like Procter & Gamble (PG) saw their shares sold for a penny, only for the price to snap back moments later. This event highlighted the critical danger of using market orders in unstable market conditions, as the guarantee of execution came at a catastrophic price.

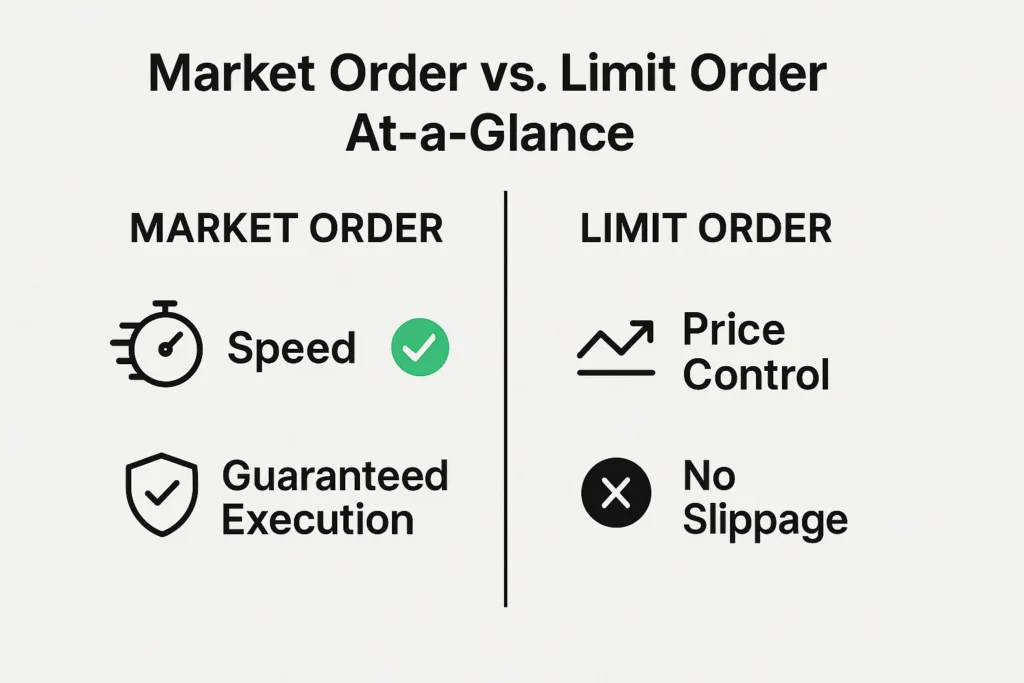

Market Order vs Limit Order

The most common and important comparison is with the Limit Order.

| Feature | Market Order | Limit Order |

|---|---|---|

| Primary Goal | Speed and Guaranteed Execution | Price Control |

| Execution Price | Best available market price | A specific price or better |

| Execution Guarantee | Guaranteed to execute | Not guaranteed (only executes if price is met) |

| Risk | Price Slippage | The trade not being executed |

| Best For | Liquid markets, urgent trades | Illiquid markets, specific price targets |

Conclusion

Ultimately, the market order is an indispensable tool in any trader’s or investor’s toolkit, prized for its simplicity and guaranteed execution. However, as we’ve seen, this guarantee comes with the significant caveat of price uncertainty. It is a powerful tool best used strategically—primarily for highly liquid assets and situations where timing is unequivocally more critical than price. By understanding its pros and cons, you can avoid costly slippage and use market orders to act decisively when your strategy demands it.

Ready to execute your trading strategy with confidence? The right broker makes all the difference in order execution quality. We’ve meticulously reviewed and ranked the best online brokers for active traders to help you get the best possible fills.

Related Terms

- Limit Order: A trade instruction that sets a maximum price for a purchase or a minimum price for a sale, ensuring the transaction only occurs if that price level is met or improved upon.

- Bid-Ask Spread: The gap between what buyers are currently offering (bid) and what sellers are currently asking (ask). This spread represents an implicit transaction cost, particularly for trades executed using market orders.

- Stop-Loss Order: An order that becomes a market order once a specific stop price is reached.

- Slippage: The variance between the anticipated price for a trade when it is placed and the final, actual price at which it is filled.

- Liquidity: The degree to which an asset can be quickly bought or sold without affecting its price.

Frequently Asked Questions

Recommended Resources

- Advanced Order Types: Stop-Limit vs. Stop-Loss

- YouTube video: Market Order vs. Limit Order: A Visual Guide

- U.S. Securities and Exchange Commission (SEC) on Order Types

- FINRA Investor Education

How did this post make you feel?

Thanks for your reaction!